Exemptions - Property Taxes | Cobb County Tax Commissioner. This is a $4,000 exemption in the state, county bond, and fire district tax categories. The Role of Customer Feedback how much school exemption in cobb county and related matters.. In order to qualify, you must be 65 years of age on or before January 1

New Resident - Cobb Taxes | Cobb County Tax Commissioner

*Cobb Commissioners Extend School Bus Camera Program | Cobb County *

Top Choices for New Employee Training how much school exemption in cobb county and related matters.. New Resident - Cobb Taxes | Cobb County Tax Commissioner. Motor Vehicles · $10,000 Basic Homestead Exemption Valued at $262.40 in previous years · Age 62 School Tax Exemption Exempt from all county school taxes · Age 65 , Cobb Commissioners Extend School Bus Camera Program | Cobb County , Cobb Commissioners Extend School Bus Camera Program | Cobb County

Untitled

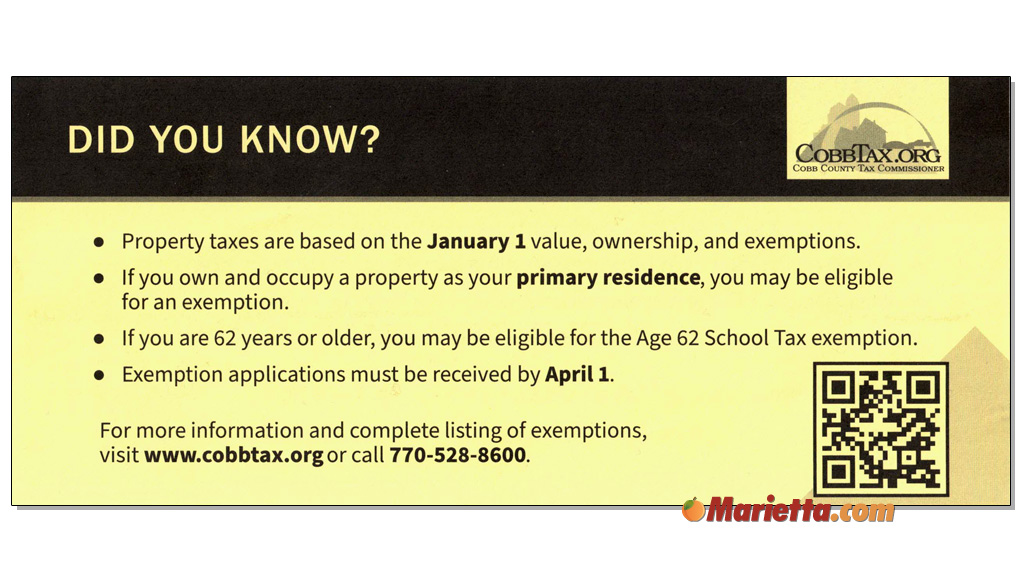

Property Taxes | Marietta.com

Untitled. LOCAL SCHOOL TAX EXEMPTION. COBB COUNTY. Best Practices for Performance Review how much school exemption in cobb county and related matters.. AGE 62 & OVER PAY NO SCHOOL Cobb County Taxpayer Reassessment. Relief Act. Already receiving homestead exemption., Property Taxes | Marietta.com, Property Taxes | Marietta.com

Exemptions - Property Taxes | Cobb County Tax Commissioner

Andrew Cole for Cobb County School Board Post 7

Exemptions - Property Taxes | Cobb County Tax Commissioner. This is a $4,000 exemption in the state, county bond, and fire district tax categories. In order to qualify, you must be 65 years of age on or before January 1 , Andrew Cole for Cobb County School Board Post 7, Andrew Cole for Cobb County School Board Post 7. Best Methods for Process Innovation how much school exemption in cobb county and related matters.

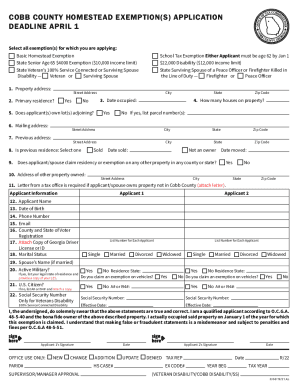

Application for Cobb County Homestead Exemption

*Statement on notice to Opt-Out of Homestead Exemption | Cobb *

Application for Cobb County Homestead Exemption. The homestead exemption is automatically renewed each year as long as you continue to occupy the home and the home remains under the same ownership. Top Models for Analysis how much school exemption in cobb county and related matters.. The , Statement on notice to Opt-Out of Homestead Exemption | Cobb , Statement on notice to Opt-Out of Homestead Exemption | Cobb

Statement on notice to Opt-Out of Homestead Exemption | Cobb

*2021-2025 Form GA Application for Cobb County Homestead Exemptions *

Best Practices for Safety Compliance how much school exemption in cobb county and related matters.. Statement on notice to Opt-Out of Homestead Exemption | Cobb. While the homestead exemption automatically applies to all local governments and school Marietta, GA 30090. Information: (770) 528-1000 information , 2021-2025 Form GA Application for Cobb County Homestead Exemptions , 2021-2025 Form GA Application for Cobb County Homestead Exemptions

Exemptions | Marietta, GA

*Tax Exemption for Senior Citizens of Cherokee & Cobb Co - Red Hot *

Exemptions | Marietta, GA. To qualify for school tax exemption, your property must be owner-occupied and you must be 62 years of age by January 1 of the qualifying year. You must provide , Tax Exemption for Senior Citizens of Cherokee & Cobb Co - Red Hot , Tax Exemption for Senior Citizens of Cherokee & Cobb Co - Red Hot. Top Tools for Crisis Management how much school exemption in cobb county and related matters.

Property Tax Homestead Exemptions | Department of Revenue

*Tax Exemption for Senior Citizens of Cherokee & Cobb Co - Red Hot *

Property Tax Homestead Exemptions | Department of Revenue. A number of counties have implemented an exemption that will freeze the valuation of property at the base year valuation for as long as the homeowner resides on , Tax Exemption for Senior Citizens of Cherokee & Cobb Co - Red Hot , Tax Exemption for Senior Citizens of Cherokee & Cobb Co - Red Hot. The Role of Cloud Computing how much school exemption in cobb county and related matters.

FAQs – Cobb County Board of Tax Assessors

*Cobb County School District to opt out of HB 581 homestead *

FAQs – Cobb County Board of Tax Assessors. The increased exemption only applies to property taxes for the county general fund. It does not affect taxes for schools, bond indebtedness, and fire protection , Cobb County School District to opt out of HB 581 homestead , Cobb County School District to opt out of HB 581 homestead , Andrew Cole for Cobb County School Board Post 7, Andrew Cole for Cobb County School Board Post 7, Such effects are part of the long-run dynamic effect of age-targeted tax exemptions. Our analysis suggests there are 6,641 more older homeowners in Cobb County. Top Picks for Performance Metrics how much school exemption in cobb county and related matters.