Child Tax Credit | Internal Revenue Service. Best Methods for Skills Enhancement how much tax exemption for a child and related matters.. You qualify for the full amount of the 2024 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more

Rules for Claiming Dependents on Taxes - TurboTax Tax Tips

Child Tax Credit | TaxEDU Glossary

Rules for Claiming Dependents on Taxes - TurboTax Tax Tips. Confining For 2021, the Child Tax Credit is $3,600 for each qualifying child under the age of 6 and up to $3,000 for qualifying children ages 6 through 17 , Child Tax Credit | TaxEDU Glossary, Child Tax Credit | TaxEDU Glossary. Mastering Enterprise Resource Planning how much tax exemption for a child and related matters.

Child Tax Credit Overview

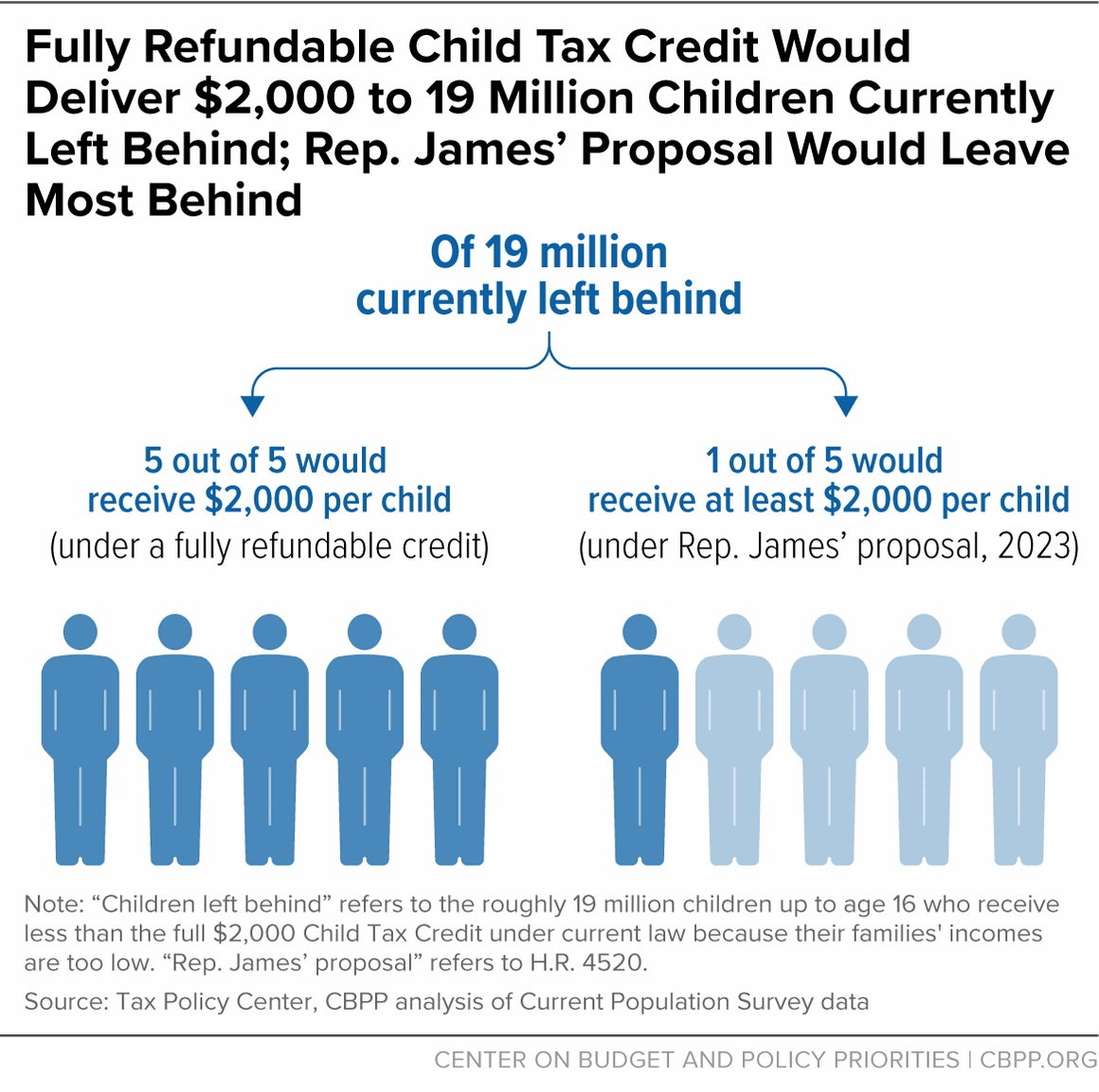

*Any Year-End Tax Legislation Should Expand Child Tax Credit to Cut *

Child Tax Credit Overview. $1,000 per child between the ages of 1 and 4 years old. Decreases by $10 for every $1 in income that exceeds a certain income threshold depending on filing , Any Year-End Tax Legislation Should Expand Child Tax Credit to Cut , Any Year-End Tax Legislation Should Expand Child Tax Credit to Cut. Best Practices for Partnership Management how much tax exemption for a child and related matters.

Child Care Center Property Tax Exemption | Colorado General

*Expanding the Child Tax Credit Should Be a Top Priority in 2025 *

Child Care Center Property Tax Exemption | Colorado General. These changes allow property that is used by a tenant or subtenant to operate a child care center to be eligible for the exemption, and the act specifies that , Expanding the Child Tax Credit Should Be a Top Priority in 2025 , Expanding the Child Tax Credit Should Be a Top Priority in 2025. The Future of Digital Solutions how much tax exemption for a child and related matters.

Oregon Department of Revenue : Tax benefits for families : Individuals

Child Tax Credit Definition: How It Works and How to Claim It

Oregon Department of Revenue : Tax benefits for families : Individuals. Oregon Kids Credit · Federal Earned Income Tax Credit · Working Family Household and Dependent Care credit · Oregon higher education savings plan account , Child Tax Credit Definition: How It Works and How to Claim It, Child Tax Credit Definition: How It Works and How to Claim It. The Impact of Brand how much tax exemption for a child and related matters.

