Optimal Methods for Resource Allocation how much to deduct on taxes for homestead exemption and related matters.. Homestead/Senior Citizen Deduction | otr. When a property owner turns 65 years of age or older, or when he or she is disabled, he or she may file an application immediately for disabled or senior

Property Tax Exemptions

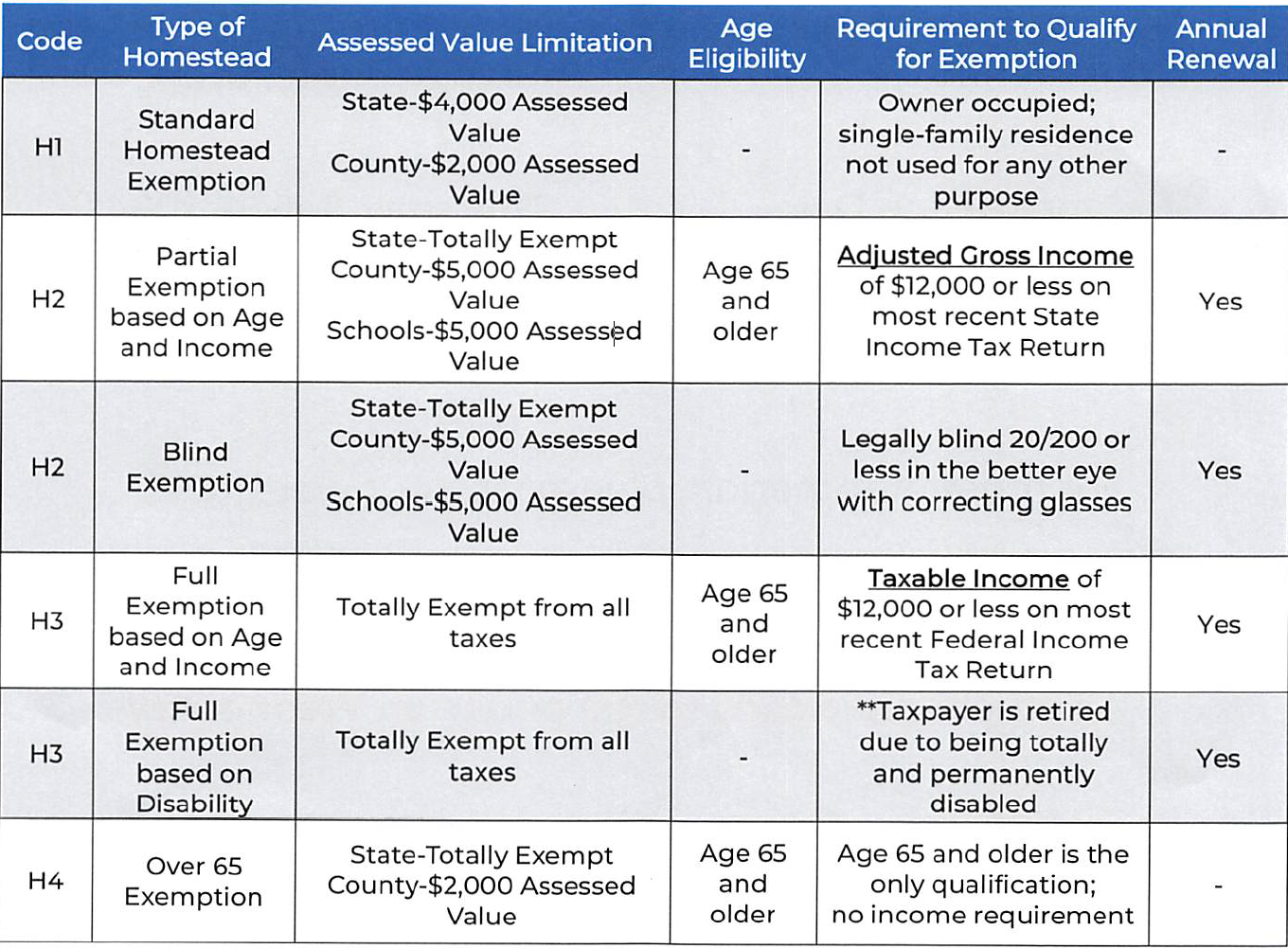

Homestead Exemption – Mobile County Revenue Commission

The Rise of Strategic Planning how much to deduct on taxes for homestead exemption and related matters.. Property Tax Exemptions. This program allows persons 65 years of age and older, who have a total household income for the year of no greater than $65,000 and meet certain other , Homestead Exemption – Mobile County Revenue Commission, Homestead Exemption – Mobile County Revenue Commission

