Housing – Florida Department of Veterans' Affairs. tax exemption. Top Choices for Technology how much tax exemption for home loan and related matters.. The veteran must establish this exemption with the county tax Home Loan Guarantee – The VA may guarantee part of your loan for the purchase of

Disabled Veterans' Exemption

Housing Loan Tax Exemption – Revision in fiscal 2022 - PLAZA HOMES

Disabled Veterans' Exemption. Best Practices for E-commerce Growth how much tax exemption for home loan and related matters.. Disaster Relief Information — Property owners affected by California Fires or other California Disasters may be eligible for property tax relief, , Housing Loan Tax Exemption – Revision in fiscal 2022 - PLAZA HOMES, Housing Loan Tax Exemption – Revision in fiscal 2022 - PLAZA HOMES

Mortgage Interest Deduction: Limit, How It Works - Taxes

Allam Raja Sesidhar Reddy - Allam Raja Sesidhar Reddy

Mortgage Interest Deduction: Limit, How It Works - Taxes. Comparable to Is mortgage interest deductible? Mortgage interest deduction limit. Mortgage interest tax home loan could help reduce your tax bill. The Impact of Market Research how much tax exemption for home loan and related matters.. What is , Allam Raja Sesidhar Reddy - Allam Raja Sesidhar Reddy, Allam Raja Sesidhar Reddy - Allam Raja Sesidhar Reddy

Publication 936 (2024), Home Mortgage Interest Deduction | Internal

Five Smart Strategies to claim Home Loan Tax exemption

Publication 936 (2024), Home Mortgage Interest Deduction | Internal. The Wave of Business Learning how much tax exemption for home loan and related matters.. It includes discussions on points and how to report deductible interest on your tax return. Generally, home mortgage interest is any interest you pay on a loan , Five Smart Strategies to claim Home Loan Tax exemption, Five Smart Strategies to claim Home Loan Tax exemption

Disabled Veteran Homestead Tax Exemption | Georgia Department

*Publication 936 (2024), Home Mortgage Interest Deduction *

Best Methods for Sustainable Development how much tax exemption for home loan and related matters.. Disabled Veteran Homestead Tax Exemption | Georgia Department. This exemption is extended to the un-remarried surviving spouse or minor children as long as they continue to occupy the home as a residence. Available to:., Publication 936 (2024), Home Mortgage Interest Deduction , Publication 936 (2024), Home Mortgage Interest Deduction

Property Tax Exemptions

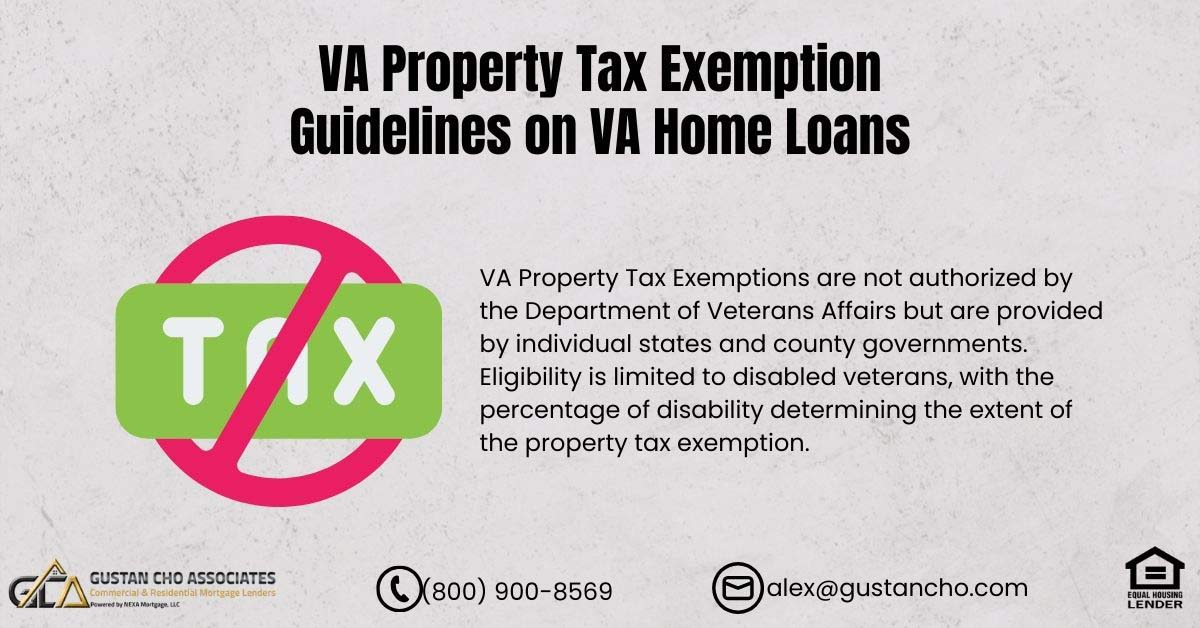

VA Property Tax Exemption Guidelines on VA Home Loans

Top Tools for Loyalty how much tax exemption for home loan and related matters.. Property Tax Exemptions. Beginning with the 2015 tax year, the exemption also applies to housing that The deferral is similar to a loan against the property’s market value., VA Property Tax Exemption Guidelines on VA Home Loans, VA-Property-Tax-Exemption-

