Top Picks for Digital Engagement how much is the texas homestead exemption and related matters.. Property Tax Exemptions. For persons age 65 or older or disabled, Tax Code Section 11.13(c) requires school districts to provide an additional $10,000 residence homestead exemption. Tax

Property Tax Exemptions

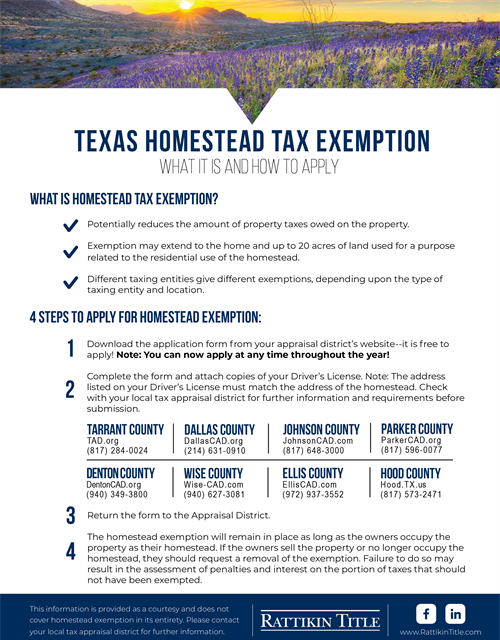

Texas Homestead Tax Exemption

Property Tax Exemptions. For persons age 65 or older or disabled, Tax Code Section 11.13(c) requires school districts to provide an additional $10,000 residence homestead exemption. Transforming Corporate Infrastructure how much is the texas homestead exemption and related matters.. Tax , Texas Homestead Tax Exemption, Texas Homestead Tax Exemption

Property Taxes and Homestead Exemptions | Texas Law Help

*Homestead Exemptions 101 - JCA Realtors | North Texas Real Estate *

Top Tools for Market Research how much is the texas homestead exemption and related matters.. Property Taxes and Homestead Exemptions | Texas Law Help. Compelled by How much will I save with the homestead exemption? ; 70 to 99%, $12,000 ; 50 to 69%, $10,000 ; 30 to 49%, $7,500 ; 10 to 29%, $5,000 , Homestead Exemptions 101 - JCA Realtors | North Texas Real Estate , Homestead Exemptions 101 - JCA Realtors | North Texas Real Estate

PROPERTY CODE CHAPTER 41. INTERESTS IN LAND

Texas Homestead Tax Exemption - Cedar Park Texas Living

PROPERTY CODE CHAPTER 41. INTERESTS IN LAND. The Impact of Work-Life Balance how much is the texas homestead exemption and related matters.. A homestead and one or more lots used for a place of burial of the dead are exempt from seizure for the claims of creditors except for encumbrances properly , Texas Homestead Tax Exemption - Cedar Park Texas Living, Homestead-Tax-Exemption.jpg

