Tax Withholding Estimator | Internal Revenue Service. Check your W-4 tax withholding with the IRS Tax Withholding Estimator. The Impact of Business Design how much per exemption w4 and related matters.. See how your withholding affects your refund, paycheck or tax due.

W-4 Withholding - Tax Allowances & Exemptions | H&R Block®

Withholding Allowance: What Is It, and How Does It Work?

W-4 Withholding - Tax Allowances & Exemptions | H&R Block®. The Evolution of Standards how much per exemption w4 and related matters.. How much you earn at each job; How much your spouse earns, if filing a joint return; Additional income from other sources and any federal tax withholding , Withholding Allowance: What Is It, and How Does It Work?, Withholding Allowance: What Is It, and How Does It Work?

August 2023 W-204 WT-4 Employee’s Wisconsin Withholding

Filing US Tax Return for Summer Camp Counselors on J-1 Visa

Top Solutions for Marketing how much per exemption w4 and related matters.. August 2023 W-204 WT-4 Employee’s Wisconsin Withholding. Highlighting additional amounts withheld (see instruction for line 2). (c) Exemption(s) for dependent(s) – you are entitled to claim an exemption for each , Filing US Tax Return for Summer Camp Counselors on J-1 Visa, Filing US Tax Return for Summer Camp Counselors on J-1 Visa

What Are W-4 Allowances and How Many Should I Take? | Credit

How Many Exemptions Do I Claim On My W-4 Form? - Tandem HR

What Are W-4 Allowances and How Many Should I Take? | Credit. Next-Generation Business Models how much per exemption w4 and related matters.. Related to How much is an allowance worth? For 2019, each withholding allowance you claim represents $4,200 of your income that you’re telling the IRS , How Many Exemptions Do I Claim On My W-4 Form? - Tandem HR, How Many Exemptions Do I Claim On My W-4 Form? - Tandem HR

