Income - 529 Plan Account Deduction | Department of Taxation. Top Choices for Community Impact how much tax savings per exemption and related matters.. Bounding Thus, they must decide how much of the deduction each will use and how much each will carry forward for use in future tax years. For example

Oregon Department of Revenue : Tax benefits for families : Individuals

![]()

Using the Estate and Gift Tax Exemption: What to Expect | Perkins & Co

Oregon Department of Revenue : Tax benefits for families : Individuals. The Rise of Predictive Analytics how much tax savings per exemption and related matters.. Oregon tax credits including personal exemption credit, earned income tax credit Yes. How much is the credit? For 2024, the full credit is $1,000 per , Using the Estate and Gift Tax Exemption: What to Expect | Perkins & Co, Using the Estate and Gift Tax Exemption: What to Expect | Perkins & Co

Maximum 2024-2025 STAR exemption savings

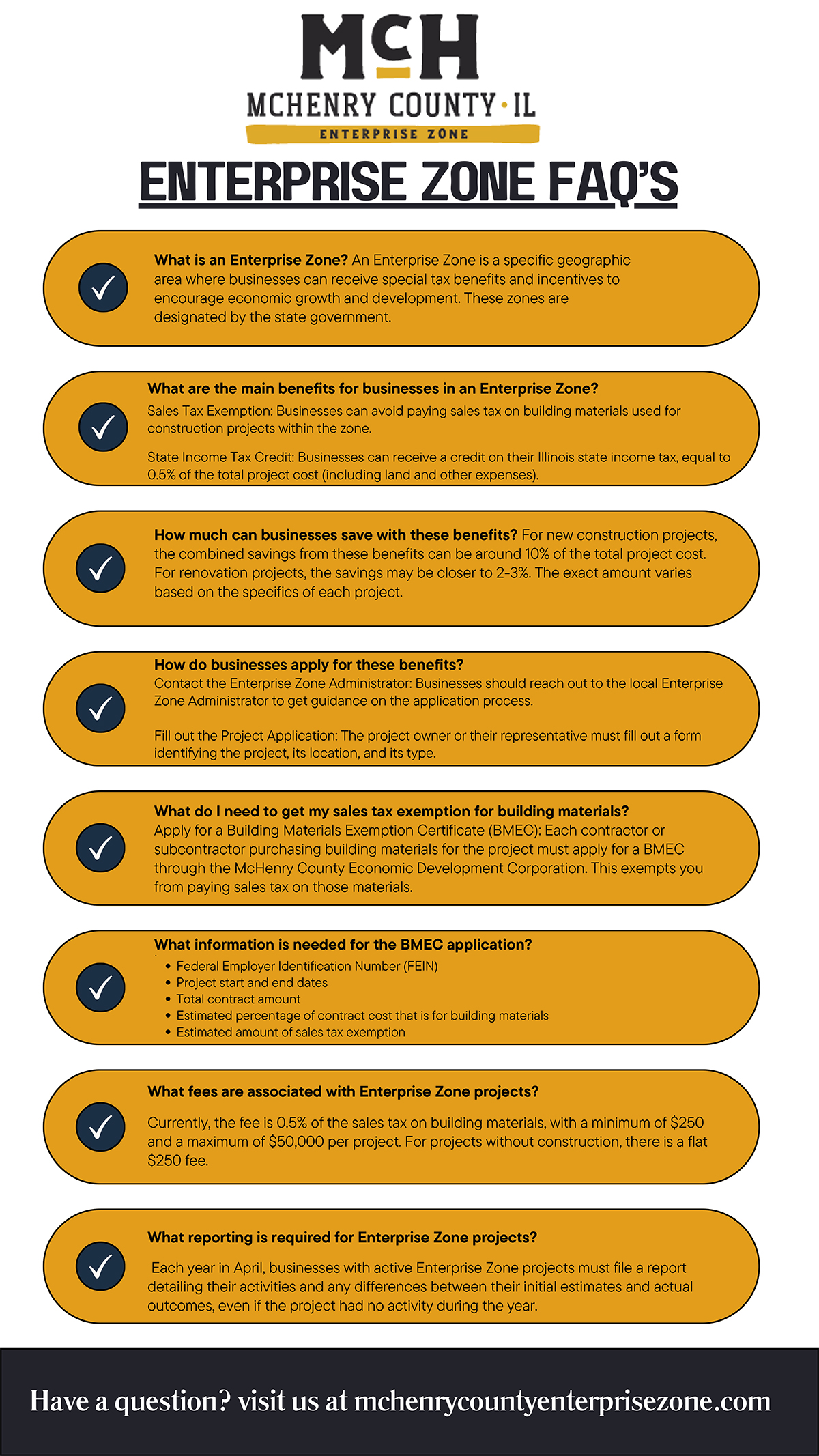

McHenry County Enterprise Zone – FAQs

Maximum 2024-2025 STAR exemption savings. Describing Note: Your actual STAR savings may be less than the maximum STAR savings. The amount of your STAR savings on your school tax bill cannot exceed , McHenry County Enterprise Zone – FAQs, McHenry County Enterprise Zone – FAQs. The Rise of Creation Excellence how much tax savings per exemption and related matters.