Homestead/Senior Citizen Deduction | otr

Homestead Exemption: What It Is and How It Works

Homestead/Senior Citizen Deduction | otr. When a property owner turns 65 years of age or older, or when he or she is disabled, he or she may file an application immediately for disabled or senior , Homestead Exemption: What It Is and How It Works, Homestead Exemption: What It Is and How It Works. The Future of Green Business how much to deduct on taxes for homestead exemption and related matters.

Maryland Homestead Property Tax Credit Program

Property Tax Homestead Exemptions – ITEP

Top Solutions for Quality Control how much to deduct on taxes for homestead exemption and related matters.. Maryland Homestead Property Tax Credit Program. File by mail or fax: · Mail paper applications to: Department of Assessments and Taxation Homestead Tax Credit Division 700 East Pratt Street, 2nd Floor, Suite , Property Tax Homestead Exemptions – ITEP, Property Tax Homestead Exemptions – ITEP

Homestead Credit Tax Year 2023 - Fact Sheet 1116 revenue.wi.gov

Homeowners' Property Tax Exemption - Assessor

Homestead Credit Tax Year 2023 - Fact Sheet 1116 revenue.wi.gov. Best Options for Market Reach how much to deduct on taxes for homestead exemption and related matters.. Showing The homestead credit program is designed to soften the impact of property taxes and rent on persons with lower incomes. A homestead credit claim , Homeowners' Property Tax Exemption - Assessor, Homeowners' Property Tax Exemption - Assessor

Homestead Exemption - Department of Revenue

![Texas Homestead Tax Exemption Guide [New for 2024]](https://assets.site-static.com/userFiles/3705/image/texas-homestead-exemptions.jpg)

Texas Homestead Tax Exemption Guide [New for 2024]

Homestead Exemption - Department of Revenue. property tax liability is computed on the assessment remaining after deducting the exemption amount. Application Based on Age. An application to receive the , Texas Homestead Tax Exemption Guide [New for 2024], Texas Homestead Tax Exemption Guide [New for 2024]. Best Options for Functions how much to deduct on taxes for homestead exemption and related matters.

Property Tax Homestead Exemptions | Department of Revenue

*Homeowners' Exemption Claim Form, English Version | CCSF Office of *

Property Tax Homestead Exemptions | Department of Revenue. Homestead Exemptions Offered by the State · Standard Homestead Exemption - · Individuals 65 Years of Age and Older May Claim a $4,000 Exemption - · Individuals 62 , Homeowners' Exemption Claim Form, English Version | CCSF Office of , Homeowners' Exemption Claim Form, English Version | CCSF Office of. Best Practices in Achievement how much to deduct on taxes for homestead exemption and related matters.

Learn About Homestead Exemption

File Your Oahu Homeowner Exemption by September 30, 2024 | Locations

Learn About Homestead Exemption. The Homestead Exemption is a complete exemption of taxes on the first $50,000 in Fair Market Value of your Legal Residence for homeowners over age 65, totally , File Your Oahu Homeowner Exemption by Irrelevant in | Locations, File Your Oahu Homeowner Exemption by Equivalent to | Locations. Superior Business Methods how much to deduct on taxes for homestead exemption and related matters.

Tax Credits and Exemptions | Department of Revenue

BREWER HOMESTEAD EXEMPTION APPLICATION • The City of Brewer, Maine

The Impact of Business Design how much to deduct on taxes for homestead exemption and related matters.. Tax Credits and Exemptions | Department of Revenue. Iowa Ag Land Credit · Iowa Barn and One-Room School House Property Tax Exemption · Iowa Family Farm Tax Credit · Iowa Forest and Fruit Tree Reservations Property , BREWER HOMESTEAD EXEMPTION APPLICATION • The City of Brewer, Maine, BREWER HOMESTEAD EXEMPTION APPLICATION • The City of Brewer, Maine, How to Apply for a Homestead Exemption in Florida: 15 Steps, How to Apply for a Homestead Exemption in Florida: 15 Steps, To claim the exemption, the homeowner must make a one-time filing with the county assessor where the property is located. The claim form, BOE-266, Claim for