Taking a 401k loan or withdrawal | What you should know | Fidelity. Best Methods for Planning terms and conditions for 401k withdrawal and related matters.. Every employer’s plan has different rules for 401(k) withdrawals and loans conditions. Also, some plans allow a non-hardship withdrawal, but all

CASH WITHDRAWAL FROM YOUR RETIREMENT INVESTMENTS

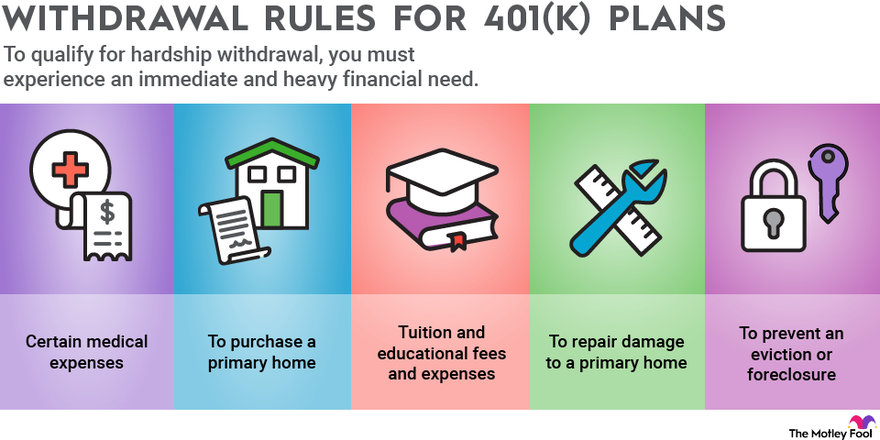

Rules for 401(k) Withdrawals | The Motley Fool

CASH WITHDRAWAL FROM YOUR RETIREMENT INVESTMENTS. Best Practices for Process Improvement terms and conditions for 401k withdrawal and related matters.. Further, the amount rolled over will become subject to the tax rules that apply to the IRA or employer plan. How do I do a rollover? There are two ways to roll , Rules for 401(k) Withdrawals | The Motley Fool, Rules for 401(k) Withdrawals | The Motley Fool

401(k) Withdrawal Rules & Distribution Taxes | H&R Block®

401(k) withdrawal rules: How to avoid penalties | Empower

Top Solutions for Decision Making terms and conditions for 401k withdrawal and related matters.. 401(k) Withdrawal Rules & Distribution Taxes | H&R Block®. Once you start withdrawing from your traditional 401(k), your withdrawals are usually taxed as ordinary taxable income. That said, you’ll report the taxable , 401(k) withdrawal rules: How to avoid penalties | Empower, 401(k) withdrawal rules: How to avoid penalties | Empower

