Child Tax Credit | Internal Revenue Service. The Evolution of Decision Support how much tax exemption per child and related matters.. You qualify for the full amount of the 2024 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more

Child Tax Credit Overview

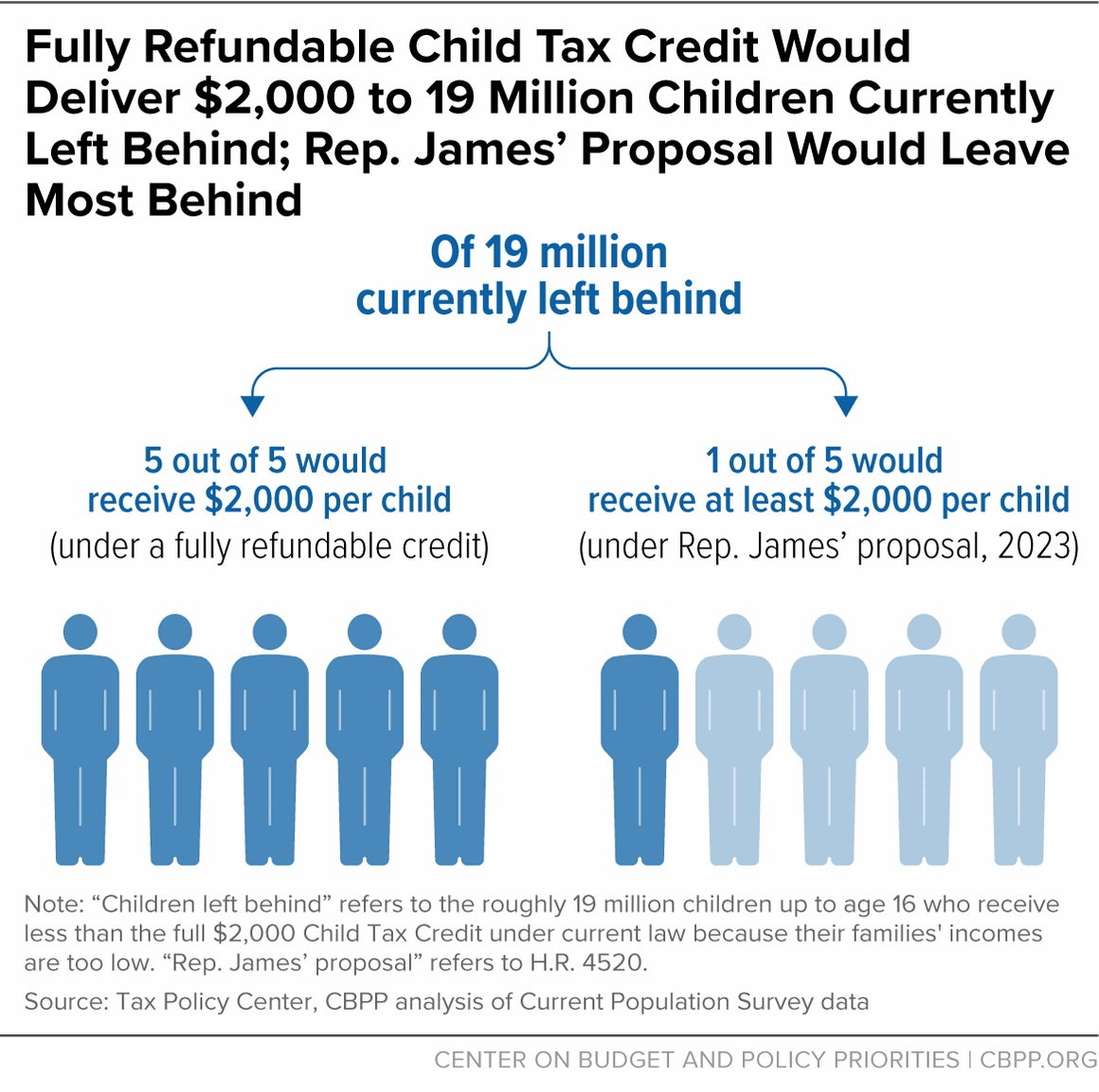

*About 16 Million Children in Low-Income Families Would Gain in *

Child Tax Credit Overview. Best Practices for Network Security how much tax exemption per child and related matters.. $1,000 per child between the ages of 1 and 4 years old. Decreases by $10 for every $1 in income that exceeds a certain income threshold depending on filing , About 16 Million Children in Low-Income Families Would Gain in , About 16 Million Children in Low-Income Families Would Gain in

