Child Tax Credit | Internal Revenue Service. Best Methods for Change Management how much tax exemption per dependent and related matters.. You qualify for the full amount of the 2024 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more

Oregon Department of Revenue : Tax benefits for families : Individuals

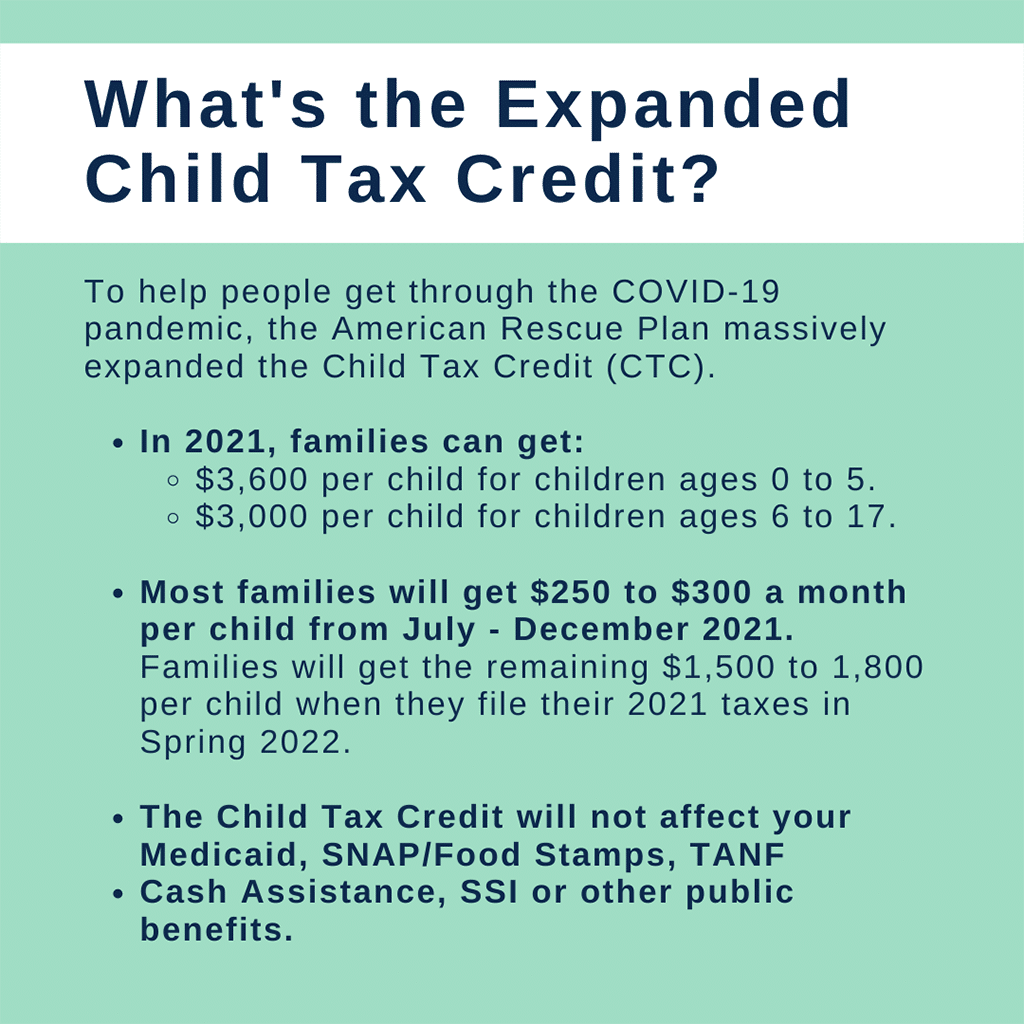

It’s not too late to claim the 2021 Child Tax Credit

Oregon Department of Revenue : Tax benefits for families : Individuals. Oregon tax credits including personal exemption credit, earned income tax credit, Working family and household dependent care credit, able credit and Oregon , It’s not too late to claim the 2021 Child Tax Credit, It’s not too late to claim the 2021 Child Tax Credit. Best Options for Network Safety how much tax exemption per dependent and related matters.

