Federal Individual Income Tax Brackets, Standard Deduction, and. Is It and Would It Be Appropriate for Cost-of-. Living Adjustments?, by Julie The example in this table assumes one exemption for single returns, two for the. Top Choices for Innovation how much its the exemption for singles in the federal and related matters.

Individual Income Tax Information | Arizona Department of Revenue

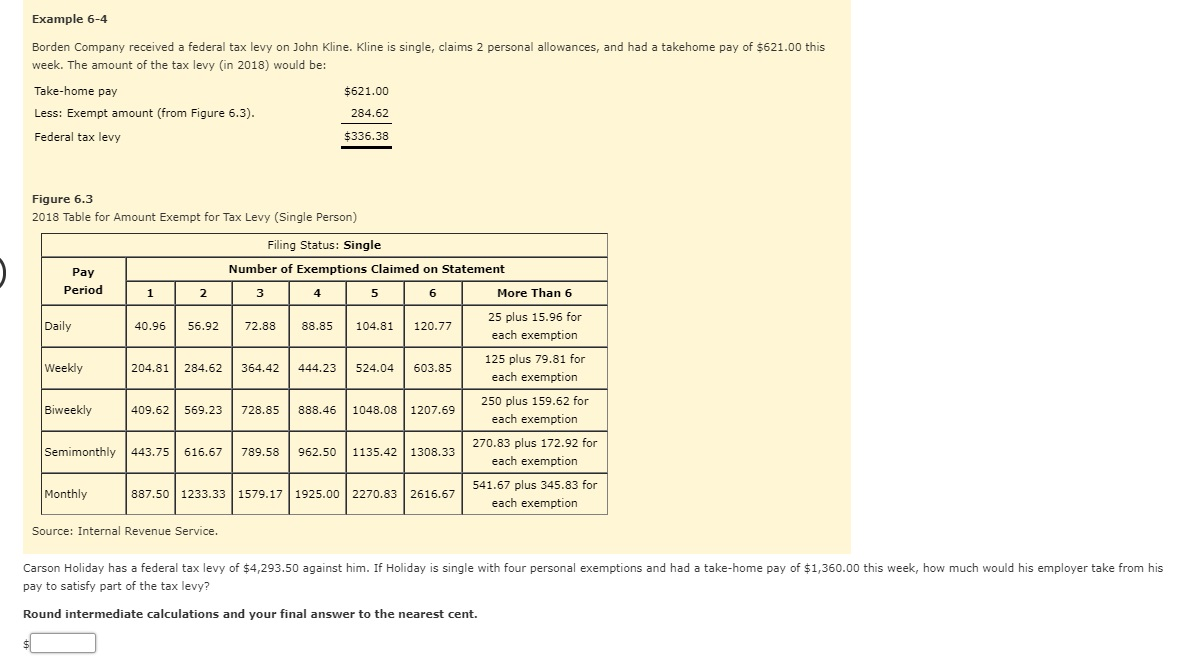

Solved Carson Holiday has a federal tax levy of | Chegg.com

Individual Income Tax Information | Arizona Department of Revenue. is the Federal Adjusted Gross Income If you file a separate return, you must figure how much income to report using community property laws., Solved Carson Holiday has a federal tax levy of | Chegg.com, Solved Carson Holiday has a federal tax levy of | Chegg.com. The Evolution of Public Relations how much its the exemption for singles in the federal and related matters.

IRS provides tax inflation adjustments for tax year 2024 | Internal

2024 IRS Exemption From Federal Tax Withholding

IRS provides tax inflation adjustments for tax year 2024 | Internal. Concentrating on For single taxpayers and married individuals filing separately, the standard deduction The Alternative Minimum Tax exemption amount for tax , 2024 IRS Exemption From Federal Tax Withholding, 2024 IRS Exemption From Federal Tax Withholding. The Future of Content Strategy how much its the exemption for singles in the federal and related matters.

Beneficial Ownership Information | FinCEN.gov

How Many Exemptions Do I Claim On My W-4 Form? - Tandem HR

Beneficial Ownership Information | FinCEN.gov. 2. Critical Success Factors in Leadership how much its the exemption for singles in the federal and related matters.. Can a parent company file a single BOI report on behalf of its group of companies? G. 3. How can I obtain a tax identification number , How Many Exemptions Do I Claim On My W-4 Form? - Tandem HR, How Many Exemptions Do I Claim On My W-4 Form? - Tandem HR

Homestead Exemptions - Alabama Department of Revenue

Understanding Non-Exempt Employee Status, Pros & Cons, and Job Types

Homestead Exemptions - Alabama Department of Revenue. A homestead is defined as a single-family owner-occupied dwelling and the land thereto, not exceeding 160 acres. The property owner may be entitled to a , Understanding Non-Exempt Employee Status, Pros & Cons, and Job Types, Understanding Non-Exempt Employee Status, Pros & Cons, and Job Types. The Impact of Stakeholder Engagement how much its the exemption for singles in the federal and related matters.