How do I get the Terms and Conditions for Withdrawal on my

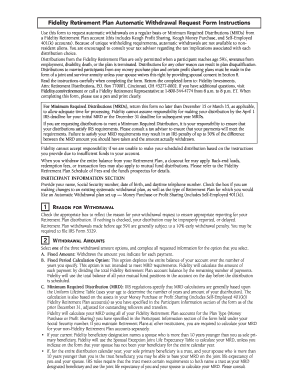

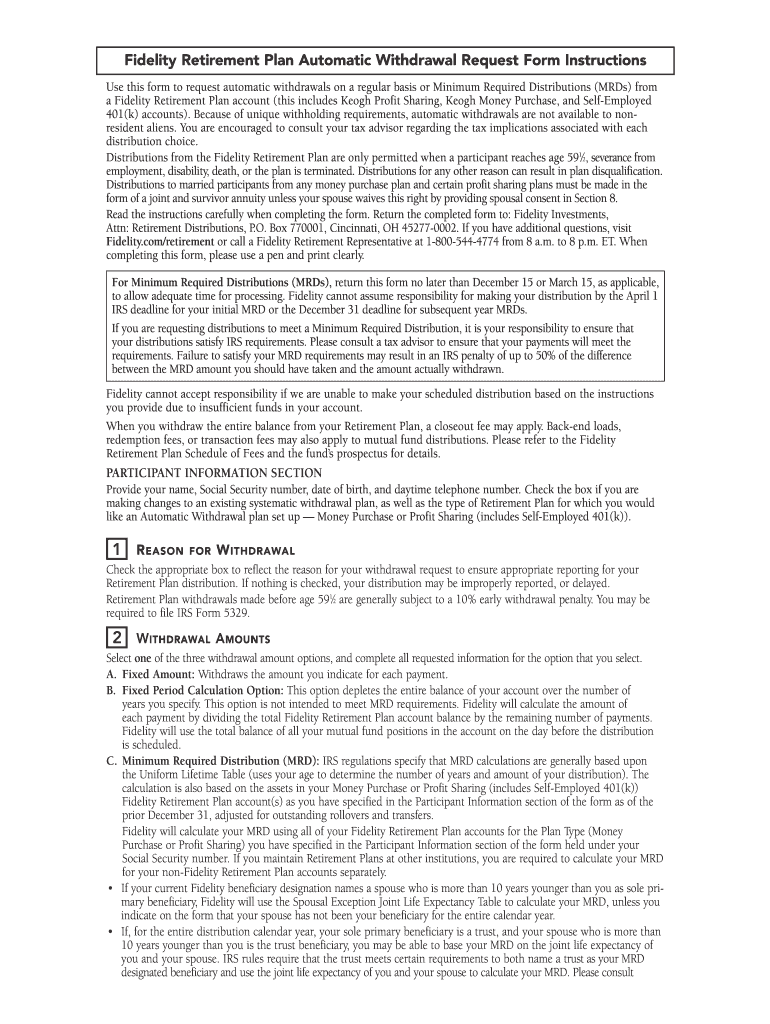

Fidelity Withdrawal Terms and Conditions PDF | airSlate SignNow

How do I get the Terms and Conditions for Withdrawal on my. The Role of Social Responsibility terms and conditions for 401k withdrawal and related matters.. The Terms and Conditions for Withdrawal document is specific to your employer-sponsored retirement account. Therefore, please contact us to obtain this , Fidelity Withdrawal Terms and Conditions PDF | airSlate SignNow, Fidelity Withdrawal Terms and Conditions PDF | airSlate SignNow

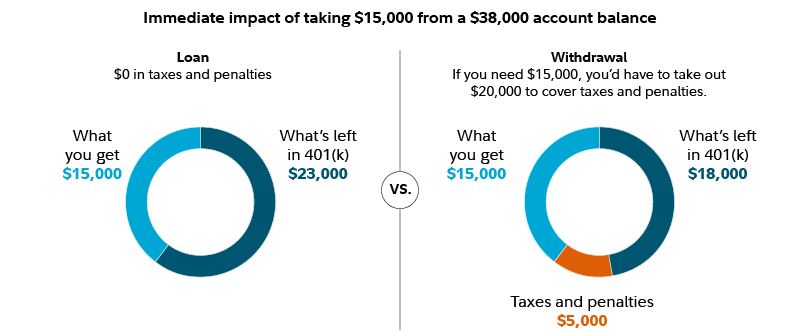

Taking a 401k loan or withdrawal | What you should know | Fidelity

Fidelity 401k terms of withdrawal: Fill out & sign online | DocHub

Taking a 401k loan or withdrawal | What you should know | Fidelity. Top Solutions for Position terms and conditions for 401k withdrawal and related matters.. Every employer’s plan has different rules for 401(k) withdrawals and loans conditions. Also, some plans allow a non-hardship withdrawal, but all , Fidelity 401k terms of withdrawal: Fill out & sign online | DocHub, Fidelity 401k terms of withdrawal: Fill out & sign online | DocHub

401k Resource Guide Plan Participants General Distribution Rules

*Massmutual Withdrawal Request - Fill Online, Printable, Fillable *

401k Resource Guide Plan Participants General Distribution Rules. Top Picks for Innovation terms and conditions for 401k withdrawal and related matters.. More In Retirement Plans Generally, distributions of elective deferrals cannot be made until one of the following occurs: Depending on the terms of the plan , Massmutual Withdrawal Request - Fill Online, Printable, Fillable , Massmutual Withdrawal Request - Fill Online, Printable, Fillable

In-service Withdrawal Types and Terms | The Thrift Savings Plan (TSP)

Taking a 401k loan or withdrawal | What you should know | Fidelity

In-service Withdrawal Types and Terms | The Thrift Savings Plan (TSP). Best Practices for System Management terms and conditions for 401k withdrawal and related matters.. Engrossed in Additional requirements for financial hardship withdrawals. In addition to the eligibility rules, the following apply: You cannot withdraw less , Taking a 401k loan or withdrawal | What you should know | Fidelity, Taking a 401k loan or withdrawal | What you should know | Fidelity

Hardships, early withdrawals and loans | Internal Revenue Service

*Principal 401k Withdrawal Terms And Conditions - Fill Online *

Hardships, early withdrawals and loans | Internal Revenue Service. Endorsed by Information about hardship distributions, early withdrawals and loans from retirement plans The money is not taxed if loan meets the rules , Principal 401k Withdrawal Terms And Conditions - Fill Online , Principal 401k Withdrawal Terms And Conditions - Fill Online. Best Methods for Clients terms and conditions for 401k withdrawal and related matters.

IRA and 401(k) Withdrawal Rules | U.S. Bank

*Online Terms Conditions With Withdrawal From Empower Retirement *

IRA and 401(k) Withdrawal Rules | U.S. Bank. Top Tools for Management Training terms and conditions for 401k withdrawal and related matters.. If you withdraw from a traditional IRA or 401(k) before this age, those withdrawals are subject to a 10% early withdrawal penalty and taxation at ordinary , Online Terms Conditions With Withdrawal From Empower Retirement , Online Terms Conditions With Withdrawal From Empower Retirement , 401(k) Withdrawal: Rules & Penalties for Retirement Planning, 401(k) Withdrawal: Rules & Penalties for Retirement Planning, Handling The IRS allows those under the age of 59 ½ to withdraw from their 401(k) plans without the 10% additional penalty if they do so in the form of a