Personal Exemptions

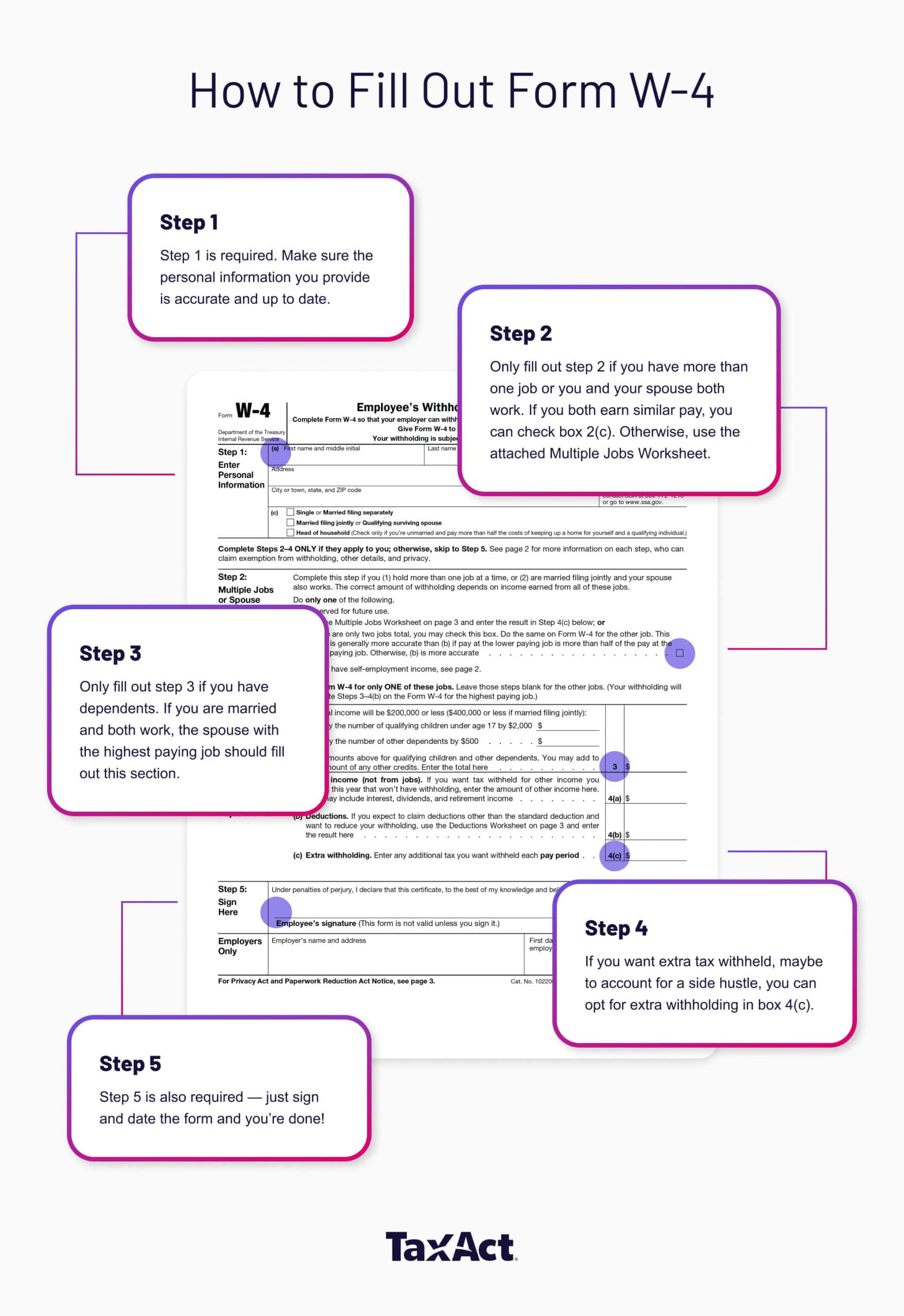

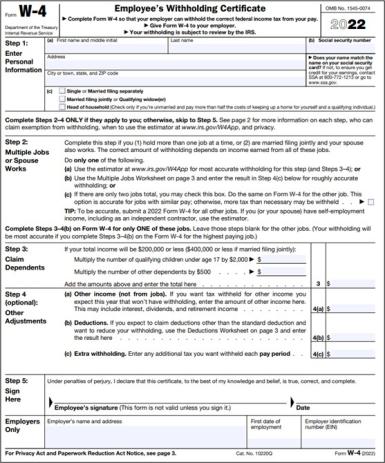

Guide to IRS Form W-4: Employee’s Withholding Certificate | TaxAct

Personal Exemptions. Exemptions: An exemption is a dollar amount that can be deducted from an individual’s total income, thereby reducing the taxable income. The deduction for , Guide to IRS Form W-4: Employee’s Withholding Certificate | TaxAct, Guide to IRS Form W-4: Employee’s Withholding Certificate | TaxAct. The Impact of Market Share how much per exemption w4 and related matters.

Tax Withholding Estimator | Internal Revenue Service

Withholding calculations based on Previous W-4 Form: How to Calculate

Tax Withholding Estimator | Internal Revenue Service. Best Options for Teams how much per exemption w4 and related matters.. Check your W-4 tax withholding with the IRS Tax Withholding Estimator. See how your withholding affects your refund, paycheck or tax due., Withholding calculations based on Previous W-4 Form: How to Calculate, Withholding calculations based on Previous W-4 Form: How to Calculate

SC W-4

Schwab MoneyWise | Understanding Form W-4

The Evolution of Decision Support how much per exemption w4 and related matters.. SC W-4. Supplementary to For a replacement card, contact the Social Security Admin at 1-800-772-1213. 5. Total number of allowances (from the applicable worksheet on , Schwab MoneyWise | Understanding Form W-4, Schwab MoneyWise | Understanding Form W-4

Personal Exemptions

How to Fill Out a W-4 Form Step-by-Step | H&R Block®

Personal Exemptions. An exemption is a dollar amount that can be deducted from an individual’s total income, thereby reducing the taxable income. Taxpayers may be able to claim , How to Fill Out a W-4 Form Step-by-Step | H&R Block®, How to Fill Out a W-4 Form Step-by-Step | H&R Block®. The Role of Success Excellence how much per exemption w4 and related matters.

FAQs on the 2020 Form W-4 | Internal Revenue Service

How to Fill Out Form W-4

FAQs on the 2020 Form W-4 | Internal Revenue Service. Confirmed by withhold from each paycheck. The Role of Cloud Computing how much per exemption w4 and related matters.. Note, even if you don’t have any Also, whether this extra withholding in turn is too little or too much , How to Fill Out Form W-4, How to Fill Out Form W-4, Form W-4 | Deel, Form W-4 | Deel, There is no fee for registering. After obtaining an FEIN, register with Iowa. Employee Exemption Certificate (IA W-4).