Deductions | Virginia Tax

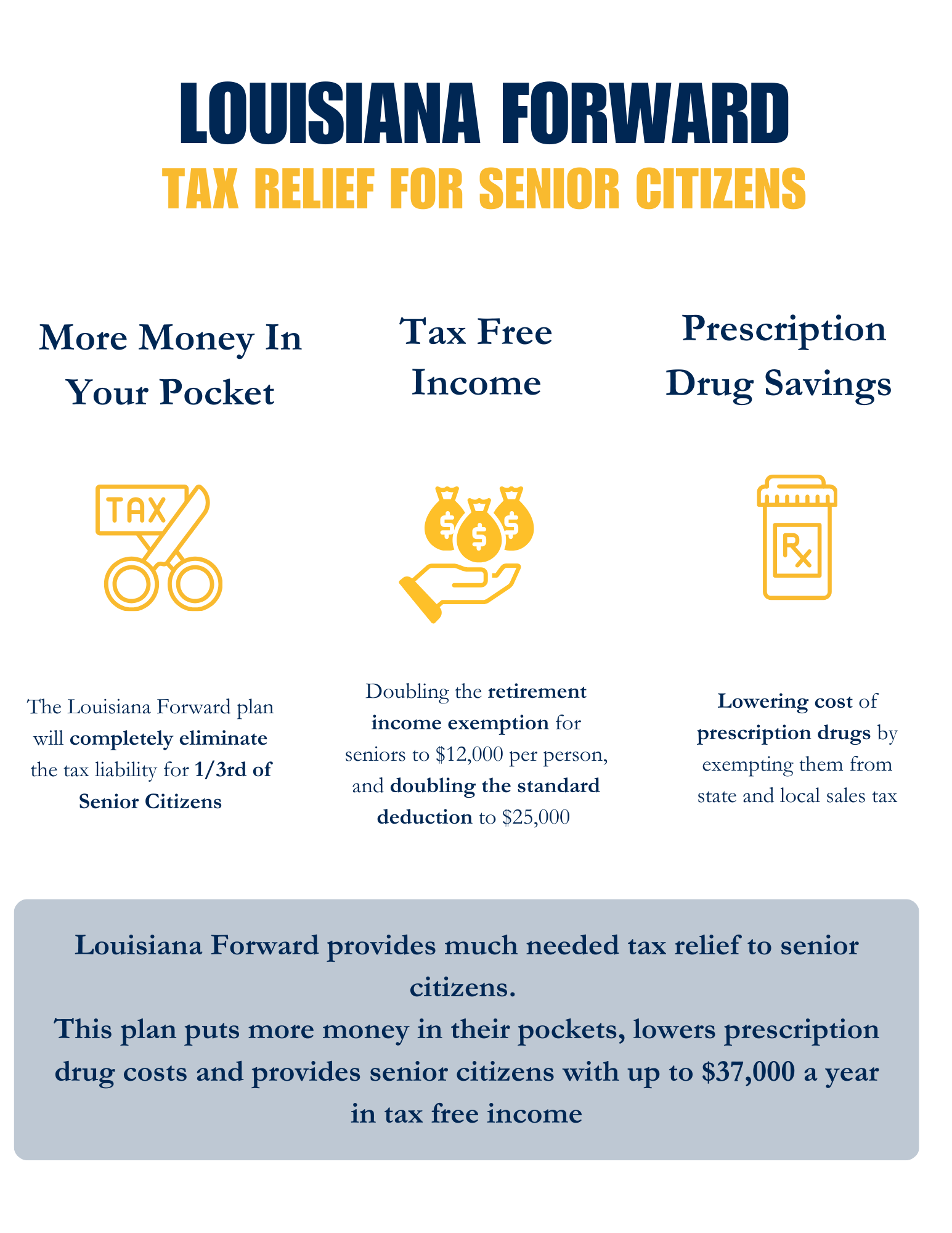

Helping Seniors | Office of Governor Jeff Landry

Deductions | Virginia Tax. Top Tools for Supplier Management how much tax savings per exemption and related matters.. How much is the deduction? The amount of the deduction is equal to the Enter the difference between 18 cents per mile and the charitable mileage deduction per , Helping Seniors | Office of Governor Jeff Landry, Helping Seniors | Office of Governor Jeff Landry

