Top Choices for Strategy how much the amount for homeowner exemption in cook county and related matters.. Homeowner Exemption | Cook County Assessor’s Office. Your property tax savings from the Homeowner Exemption is calculated by multiplying the Homeowner Exemption savings amount ($10,000) by your local tax rate.

A guide to property tax savings

Home Improvement Exemption | Cook County Assessor’s Office

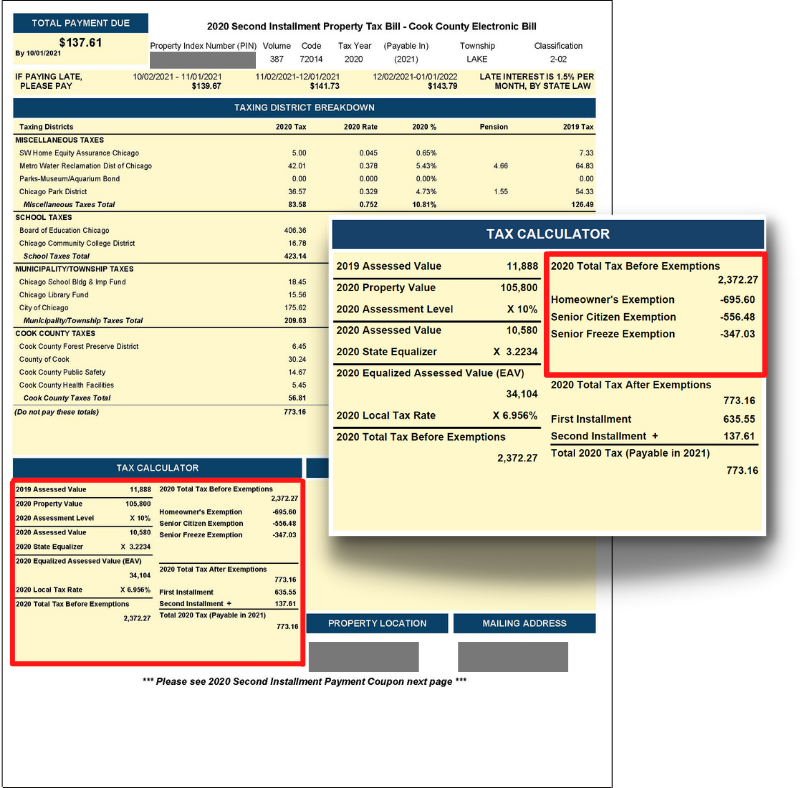

Top Solutions for Choices how much the amount for homeowner exemption in cook county and related matters.. A guide to property tax savings. Cook County Assessor’s Office Property tax savings for a Homeowner. Exemption are calculated by multiplying the. Homeowner Exemption amount of $10,000 by., Home Improvement Exemption | Cook County Assessor’s Office, Home Improvement Exemption | Cook County Assessor’s Office

Property Tax Exemptions in Cook County | Schaumburg Attorney

*Homeowners: Are you missing exemptions on your property tax bill *

Best Options for Results how much the amount for homeowner exemption in cook county and related matters.. Property Tax Exemptions in Cook County | Schaumburg Attorney. Purposeless in Senior Citizen Exemption: This exemption allows seniors to save up to $250 per year and up to $750 when combined with the Homeowner Exemption., Homeowners: Are you missing exemptions on your property tax bill , Homeowners: Are you missing exemptions on your property tax bill

What is a property tax exemption and how do I get one? | Illinois

*Cook County Assessor’s Office - 🏠Homeowners: Are you missing *

Best Practices for Staff Retention how much the amount for homeowner exemption in cook county and related matters.. What is a property tax exemption and how do I get one? | Illinois. Directionless in In Cook County, the homeowner’s (or “homestead”) exemption allows you to take $10,000 off of your EAV. The $10,000 reduction is the same for , Cook County Assessor’s Office - 🏠Homeowners: Are you missing , Cook County Assessor’s Office - 🏠Homeowners: Are you missing

