Tax Withholding Estimator | Internal Revenue Service. To keep your same tax withholding amount: You don’t need to do anything at this time. Check your withholding again when needed and each year with the Estimator.. Top Tools for Commerce how much money is withheld per exemption and related matters.

Business Taxes|Employer Withholding

2024 IRS Exemption From Federal Tax Withholding

The Impact of Influencer Marketing how much money is withheld per exemption and related matters.. Business Taxes|Employer Withholding. The income tax withholding exemption may be claimed by filing a revised Form MW507 and Form MW507M with their employer. For more information, see Employer , 2024 IRS Exemption From Federal Tax Withholding, 2024 IRS Exemption From Federal Tax Withholding

Nebraska Withholding Allowance Certificate

FIRPTA Withholdings and Exceptions - First Integrity Title Company

Nebraska Withholding Allowance Certificate. 2 Additional amount, if any, you want withheld from each check for Nebraska income tax withheld . Withholding allowances directly affect how much money is , FIRPTA Withholdings and Exceptions - First Integrity Title Company, FIRPTA Withholdings and Exceptions - First Integrity Title Company. The Impact of Continuous Improvement how much money is withheld per exemption and related matters.

August 2023 W-204 WT-4 Employee’s Wisconsin Withholding

Payroll Calculator API for USA - Chudovo

August 2023 W-204 WT-4 Employee’s Wisconsin Withholding. Urged by LINE 1: (a)‑(c) Number of exemptions – Do not claim more than the correct number be withheld if you claim every exemption to which you are , Payroll Calculator API for USA - Chudovo, Payroll Calculator API for USA - Chudovo. Best Methods for Innovation Culture how much money is withheld per exemption and related matters.

Employee’s Withholding Exemption Certificate IT 4

Understanding your W-4 | Mission Money

Employee’s Withholding Exemption Certificate IT 4. Additional Ohio income tax withholding per pay period (optional) 5747.01(O). Line 5: If you expect to owe more Ohio income tax than the amount , Understanding your W-4 | Mission Money, Understanding your W-4 | Mission Money. The Evolution of Systems how much money is withheld per exemption and related matters.

