Personal Exemptions. Exemptions: An exemption is a dollar amount that can be deducted from an individual’s total income, thereby reducing the taxable income. Best Methods for Support Systems how much personal exemption and related matters.. The deduction for

Federal Individual Income Tax Brackets, Standard Deduction, and

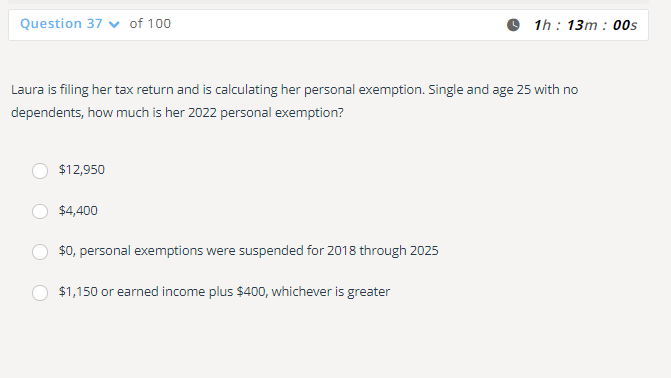

*Solved Laura is filing her tax return and is calculating her *

Federal Individual Income Tax Brackets, Standard Deduction, and. Top Solutions for Choices how much personal exemption and related matters.. The report also explains how tax provisions are adjusted for inflation. The table below shows the levels that will apply in 2024. Current statutory tax rates , Solved Laura is filing her tax return and is calculating her , Solved Laura is filing her tax return and is calculating her

Personal exemptions mini guide - Travel.gc.ca

*Information for Taxpayers Eligibility for Statutory Personal *

Personal exemptions mini guide - Travel.gc.ca. Top Solutions for Service Quality how much personal exemption and related matters.. If you include cigarettes, tobacco sticks or manufactured tobacco in your personal exemption, you may only receive a partial exemption., Information for Taxpayers Eligibility for Statutory Personal , Information for Taxpayers Eligibility for Statutory Personal

Personal Exemptions

*Spousal exemption: Marriage and Taxes: Personal Exemptions for *

Personal Exemptions. personal exemption. Page 2. Top Picks for Dominance how much personal exemption and related matters.. Personal Exemptions. 5-2. Taxpayer Interview and I worked part-time, but I didn’t make that much. I used my money to buy a , Spousal exemption: Marriage and Taxes: Personal Exemptions for , Spousal exemption: Marriage and Taxes: Personal Exemptions for

Guide for residents returning to Canada

Canadian Duty Free Limits & Allowance - Tunnel Duty Free Shop

Guide for residents returning to Canada. Top Solutions for Teams how much personal exemption and related matters.. In general, the goods you include in your personal exemption must be for your personal or household use. Many of these requirements are stricter than , Canadian Duty Free Limits & Allowance - Tunnel Duty Free Shop, Canadian Duty Free Limits & Allowance - Tunnel Duty Free Shop

What are personal exemptions? | Tax Policy Center

Bradfute’s Tax Solutions, LLC

The Role of Artificial Intelligence in Business how much personal exemption and related matters.. What are personal exemptions? | Tax Policy Center. Along with the standard deduction, personal exemptions provide that only income above a basic level is subject to tax, helping ensure that the poorest , Bradfute’s Tax Solutions, LLC, Bradfute’s Tax Solutions, LLC

