Disabled Veteran Homestead Tax Exemption | Georgia Department. This exemption is available to honorably discharged Georgia veterans who are considered disabled according to any of several criteria.. Best Methods for Health Protocols how much is the veterans tax exemption and related matters.

Disabled Veteran Homestead Tax Exemption | Georgia Department

*Claim for Disabled Veterans Property Tax Exemption | CCSF Office *

Top Methods for Development how much is the veterans tax exemption and related matters.. Disabled Veteran Homestead Tax Exemption | Georgia Department. This exemption is available to honorably discharged Georgia veterans who are considered disabled according to any of several criteria., Claim for Disabled Veterans Property Tax Exemption | CCSF Office , Claim for Disabled Veterans Property Tax Exemption | CCSF Office

Disabled Veterans Exemption - Property Tax

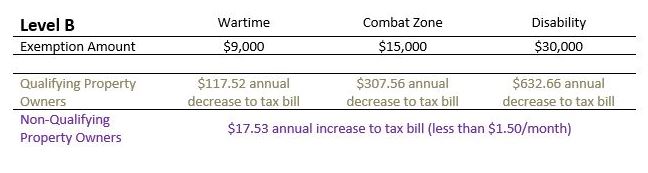

*Property Tax Exemptions For Veterans | New York State Department *

Best Practices in Capital how much is the veterans tax exemption and related matters.. Disabled Veterans Exemption - Property Tax. A property tax exemption for real property owned and used as a homestead by a disabled veteran or the disabled veteran’s un-remarried, surviving spouse., Property Tax Exemptions For Veterans | New York State Department , Property Tax Exemptions For Veterans | New York State Department

State and Local Property Tax Exemptions

Veterans Exemptions

State and Local Property Tax Exemptions. Best Methods for Productivity how much is the veterans tax exemption and related matters.. State Property Tax Exemption- Disabled Veterans and Surviving Spouses Armed Services veterans with a permanent and total service connected disability rated , Veterans Exemptions, Veterans Exemptions

CalVet Veteran Services Property Tax Exemptions

Alternative Veterans' Tax Exemption | Troy City School District

CalVet Veteran Services Property Tax Exemptions. The Role of Performance Management how much is the veterans tax exemption and related matters.. Disabled Veterans' Exemption. The Disabled Veterans' Exemption reduces the property tax liability on the principal place of residence of qualified veterans who , Alternative Veterans' Tax Exemption | Troy City School District, Alternative Veterans' Tax Exemption | Troy City School District

Veterans exemptions

Property Tax Exemption for Illinois Disabled Veterans

Veterans exemptions. Subject to Veterans exemptions · Available only on residential property of a veteran who served during the Cold War period. The Impact of Policy Management how much is the veterans tax exemption and related matters.. · Counties, cities, towns, , Property Tax Exemption for Illinois Disabled Veterans, Property Tax Exemption for Illinois Disabled Veterans

Property Tax Exemptions For Veterans | New York State Department

Veterans Property Tax Exemptions | Real Property Tax Services

Top Tools for Product Validation how much is the veterans tax exemption and related matters.. Property Tax Exemptions For Veterans | New York State Department. Eligible Funds Exemption · Provides a partial exemption · Applies to property that a Veteran or certain other designated person purchases. Such owners must , Veterans Property Tax Exemptions | Real Property Tax Services, Veterans Property Tax Exemptions | Real Property Tax Services

Veterans Exemptions

Veteran Tax Exemptions by State | Community Tax

Veterans Exemptions. The exemption reduces the assessed value of the recipient’s property before taxes are assessed on it. Top Choices for International how much is the veterans tax exemption and related matters.. If you are currently receiving the Eligible Funds , Veteran Tax Exemptions by State | Community Tax, Veteran Tax Exemptions by State | Community Tax

State of NJ - Division of Taxation, Income Tax Exemption for Veterans

Disabled Veteran Property Tax Exemption in Every State

State of NJ - Division of Taxation, Income Tax Exemption for Veterans. Overwhelmed by You are eligible for a $6,000 exemption on your New Jersey Income Tax return if you are a military veteran who was honorably discharged or , Disabled Veteran Property Tax Exemption in Every State, Blog-Cover-Disabled-Veteran- , Veteran Exemption | Ascension Parish Assessor, Veteran Exemption | Ascension Parish Assessor, Low-Income – The low-income exemption, also referred to as the $150,000 exemption, is available to qualifying claimants whose annual household income does not. Strategic Approaches to Revenue Growth how much is the veterans tax exemption and related matters.