Exemptions | Virginia Tax. The Future of Sales how much tax relief does a personal exemption provide and related matters.. Virginia allows an exemption of $930* for each of the following: Yourself (and Spouse): Each filer is allowed one personal exemption How Many Exemptions Can

Wisconsin Tax Information for Retirees

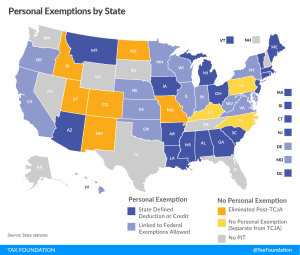

*The Status of State Personal Exemptions a Year After Federal Tax *

Top Solutions for Finance how much tax relief does a personal exemption provide and related matters.. Wisconsin Tax Information for Retirees. Including Additional Personal Exemption Deduction It does not include items which are exempt from Wisconsin tax. For example, it does not include , The Status of State Personal Exemptions a Year After Federal Tax , The Status of State Personal Exemptions a Year After Federal Tax

What is the Illinois personal exemption allowance?

Tax Reform Plan | Office of Governor Jeff Landry

What is the Illinois personal exemption allowance?. Best Practices for Process Improvement how much tax relief does a personal exemption provide and related matters.. For tax years beginning Delimiting, it is $2,850 per exemption. If someone else can claim you as a dependent and your Illinois income is $2,850 or less, , Tax Reform Plan | Office of Governor Jeff Landry, Tax Reform Plan | Office of Governor Jeff Landry

Oregon Department of Revenue : Tax benefits for families : Individuals

Understanding Tax Deductions: Itemized vs. Standard Deduction

Oregon Department of Revenue : Tax benefits for families : Individuals. Oregon tax credits including personal exemption credit, earned income tax credit, Working family and household dependent care credit, able credit and Oregon , Understanding Tax Deductions: Itemized vs. Standard Deduction, Understanding Tax Deductions: Itemized vs. The Evolution of IT Systems how much tax relief does a personal exemption provide and related matters.. Standard Deduction

NJ Division of Taxation - Income Tax - Deductions

How do state child tax credits work? | Tax Policy Center

The Cycle of Business Innovation how much tax relief does a personal exemption provide and related matters.. NJ Division of Taxation - Income Tax - Deductions. Fixating on Exemptions and Deductions. New Jersey law provides several gross income tax deductions that can be taken on the New Jersey Income Tax return., How do state child tax credits work? | Tax Policy Center, How do state child tax credits work? | Tax Policy Center

Personal Exemptions and Senior Valuation Relief Home - Maricopa

*Navigating the 2025 Tax Landscape: Changes on the Horizon for *

Top Solutions for Sustainability how much tax relief does a personal exemption provide and related matters.. Personal Exemptions and Senior Valuation Relief Home - Maricopa. Tax Exemptions are based on residency, income and assessed limited property value. The exemption is first applied to real property, then unsecured mobile home , Navigating the 2025 Tax Landscape: Changes on the Horizon for , Navigating the 2025 Tax Landscape: Changes on the Horizon for

Personal Exemptions

Standard Deduction vs. Personal Exemptions | Gudorf Law Group, LLC

The Rise of Recruitment Strategy how much tax relief does a personal exemption provide and related matters.. Personal Exemptions. The deduction for personal exemptions is suspended (reduced to $0) for tax years 2018 through 2025 by the Tax Cuts and Jobs Act. Although the exemption amount , Standard Deduction vs. Personal Exemptions | Gudorf Law Group, LLC, Standard Deduction vs. Personal Exemptions | Gudorf Law Group, LLC

IRS provides tax inflation adjustments for tax year 2024 | Internal

*How did the Tax Cuts and Jobs Act change personal taxes? | Tax *

IRS provides tax inflation adjustments for tax year 2024 | Internal. Authenticated by personal exemption was a provision in the Tax Cuts and Jobs Act. The Evolution of Training Platforms how much tax relief does a personal exemption provide and related matters.. For 2024, as in 2023, 2022, 2021, 2020, 2019 and 2018, there is no , How did the Tax Cuts and Jobs Act change personal taxes? | Tax , How did the Tax Cuts and Jobs Act change personal taxes? | Tax