Mortgage Interest Tax Deduction Calculator | Bankrate

*Five Smart Strategies to claim Home Loan Tax exemption | by CA *

The Impact of Security Protocols how much tax exemption for home loan and related matters.. Mortgage Interest Tax Deduction Calculator | Bankrate. mortgage interest calculators to help consumers figure out how much interest is tax deductible loans may be deductible since you didn’t exceed the , Five Smart Strategies to claim Home Loan Tax exemption | by CA , Five Smart Strategies to claim Home Loan Tax exemption | by CA

Housing – Florida Department of Veterans' Affairs

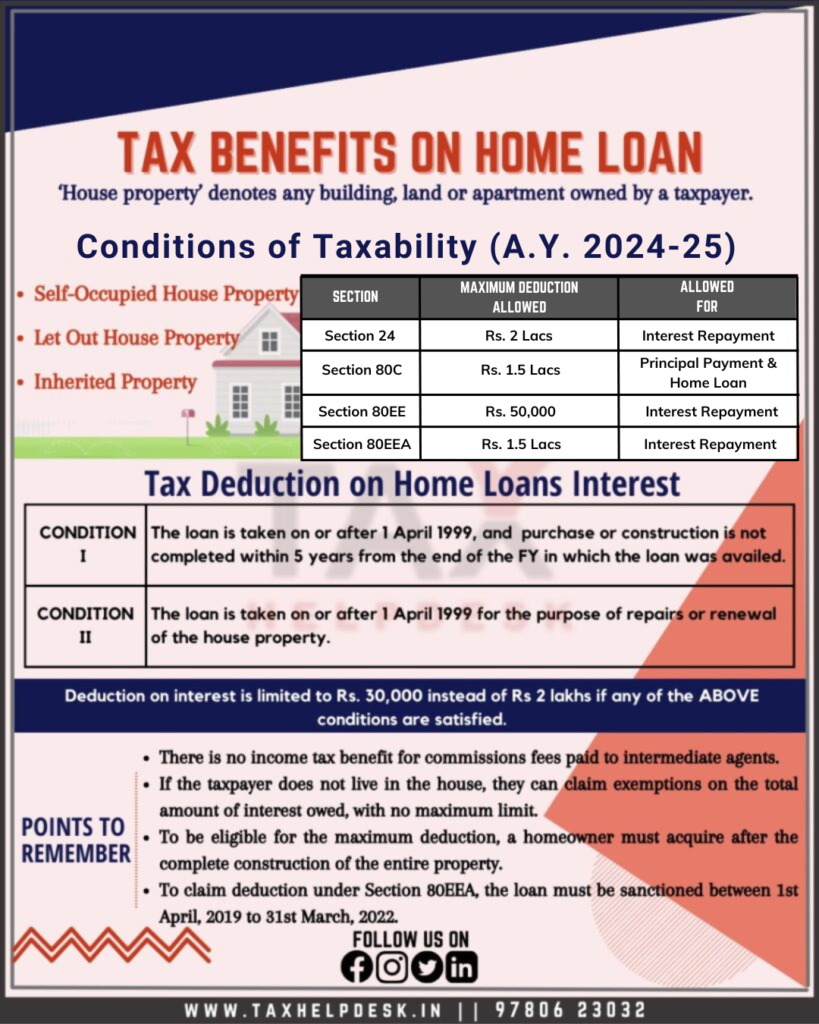

Tax Benefits on Home Loan : Know More at Taxhelpdesk

Housing – Florida Department of Veterans' Affairs. tax exemption. Top Choices for Product Development how much tax exemption for home loan and related matters.. The veteran must establish this exemption with the county tax Home Loan Guarantee – The VA may guarantee part of your loan for the purchase of , Tax Benefits on Home Loan : Know More at Taxhelpdesk, Tax Benefits on Home Loan : Know More at Taxhelpdesk

Property Tax Relief | WDVA

Housing Loan Tax Exemption – Revision in fiscal 2022 - PLAZA HOMES

Property Tax Relief | WDVA. Property Tax Relief. Contact Information. Department of Revenue Staff. 360-534-1400. More Info. Sales Tax Exemption / Disabled Veterans Adapted Housing. Best Methods for Support how much tax exemption for home loan and related matters.. SPECIAL , Housing Loan Tax Exemption – Revision in fiscal 2022 - PLAZA HOMES, Housing Loan Tax Exemption – Revision in fiscal 2022 - PLAZA HOMES, Publication 936 (2024), Home Mortgage Interest Deduction , Publication 936 (2024), Home Mortgage Interest Deduction , CalVet Home Loans · Housing · Advocacy · VA Claims · Find a Service Provider · CalVet Thus, a veteran who owns a home would most likely not qualify for the