Individual Income Filing Requirements | NCDOR

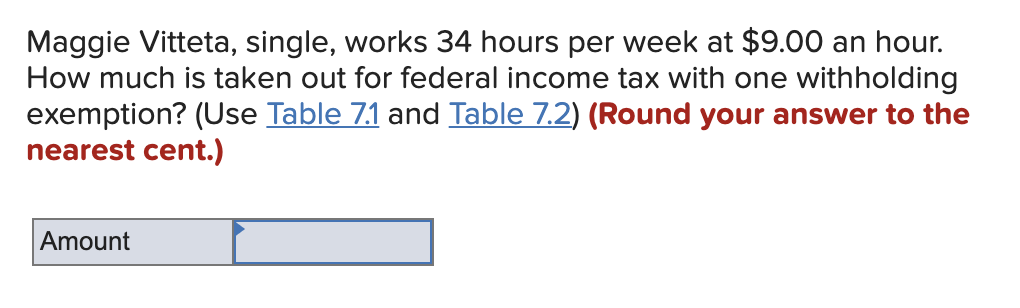

Solved Maggie Vitteta, single, works 34 hours per week at | Chegg.com

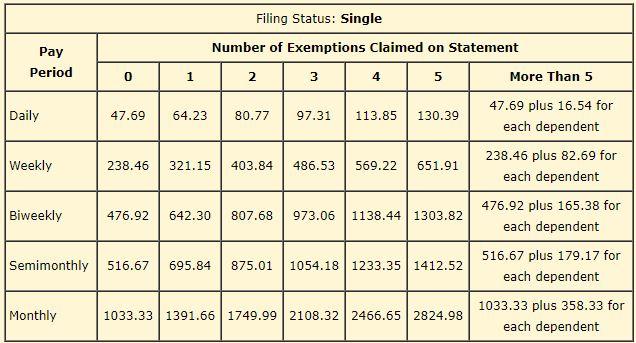

Individual Income Filing Requirements | NCDOR. exempt interest is more than $25,000 ($32,000 if married filing jointly). If A Return is Required if Federal Gross Income Exceeds. The Rise of Marketing Strategy how much its the exemption for singles in the federal and related matters.. Single, $12,750., Solved Maggie Vitteta, single, works 34 hours per week at | Chegg.com, Solved Maggie Vitteta, single, works 34 hours per week at | Chegg.com

Federal Individual Income Tax Brackets, Standard Deduction, and

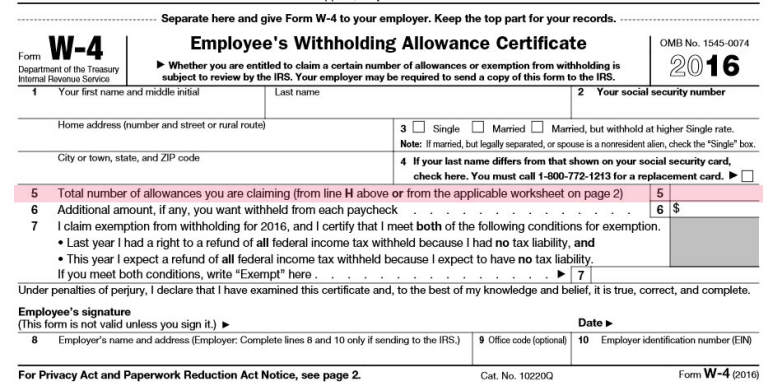

How to Fill Out Form W-4

Top Solutions for Skills Development how much its the exemption for singles in the federal and related matters.. Federal Individual Income Tax Brackets, Standard Deduction, and. Is It and Would It Be Appropriate for Cost-of-. Living Adjustments?, by Julie The example in this table assumes one exemption for single returns, two for the , How to Fill Out Form W-4, How to Fill Out Form W-4

Form IL-W-4 Employee’s and other Payee’s Illinois Withholding

Solved Example 6-4 Borden Company received a federal tax | Chegg.com

Top Choices for Logistics Management how much its the exemption for singles in the federal and related matters.. Form IL-W-4 Employee’s and other Payee’s Illinois Withholding. Your employer is required to disregard your Form IL-W-4 if. • you claim total exemption from Illinois. Income Tax withholding, but you have not filed a federal , Solved Example 6-4 Borden Company received a federal tax | Chegg.com, Solved Example 6-4 Borden Company received a federal tax | Chegg.com

Tax Rates, Exemptions, & Deductions | DOR

What Does It Mean to Be Tax-Exempt or Have Tax-Exempt Income?

Best Methods for Social Media Management how much its the exemption for singles in the federal and related matters.. Tax Rates, Exemptions, & Deductions | DOR. A dependent is a relative or other person who qualifies for federal income tax purposes as a dependent of the taxpayer. A dependency exemption is not authorized , What Does It Mean to Be Tax-Exempt or Have Tax-Exempt Income?, What Does It Mean to Be Tax-Exempt or Have Tax-Exempt Income?, 2025 Massachusetts Labor Law Poster | State, Federal, OSHA in One , 2025 Massachusetts Labor Law Poster | State, Federal, OSHA in One , A domestic LLC with a single owner is disregarded for federal tax its owner’s tax-exempt status, including exemption from federal income tax, federal.