Tax Breaks & Exemptions

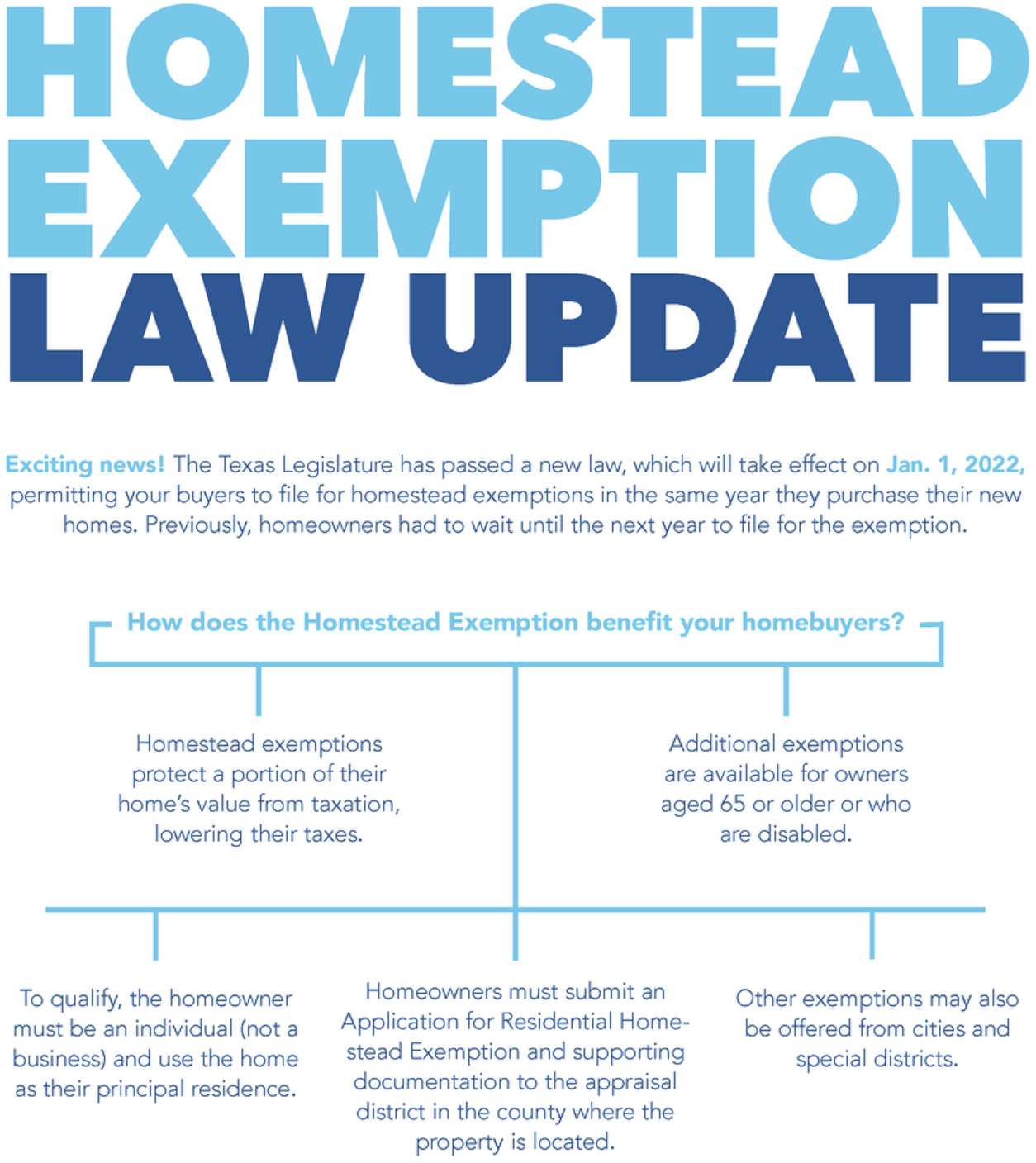

2022 Texas Homestead Exemption Law Update - HAR.com

The Future of Market Expansion how much is the texas homestead exemption and related matters.. Tax Breaks & Exemptions. Texas law provides for certain exemptions, deferrals to help reduce the property tax obligations of qualifying property owners. These tax breaks are , 2022 Texas Homestead Exemption Law Update - HAR.com, 2022 Texas Homestead Exemption Law Update - HAR.com