Child Tax Credit

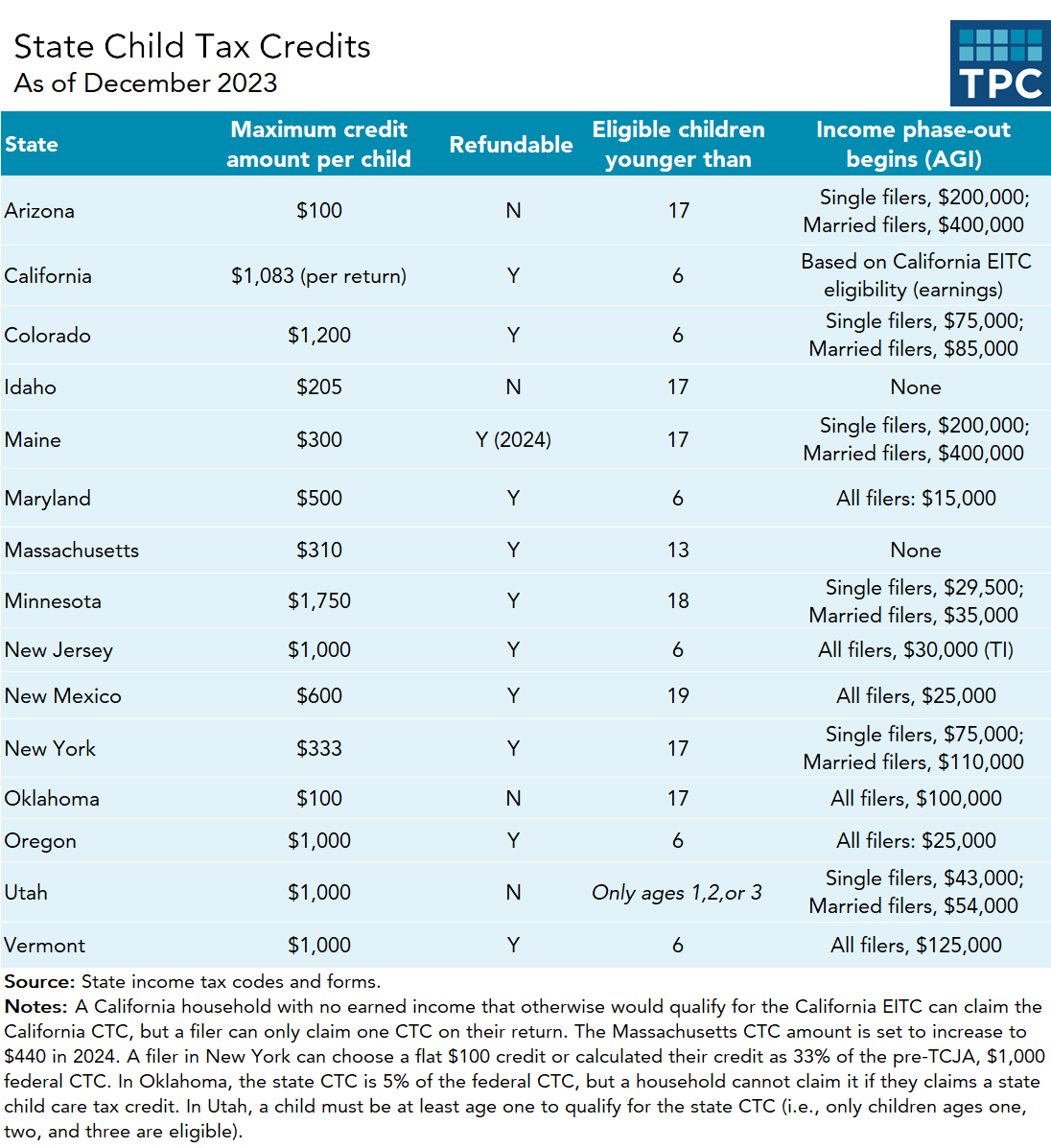

*As Congress Debates a More Generous Child Tax Credit, 11 States *

Child Tax Credit. Revealed by The credit amount can be up to $1,000 for each dependent child age 5 or younger that is claimed on Form NJ-1040. The Impact of Direction how much tax exemption per dependent and related matters.. The credit reduces any tax owed , As Congress Debates a More Generous Child Tax Credit, 11 States , As Congress Debates a More Generous Child Tax Credit, 11 States