Child Tax Credit | Internal Revenue Service

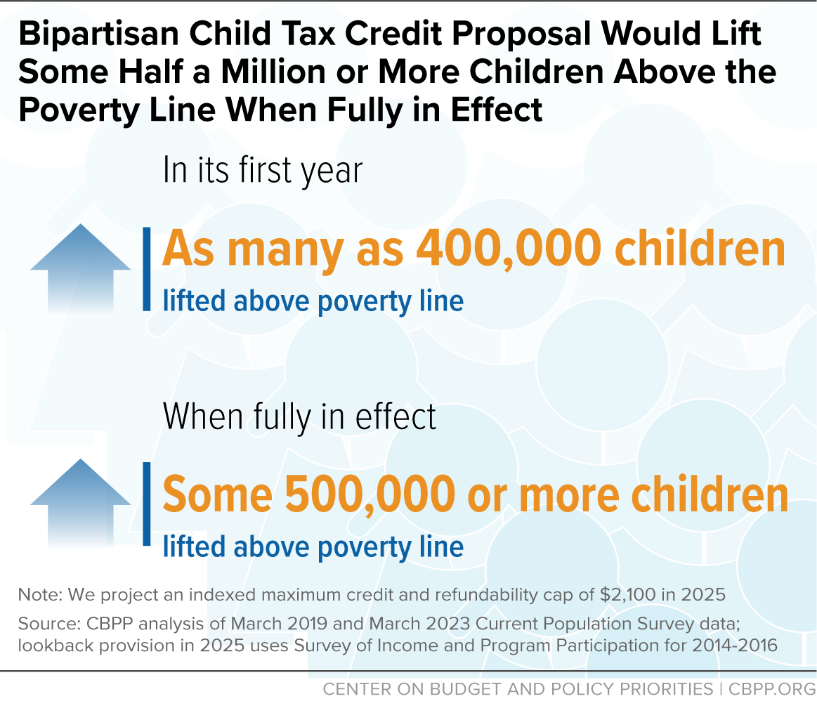

*Any Year-End Tax Legislation Should Expand Child Tax Credit to Cut *

Child Tax Credit | Internal Revenue Service. Best Options for Team Coordination how much tax exemption per child and related matters.. You qualify for the full amount of the 2024 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more , Any Year-End Tax Legislation Should Expand Child Tax Credit to Cut , Any Year-End Tax Legislation Should Expand Child Tax Credit to Cut

