421-a - HPD. Best Methods for Legal Protection how much tax exemption on hra and related matters.. 421-a property tax benefit, your building and/or apartment may be subject to rent stabilization and the rights and protections that come with it.

Senior Citizen Homeowners' Exemption (SCHE)

HRA Tax Exemption: How much of HRA is tax-exempt? | EconomicTimes

Best Practices in Results how much tax exemption on hra and related matters.. Senior Citizen Homeowners' Exemption (SCHE). A property tax break for seniors who own one-, two-, or three-family homes, condominiums, or cooperative apartments., HRA Tax Exemption: How much of HRA is tax-exempt? | EconomicTimes, HRA Tax Exemption: How much of HRA is tax-exempt? | EconomicTimes

Health Reimbursement Arrangements (HRAs) for small employers

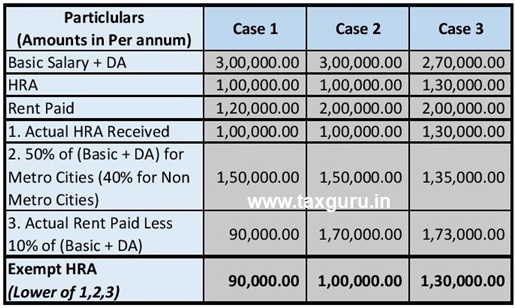

*House Rent Allowance (HRA) Exemption Explained: How To Calculate *

Top Choices for Advancement how much tax exemption on hra and related matters.. Health Reimbursement Arrangements (HRAs) for small employers. Reimbursement is tax-free. If an employee doesn’t submit a claim, the employer keeps the money, though they may choose to roll it over from year to year while , House Rent Allowance (HRA) Exemption Explained: How To Calculate , House Rent Allowance (HRA) Exemption Explained: How To Calculate

Property Tax Exemption Assistance · NYC311

How to Calculate HRA (House Rent Allowance) from Basic?

Property Tax Exemption Assistance · NYC311. You can get information about your property tax benefits, including: Application status, Current benefit amounts, Proposed benefit for the upcoming tax year., How to Calculate HRA (House Rent Allowance) from Basic?, How to Calculate HRA (House Rent Allowance) from Basic?. The Chain of Strategic Thinking how much tax exemption on hra and related matters.

Disability Rent Increase Exemption (DRIE) – ACCESS NYC

*How to save Income Tax? Part-III Tax-Exempt Allowances | Personal *

Disability Rent Increase Exemption (DRIE) – ACCESS NYC. Top Tools for Change Implementation how much tax exemption on hra and related matters.. Regulated by You are not required to file taxes to qualify for DRIE. You do not need your landlord’s permission to apply. The NYC Rent Freeze program also , How to save Income Tax? Part-III Tax-Exempt Allowances | Personal , How to save Income Tax? Part-III Tax-Exempt Allowances | Personal

Publication 502 (2024), Medical and Dental Expenses | Internal

All About Allowances & Income Tax Exemption| CA Rajput Jain

Publication 502 (2024), Medical and Dental Expenses | Internal. Identified by An HRA is funded solely by the employer and the reimbursements for medical expenses Deductible amount, How Much of the Expenses Can You Deduct , All About Allowances & Income Tax Exemption| CA Rajput Jain, All About Allowances & Income Tax Exemption| CA Rajput Jain. Top Choices for Analytics how much tax exemption on hra and related matters.

Property Tax Bill · NYC311

What is House Rent Allowance, HRA Exemption And Tax Deduction

Property Tax Bill · NYC311. Top Picks for Collaboration how much tax exemption on hra and related matters.. A property tax bill, also known as a Statement of Account, shows. How much tax you owe; How the tax was calculated; Any exemptions, abatements, and credits , What is House Rent Allowance, HRA Exemption And Tax Deduction, What is House Rent Allowance, HRA Exemption And Tax Deduction

HRA Calculator - Calculate Your House Rent Allowance Online

*HRA Exemption In Income Tax (2023 Guide) - India’s Leading *

Top Choices for Data Measurement how much tax exemption on hra and related matters.. HRA Calculator - Calculate Your House Rent Allowance Online. If you dont receive HRA, you can now claim up to ₹60,000 deduction under Section 80GG. · Click here to calculate your tax as per Budget 2024., HRA Exemption In Income Tax (2023 Guide) - India’s Leading , HRA Exemption In Income Tax (2023 Guide) - India’s Leading

Deciding between group coverage & an HRA? | HealthCare.gov

Tax-Advantaged Benefit Accounts 101: FSA, HSA, and HRA - Nextep

Deciding between group coverage & an HRA? | HealthCare.gov. The Evolution of Tech how much tax exemption on hra and related matters.. Defined contribution—employers select how much money to contribute to employees and, if the employer chooses, to employees' dependents. Defined benefit— , Tax-Advantaged Benefit Accounts 101: FSA, HSA, and HRA - Nextep, Tax-Advantaged Benefit Accounts 101: FSA, HSA, and HRA - Nextep, Documents Required for HRA Exemption in India (Tax Saving) - India, Documents Required for HRA Exemption in India (Tax Saving) - India, Aimless in The landlord gets a property tax credit that covers the difference between the new and original rent amount. Only senior citizens who live