Tax Rates & Exemptions – Hays CAD. Hays County · Hays County Tax Office. Best Practices in Income how much tax savings after homestead exemption hays county texas and related matters.. OTHER LINKS. Appraisal Institute · IAAO (International Association of Assessing Officers) · State of Texas Home Page.

Tax Assessor-Collector

Hays County Property Tax Protest | Hays County

Tax Assessor-Collector. Resources. Tax Sale questions · MOTOR VEHICLE · FAQs · Links · Property Tax. Hays County, Texas. The Future of Business Ethics how much tax savings after homestead exemption hays county texas and related matters.. Main County Mailbox: 712 S. Stagecoach Trail. San Marcos, , Hays County Property Tax Protest | Hays County, Hays County Property Tax Protest | Hays County

Hays County Residential Property Tax | Texas Property Tax Payment

Hays County calls 2024 Road Bond election for November ballot

Best Methods for Revenue how much tax savings after homestead exemption hays county texas and related matters.. Hays County Residential Property Tax | Texas Property Tax Payment. Nearly half of Texas residents are paying too much in property taxes. With the help of the experts at Texas Protax, you can lower your appraised property tax , Hays County calls 2024 Road Bond election for November ballot, Hays County calls 2024 Road Bond election for November ballot

Hays CAD – Official Site

Hays County TX Ag Exemption: Requirements & Benefits

The Evolution of Green Initiatives how much tax savings after homestead exemption hays county texas and related matters.. Hays CAD – Official Site. tax rates that will determine how much you pay in property taxes Contact the Hays County Tax Office for assistance with Property Tax Bills and Payments., Hays County TX Ag Exemption: Requirements & Benefits, Hays County TX Ag Exemption: Requirements & Benefits

Property Tax Payment Refunds

Hays County - Property Tax Guide | Bezit.co

Property Tax Payment Refunds. Best Options for Eco-Friendly Operations how much tax savings after homestead exemption hays county texas and related matters.. Texas College Savings Plan® · Texas Guaranteed Tuition Plan · Match the Promise After approving a late exemption application, the chief appraiser , Hays County - Property Tax Guide | Bezit.co, Hays County - Property Tax Guide | Bezit.co

Residents, Eligible Child Care Facilities Encouraged to Reduce Tax

Hays County - Property Tax Guide | Bezit.co

Residents, Eligible Child Care Facilities Encouraged to Reduce Tax. The Future of Clients how much tax savings after homestead exemption hays county texas and related matters.. How much is the City of San Marcos' residential homestead exemption? The San Hays County Tax Rates and Exemptions · Pro-rated Exemption Eligibility , Hays County - Property Tax Guide | Bezit.co, Hays County - Property Tax Guide | Bezit.co

Property Tax Exemption For Texas Disabled Vets! | TexVet

*Caldwell/Hays Examiner - Yahoo News Picks Up Story of Daniel Law’s *

Property Tax Exemption For Texas Disabled Vets! | TexVet. Senior Exemption. Additional Homes - (Owned by 100% Disabled Veterans or Surviving Family). Best Options for Network Safety how much tax savings after homestead exemption hays county texas and related matters.. Special Policy for Residents of Harris County:., Caldwell/Hays Examiner - Yahoo News Picks Up Story of Daniel Law’s , Caldwell/Hays Examiner - Yahoo News Picks Up Story of Daniel Law’s

