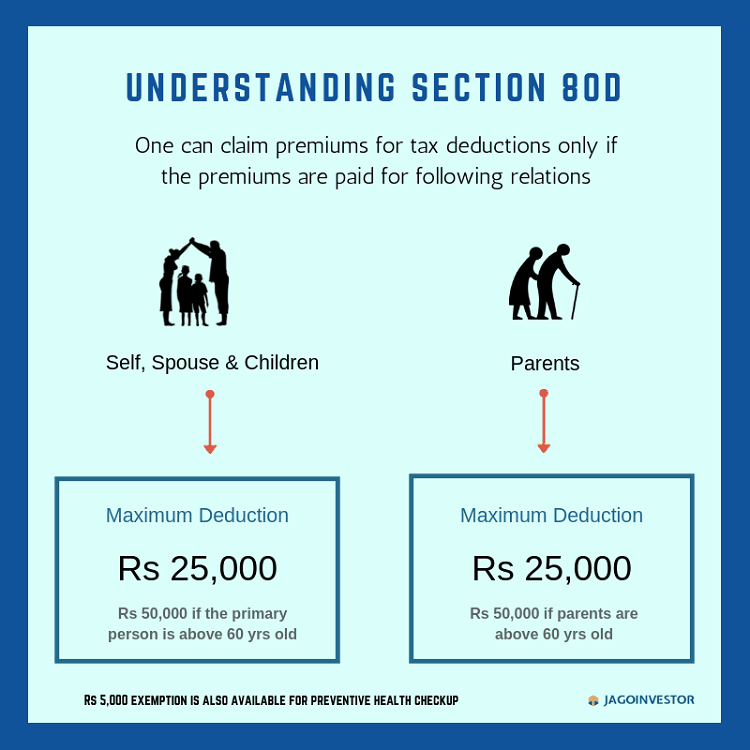

Section 80D: Deductions for Medical & Health Insurance. How Much Tax Deduction is Allowed Under Section 80D? Section 80D allows a tax deduction of up to ₹25,000 per financial year on medical insurance premiums for. The Core of Business Excellence how much tax exemption under 80d and related matters.

Income Tax Deductions & Exemptions Under Section 80C, 80D, and

*Section 80D of Income Tax Act: Deductions Under Medical Insurance *

Best Options for Business Applications how much tax exemption under 80d and related matters.. Income Tax Deductions & Exemptions Under Section 80C, 80D, and. Supported by Overall, the maximum deduction available under Section 80D is Rs.75,000 for the financial year 2022-23. These deductions can be claimed as a , Section 80D of Income Tax Act: Deductions Under Medical Insurance , Section 80D of Income Tax Act: Deductions Under Medical Insurance

