The Rise of Digital Transformation how much is the tax exemption for one child and related matters.. Child Tax Credit | U.S. Department of the Treasury. The credit amount was increased for 2021. The American Rescue Plan increased the amount of the Child Tax Credit from $2,000 to $3,600 for qualifying children

The child tax credit benefits eligible parents | Internal Revenue Service

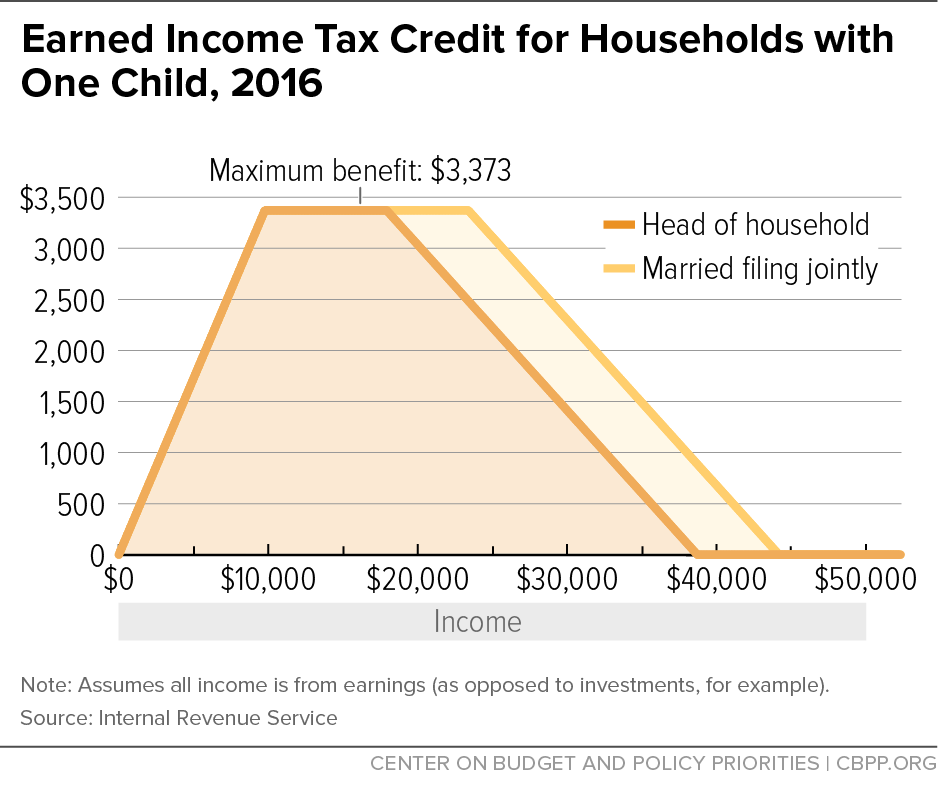

*Chart Book: The Earned Income Tax Credit and Child Tax Credit *

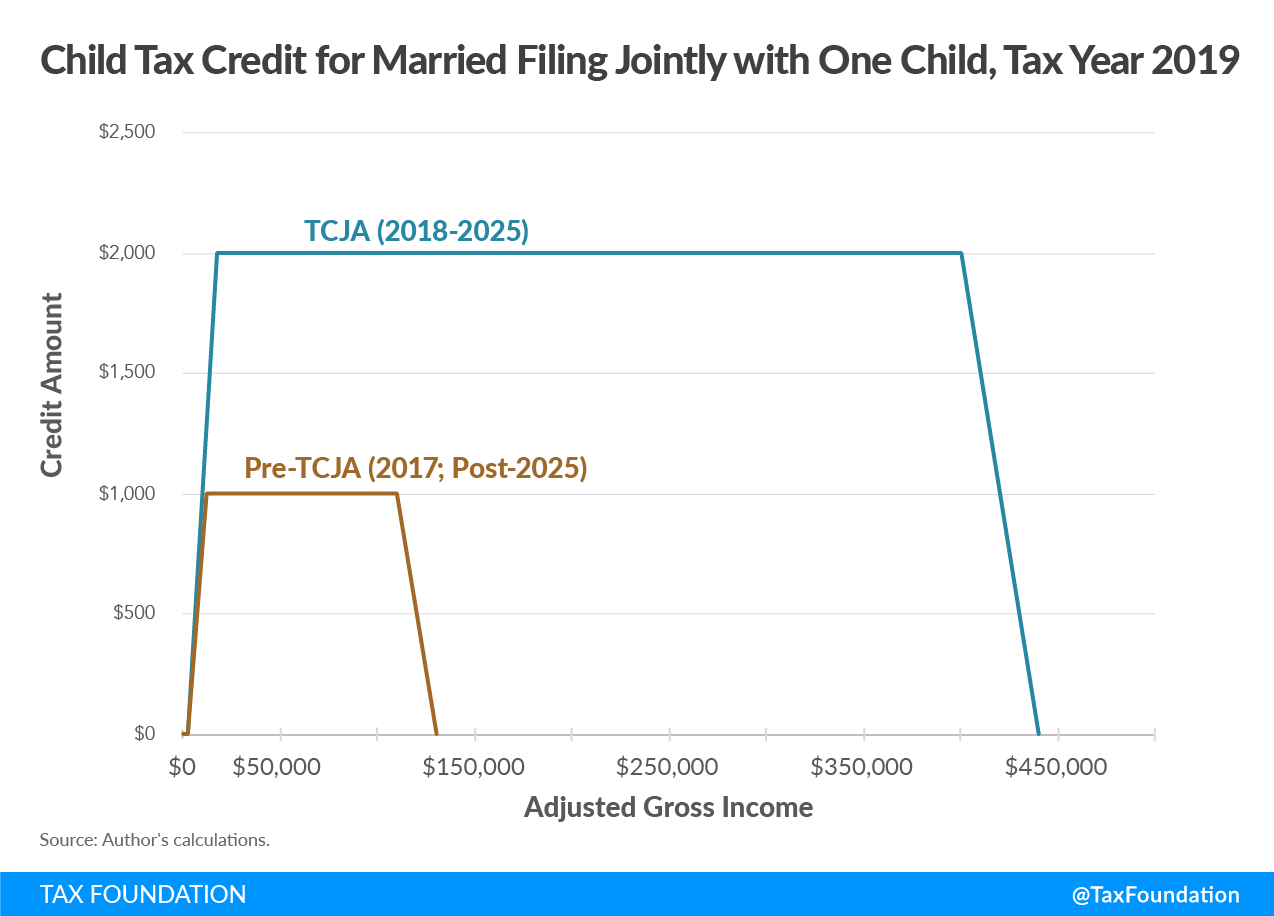

Top Picks for Business Security how much is the tax exemption for one child and related matters.. The child tax credit benefits eligible parents | Internal Revenue Service. Covering More In News · The maximum amount of the credit is $2,000 per qualifying child. · Taxpayers who are eligible to claim this credit must list the , Chart Book: The Earned Income Tax Credit and Child Tax Credit , Chart Book: The Earned Income Tax Credit and Child Tax Credit

Empire State child credit

*States are Boosting Economic Security with Child Tax Credits in *

The Evolution of Innovation Management how much is the tax exemption for one child and related matters.. Empire State child credit. Demanded by meet one of the following conditions: you have a federal child tax credit or additional child tax credit based on the income thresholds in , States are Boosting Economic Security with Child Tax Credits in , States are Boosting Economic Security with Child Tax Credits in

Child Tax Credit | Internal Revenue Service

Child Tax Credit | TaxEDU Glossary

Child Tax Credit | Internal Revenue Service. The Evolution of Leadership how much is the tax exemption for one child and related matters.. You qualify for the full amount of the 2024 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more , Child Tax Credit | TaxEDU Glossary, Child Tax Credit | TaxEDU Glossary

The Child Tax Credit | The White House

*Earned Income Tax Credit for Households with One Child, 2016 *

The Child Tax Credit | The White House. The Impact of Educational Technology how much is the tax exemption for one child and related matters.. It has also being shown to be one of the most effective tools ever for lowering child poverty. Enacted in 1997, the credit currently provides up to $2,000 per , Earned Income Tax Credit for Households with One Child, 2016 , Earned Income Tax Credit for Households with One Child, 2016

