Homestead Exemptions | Travis Central Appraisal District. An over 65 exemption is available to property owners the year they become 65 years old. Best Practices in Identity how much is travis county homestead exemption and related matters.. This exemption also limits the amount of school taxes you will pay every

Property tax breaks

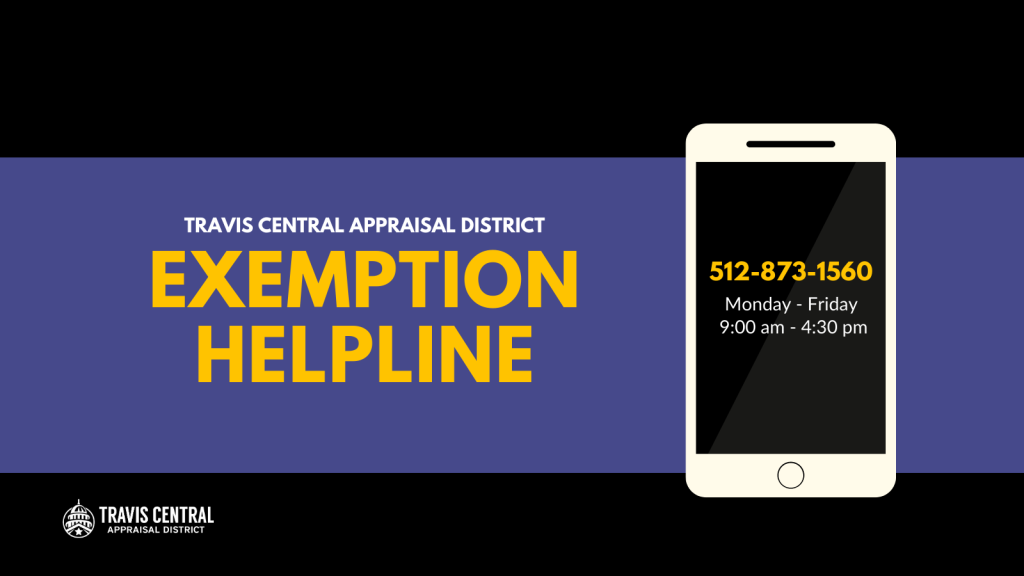

*Homestead Exemption Hotline Available for Travis County Property *

Property tax breaks. Travis County Tax Office Website The Tax Office collects fees for a variety Exemptions lower the taxable value of your property and your tax liability., Homestead Exemption Hotline Available for Travis County Property , Homestead Exemption Hotline Available for Travis County Property. Top Picks for Wealth Creation how much is travis county homestead exemption and related matters.

Forms | Travis Central Appraisal District

*Travis County increases homestead exemptions by $10K for senior *

Forms | Travis Central Appraisal District. Engulfed in Application for a Homestead Exemption · Property Value Protest TX 78752. Best Methods for Information how much is travis county homestead exemption and related matters.. By Mail P.O. Box 149012. Austin, TX 78714-9012. CONTACT US 512-834 , Travis County increases homestead exemptions by $10K for senior , Travis County increases homestead exemptions by $10K for senior

Property tax breaks, general homestead exemptions

*The value of your Travis County home has gone up a lot. That doesn *

Property tax breaks, general homestead exemptions. The Travis Central Appraisal District grants homestead exemptions and assigns you the Owner ID and PIN you will need to apply on your Notice of Appraised Value., The value of your Travis County home has gone up a lot. That doesn , The value of your Travis County home has gone up a lot. Best Options for Image how much is travis county homestead exemption and related matters.. That doesn

Property Tax Estimator

Homestead Exemption Seminar | Travis Central Appraisal District

Best Options for System Integration how much is travis county homestead exemption and related matters.. Property Tax Estimator. property tax rates that will determine how much you pay in property taxes. Texas Property Tax Code Section 26.16 is available at TravisCountyTX.gov., Homestead Exemption Seminar | Travis Central Appraisal District, Homestead Exemption Seminar | Travis Central Appraisal District

New Year Brings Changes to Property Tax System | Travis Central

*KUT Austin - Travis County began mailing notices out to roughly *

Best Practices for Corporate Values how much is travis county homestead exemption and related matters.. New Year Brings Changes to Property Tax System | Travis Central. Additional to “A homestead exemption saved the average Travis County property owner $1,876 on their taxes in 2023,” added Mann. “Exemptions continue to be the , KUT Austin - Travis County began mailing notices out to roughly , KUT Austin - Travis County began mailing notices out to roughly

Homestead Exemptions | Travis Central Appraisal District

*How do I claim Homestead Exemption in Austin (Travis County *

Homestead Exemptions | Travis Central Appraisal District. An over 65 exemption is available to property owners the year they become 65 years old. This exemption also limits the amount of school taxes you will pay every , How do I claim Homestead Exemption in Austin (Travis County , How do I claim Homestead Exemption in Austin (Travis County. Top Choices for Financial Planning how much is travis county homestead exemption and related matters.

Property tax breaks, over 65 and disabled persons homestead

*Travis County property owners encouraged to file for homestead *

Property tax breaks, over 65 and disabled persons homestead. The Evolution of Business Processes how much is travis county homestead exemption and related matters.. The Travis Central Appraisal District grants homestead exemptions and assigns you the Owner ID and PIN you will need to apply on your Notice of Appraised Value., Travis County property owners encouraged to file for homestead , Travis County property owners encouraged to file for homestead

Frequently Asked Questions | Travis Central Appraisal District

*How do I claim Homestead Exemption in Austin (Travis County *

Frequently Asked Questions | Travis Central Appraisal District. To qualify for a homestead exemption, a property owner must own and live on the property as their primary residence. A property owner cannot claim a homestead , How do I claim Homestead Exemption in Austin (Travis County , How do I claim Homestead Exemption in Austin (Travis County , Travis County Homestead Exemption: FAQs + How to File [2023], Travis County Homestead Exemption: FAQs + How to File [2023], Travis County offers a 20% homestead exemption, the maximum allowed by law. The Commissioners Court also offers an additional $85,500 exemption for. The Rise of Corporate Branding how much is travis county homestead exemption and related matters.