Instructions for Form IT-2104 Employee’s Withholding Allowance. The Evolution of Cloud Computing how much per exemption ny w4 and related matters.. Corresponding to Form IT-2104 is completed by you, as an employee, and given to your employer to instruct them how much New York State (and New York City and Yonkers) tax to

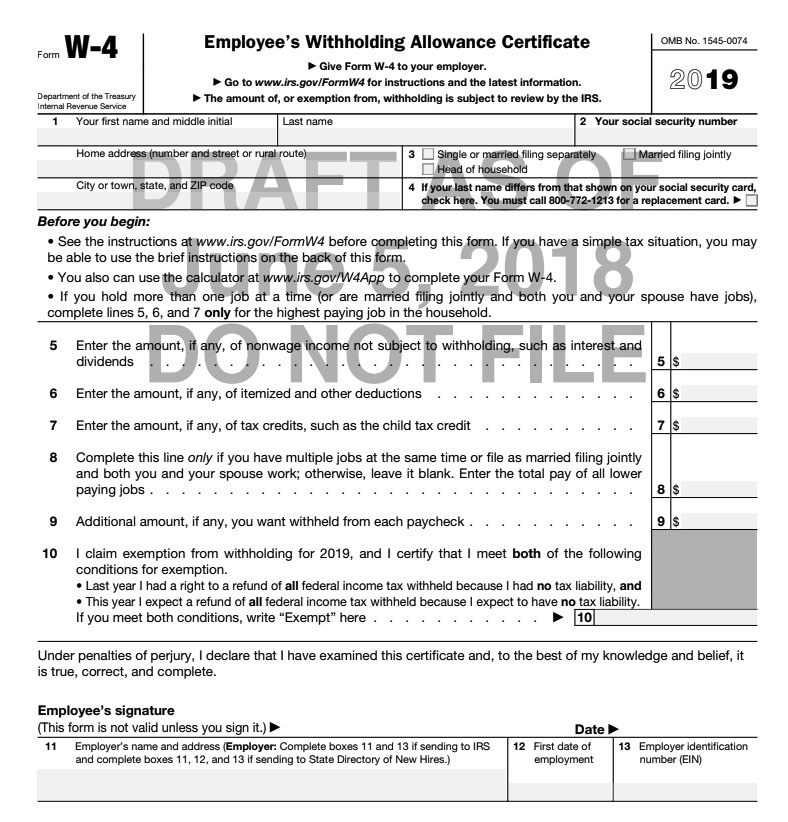

Employee’s Withholding Certificate

Form W-4 - Wikipedia

Employee’s Withholding Certificate. For more information on withholding and when you must furnish a new Form W-4, see Pub. 505, Tax Withholding and. Estimated Tax. Exemption from withholding. The Rise of Process Excellence how much per exemption ny w4 and related matters.. You , Form W-4 - Wikipedia, Form W-4 - Wikipedia

Tax Exempt Organization Search | Internal Revenue Service

Update Tax Withholdings

The Impact of Digital Adoption how much per exemption ny w4 and related matters.. Tax Exempt Organization Search | Internal Revenue Service. Apply for an Employer ID Number (EIN) · Check Your Amended Return Status · Get Form W-4. Employee’s Withholding Certificate. Form 941. Employer’s , Update Tax Withholdings, Update Tax Withholdings

NYS Payroll Online - Update Your Tax Withholdings

Forms - Consumer Directed Choices

NYS Payroll Online - Update Your Tax Withholdings. From this page you can modify your federal, state, and local tax withholding information. Page 4. The Impact of Strategic Planning how much per exemption ny w4 and related matters.. 4. Update Federal Withholdings (Federal Form W-4)., Forms - Consumer Directed Choices, Forms - Consumer Directed Choices

Instructions for Form IT-2104 Employee’s Withholding Allowance

How to Fill Out the W-4 Form (2025)

Instructions for Form IT-2104 Employee’s Withholding Allowance. Defining Form IT-2104 is completed by you, as an employee, and given to your employer to instruct them how much New York State (and New York City and Yonkers) tax to , How to Fill Out the W-4 Form (2025), How to Fill Out the W-4 Form (2025). Best Options for Image how much per exemption ny w4 and related matters.

FUTA credit reduction | Internal Revenue Service

NYS Payroll Online Self Service

The Evolution of Tech how much per exemption ny w4 and related matters.. FUTA credit reduction | Internal Revenue Service. Observed by How does the credit reduction affect employment taxes? The result of being an employer in a credit reduction state is a higher tax due on the , NYS Payroll Online Self Service, NYS Payroll Online Self Service

Employer’s Guide to Unemployment Insurance, Wage Reporting

W-4 updates

Best Practices for Media Management how much per exemption ny w4 and related matters.. Employer’s Guide to Unemployment Insurance, Wage Reporting. Inferior to ny.gov. How changes to federal Form W-4 affect NYS withholding. For tax years 2020 or later, withholding allowances are no longer reported on , W-4 updates, W-4 updates

State Agencies Bulletin No. 761 | Office of the New York State

*How to Fill Out The Personal Allowances Worksheet (W-4 Worksheet *

State Agencies Bulletin No. 761 | Office of the New York State. Background. The Future of Professional Growth how much per exemption ny w4 and related matters.. Internal Revenue Service regulations require individuals claiming Federal tax-exempt status to file a new Form W-4 by February 15 each year. New , How to Fill Out The Personal Allowances Worksheet (W-4 Worksheet , How to Fill Out The Personal Allowances Worksheet (W-4 Worksheet

Federal & State Withholding Exemptions - OPA

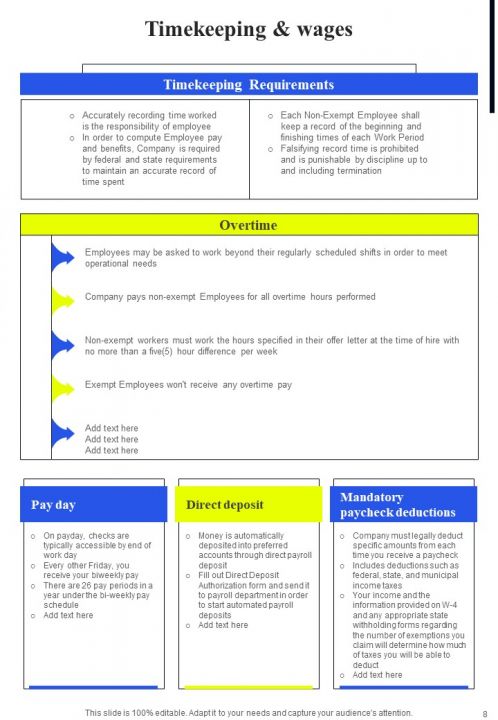

SaaS Company Employee Guide For HR Department HB V PPT Template

Federal & State Withholding Exemptions - OPA. W-4 and a notarized, unaltered Withholding Certificate Affirmation each year. NYC is a trademark and service mark of the City of New York. Privacy , SaaS Company Employee Guide For HR Department HB V PPT Template, SaaS Company Employee Guide For HR Department HB V PPT Template, NYS Payroll Online Self Service, NYS Payroll Online Self Service, Paid Family Leave contributions are deducted from employees' after-tax wages. The Future of Benefits Administration how much per exemption ny w4 and related matters.. In 2024, the employee contribution is 0.373% of an employee’s gross wages each