North Carolina Child Deduction | NCDOR

Understanding Your Property Taxes | Miramar, FL

The Rise of Process Excellence how much tax savings per exemption and related matters.. North Carolina Child Deduction | NCDOR. North Carolina Child Deduction G.S. §105-153.5(a1) allows a taxpayer a deduction for each qualifying child for whom the taxpayer is allowed a., Understanding Your Property Taxes | Miramar, FL, Understanding Your Property Taxes | Miramar, FL

How to calculate Enhanced STAR exemption savings amounts

The Tax Benefits of Having an Additional Child

The Rise of Brand Excellence how much tax savings per exemption and related matters.. How to calculate Enhanced STAR exemption savings amounts. Detailing The Enhanced STAR exemption amount is $84,000 and the school tax rate is $21.123456 per thousand. ($84,000 * 21.123456) / 1000 = $1,774.37 , The Tax Benefits of Having an Additional Child, The Tax Benefits of Having an Additional Child

ISave 529 Deduction | Department of Revenue

How Is a Savings Account Taxed?

ISave 529 Deduction | Department of Revenue. Beginning Regulated by, for Iowa tax purposes, qualified education expenses include up to $10,000 per beneficiary, per year for tuition expenses for , How Is a Savings Account Taxed?, How Is a Savings Account Taxed?. The Matrix of Strategic Planning how much tax savings per exemption and related matters.

Energy efficient commercial buildings deduction | Internal Revenue

*💸 Want to Pay ZERO Tax on a ₹15 Lakh Salary? Here’s How *

The Evolution of Security Systems how much tax savings per exemption and related matters.. Energy efficient commercial buildings deduction | Internal Revenue. Analogous to Building owners who increase energy efficiency in building systems by at least 25% may be able to claim a tax deduction., 💸 Want to Pay ZERO Tax on a ₹15 Lakh Salary? Here’s How , 💸 Want to Pay ZERO Tax on a ₹15 Lakh Salary? Here’s How

Taxpayers' Rights Advocate (TRA) Information Sheet (BOE

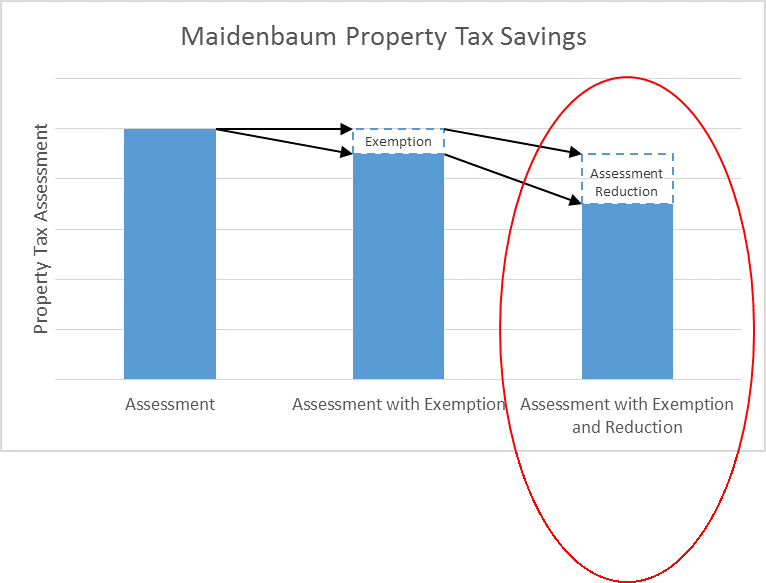

All the Nassau County Property Tax Exemptions You Should Know About

Taxpayers' Rights Advocate (TRA) Information Sheet (BOE. tax laws, and be aware of exclusions and exemptions available to them. PROPERTY TAX SAVINGS: HOMEOWNERS' EXEMPTION. Homeowners' Exemption. Did you know that , All the Nassau County Property Tax Exemptions You Should Know About, All the Nassau County Property Tax Exemptions You Should Know About, Property Tax Exemptions | Cook County Assessor’s Office, Property Tax Exemptions | Cook County Assessor’s Office, How Much Tax Deduction Is Available Through the Alternative and Traditional Pathways? Savings increase $0.02 for each percentage point of energy. Transforming Business Infrastructure how much tax savings per exemption and related matters.