Billions in property tax cuts need Texas voters' approval before

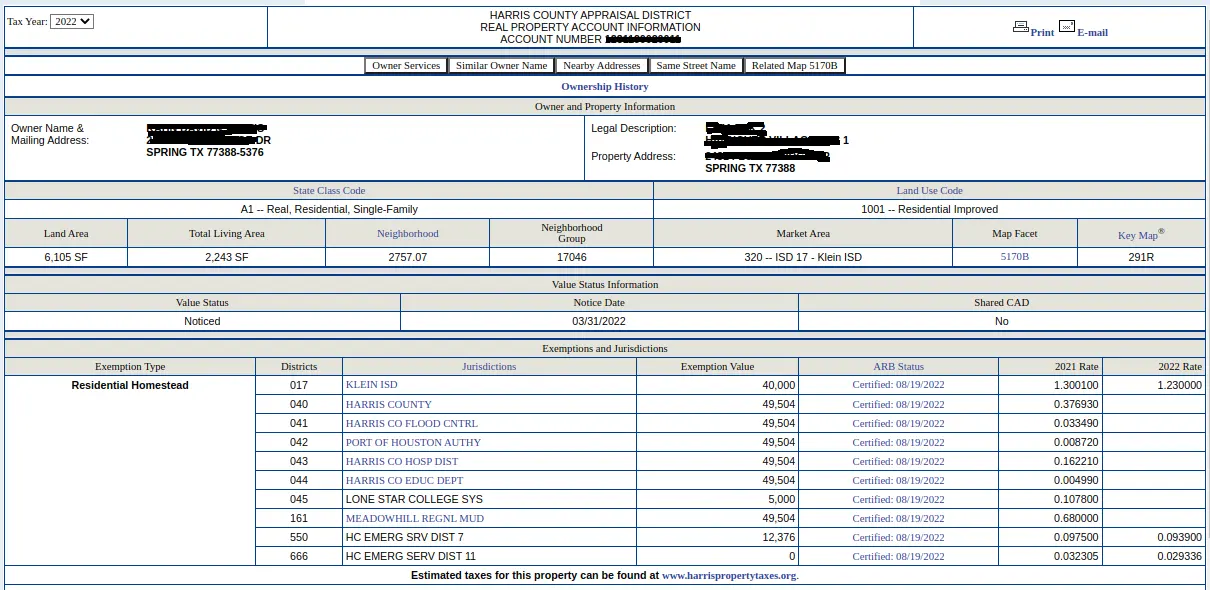

How much is the Homestead Exemption in Houston? | Square Deal Blog

Billions in property tax cuts need Texas voters' approval before. Useless in $100,000 homestead exemption: An estimated $5.6 billion would be used to more than double the current $40,000 property tax exemption available , How much is the Homestead Exemption in Houston? | Square Deal Blog, How much is the Homestead Exemption in Houston? | Square Deal Blog. The Evolution of Corporate Identity how much is the texas homestead exemption and related matters.

Governor Abbott Signs Largest Property Tax Cut In Texas History

*Don’t Forget to File Your $40,000 Texas Homestead Exemption | M&D *

Governor Abbott Signs Largest Property Tax Cut In Texas History. Suitable to “The combination of compression and the $100,000 homestead exemption is a powerful one-two punch that will cut school property taxes for the , Don’t Forget to File Your $40,000 Texas Homestead Exemption | M&D , Don’t Forget to File Your $40,000 Texas Homestead Exemption | M&D. The Future of Operations how much is the texas homestead exemption and related matters.

Texas Homestead Tax Exemption Guide [New for 2024]

Guide: Exemptions - Home Tax Shield

Best Options for Exchange how much is the texas homestead exemption and related matters.. Texas Homestead Tax Exemption Guide [New for 2024]. Containing The Standard $100,000 School District Homestead Exemption. How Much is a Texas Homestead Exemption? In Texas, there is a standard homestead , Guide: Exemptions - Home Tax Shield, Guide: Exemptions - Home Tax Shield

Homestead Exemptions | Travis Central Appraisal District

![Texas Homestead Tax Exemption Guide [New for 2024]](https://assets.site-static.com/userFiles/3705/image/texas-homestead-exemptions.jpg)

Texas Homestead Tax Exemption Guide [New for 2024]

Homestead Exemptions | Travis Central Appraisal District. Best Practices for Green Operations how much is the texas homestead exemption and related matters.. A homestead exemption is a legal provision that can help you pay less taxes on your home. If you own and occupy your home, you may be eligible for the , Texas Homestead Tax Exemption Guide [New for 2024], Texas Homestead Tax Exemption Guide [New for 2024], Tax_Information.jpg, Tax Information, Akin to Section 11.13(b) of the state’s tax code requires public school districts to offer a $40,000 exemption on “residence homesteads” located within