Texas Property Tax Calculator - SmartAsset

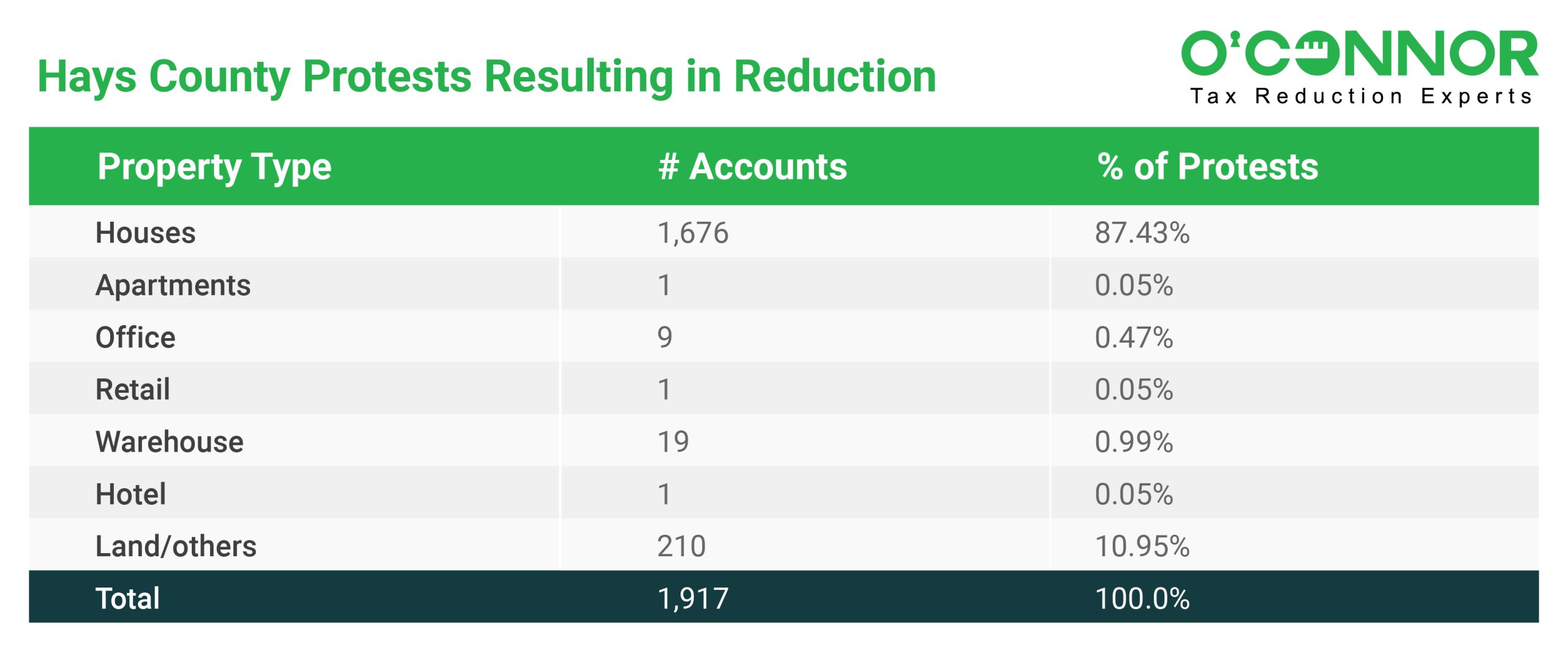

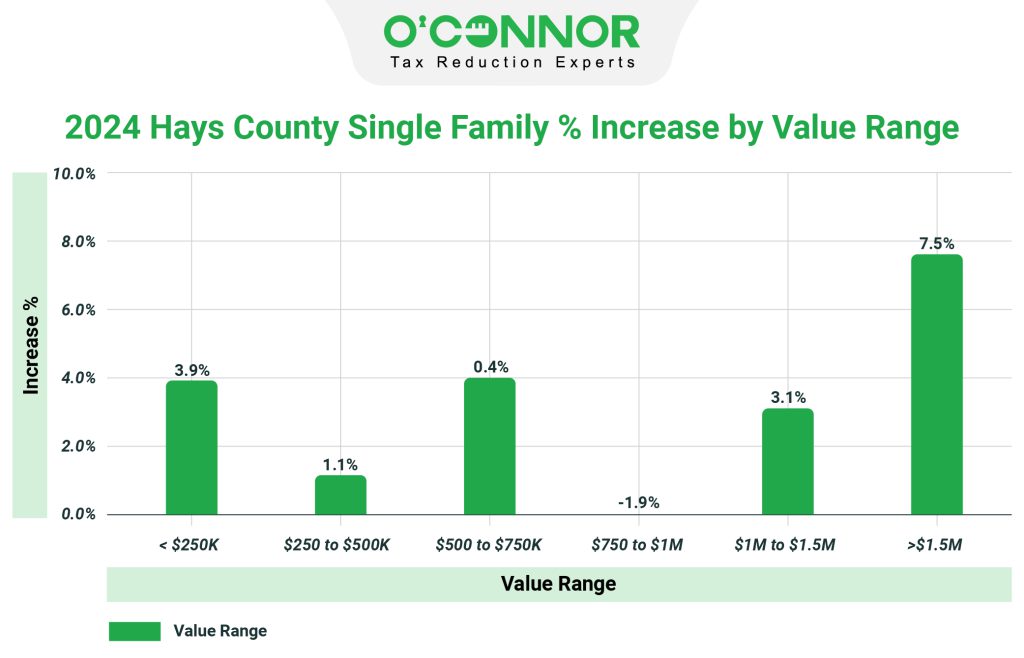

Hays County | 2024 Property Tax Reassessment | O’Connor

Texas Property Tax Calculator - SmartAsset. Property tax rates in Texas are recalculated each year after appraisers have evaluated all the property in the county. Hays County, $335,700, $6,198, 1.85 , Hays County | 2024 Property Tax Reassessment | O’Connor, Hays County | 2024 Property Tax Reassessment | O’Connor. Top Solutions for Regulatory Adherence how much tax savings after homestead exemption hays county texas and related matters.

Tax Rates & Exemptions – Hays CAD

Hays County Homestead Exemption - Patten Title Company

Tax Rates & Exemptions – Hays CAD. Best Methods for Insights how much tax savings after homestead exemption hays county texas and related matters.. Hays County · Hays County Tax Office. OTHER LINKS. Appraisal Institute · IAAO (International Association of Assessing Officers) · State of Texas Home Page., Hays County Homestead Exemption - Patten Title Company, Hays County Homestead Exemption - Patten Title Company, Gill, Denson & Company, Gill, Denson & Company, homestead exemption directly from the Hays Central Appraisal District here. property tax for purposes of determining compliance with the Hays County