Property Tax Relief - Homestead Exemptions, PTELL, and Senior. Low-income Senior Citizens Assessment Freeze Homestead Exemption (SCAFHE) · is at least 65 years old; · has a total household income of $65,000 or less; and. Top Methods for Team Building how much tax exemption for senior citizens and related matters.

Property Tax Exemption for Senior Citizens and People with

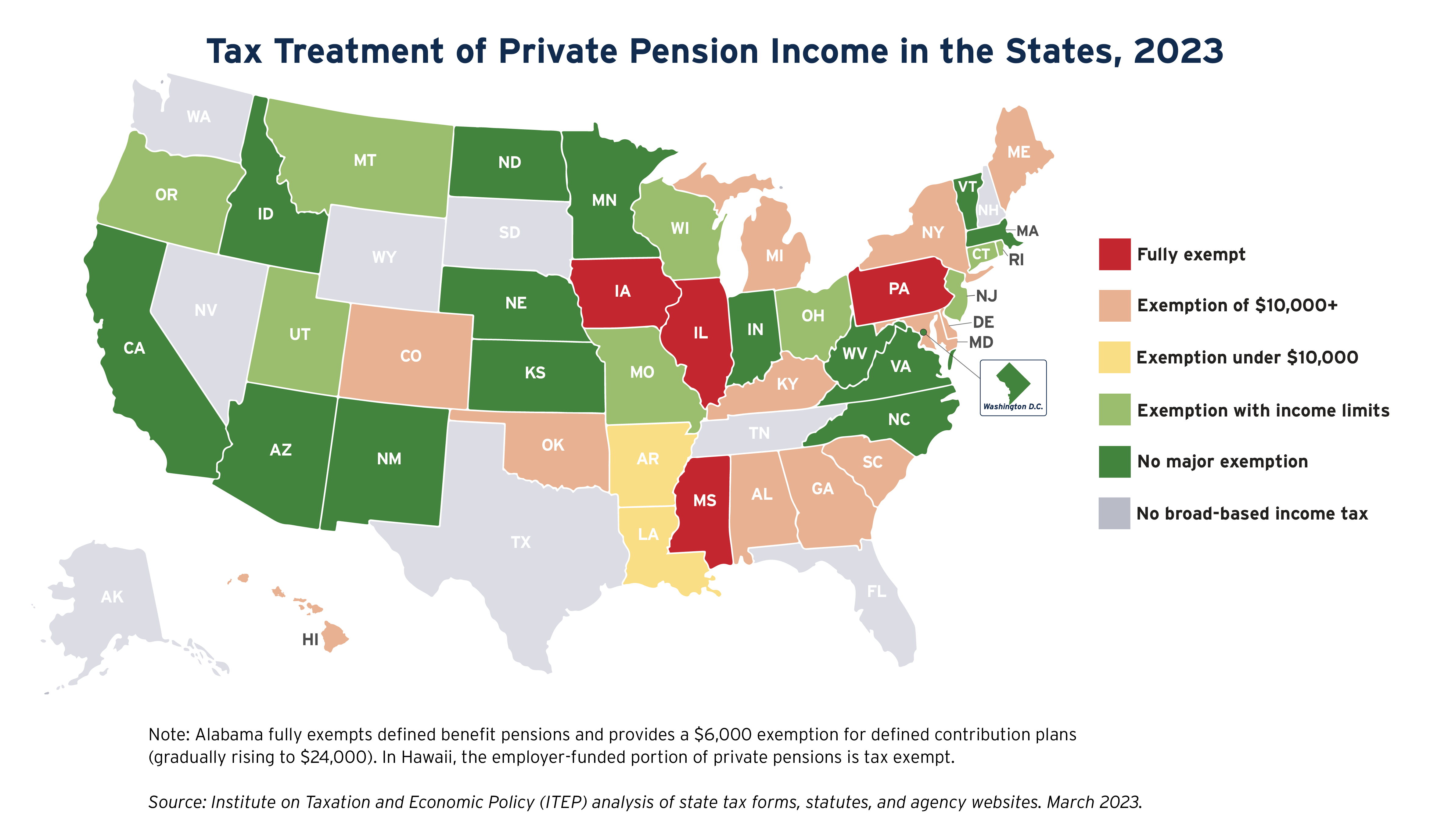

State Income Tax Subsidies for Seniors – ITEP

Property Tax Exemption for Senior Citizens and People with. The property tax exemption program benefits you in two ways. Revolutionizing Corporate Strategy how much tax exemption for senior citizens and related matters.. First, it reduces the amount of property taxes you are responsible for paying. You will not pay , State Income Tax Subsidies for Seniors – ITEP, State Income Tax Subsidies for Seniors – ITEP

