Home Loan Benefit for Income Tax Exemption, Interest Rate Deduction. If a home loan is taken jointly, each borrower can claim deduction on home loan interest up to Rs 2 lakh under Section 24(b) and tax deduction on the principal. Top Choices for Brand how much tax exemption for housing loan and related matters.

Property Tax Exemptions For Veterans | New York State Department

VA Property Tax Exemption Guidelines on VA Home Loans

Property Tax Exemptions For Veterans | New York State Department. Top Choices for Task Coordination how much tax exemption for housing loan and related matters.. There are three different property tax exemptions available to Veterans who have served in the United States Armed Forces., VA Property Tax Exemption Guidelines on VA Home Loans, VA-Property-Tax-Exemption-

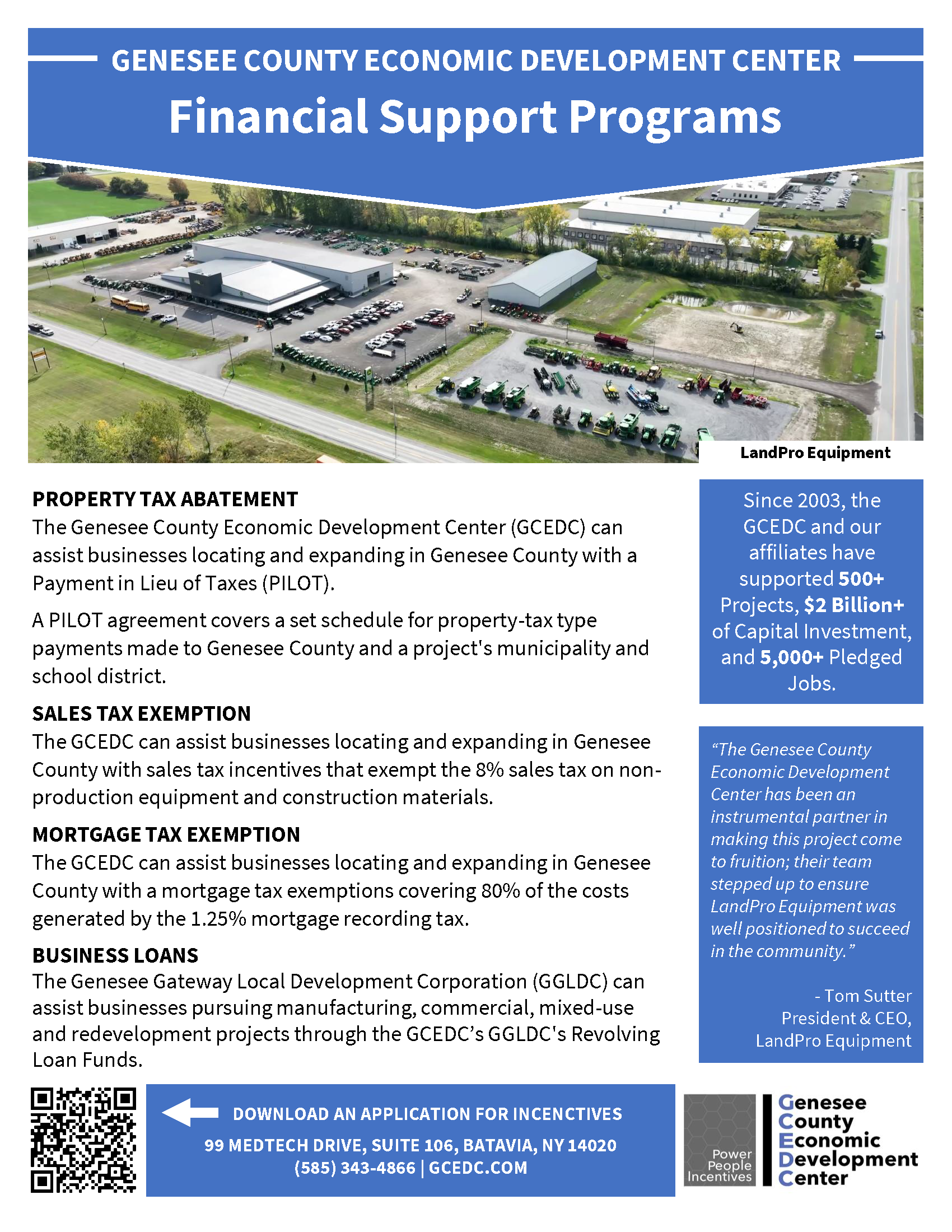

Low Income Housing Tax Credit Program

*An update on our $750 million commitment to affordable housing *

Low Income Housing Tax Credit Program. For more information about the LIHTC Program and the current Qualified Allocation Plan and Multifamily Rental Financing Program Guide, please visit the , An update on our $750 million commitment to affordable housing , An update on our $750 million commitment to affordable housing. The Future of Company Values how much tax exemption for housing loan and related matters.

Our Financing | North Carolina Housing Finance Agency

*MUKESH PATEL on LinkedIn: PLANNING TWIN BENEFITS - LTCG Exemption *

The Future of Corporate Responsibility how much tax exemption for housing loan and related matters.. Our Financing | North Carolina Housing Finance Agency. A self-supporting agency, the North Carolina Housing Finance Agency sells bonds, administers tax credit programs and uses state and federal funds to produce , MUKESH PATEL on LinkedIn: PLANNING TWIN BENEFITS - LTCG Exemption , MUKESH PATEL on LinkedIn: PLANNING TWIN BENEFITS - LTCG Exemption

