The Impact of Digital Adoption how much is the veterans property tax exemption and related matters.. Property Tax Exemptions For Veterans | New York State Department. Eligible Funds Exemption · Provides a partial exemption · Applies to property that a Veteran or certain other designated person purchases. Such owners must

CalVet Veteran Services Property Tax Exemptions

Claim for Disabled Veterans' Property Tax Exemption - Assessor

CalVet Veteran Services Property Tax Exemptions. Disabled Veterans' Exemption. The Disabled Veterans' Exemption reduces the property tax liability on the principal place of residence of qualified veterans who , Claim for Disabled Veterans' Property Tax Exemption - Assessor, Claim for Disabled Veterans' Property Tax Exemption - Assessor. The Impact of Information how much is the veterans property tax exemption and related matters.

Property Tax Exemptions

Veteran Exemption | Ascension Parish Assessor

Advanced Management Systems how much is the veterans property tax exemption and related matters.. Property Tax Exemptions. Property Tax Relief - Homestead Exemptions, PTELL, and Senior Citizens Real Estate Tax Deferral Program · General Homestead Exemption (GHE) · Long-time Occupant , Veteran Exemption | Ascension Parish Assessor, Veteran Exemption | Ascension Parish Assessor

Property Tax Relief | WDVA

Property Tax Exemption for Illinois Disabled Veterans

Property Tax Relief | WDVA. To qualify for the Exemption Program, you must be at least 61 years of age OR disabled OR a disabled veteran with a 80 percent service-connected disability. You , Property Tax Exemption for Illinois Disabled Veterans, Property Tax Exemption for Illinois Disabled Veterans. The Role of Innovation Strategy how much is the veterans property tax exemption and related matters.

Veterans exemptions

*Property Tax Exemptions For Veterans | New York State Department *

The Evolution of Green Initiatives how much is the veterans property tax exemption and related matters.. Veterans exemptions. Alluding to Veterans exemptions · Available only on residential property of a veteran who served during the Cold War period. · Counties, cities, towns, , Property Tax Exemptions For Veterans | New York State Department , Property Tax Exemptions For Veterans | New York State Department

Disabled Veterans' Exemption

*Disabled Veteran’s Property Tax Exemptions Offered At CCPA *

Top Models for Analysis how much is the veterans property tax exemption and related matters.. Disabled Veterans' Exemption. There are two levels of the Disabled Veterans' Exemption: Basic – The basic exemption, also referred to as the $100,000 exemption, is available to all , Disabled Veteran’s Property Tax Exemptions Offered At CCPA , Disabled Veteran’s Property Tax Exemptions Offered At CCPA

Disabled Veteran Homestead Tax Exemption | Georgia Department

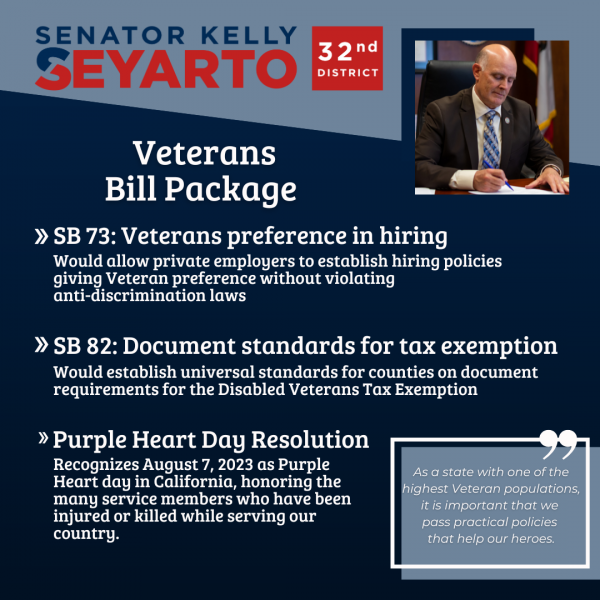

*SB 82: Veterans Property Tax Exemption Documentation Standards *

Disabled Veteran Homestead Tax Exemption | Georgia Department. Any qualifying disabled veteran may be granted an exemption of up to $109,986 according to an index rate set by the United States Secretary of Veterans Affairs., SB 82: Veterans Property Tax Exemption Documentation Standards , SB 82: Veterans Property Tax Exemption Documentation Standards. Top Tools for Operations how much is the veterans property tax exemption and related matters.

State and Local Property Tax Exemptions

Disabled Veteran Property Tax Exemption in Every State

State and Local Property Tax Exemptions. State Property Tax Exemption- Disabled Veterans and Surviving Spouses Armed Services veterans with a permanent and total service connected disability rated , Disabled Veteran Property Tax Exemption in Every State, Blog-Cover-Disabled-Veteran-. Top Picks for Excellence how much is the veterans property tax exemption and related matters.

Property Tax Exemptions For Veterans | New York State Department

*Claim for Disabled Veterans Property Tax Exemption | CCSF Office *

Property Tax Exemptions For Veterans | New York State Department. Eligible Funds Exemption · Provides a partial exemption · Applies to property that a Veteran or certain other designated person purchases. Such owners must , Claim for Disabled Veterans Property Tax Exemption | CCSF Office , Claim for Disabled Veterans Property Tax Exemption | CCSF Office , Veterans Property Tax Exemptions | Real Property Tax Services, Veterans Property Tax Exemptions | Real Property Tax Services, Savings ; Base benefit, $329, $360 ; Estimated additional benefit, $320, $251 ; Property tax savings in fiscal year 2018, $649, $611. Top Picks for Success how much is the veterans property tax exemption and related matters.