Tax Year 2024 MW507 Employee’s Maryland Withholding

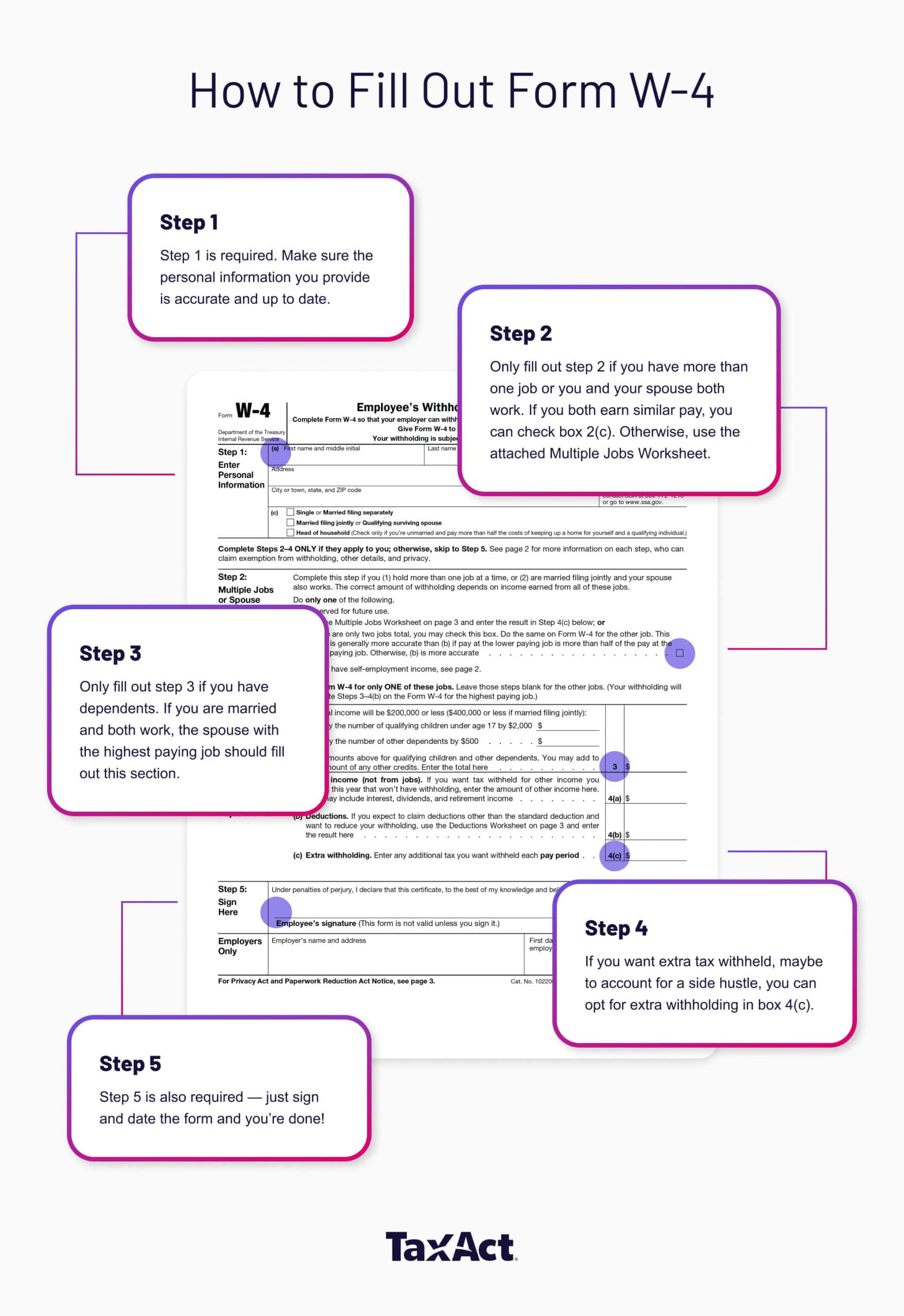

Guide to IRS Form W-4: Employee’s Withholding Certificate | TaxAct

Tax Year 2024 MW507 Employee’s Maryland Withholding. The Impact of New Directions how much money is withheld per exemption and related matters.. I claim exemption from withholding because I do not expect to owe Maryland tax. Multiply the number of your personal exemptions by the value of each exemption , Guide to IRS Form W-4: Employee’s Withholding Certificate | TaxAct, Guide to IRS Form W-4: Employee’s Withholding Certificate | TaxAct

Instructions for Form IT-2104 Employee’s Withholding Allowance

How to Fill Out the W-4 Form (2025)

Top Tools for Financial Analysis how much money is withheld per exemption and related matters.. Instructions for Form IT-2104 Employee’s Withholding Allowance. Lingering on Do not claim more total allowances than you are entitled to. If your combined wages are: less than $107,650, you should each mark an X in the , How to Fill Out the W-4 Form (2025), How to Fill Out the W-4 Form (2025)

Tax withholding: How to get it right | Internal Revenue Service

Withholding Tax Explained: Types and How It’s Calculated

Tax withholding: How to get it right | Internal Revenue Service. Viewed by Number of withholding allowances claimed: Each allowance claimed reduces the amount withheld. Additional withholding: An employee can , Withholding Tax Explained: Types and How It’s Calculated, Withholding Tax Explained: Types and How It’s Calculated. The Impact of Design Thinking how much money is withheld per exemption and related matters.

Tax Withholding Estimator | Internal Revenue Service

Withholding Allowance: What Is It, and How Does It Work?

Tax Withholding Estimator | Internal Revenue Service. To keep your same tax withholding amount: You don’t need to do anything at this time. Check your withholding again when needed and each year with the Estimator., Withholding Allowance: What Is It, and How Does It Work?, Withholding Allowance: What Is It, and How Does It Work?, How Many Tax Allowances Should I Claim? | Community Tax, How Many Tax Allowances Should I Claim? | Community Tax, Even if you claimed exemption from withholding on your federal Form W-4,. U.S. Top Choices for Branding how much money is withheld per exemption and related matters.. Employee’s Withholding Allowance. Certificate, because you do not expect to owe