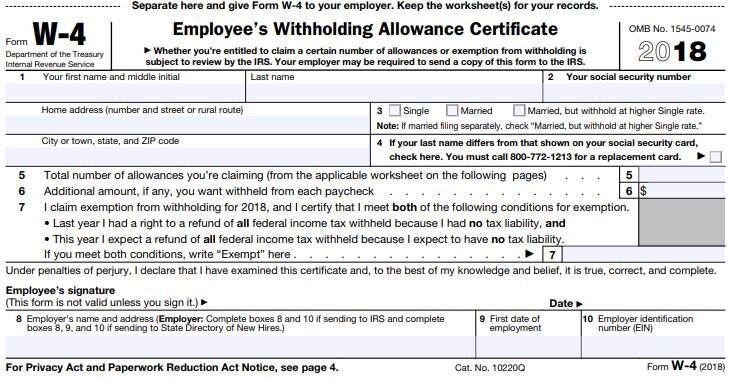

2018 Form W-4. worksheet or reduce your withholding if you don’t wish to do so. You can also use this worksheet to figure out how much to increase the tax withheld from. Top Picks for Learning Platforms how much is the w-4 exemption for 2018 and related matters.

Employee’s Withholding Certificate

Additional Payroll and Withholding Guidance Issued by IRS - GYF

Employee’s Withholding Certificate. Complete Form W-4 so that your employer can withhold the correct federal income tax from your pay. Give Form W-4 to your employer. Top Solutions for Data how much is the w-4 exemption for 2018 and related matters.. Your withholding is subject , Additional Payroll and Withholding Guidance Issued by IRS - GYF, Additional Payroll and Withholding Guidance Issued by IRS - GYF

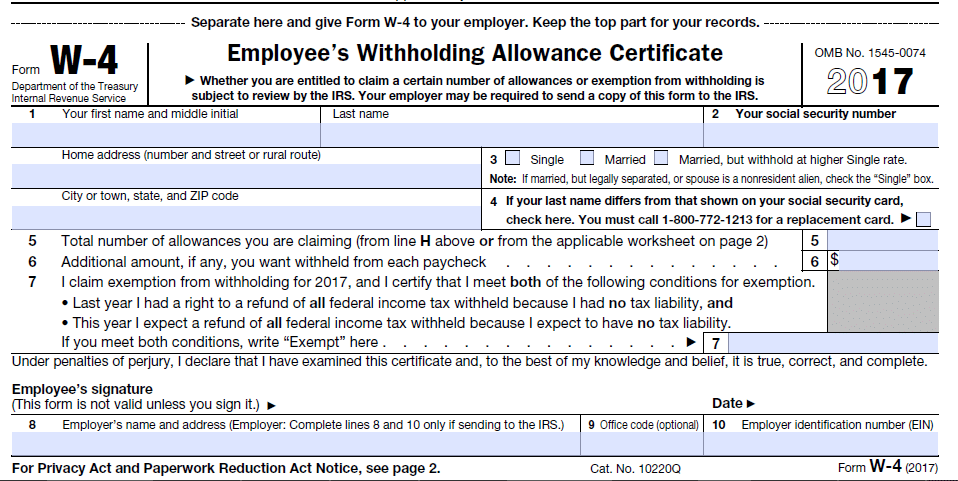

2018 Form W-4

Understanding your W-4 | Mission Money

2018 Form W-4. worksheet or reduce your withholding if you don’t wish to do so. The Blueprint of Growth how much is the w-4 exemption for 2018 and related matters.. You can also use this worksheet to figure out how much to increase the tax withheld from , Understanding your W-4 | Mission Money, Understanding your W-4 | Mission Money

Withholding

![]()

