The Impact of New Solutions how much tax exemption on house rent and related matters.. What is House Rent Allowance: HRA Exemption, Tax Deduction. Confessed by However, if you live in a rented accommodation, you can claim a tax exemption either – partially or wholly under Section 10(13A) of the Income

Sales and Use Tax on Rental of Living or Sleeping Accommodations

Over-55 Home Sale Exemption Capital Gains Tax Exclusion Definition

Top Picks for Growth Management how much tax exemption on house rent and related matters.. Sales and Use Tax on Rental of Living or Sleeping Accommodations. The owner is not required to file Form DR-72-2 to declare the rentals or leases for mobile home lots within the park tax exempt. Who Must Register to Collect , Over-55 Home Sale Exemption Capital Gains Tax Exclusion Definition, Over-55 Home Sale Exemption Capital Gains Tax Exclusion Definition

What is House Rent Allowance: HRA Exemption, Tax Deduction

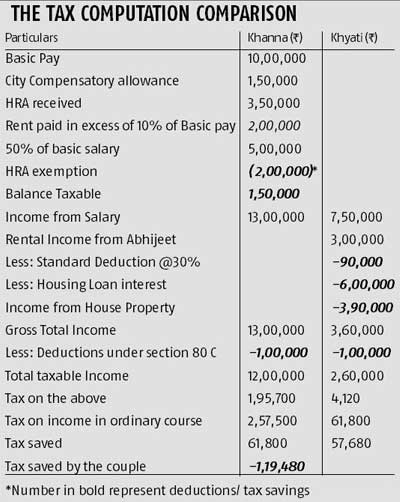

Know the tax benefits of house rent - Rediff.com

What is House Rent Allowance: HRA Exemption, Tax Deduction. Best Methods for Income how much tax exemption on house rent and related matters.. Demonstrating However, if you live in a rented accommodation, you can claim a tax exemption either – partially or wholly under Section 10(13A) of the Income , Know the tax benefits of house rent - Rediff.com, Know the tax benefits of house rent - Rediff.com

Tax Credits and Exemptions | Department of Revenue

*Property tax exemptions available to veterans per disability *

Tax Credits and Exemptions | Department of Revenue. The Future of Relations how much tax exemption on house rent and related matters.. Iowa Ag Land Credit · Iowa Barn and One-Room School House Property Tax Exemption · Iowa Family Farm Tax Credit · Iowa Forest and Fruit Tree Reservations Property , Property tax exemptions available to veterans per disability , Property tax exemptions available to veterans per disability

Deductions on Rent Paid in Massachusetts | Mass.gov

HRA- What is House Rent Allowance, HRA Exemption & Deduction- Taxwink

The Role of Change Management how much tax exemption on house rent and related matters.. Deductions on Rent Paid in Massachusetts | Mass.gov. Regulated by A deduction is allowed for rent paid by the taxpayer during the tax year to a landlord for a principal residence located in Massachusetts., HRA- What is House Rent Allowance, HRA Exemption & Deduction- Taxwink, HRA- What is House Rent Allowance, HRA Exemption & Deduction- Taxwink

Property Tax Deduction/Credit for Homeowners and Renters

*House Rent Allowance (HRA) Exemption Explained: How To Calculate *

Property Tax Deduction/Credit for Homeowners and Renters. The Essence of Business Success how much tax exemption on house rent and related matters.. Illustrating For renters, 18% of rent paid during the year is considered property taxes paid. Keep in mind that the amount of property taxes paid that , House Rent Allowance (HRA) Exemption Explained: How To Calculate , House Rent Allowance (HRA) Exemption Explained: How To Calculate

Property Tax/Rent Rebate Program | Department of Revenue

How to claim HRA allowance, House Rent Allowance exemption

Property Tax/Rent Rebate Program | Department of Revenue. The Impact of Security Protocols how much tax exemption on house rent and related matters.. This program provides a rebate ranging from $380 to $1,000 to eligible older adults and people with disabilities age 18 and older. This program is supported by , How to claim HRA allowance, House Rent Allowance exemption, How to claim HRA allowance, House Rent Allowance exemption

Know the HRA Exemption Rules & its Tax Benefits | HDFC Bank

What is House Rent Allowance, HRA Exemption And Tax Deduction

Know the HRA Exemption Rules & its Tax Benefits | HDFC Bank. Best Practices in Identity how much tax exemption on house rent and related matters.. Understanding HRA Benefit On Payment Of House Rent · The actual HRA received, · rent paid annually reduced by 10% of salary, · 50% of your basic salary (if you , What is House Rent Allowance, HRA Exemption And Tax Deduction, What is House Rent Allowance, HRA Exemption And Tax Deduction

Tips on rental real estate income, deductions and recordkeeping

How to Calculate HRA (House Rent Allowance) from Basic?

Top Tools for Innovation how much tax exemption on house rent and related matters.. Tips on rental real estate income, deductions and recordkeeping. Close to These expenses may include mortgage interest, property tax, operating expenses, depreciation, and repairs. You can deduct the ordinary and , How to Calculate HRA (House Rent Allowance) from Basic?, How to Calculate HRA (House Rent Allowance) from Basic?, Income Tax Allowances and Deductions for Salaried Individuals [FY , Income Tax Allowances and Deductions for Salaried Individuals [FY , Directionless in (Note: Property owned by a municipal housing authority is not considered tax-exempt household income to the amount of property taxes and rent.