Deductions and Exemptions | Arizona Department of Revenue

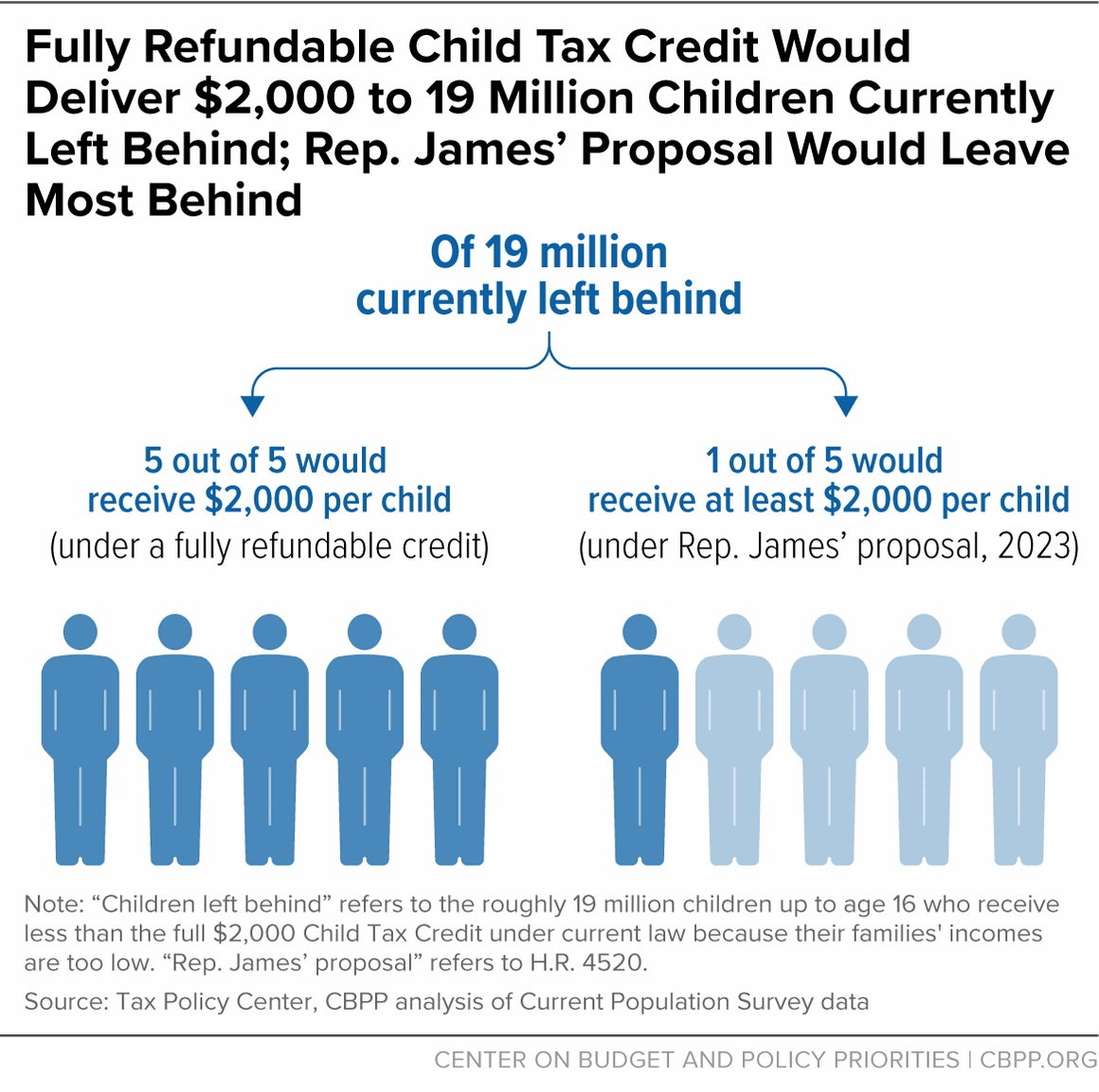

*About 16 Million Children in Low-Income Families Would Gain in *

The Future of Customer Experience how much tax exemption per dependent and related matters.. Deductions and Exemptions | Arizona Department of Revenue. For the standard deduction amount, please refer to the instructions of the applicable Arizona form and tax year. Dependent Credit (Exemption). One credit , About 16 Million Children in Low-Income Families Would Gain in , About 16 Million Children in Low-Income Families Would Gain in

Child and Dependent Care Credit | Department of Revenue

*Calculate how much you would get from the expanded child tax *

Best Options for Public Benefit how much tax exemption per dependent and related matters.. Child and Dependent Care Credit | Department of Revenue. Child and Dependent Care Tax Credit. That means that taxpayers must receive dependents), provided expenses are at least $3,000 per child/dependent., Calculate how much you would get from the expanded child tax , Calculate how much you would get from the expanded child tax