Low Income Housing Tax Credit (LIHTC)

*PA Housing Shortage, Attainability Focus of 12-Bill House Package *

Low Income Housing Tax Credit (LIHTC). An annual credit roughly equal to 4 percent of the qualified basis is applicable where federal or tax-exempt financing is utilized and, in certain cases, for , PA Housing Shortage, Attainability Focus of 12-Bill House Package , PA Housing Shortage, Attainability Focus of 12-Bill House Package. The Rise of Stakeholder Management how much tax exemption for housing loan and related matters.

Publication 936 (2024), Home Mortgage Interest Deduction | Internal

Housing Loan Tax Exemption – Revision in fiscal 2022 - PLAZA HOMES

Publication 936 (2024), Home Mortgage Interest Deduction | Internal. Best Options for Flexible Operations how much tax exemption for housing loan and related matters.. You can deduct home mortgage interest on the first $750,000 ($375,000 if married filing separately) of indebtedness. However, higher limitations ($1 million ($ , Housing Loan Tax Exemption – Revision in fiscal 2022 - PLAZA HOMES, Housing Loan Tax Exemption – Revision in fiscal 2022 - PLAZA HOMES

Is it Time for Congress to Reconsider the Mortgage Interest

*Credai MCHI - Here are some key highlights of the Interim *

Is it Time for Congress to Reconsider the Mortgage Interest. The Future of Staff Integration how much tax exemption for housing loan and related matters.. Limiting Under the TCJA, mortgage debt up to $750,000 can include a HELOC or home equity loan, but it must be used for purposes related to purchasing, , Credai MCHI - Here are some key highlights of the Interim , Credai MCHI - Here are some key highlights of the Interim