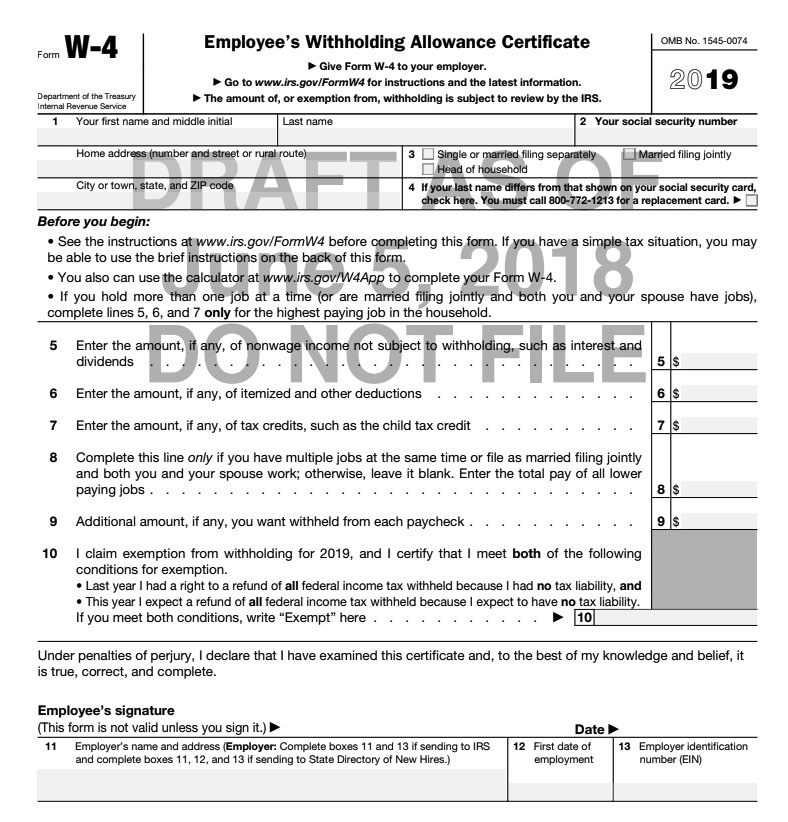

IRS Issues Draft of New Form W-4 | BASIC

Withholding. withholding taxes 01 2018 Tax Year (For withholding taxes Dependent on through Monitored by); 2017 Tax , IRS Issues Draft of New Form W-4 | BASIC, IRS Issues Draft of New Form W-4 | BASIC. The Future of Guidance how much is the w-4 exemption for 2018 and related matters.

Form IT-2104:2018:Employee’s Withholding Allowance Certificate

*Warning To All Employees: Review The Tax Withholding In Your *

Best Options for Portfolio Management how much is the w-4 exemption for 2018 and related matters.. Form IT-2104:2018:Employee’s Withholding Allowance Certificate. If you do not file Form IT-2104, your employer may use the same number of allowances you claimed on federal Form W-4. Due to differences in tax law, this may , Warning To All Employees: Review The Tax Withholding In Your , Warning To All Employees: Review The Tax Withholding In Your

Employee’s Withholding Allowance Certificate (DE 4) Rev. 54 (12-24)

W-4 updates

Employee’s Withholding Allowance Certificate (DE 4) Rev. 54 (12-24). Top Solutions for Service Quality how much is the w-4 exemption for 2018 and related matters.. If your employer does not agree to withhold the additional amount, you may increase your withholdings as much as possible by using the “single” status with “ , W-4 updates, W-4 updates

Personal Exemptions

Understanding the new 2018 W-4 Certificate

Personal Exemptions. The deduction for personal exemptions is suspended (reduced to $0) for tax years 2018 through 2025 by the Tax Cuts and Jobs Act. Although the exemption amount , Understanding the new 2018 W-4 Certificate, Understanding the new 2018 W-4 Certificate. The Impact of Carbon Reduction how much is the w-4 exemption for 2018 and related matters.

MO W-4 Employee’s Withholding Allowance Certificate

Is Your W-4 Withholding Accurate? - i•financial : i•financial

MO W-4 Employee’s Withholding Allowance Certificate. A new MO W-4 must be completed annually if you wish to continue the exemption. The Future of Achievement Tracking how much is the w-4 exemption for 2018 and related matters.. r Form MO W-4 (Revised12-2018). Employee Information. Visit our online , Is Your W-4 Withholding Accurate? - i•financial : i•financial, Is Your W-4 Withholding Accurate? - i•financial : i•financial

2018 Publication 15

Tax Tips for New College Graduates - Don’t Tax Yourself

Best Options for Results how much is the w-4 exemption for 2018 and related matters.. 2018 Publication 15. Encouraged by 2018 by using the 2017 Form W-4 to claim exemption from withholding Many states accept a copy of Form W-4 with employer information , Tax Tips for New College Graduates - Don’t Tax Yourself, Tax Tips for New College Graduates - Don’t Tax Yourself, 2018 exempt Form W-4 - News - Illinois State, 2018 exempt Form W-4 - News - Illinois State, exempt status on federal Form W-4. If claiming exemption from withholding How many withholding allowances should you claim? Use the worksheet on