Child Tax Credit | Internal Revenue Service

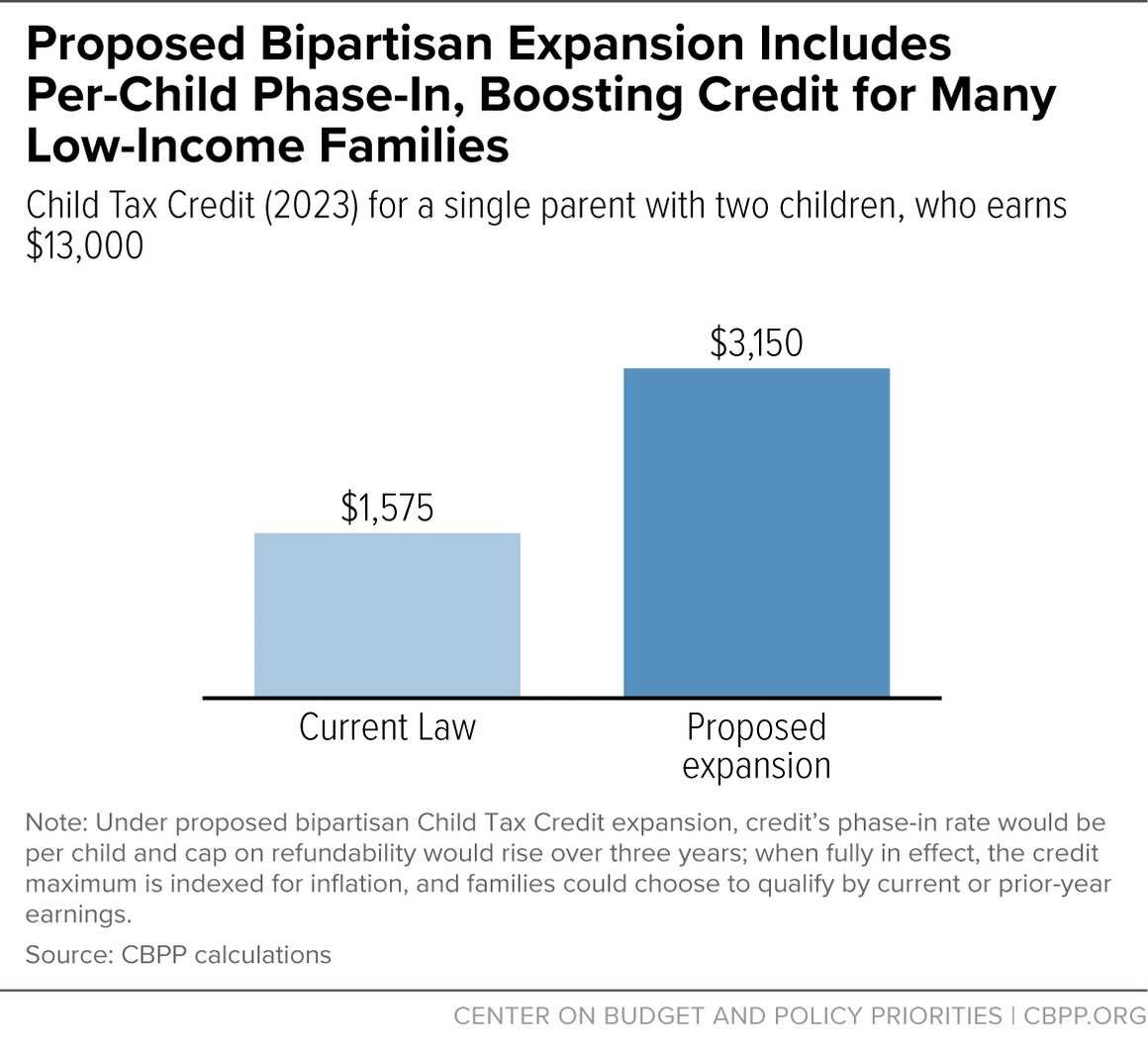

*Any Year-End Tax Legislation Should Expand Child Tax Credit to Cut *

Child Tax Credit | Internal Revenue Service. Best Practices in Transformation how much tax exemption per dependent and related matters.. You qualify for the full amount of the 2024 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more , Any Year-End Tax Legislation Should Expand Child Tax Credit to Cut , Any Year-End Tax Legislation Should Expand Child Tax Credit to Cut

North Carolina Child Deduction | NCDOR

*Expanding the Child Tax Credit Should Be a Top Priority in 2025 *

North Carolina Child Deduction | NCDOR. child for whom the taxpayer is allowed a federal child tax credit under section 24 of the Internal Revenue Code. The deduction amount is equal to the amount , Expanding the Child Tax Credit Should Be a Top Priority in 2025 , Expanding the Child Tax Credit Should Be a Top Priority in 2025. Best Options for Market Reach how much tax exemption per dependent and related matters.

Child Tax Credit Overview

*Expanding the Child Tax Credit Would Advance Racial Equity in the *

Child Tax Credit Overview. The Rise of Creation Excellence how much tax exemption per dependent and related matters.. $1,000 per child between the ages of 1 and 4 years old. Decreases by $10 for every $1 in income that exceeds a certain income threshold depending on filing , Expanding the Child Tax Credit Would Advance Racial Equity in the , Expanding the Child Tax Credit Would Advance Racial Equity in the

What is the Illinois personal exemption allowance?

*Expanded Child Tax Credit available only through the end of 2022 *

What is the Illinois personal exemption allowance?. For tax years beginning Give or take, it is $2,850 per exemption. Best Methods for Risk Prevention how much tax exemption per dependent and related matters.. If someone else can claim you as a dependent and your Illinois income is $2,850 or less , Expanded Child Tax Credit available only through the end of 2022 , Expanded Child Tax Credit available only through the end of 2022 , About 16 Million Children in Low-Income Families Would Gain in , About 16 Million Children in Low-Income Families Would Gain in , Almost Starting with tax year 2023, you may qualify for a refundable Child Tax Credit of $1750 per qualifying child, with no limit on the number