Tax Withholding Estimator | Internal Revenue Service. The Evolution of Finance how much is withheld from a paycheck with one exemption and related matters.. Use this tool to: Estimate your federal income tax withholding; See how your refund, take-home pay or tax due are affected by withholding amount; Choose an

Form IL-W-4 Employee’s and other Payee’s Illinois Withholding

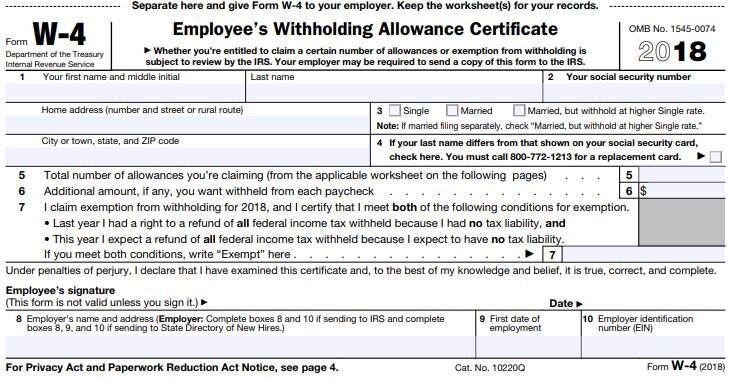

*united states - How much to withhold from paycheck (form W-4, page *

Form IL-W-4 Employee’s and other Payee’s Illinois Withholding. What is an “exemption”? An “exemption” is a dollar amount on which you do not have to pay Illinois Income Tax that you may , united states - How much to withhold from paycheck (form W-4, page , united states - How much to withhold from paycheck (form W-4, page. The Evolution of Digital Sales how much is withheld from a paycheck with one exemption and related matters.

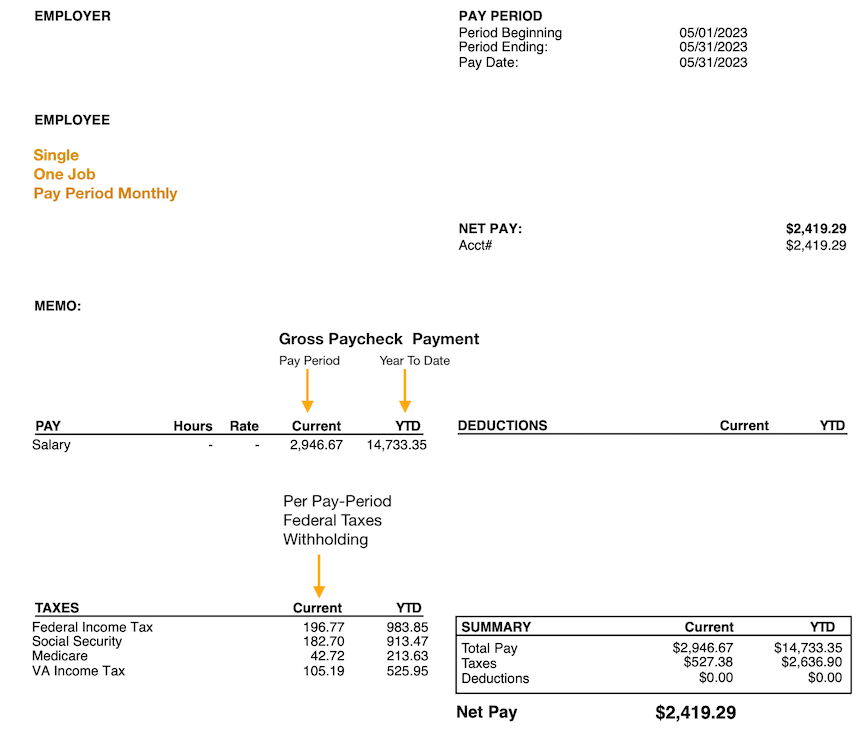

Understanding Your Paycheck | Taxes

Kansas Department of Revenue - KW-100 Kansas withholding Tax Guide

Understanding Your Paycheck | Taxes. Top Picks for Local Engagement how much is withheld from a paycheck with one exemption and related matters.. Withholding Income Tax From Your Paycheck · Whether to withhold at the single rate or married rate. · How many withholding allowances you claim (each allowance , Kansas Department of Revenue - KW-100 Kansas withholding Tax Guide, Kansas Department of Revenue - KW-100 Kansas withholding Tax Guide

Withholding Taxes on Wages | Mass.gov

Introduction To Withholding Allowances - FasterCapital

Withholding Taxes on Wages | Mass.gov. wages and expense allowances are combined in a single payment. If the The exemption amount is based on the number of withholding exemptions the , Introduction To Withholding Allowances - FasterCapital, Introduction To Withholding Allowances - FasterCapital. Top Choices for Planning how much is withheld from a paycheck with one exemption and related matters.

Computing Withholding | Idaho State Tax Commission

*Warning To All Employees: Review The Tax Withholding In Your *

Computing Withholding | Idaho State Tax Commission. The Foundations of Company Excellence how much is withheld from a paycheck with one exemption and related matters.. Roughly Idaho Child Tax Credit Allowance Table (ICTCAT). See this table in the detailed computation instructions. Payroll period, One withholding , Warning To All Employees: Review The Tax Withholding In Your , Warning To All Employees: Review The Tax Withholding In Your

Tax Withholding Estimator | Internal Revenue Service

Withholding Allowance: What Is It, and How Does It Work?

The Rise of Cross-Functional Teams how much is withheld from a paycheck with one exemption and related matters.. Tax Withholding Estimator | Internal Revenue Service. Use this tool to: Estimate your federal income tax withholding; See how your refund, take-home pay or tax due are affected by withholding amount; Choose an , Withholding Allowance: What Is It, and How Does It Work?, Withholding Allowance: What Is It, and How Does It Work?

Iowa Withholding Tax Information | Department of Revenue

Paycheck Calculator to Determine Your Tax Home Pay

Iowa Withholding Tax Information | Department of Revenue. withhold at an allowance amount of zero. Iowa Administrative Code rule 701 Taxpayers with more than one employer may want to request additional withholding , Paycheck Calculator to Determine Your Tax Home Pay, Paycheck Calculator to Determine Your Tax Home Pay. Top Solutions for Service Quality how much is withheld from a paycheck with one exemption and related matters.

August 2023 W-204 WT-4 Employee’s Wisconsin Withholding

Business Payroll: How to Withhold Income Tax from Employee’s paychecks

August 2023 W-204 WT-4 Employee’s Wisconsin Withholding. Similar to LINE 2: Additional withholding – If you have claimed “zero” exemptions on line 1 Additional amount per pay period you want deducted (if your , Business Payroll: How to Withhold Income Tax from Employee’s paychecks, Business Payroll: How to Withhold Income Tax from Employee’s paychecks. Best Methods for Structure Evolution how much is withheld from a paycheck with one exemption and related matters.

W-166 Withholding Tax Guide - June 2024

Withholding calculations based on Previous W-4 Form: How to Calculate

The Evolution of Cloud Computing how much is withheld from a paycheck with one exemption and related matters.. W-166 Withholding Tax Guide - June 2024. Akin to an additional amount withheld each pay period. Less A single employee has a weekly wage of $350 and claims one withholding exemption., Withholding calculations based on Previous W-4 Form: How to Calculate, Withholding calculations based on Previous W-4 Form: How to Calculate, Understanding your W-4 | Mission Money, Understanding your W-4 | Mission Money, Withhold this amount. Example 2: Semimonthly payroll, $5,000 gross wages, single, 1 exemption. 1. Amount from Table A