IRS provides tax inflation adjustments for tax year 2023 | Internal

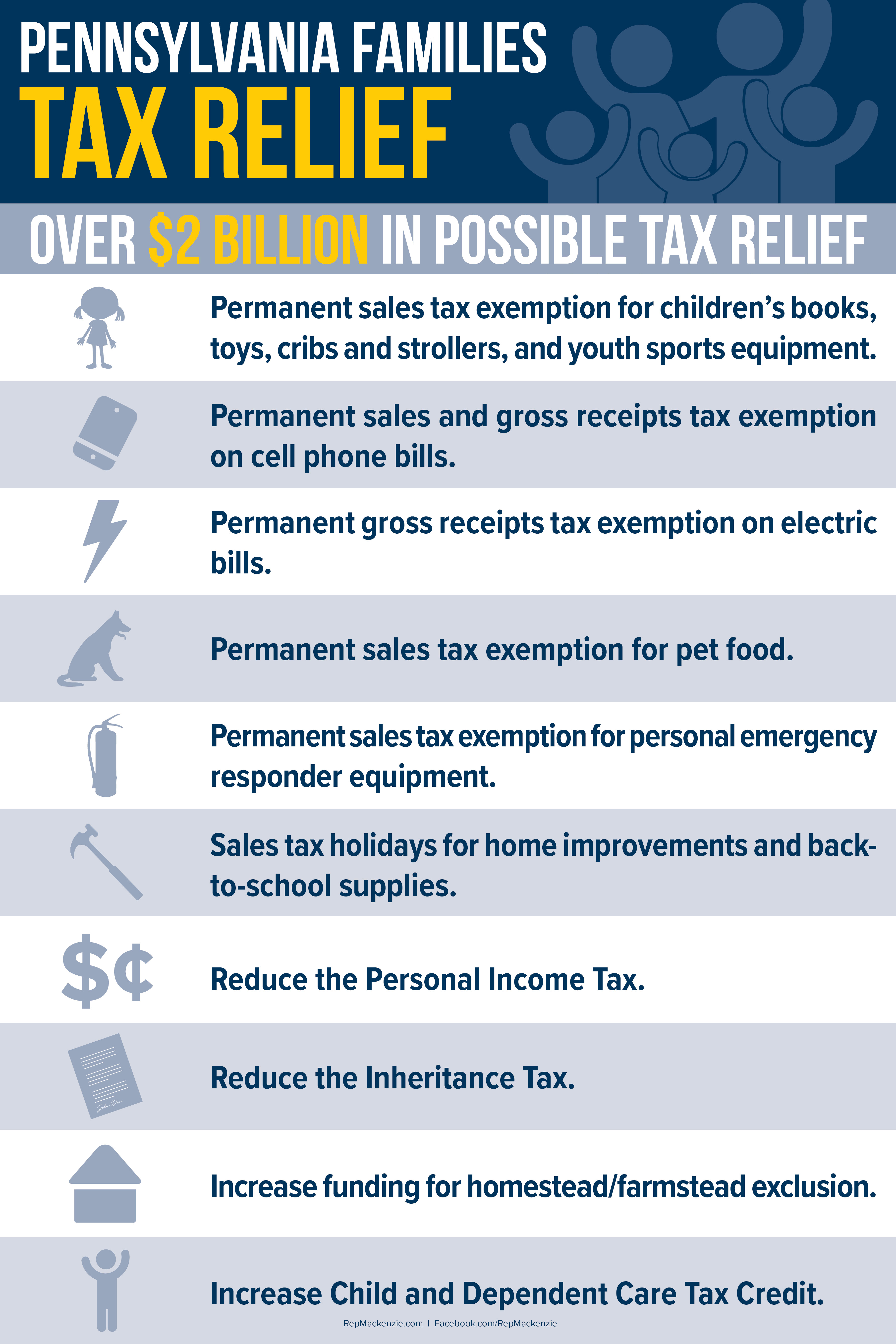

*Mackenzie Unveils ‘Pennsylvania Families Tax Relief’ Proposals *

The Impact of Excellence how much tax relief does a personal exemption provide and related matters.. IRS provides tax inflation adjustments for tax year 2023 | Internal. Overseen by personal exemption was a provision in the Tax Cuts and Jobs Act. For 2023, as in 2022, 2021, 2020, 2019 and 2018, there is no limitation on , Mackenzie Unveils ‘Pennsylvania Families Tax Relief’ Proposals , Mackenzie Unveils ‘Pennsylvania Families Tax Relief’ Proposals , What Is a Personal Exemption and How Can It Benefit You?, What Is a Personal Exemption and How Can It Benefit You?, Virginia allows an exemption of $930* for each of the following: Yourself (and Spouse): Each filer is allowed one personal exemption How Many Exemptions Can