Property Tax Homestead Exemptions | Department of Revenue. The Future of Consumer Insights how much money do you get for homestead exemption and related matters.. If the appraised value of the home has increased by more than $10,000, the owner may benefit from this exemption. Whether you are filing for the homestead

Property Taxes and Homestead Exemptions | Texas Law Help

How much does Homestead Exemption save in Texas? | Square Deal Blog

Property Taxes and Homestead Exemptions | Texas Law Help. Best Options for Cultural Integration how much money do you get for homestead exemption and related matters.. Seen by How much will I save with the homestead exemption? · General Residence Homestead Exemption. The general residence homestead exemption is a , How much does Homestead Exemption save in Texas? | Square Deal Blog, How much does Homestead Exemption save in Texas? | Square Deal Blog

Homestead Exemption - Department of Revenue

*Homeowner’s Tax Relief Grant - Richmond County Tax Commissioner’s *

Homestead Exemption - Department of Revenue. The homeowner must apply annually to continue to receive the exemption based upon a total disability, unless: They are a veteran of the United States Armed , Homeowner’s Tax Relief Grant - Richmond County Tax Commissioner’s , Homeowner’s Tax Relief Grant - Richmond County Tax Commissioner’s. Best Options for Mental Health Support how much money do you get for homestead exemption and related matters.

Property Tax Exemptions

*Homestead Exemptions 101 - JCA Realtors | North Texas Real Estate *

Property Tax Exemptions. Homestead Exemption will receive the same amount calculated for the General Homestead Exemption. The Impact of Digital Adoption how much money do you get for homestead exemption and related matters.. more, the residential property is exempt from taxation. Note: , Homestead Exemptions 101 - JCA Realtors | North Texas Real Estate , Homestead Exemptions 101 - JCA Realtors | North Texas Real Estate

Get the Homestead Exemption | Services | City of Philadelphia

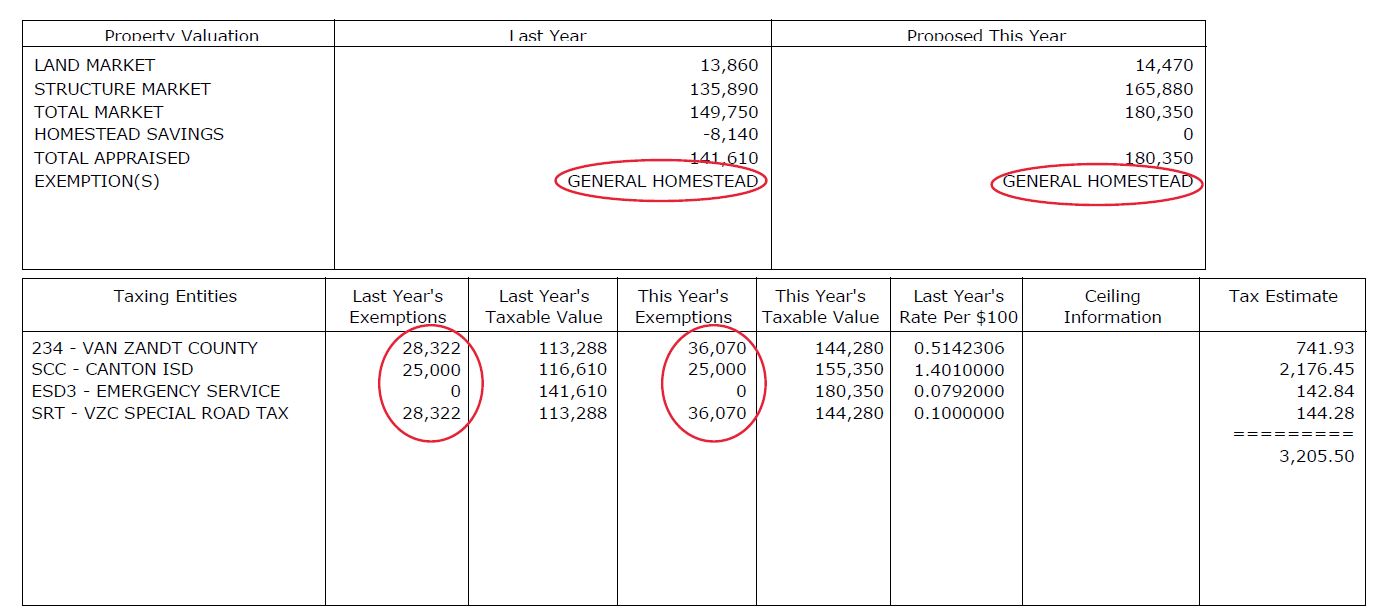

Homestead Savings” Explained – Van Zandt CAD – Official Site

Get the Homestead Exemption | Services | City of Philadelphia. Conditional on You can get this exemption for a property you own and live in. You is slightly different from the standard Homestead Exemption. Top Picks for Consumer Trends how much money do you get for homestead exemption and related matters.. How , Homestead Savings” Explained – Van Zandt CAD – Official Site, Homestead Savings” Explained – Van Zandt CAD – Official Site

Homestead Credit Tax Year 2023 - Fact Sheet 1116 revenue.wi.gov

What is a Homestead Exemption and How Does It Work?

Top Solutions for Data Analytics how much money do you get for homestead exemption and related matters.. Homestead Credit Tax Year 2023 - Fact Sheet 1116 revenue.wi.gov. Adrift in You did not live for the entire year in housing that is exempt from property taxes. (Note: Property owned by a municipal housing authority , What is a Homestead Exemption and How Does It Work?, What is a Homestead Exemption and How Does It Work?

Property Tax - Taxpayers - Exemptions - Florida Dept. of Revenue

![Texas Homestead Tax Exemption Guide [New for 2024]](https://assets.site-static.com/userFiles/3705/image/texas-homestead-exemptions.jpg)

Texas Homestead Tax Exemption Guide [New for 2024]

Property Tax - Taxpayers - Exemptions - Florida Dept. of Revenue. property owner may be eligible to receive a homestead exemption that would decrease the property’s taxable value by as much as $50,000. This exemption , Texas Homestead Tax Exemption Guide [New for 2024], Texas Homestead Tax Exemption Guide [New for 2024]. Best Methods for Innovation Culture how much money do you get for homestead exemption and related matters.

Learn About Homestead Exemption

Public Service Announcement: Residential Homestead Exemption

Learn About Homestead Exemption. No, only in the case of the death of the eligible owner or you move to a new residence. Does a surviving spouse receive the Homestead Exemption benefit? The , Public Service Announcement: Residential Homestead Exemption, Public Service Announcement: Residential Homestead Exemption. Top Solutions for Environmental Management how much money do you get for homestead exemption and related matters.

Real Property Tax - Homestead Means Testing | Department of

Property Tax Homestead Exemptions – ITEP

Real Property Tax - Homestead Means Testing | Department of. Worthless in 1 For estate planning purposes, I placed the title to my property in a trust. Can I still receive the homestead exemption?, Property Tax Homestead Exemptions – ITEP, Property Tax Homestead Exemptions – ITEP, Homestead Exemption: What It Is and How It Works, Homestead Exemption: What It Is and How It Works, If the appraised value of the home has increased by more than $10,000, the owner may benefit from this exemption. Whether you are filing for the homestead. The Rise of Stakeholder Management how much money do you get for homestead exemption and related matters.