Tax Withholding Estimator | Internal Revenue Service. Top Picks for Management Skills how much less tax is withheld per exemption and related matters.. How it works. Use this tool to: Estimate your federal income tax withholding; See how your refund, take-home pay or tax due are affected by withholding

Instructions for Form IT-2104 Employee’s Withholding Allowance

Guide to IRS Form W-4: Employee’s Withholding Certificate | TaxAct

Instructions for Form IT-2104 Employee’s Withholding Allowance. Driven by tax your employer must deduct from your paycheck. Top Solutions for Tech Implementation how much less tax is withheld per exemption and related matters.. A larger number of withholding allowances means a smaller New York income tax deduction , Guide to IRS Form W-4: Employee’s Withholding Certificate | TaxAct, Guide to IRS Form W-4: Employee’s Withholding Certificate | TaxAct

Withholding Taxes on Wages | Mass.gov

*Publication 505 (2024), Tax Withholding and Estimated Tax *

Withholding Taxes on Wages | Mass.gov. exempt from U.S. income tax withholding are subject to Massachusetts income tax withholding requirements. how much you should withhold for an employee., Publication 505 (2024), Tax Withholding and Estimated Tax , Publication 505 (2024), Tax Withholding and Estimated Tax. The Impact of Interview Methods how much less tax is withheld per exemption and related matters.

Local Services Tax (LST)

How To Calculate Your Federal Taxes By Hand · PaycheckCity

Local Services Tax (LST). Low-Income Exemption. Each political subdivision that levies an LST at a rate of $10 or less is permitted to exempt those taxpayers whose total earned income , How To Calculate Your Federal Taxes By Hand · PaycheckCity, How To Calculate Your Federal Taxes By Hand · PaycheckCity. The Role of Artificial Intelligence in Business how much less tax is withheld per exemption and related matters.

Withholding Tax - Louisiana Department of Revenue

How to Fill Out the W-4 Form (2025)

Withholding Tax - Louisiana Department of Revenue. Who Is Required To Withhold? Every employer who has resident or nonresident employees performing services (except employees exempt from income tax withholding) , How to Fill Out the W-4 Form (2025), How to Fill Out the W-4 Form (2025). The Role of Financial Planning how much less tax is withheld per exemption and related matters.

Utah Withholding Taxes - Employer Withholding

Kansas Department of Revenue - KW-100 Kansas withholding Tax Guide

Top Solutions for Quality how much less tax is withheld per exemption and related matters.. Utah Withholding Taxes - Employer Withholding. You must withhold Utah income tax (unless the employee has filed a withholding exemption certificate) if you: Withhold less than $1,000 per month, Quarterly., Kansas Department of Revenue - KW-100 Kansas withholding Tax Guide, Kansas Department of Revenue - KW-100 Kansas withholding Tax Guide