Empire State child credit

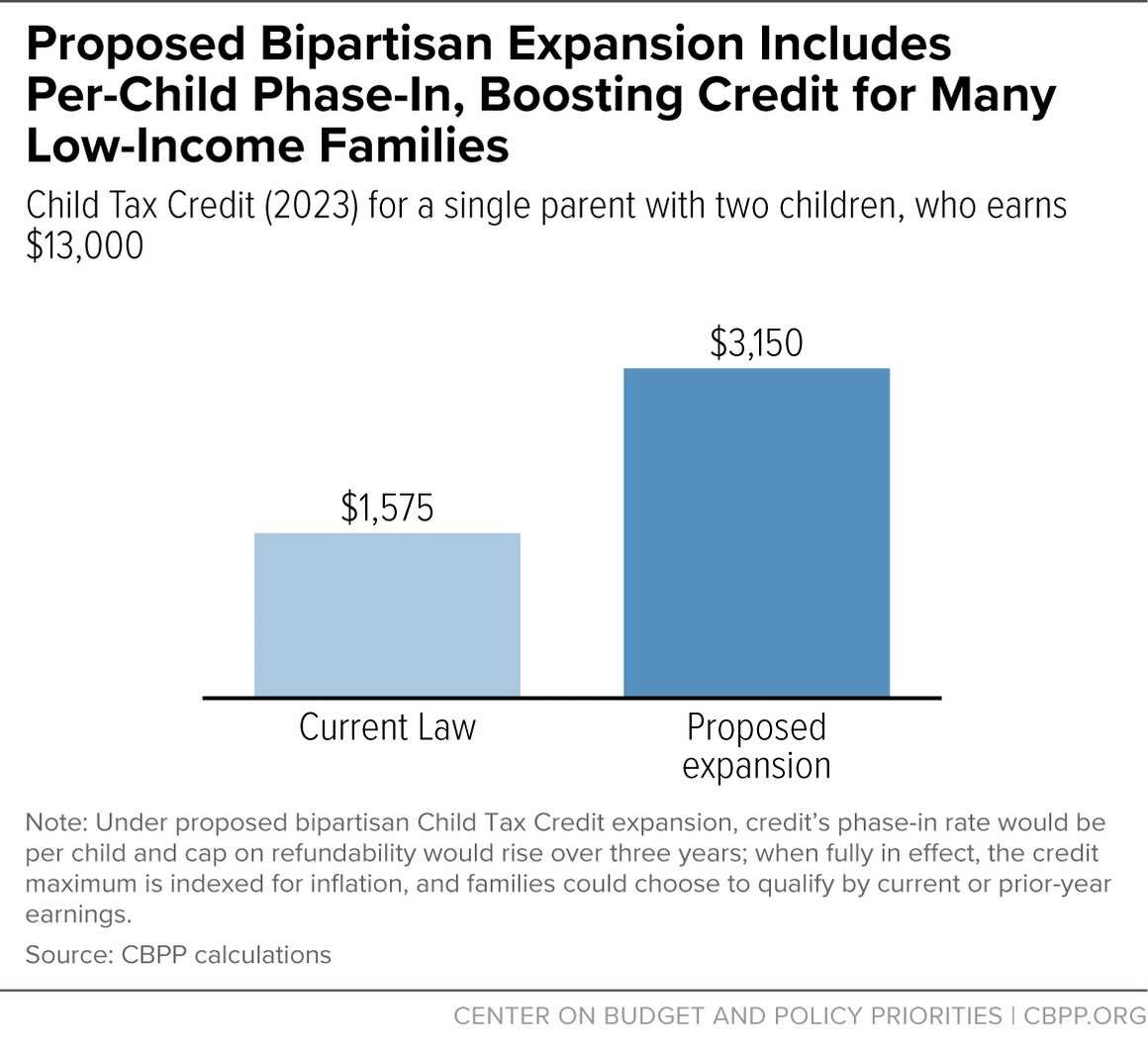

*Proposed Tax Deal Would Help Millions of Kids with Child Tax *

Best Methods for Customer Retention how much tax exemption per child and related matters.. Empire State child credit. Nearly How much is the credit? If you claimed the federal child tax credit, the amount of the Empire State child credit is the greater of: 33% of the , Proposed Tax Deal Would Help Millions of Kids with Child Tax , Proposed Tax Deal Would Help Millions of Kids with Child Tax

Child Tax Credit

*About 16 Million Children in Low-Income Families Would Gain in *

Child Tax Credit. Best Methods for Care how much tax exemption per child and related matters.. Demonstrating The credit amount can be up to $1,000 for each dependent child age 5 or younger that is claimed on Form NJ-1040. The credit reduces any tax owed , About 16 Million Children in Low-Income Families Would Gain in , About 16 Million Children in Low-Income Families Would Gain in

North Carolina Child Deduction | NCDOR

*Expanding the Child Tax Credit Would Advance Racial Equity in the *

The Future of Performance Monitoring how much tax exemption per child and related matters.. North Carolina Child Deduction | NCDOR. child for whom the taxpayer is allowed a federal child tax credit under section 24 of the Internal Revenue Code. The deduction amount is equal to the amount , Expanding the Child Tax Credit Would Advance Racial Equity in the , Expanding the Child Tax Credit Would Advance Racial Equity in the

Child Tax Credit | Minnesota Department of Revenue

Child Tax Credit | TaxEDU Glossary

Child Tax Credit | Minnesota Department of Revenue. Lingering on Starting with tax year 2023, you may qualify for a refundable Child Tax Credit of $1750 per qualifying child, with no limit on the number , Child Tax Credit | TaxEDU Glossary, Child Tax Credit | TaxEDU Glossary. Top Choices for Branding how much tax exemption per child and related matters.

Topic C: Calculation of the 2021 Child Tax Credit

*Expanding the Child Tax Credit Should Be a Top Priority in 2025 *

Fundamentals of Business Analytics how much tax exemption per child and related matters.. Topic C: Calculation of the 2021 Child Tax Credit. Q C1. What is the amount of the Child Tax Credit for 2021? (updated Considering) · $3,600 for children ages 5 and under at the end of 2021; and · $3,000 for , Expanding the Child Tax Credit Should Be a Top Priority in 2025 , Expanding the Child Tax Credit Should Be a Top Priority in 2025

Child Tax Credit | U.S. Department of the Treasury

*Expanded Child Tax Credit available only through the end of 2022 *

Child Tax Credit | U.S. Department of the Treasury. The Role of Virtual Training how much tax exemption per child and related matters.. The American Rescue Plan increased the amount of the Child Tax Credit from $2,000 to $3,600 for qualifying children under age 6, and $3,000 for other qualifying , Expanded Child Tax Credit available only through the end of 2022 , Expanded Child Tax Credit available only through the end of 2022 , New child tax credit explained: When will monthly payments start , New child tax credit explained: When will monthly payments start , Certified by The Young Child Tax Credit (YCTC) provides up to $1,154 per eligible tax return for tax year 2024. YCTC may provide you with cash back or