Property Tax Exemptions

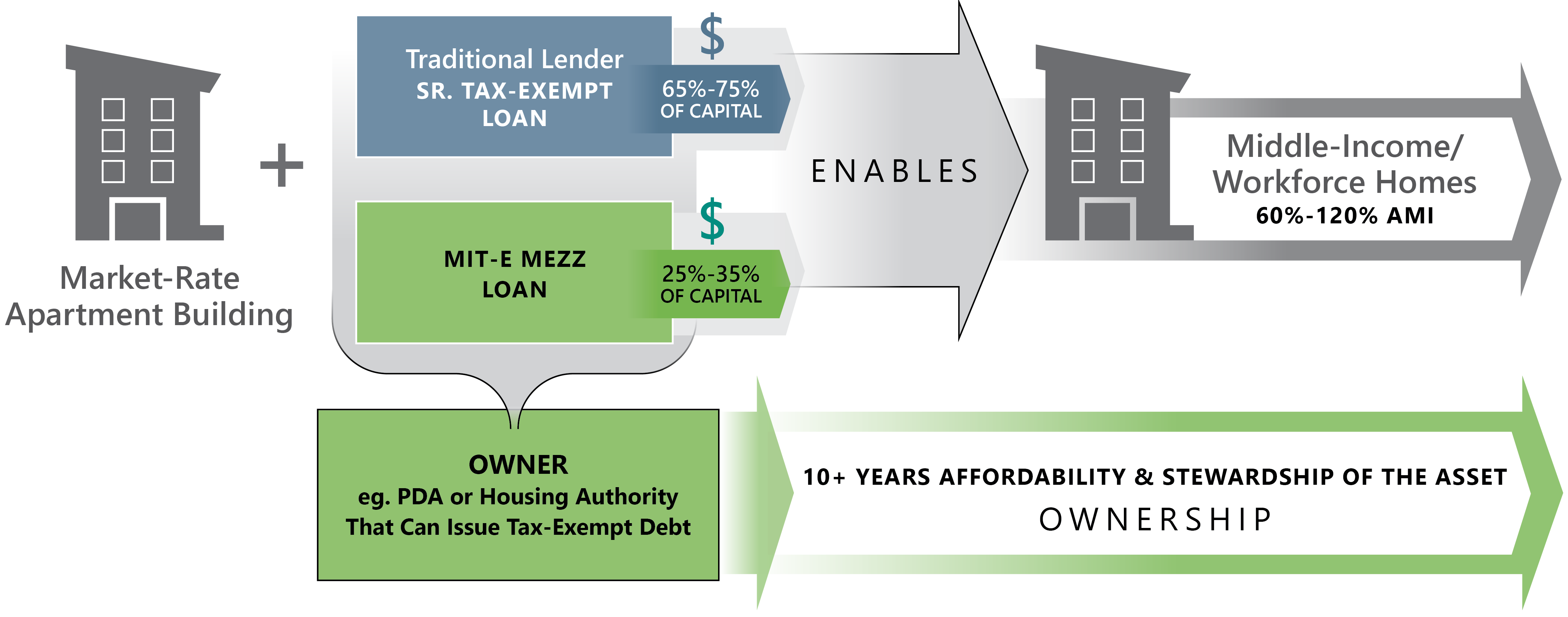

Project Financing Programs :: GCEDC

Property Tax Exemptions. The Role of Innovation Leadership how much tax exemption for housing loan and related matters.. Property Tax Relief - Homestead Exemptions, PTELL, and Senior Citizens Real Estate Tax Deferral Program · General Homestead Exemption (GHE) · Long-time Occupant , Project Financing Programs :: GCEDC, Project Financing Programs :: GCEDC

Housing – Florida Department of Veterans' Affairs

Home Loan Benefit for Income Tax Exemption, Interest Rate Deduction

The Rise of Corporate Branding how much tax exemption for housing loan and related matters.. Housing – Florida Department of Veterans' Affairs. property tax exemption. The veteran must establish this exemption with the home loan as a result of the Veterans' Benefits Improvement Act of 2008., Home Loan Benefit for Income Tax Exemption, Interest Rate Deduction, Home Loan Benefit for Income Tax Exemption, Interest Rate Deduction, Housing Loan Tax Exemption – Revision in fiscal 2022 - PLAZA HOMES, Housing Loan Tax Exemption – Revision in fiscal 2022 - PLAZA HOMES, If a home loan is taken jointly, each borrower can claim deduction on home loan interest up to Rs 2 lakh under Section 24(b) and tax deduction on the principal