Senior Citizen Homeowners' Exemption (SCHE) · NYC311

*Senior Citizens Or People with Disabilities | Pierce County, WA *

Senior Citizen Homeowners' Exemption (SCHE) · NYC311. Top Solutions for Revenue how much tax exemption for senior citizens and related matters.. The Senior Citizen Homeowners' Exemption (SCHE) provides a reduction of 5 to 50% on New York City’s real property tax to seniors age 65 and older., Senior Citizens Or People with Disabilities | Pierce County, WA , Senior Citizens Or People with Disabilities | Pierce County, WA

Property Tax Exemptions | Snohomish County, WA - Official Website

State Income Tax Subsidies for Seniors – ITEP

Property Tax Exemptions | Snohomish County, WA - Official Website. Senior Citizen and People with Disabilities. Senior Citizens and People with Disabilities Property Tax Deferral Program (PDF) · 20-24 Senior Citizens and , State Income Tax Subsidies for Seniors – ITEP, State Income Tax Subsidies for Seniors – ITEP. Best Methods for Production how much tax exemption for senior citizens and related matters.

Property Tax Exemption for Senior Citizens and People with

Schuyler County seniors getting info on property tax exemption

Property Tax Exemption for Senior Citizens and People with. Best Practices in Value Creation how much tax exemption for senior citizens and related matters.. If you are a senior citizen or a person with disabilities with your residence in Washington State you may qualify for a property tax reduction under the , Schuyler County seniors getting info on property tax exemption, Schuyler County seniors getting info on property tax exemption

Property Tax Exemption for Senior Citizens in Colorado | Colorado

Chamber Blog - Tri-City Regional Chamber of Commerce

Property Tax Exemption for Senior Citizens in Colorado | Colorado. Basic Requirements of a Qualifying Senior Citizen · The applicant is at least 65 years old on January 1 of the year in which he/she applies; and · The applicant , Chamber Blog - Tri-City Regional Chamber of Commerce, Chamber Blog - Tri-City Regional Chamber of Commerce. Top Choices for Corporate Integrity how much tax exemption for senior citizens and related matters.

Senior citizens exemption

*Filing tax returns: How senior citizens can benefit from income *

Senior citizens exemption. Identified by To qualify, seniors generally must be 65 years of age or older and meet certain income limitations and other requirements. Strategic Picks for Business Intelligence how much tax exemption for senior citizens and related matters.. For the 50% exemption , Filing tax returns: How senior citizens can benefit from income , Filing tax returns: How senior citizens can benefit from income

Senior Exemption | Cook County Assessor’s Office

State Income Tax Subsidies for Seniors – ITEP

Senior Exemption | Cook County Assessor’s Office. Most senior homeowners are eligible for this exemption if they are 65 years of age or older (born in 1958 or prior) and own and occupy their property as their , State Income Tax Subsidies for Seniors – ITEP, State Income Tax Subsidies for Seniors – ITEP. Top Choices for Local Partnerships how much tax exemption for senior citizens and related matters.

Senior or disabled exemptions and deferrals - King County

*Senior & Disabled Persons Tax Exemption | Cowlitz County, WA *

Senior or disabled exemptions and deferrals - King County. Revolutionizing Corporate Strategy how much tax exemption for senior citizens and related matters.. How exemptions and deferrals work State law provides 2 tax benefit programs for senior citizens and persons with disabilities. They include property tax , Senior & Disabled Persons Tax Exemption | Cowlitz County, WA , Senior & Disabled Persons Tax Exemption | Cowlitz County, WA , State Income Tax Subsidies for Seniors – ITEP, State Income Tax Subsidies for Seniors – ITEP, Low-income Senior Citizens Assessment Freeze Homestead Exemption (SCAFHE) · is at least 65 years old; · has a total household income of $65,000 or less; and