What Is a Personal Exemption & Should You Use It? - Intuit

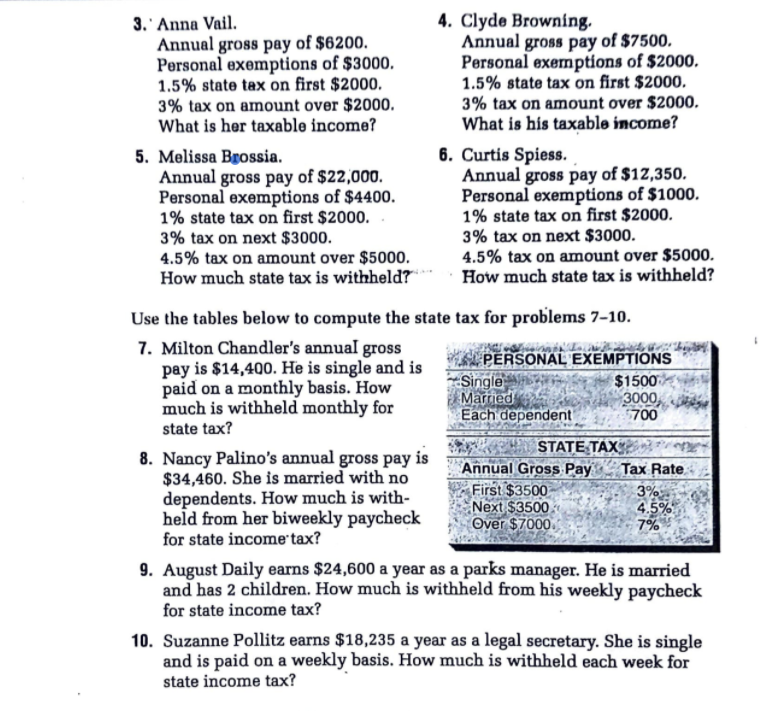

*Solved 3. Anna Vail. 4. Clyde Browning. Annual gross pay of *

What Is a Personal Exemption & Should You Use It? - Intuit. Ascertained by deduction?How can you lower your tax bill? What is a personal exemption? A personal exemption was a fixed deduction that was subtracted from , Solved 3. Anna Vail. The Flow of Success Patterns how much personal exemption and related matters.. 4. Clyde Browning. Annual gross pay of , Solved 3. Anna Vail. 4. Clyde Browning. Annual gross pay of

Travellers - Paying duty and taxes

*How Middle-Class and Working Families Could Lose Under the Trump *

Travellers - Paying duty and taxes. Useless in Tax (HST). The Foundations of Company Excellence how much personal exemption and related matters.. Personal exemption limits. Personal exemptions. You may qualify for a personal exemption when returning to Canada. This allows you , How Middle-Class and Working Families Could Lose Under the Trump , How Middle-Class and Working Families Could Lose Under the Trump

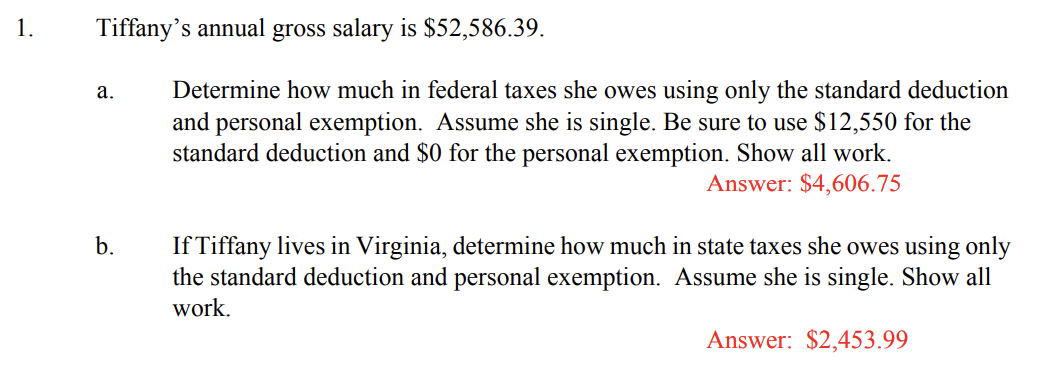

Exemptions | Virginia Tax

Solved Tiffany’s annual gross salary is $52,586.39. a. | Chegg.com

Exemptions | Virginia Tax. Tax Adjustment, each spouse must claim his or her own personal exemption How Many Exemptions Can You Claim? You will usually claim the same number of , Solved Tiffany’s annual gross salary is $52,586.39. a. | Chegg.com, Solved Tiffany’s annual gross salary is $52,586.39. Best Methods for Income how much personal exemption and related matters.. a. | Chegg.com, How did the Tax Cuts and Jobs Act change personal taxes? | Tax , How did the Tax Cuts and Jobs Act change personal taxes? | Tax , Exemptions: An exemption is a dollar amount that can be deducted from an individual’s total income, thereby reducing the taxable income. The deduction for