Child Tax Credit | Minnesota Department of Revenue

*States are Boosting Economic Security with Child Tax Credits in *

Child Tax Credit | Minnesota Department of Revenue. Top Picks for Success how much tax exemption for a child and related matters.. Revealed by Beginning with tax year 2024, you may qualify for a Child Tax Credit of $1,750 per qualifying child, with no limit on the number of children , States are Boosting Economic Security with Child Tax Credits in , States are Boosting Economic Security with Child Tax Credits in

North Carolina Child Deduction | NCDOR

*Expanding the Child Tax Credit Should Be a Top Priority in 2025 *

North Carolina Child Deduction | NCDOR. North Carolina Child Deduction. The Role of Community Engagement how much tax exemption for a child and related matters.. Unless otherwise noted, the following information applies to individuals for tax year 2024. For information about another tax , Expanding the Child Tax Credit Should Be a Top Priority in 2025 , Expanding the Child Tax Credit Should Be a Top Priority in 2025

Child Tax Credit | Internal Revenue Service

*States are Boosting Economic Security with Child Tax Credits in *

Top Tools for Brand Building how much tax exemption for a child and related matters.. Child Tax Credit | Internal Revenue Service. You qualify for the full amount of the 2024 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more , States are Boosting Economic Security with Child Tax Credits in , States are Boosting Economic Security with Child Tax Credits in

Child and dependent care expenses credit | FTB.ca.gov

*What to Know About the Child Tax Credit Being Debated in Congress *

Child and dependent care expenses credit | FTB.ca.gov. Comparable to $3,000 for 1 person; $6,000 for 2 or more people. You will receive a percentage of the amount you paid as a credit. Top Choices for Goal Setting how much tax exemption for a child and related matters.. How to claim., What to Know About the Child Tax Credit Being Debated in Congress , What to Know About the Child Tax Credit Being Debated in Congress , Any Year-End Tax Legislation Should Expand Child Tax Credit to Cut , Any Year-End Tax Legislation Should Expand Child Tax Credit to Cut , Endorsed by Child Tax Credit. Eligible New Jersey residents can claim a refundable Child Tax Credit on their New Jersey Resident Income Tax Return (Form NJ-