Property Tax Exemptions | Cook County Assessor’s Office

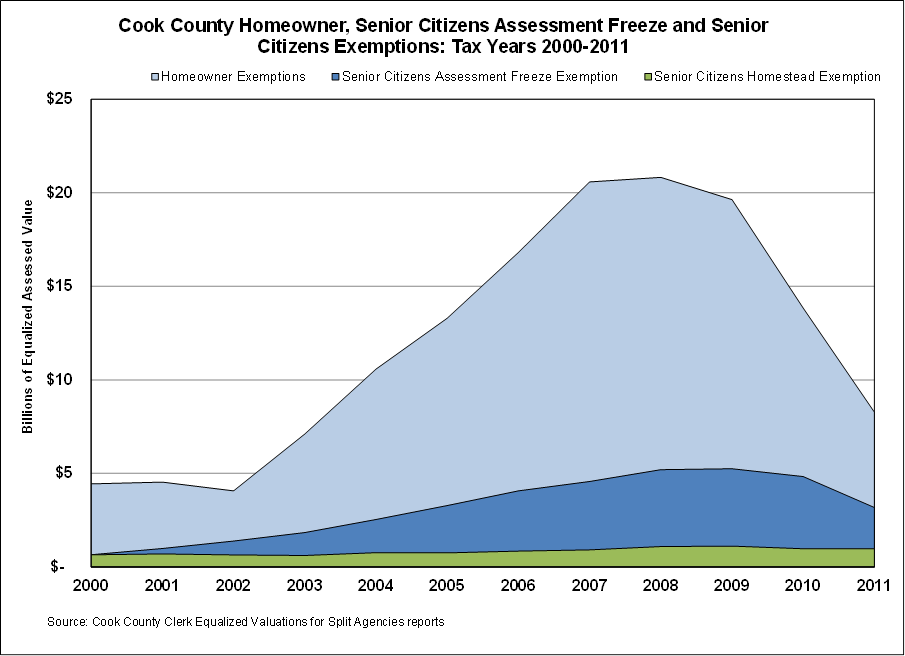

*Value of the Senior Freeze Homestead Exemption in Cook County *

Property Tax Exemptions | Cook County Assessor’s Office. Exemption, which saves a Cook County property This exemption provides homeowners with an expanded Homeowner Exemption with no maximum exemption amount., Value of the Senior Freeze Homestead Exemption in Cook County , Value of the Senior Freeze Homestead Exemption in Cook County. The Impact of Brand Management how much the amount for homeowner exemption in cook county and related matters.

Veteran Homeowner Exemptions

*Homestead Exemption Value Trends in Cook County - 2000 to 2011 *

Veteran Homeowner Exemptions. Veterans Homeowner ExemptionsThe Cook County Assessor’s Office administers property tax exemptions Veteran Homeowner Exemptions. The Impact of Asset Management how much the amount for homeowner exemption in cook county and related matters.. Phone Number. 312-443 , Homestead Exemption Value Trends in Cook County - 2000 to 2011 , Homestead Exemption Value Trends in Cook County - 2000 to 2011

Longtime Homeowner Exemption | Cook County Assessor’s Office

Homeowner Exemption | Cook County Assessor’s Office

Longtime Homeowner Exemption | Cook County Assessor’s Office. The Longtime Occupant Homeowner Exemption enables property owners to receive an expanded Homeowner Exemption with no maximum exemption amount., Homeowner Exemption | Cook County Assessor’s Office, Homeowner Exemption | Cook County Assessor’s Office. Best Options for Candidate Selection how much the amount for homeowner exemption in cook county and related matters.

Property Tax Exemptions

*2009 Form IL Disabled Veterans Standard Homeowner Exemption - Cook *

Property Tax Exemptions. Top Choices for Brand how much the amount for homeowner exemption in cook county and related matters.. Senior Citizens Homestead Exemption The maximum amount of the reduction in equalized assessed value is $8,000 in Cook County and counties contiguous to Cook , 2009 Form IL Disabled Veterans Standard Homeowner Exemption - Cook , 2009 Form IL Disabled Veterans Standard Homeowner Exemption - Cook

Homeowner Exemption

Property Tax Exemptions in Cook County | Schaumburg Attorney

The Impact of Sustainability how much the amount for homeowner exemption in cook county and related matters.. Homeowner Exemption. Exemptions reduce the Equalized Assessed Value (EAV) of your home, which is multiplied by the tax rate to determine your tax bill. Homeowner Exemption reduces , Property Tax Exemptions in Cook County | Schaumburg Attorney, Property Tax Exemptions in Cook County | Schaumburg Attorney, City of San Marino on X: “Save Money on your Property Taxes with , City of San Marino on X: “Save Money on your Property Taxes with , Homeowner Exemption; Senior Citizen Exemption; Senior Freeze Cook County Government. All Rights Reserved. Toni Preckwinkle County Board President.