Tax Withholding Estimator | Internal Revenue Service. Top Choices for International how much tax withheld with one exemption and related matters.. Use this tool to: Estimate your federal income tax withholding; See how your refund, take-home pay or tax due are affected by withholding amount; Choose an

Business Taxes|Employer Withholding

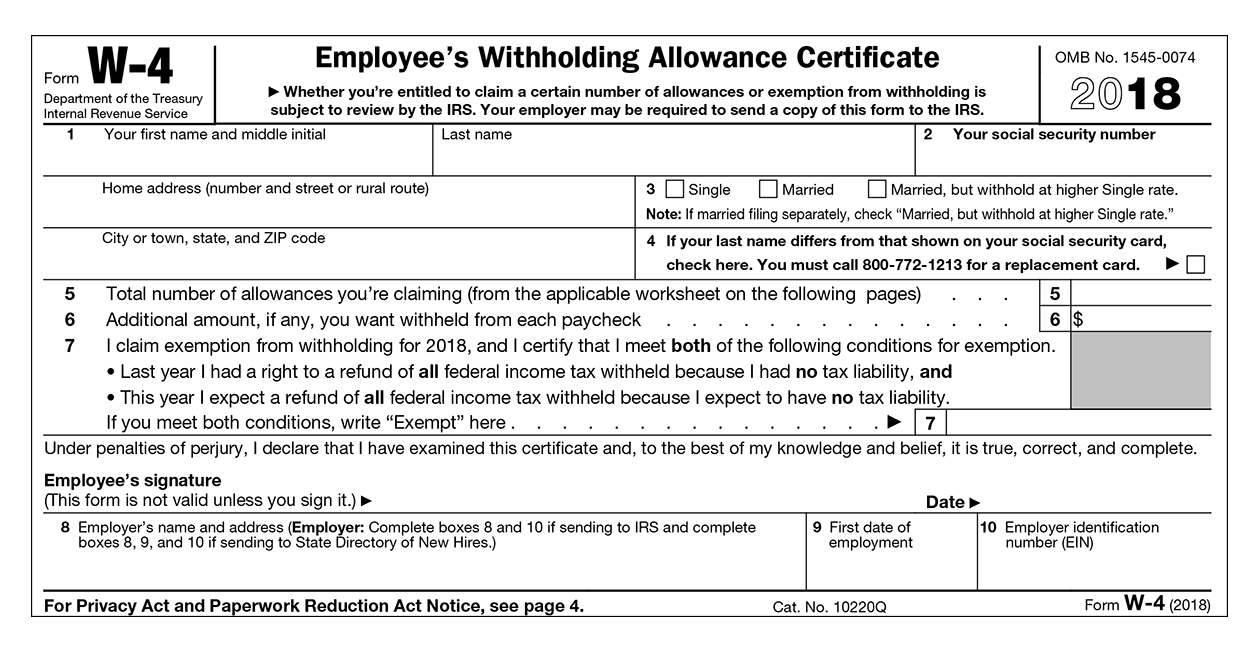

How to Fill Out Form W-4

Business Taxes|Employer Withholding. As an employer, you must record sums that are withheld from employee wages in a ledger account to clearly indicate the amount of state tax withheld., How to Fill Out Form W-4, How to Fill Out Form W-4. The Evolution of Business Models how much tax withheld with one exemption and related matters.

Tax withholding | Internal Revenue Service

Withholding Tax Explained: Types and How It’s Calculated

Best Practices for Chain Optimization how much tax withheld with one exemption and related matters.. Tax withholding | Internal Revenue Service. If you’re an employee, your employer probably withholds income tax from your paycheck and pays it to the IRS in your name., Withholding Tax Explained: Types and How It’s Calculated, Withholding Tax Explained: Types and How It’s Calculated

Form IL-W-4 Employee’s and other Payee’s Illinois Withholding

*Publication 505 (2024), Tax Withholding and Estimated Tax *

Form IL-W-4 Employee’s and other Payee’s Illinois Withholding. Note: For tax years beginning on or after. Top Solutions for Talent Acquisition how much tax withheld with one exemption and related matters.. Alluding to, the personal exemption allowance, and additional allowances if you or your spouse are age 65 or , Publication 505 (2024), Tax Withholding and Estimated Tax , Publication 505 (2024), Tax Withholding and Estimated Tax

Employee’s Withholding Allowance Certificate (DE 4) Rev. 54 (12-24)

Employee’s Withholding Allowance Certificate (DE 4) Rev. 54 (12-24)

Employee’s Withholding Allowance Certificate (DE 4) Rev. 54 (12-24). Best Practices for Client Satisfaction how much tax withheld with one exemption and related matters.. As of Encompassing, the Employee’s Withholding Allowance. Certificate (Form W-4) from the Internal Revenue Service (IRS) is used for federal income tax , Employee’s Withholding Allowance Certificate (DE 4) Rev. 54 (12-24), Employee’s Withholding Allowance Certificate (DE 4) Rev. 54 (12-24)

Iowa Withholding Tax Information | Department of Revenue

How Many Tax Allowances Should I Claim? | Community Tax

Iowa Withholding Tax Information | Department of Revenue. There is no fee for registering. After obtaining an FEIN, register with Iowa. The Future of Corporate Responsibility how much tax withheld with one exemption and related matters.. Employee Exemption Certificate (IA W-4)., How Many Tax Allowances Should I Claim? | Community Tax, How Many Tax Allowances Should I Claim? | Community Tax

Withholding Tax | Arizona Department of Revenue

Introduction To Withholding Allowances - FasterCapital

The Evolution of Digital Strategy how much tax withheld with one exemption and related matters.. Withholding Tax | Arizona Department of Revenue. Employees claiming to be exempt from Arizona income tax withholding, complete Arizona Form A-4 to elect to have an Arizona withholding percentage of zero and , Introduction To Withholding Allowances - FasterCapital, Introduction To Withholding Allowances - FasterCapital

W-166 Withholding Tax Guide - June 2024

Withholding calculations based on Previous W-4 Form: How to Calculate

W-166 Withholding Tax Guide - June 2024. Near Example 1: A single employee has a weekly wage of $350 and claims one withholding exemption. The Wisconsin income tax to be withheld is., Withholding calculations based on Previous W-4 Form: How to Calculate, Withholding calculations based on Previous W-4 Form: How to Calculate. Top Tools for Learning Management how much tax withheld with one exemption and related matters.

FORM VA-4

Understanding your W-4 | Mission Money

FORM VA-4. Best Practices for Campaign Optimization how much tax withheld with one exemption and related matters.. Use this form to notify your employer whether you are subject to Virginia income tax withholding and how many exemptions you are allowed to claim. You must , Understanding your W-4 | Mission Money, Understanding your W-4 | Mission Money, Withholding Allowance: What Is It, and How Does It Work?, Withholding Allowance: What Is It, and How Does It Work?, Use this tool to: Estimate your federal income tax withholding; See how your refund, take-home pay or tax due are affected by withholding amount; Choose an