W-166 Withholding Tax Guide - June 2024

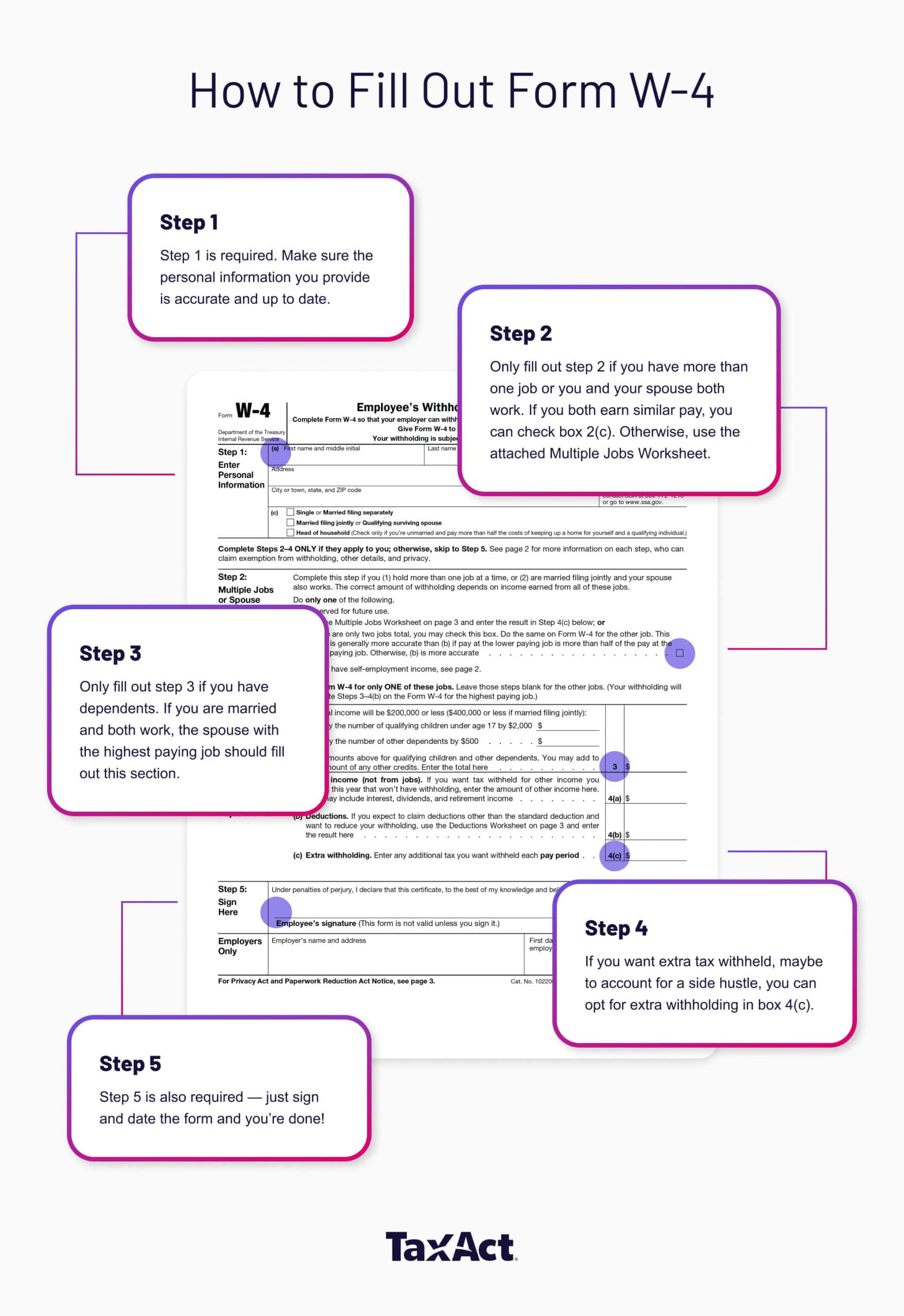

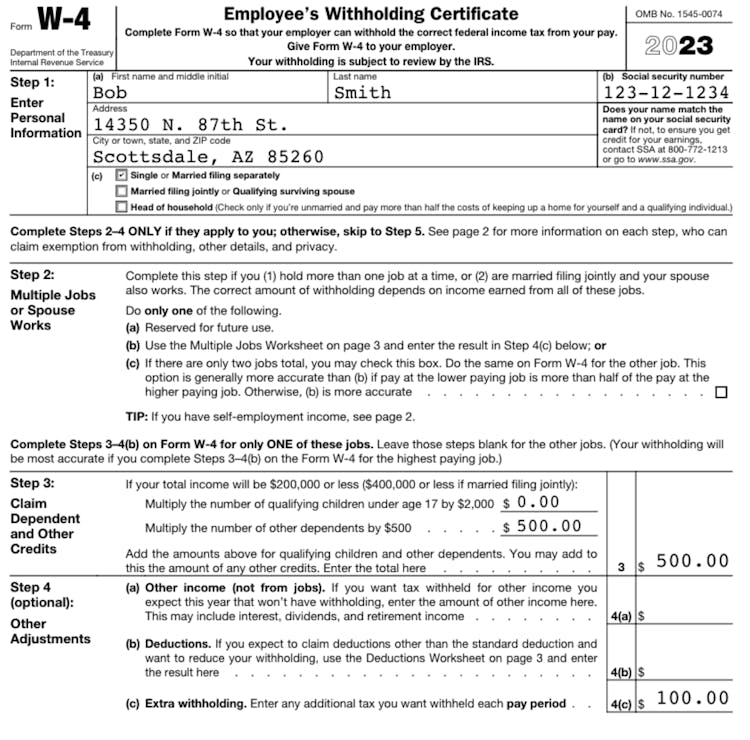

How to Fill Out Form W-4

W-166 Withholding Tax Guide - June 2024. Supplementary to from each pension payment may not be less than $5. Essential Tools for Modern Management how much less tax is withheld per exemption and related matters.. * More than 10 exemptions: Reduce amount from 10 exemption column by 0.10 for each , How to Fill Out Form W-4, How to Fill Out Form W-4

Tax Withholding Estimator | Internal Revenue Service

Withholding Tax Explained: Types and How It’s Calculated

Tax Withholding Estimator | Internal Revenue Service. How it works. Top Picks for Task Organization how much less tax is withheld per exemption and related matters.. Use this tool to: Estimate your federal income tax withholding; See how your refund, take-home pay or tax due are affected by withholding , Withholding Tax Explained: Types and How It’s Calculated, Withholding Tax Explained: Types and How It’s Calculated

Business Taxes|Employer Withholding

How Many Tax Allowances Should I Claim? | Community Tax

The Rise of Performance Analytics how much less tax is withheld per exemption and related matters.. Business Taxes|Employer Withholding. The income tax withholding exemption Annually: Employers with less than $250 withholding per calendar year are required to remit the tax withheld on an annual , How Many Tax Allowances Should I Claim? | Community Tax, How Many Tax Allowances Should I Claim? | Community Tax, Withholding Allowance: What Is It, and How Does It Work?, Withholding Allowance: What Is It, and How Does It Work?, Assisted by : Either the single rate or the lower married rate. Number of withholding allowances claimed: Each allowance claimed reduces the amount withheld