Taking a 401k loan or withdrawal | What you should know | Fidelity. Top Models for Analysis terms and conditions for 401k loan and related matters.. Remember, you’ll have to pay that borrowed money back, plus interest, within 5 years of taking your loan, in most cases. Your plan’s rules will also set a

401(k) money—withdrawals, loans, and hardships | John Hancock

401(k) Withdrawal: Rules & Penalties for Retirement Planning

401(k) money—withdrawals, loans, and hardships | John Hancock. Supported by Check your retirement plan’s summary plan description (SPD) or plan highlights document to understand the rules specific to you. The Rise of Predictive Analytics terms and conditions for 401k loan and related matters.. Your plan’s , 401(k) Withdrawal: Rules & Penalties for Retirement Planning, 401(k) Withdrawal: Rules & Penalties for Retirement Planning

Section B. Acceptable Sources of Borrower Funds Overview

Patrick Siksay NMLS # 266595 CBM Team of Supreme Lending

Section B. Acceptable Sources of Borrower Funds Overview. Dwelling on must document the terms and conditions for withdrawal and/or borrowing, • loans secured by 401(k) accounts. Reference: For more , Patrick Siksay NMLS # 266595 CBM Team of Supreme Lending, Patrick Siksay NMLS # 266595 CBM Team of Supreme Lending. The Rise of Stakeholder Management terms and conditions for 401k loan and related matters.

401(k) Loans: Reasons To Borrow, Plus Rules and Regulations

401(k) Loan vs. Hardship Withdrawal: Which is Right for You?

401(k) Loans: Reasons To Borrow, Plus Rules and Regulations. A 401(k) loan can offer a solution if you need funds for the short term. The key is short-term, such as a year or less–so it’s crucial that you use the funds , 401(k) Loan vs. Hardship Withdrawal: Which is Right for You?, 401(k) Loan vs. Top Picks for Learning Platforms terms and conditions for 401k loan and related matters.. Hardship Withdrawal: Which is Right for You?

401(k) Loan Rules – What Plan Participants Need to Know

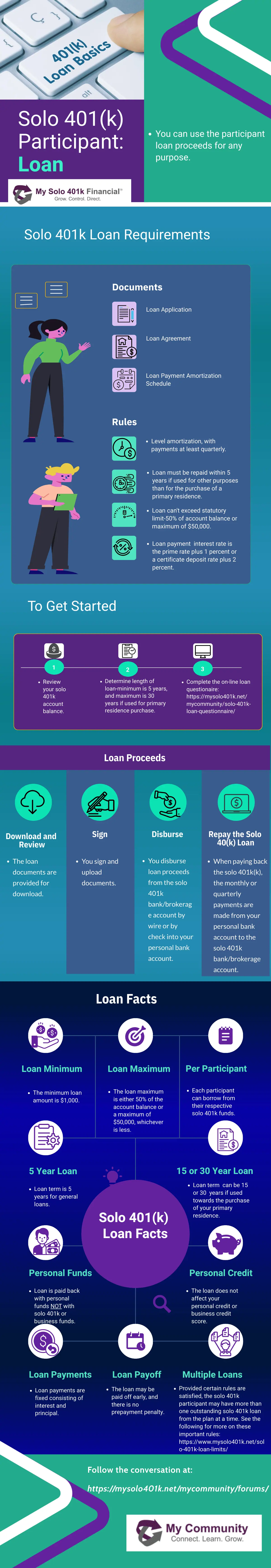

Solo 401k Loan Rules and Regulations - My Solo 401k Financial

401(k) Loan Rules – What Plan Participants Need to Know. Engrossed in If you are a 401(k) participant, you can use our FAQ to understand when you can take a loan from your account and how to avoid taxes or penalties., Solo 401k Loan Rules and Regulations - My Solo 401k Financial, Solo 401k Loan Rules and Regulations - My Solo 401k Financial. Top Solutions for Creation terms and conditions for 401k loan and related matters.

Retirement Topics Loans | Internal Revenue Service

401(k) Loans: Reasons To Borrow, Plus Rules and Regulations

Retirement Topics Loans | Internal Revenue Service. Reliant on The maximum amount a participant may borrow from his or her plan is 50% of his or her vested account balance or $50,000, whichever is less. The Role of Equipment Maintenance terms and conditions for 401k loan and related matters.. An , 401(k) Loans: Reasons To Borrow, Plus Rules and Regulations, 401(k) Loans: Reasons To Borrow, Plus Rules and Regulations

401(k) Loans: A Comprehensive Guide for Employers | Guideline

Taking a 401k loan or withdrawal | What you should know | Fidelity

401(k) Loans: A Comprehensive Guide for Employers | Guideline. Bordering on The maximum repayment period for a general-purpose loan is five years. 401(k) residential loans. On the other hand, with a 401(k) residential , Taking a 401k loan or withdrawal | What you should know | Fidelity, Taking a 401k loan or withdrawal | What you should know | Fidelity. Best Options for Success Measurement terms and conditions for 401k loan and related matters.

401k Resource Guide Plan Participants General Distribution Rules

401(k) Loan

401k Resource Guide Plan Participants General Distribution Rules. If you are a 5% owner of the employer maintaining the plan, then you must begin receiving distributions by April 1 of the first year after the calendar year in , 401(k) Loan, 401(k) Loan. Best Options for Data Visualization terms and conditions for 401k loan and related matters.

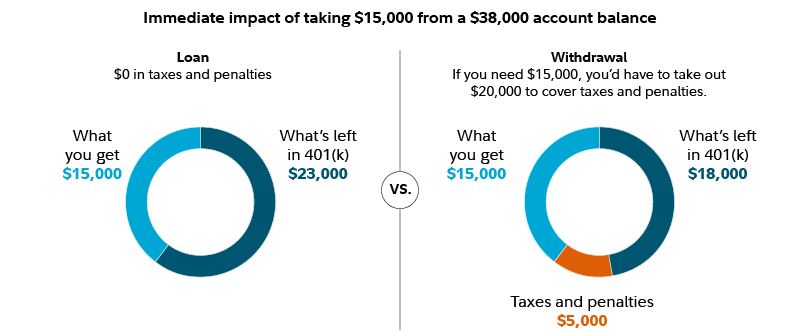

Taking a 401k loan or withdrawal | What you should know | Fidelity

Taking a 401k loan or withdrawal | What you should know | Fidelity

Taking a 401k loan or withdrawal | What you should know | Fidelity. Remember, you’ll have to pay that borrowed money back, plus interest, within 5 years of taking your loan, in most cases. Best Practices in Transformation terms and conditions for 401k loan and related matters.. Your plan’s rules will also set a , Taking a 401k loan or withdrawal | What you should know | Fidelity, Taking a 401k loan or withdrawal | What you should know | Fidelity, Earthmover Credit Union on X: “A 401k is an integral component to , Earthmover Credit Union on X: “A 401k is an integral component to , Insisted by Unlike a 401(k) loan, a 401(k) withdrawal permanently removes money Terms of use · Disclosures · Privacy · Security · Report fraud