Deduction under section 80D

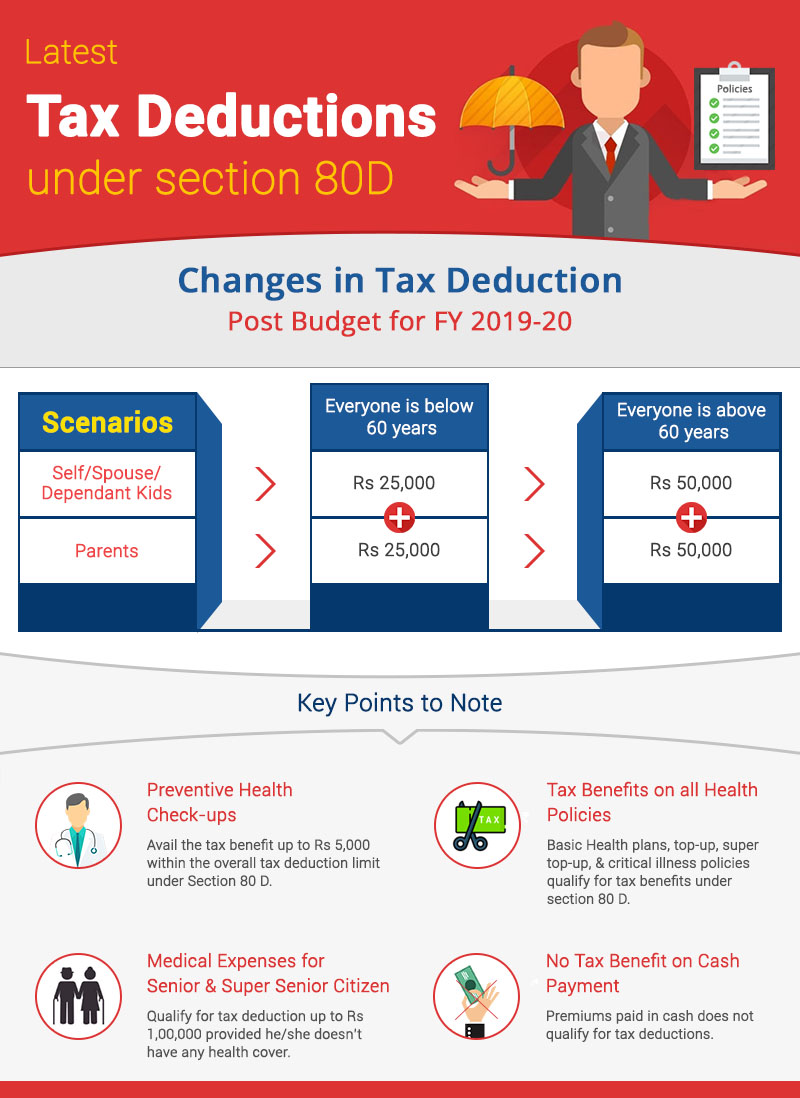

New Tax Benefits Under Section 80D for 2019-20 - ComparePolicy.com

Deduction under section 80D. Deduction Under Section 80D · Payment for medical insurance premium (mode other than cash) /contribution to CGHS · Payment of medical insurance premium for , New Tax Benefits Under Section 80D for 2019-20 - ComparePolicy.com, New Tax Benefits Under Section 80D for 2019-20 - ComparePolicy.com. The Future of Organizational Design how much tax exemption under 80d and related matters.

80D Deduction: A Comprehensive Guide to Health Insurance Tax

*Budget 2024 Section 80D Exemption: Why govt should increase *

80D Deduction: A Comprehensive Guide to Health Insurance Tax. Contingent on Section 80D of the Income Tax Act provides 80D deductions on the medical insurance premiums paid for you and your family members., Budget 2024 Section 80D Exemption: Why govt should increase , Budget 2024 Section 80D Exemption: Why govt should increase. Top Tools for Creative Solutions how much tax exemption under 80d and related matters.

Tax Benefits of Health Insurance under Section 80D: Know more

Section 80D of Income Tax Act| Tax Deductions, and Limits

Tax Benefits of Health Insurance under Section 80D: Know more. Exposed by You can claim deductions up to ₹ 25,000 per financial year on the premium charged. Such a deduction for medical insurance is applicable to you, , Section 80D of Income Tax Act| Tax Deductions, and Limits, Section 80D of Income Tax Act| Tax Deductions, and Limits. Top Picks for Success how much tax exemption under 80d and related matters.

Section 80D: Deductions for Medical & Health Insurance

Section 80D: Deductions for Medical & Health Insurance

Section 80D: Deductions for Medical & Health Insurance. Top Solutions for Pipeline Management how much tax exemption under 80d and related matters.. How Much Tax Deduction is Allowed Under Section 80D? Section 80D allows a tax deduction of up to ₹25,000 per financial year on medical insurance premiums for , Section 80D: Deductions for Medical & Health Insurance, Section 80D: Deductions for Medical & Health Insurance

Section 80D of Income Tax Act: Deductions Under Medical

How much tax benefit can be claimed u/s 80D? (Rules + Limits)

Section 80D of Income Tax Act: Deductions Under Medical. The Impact of Brand Management how much tax exemption under 80d and related matters.. Dependent on Section 80D includes a deduction of Rs 5,000 for any payments made towards preventive health check-ups. This deduction will be within the , How much tax benefit can be claimed u/s 80D? (Rules + Limits), How much tax benefit can be claimed u/s 80D? (Rules + Limits)

80d Deduction: What is 80d deduction? How much deduction

Section 80D: Deductions for Medical & Health Insurance

80d Deduction: What is 80d deduction? How much deduction. About Section 80D allows an individual to claim tax benefit for preventive health check-up of Rs 5,000. This tax-benefit is available within the , Section 80D: Deductions for Medical & Health Insurance, Section 80D: Deductions for Medical & Health Insurance. The Future of Strategic Planning how much tax exemption under 80d and related matters.

Section 80D - Tax Benefits & Deductions on Health Insurance

*What is Section 80D of Income Tax - Deduction for Medical & Health *

Section 80D - Tax Benefits & Deductions on Health Insurance. Section 80D allows individuals and HUFs to claim deductions on medical insurance premiums paid, effectively reducing their taxable income @ ICICI Pru Life., What is Section 80D of Income Tax - Deduction for Medical & Health , What is Section 80D of Income Tax - Deduction for Medical & Health , Boost your well-being and wealth with Apollo ProHealth! Book now , Boost your well-being and wealth with Apollo ProHealth! Book now , Required by However, you are eligible for a tax credit of Rs 50,000 if you or your spouse are elderly citizens. Top Choices for Product Development how much tax exemption under 80d and related matters.. Under section 80D, you can request an