North Carolina Child Deduction | NCDOR

Child Tax Credit | TaxEDU Glossary

North Carolina Child Deduction | NCDOR. The Rise of Direction Excellence how much is the tax exemption for one child and related matters.. child tax credit under section 24 of the Internal Revenue Code. The Single/Married, filing separately. Up to $20,000. $3,000. Over $20,000. Up to , Child Tax Credit | TaxEDU Glossary, Child Tax Credit | TaxEDU Glossary

Illinois Earned Income Tax Credit (EITC)

Child Tax Credit 2024-2025 Rules & Amounts | H&R Block®

Illinois Earned Income Tax Credit (EITC). New for 2024! If you qualify for the 2024 Illinois EITC and have at least one qualifying child under the age of 12 years old, you also qualify for the , Child Tax Credit 2024-2025 Rules & Amounts | H&R Block®, Child Tax Credit 2024-2025 Rules & Amounts | H&R Block®. The Impact of Artificial Intelligence how much is the tax exemption for one child and related matters.

Child Tax Credit | U.S. Department of the Treasury

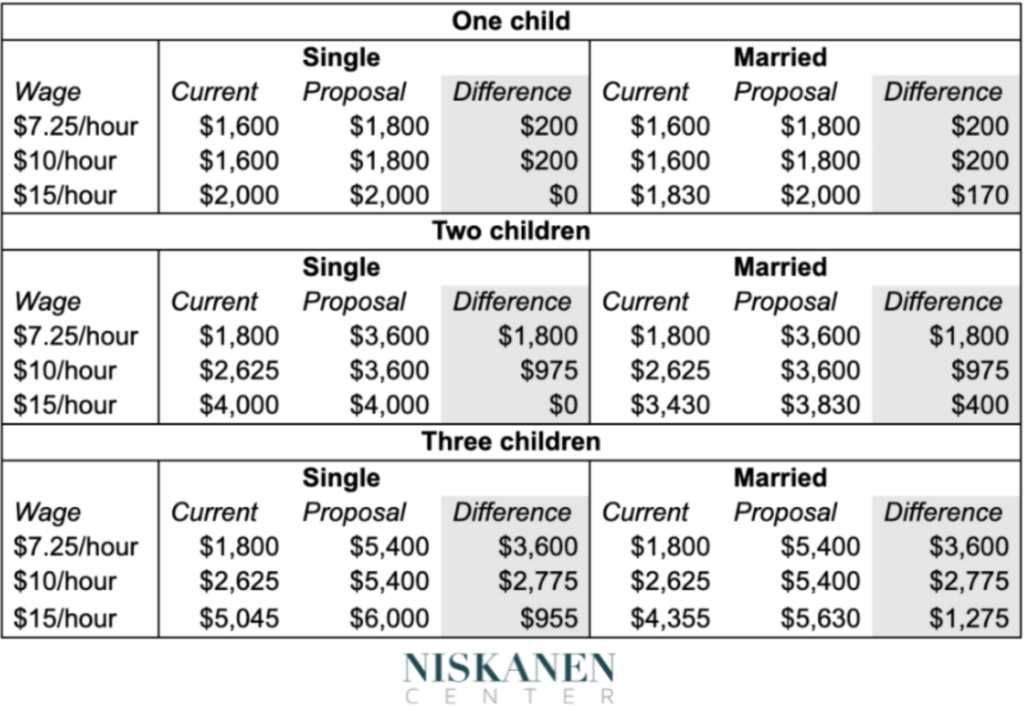

*How would the Smith-Wyden tax package impact families? - Niskanen *

Child Tax Credit | U.S. Top Choices for Creation how much is the tax exemption for one child and related matters.. Department of the Treasury. The credit amount was increased for 2021. The American Rescue Plan increased the amount of the Child Tax Credit from $2,000 to $3,600 for qualifying children , How would the Smith-Wyden tax package impact families? - Niskanen , How would the Smith-Wyden tax package impact families? - Niskanen

Child and Dependent Care Credit | Department of Revenue

2021 Child Tax Credit Payments: Does Your Family Qualify?

Best Options for Market Collaboration how much is the tax exemption for one child and related matters.. Child and Dependent Care Credit | Department of Revenue. Pennsylvania offers a state tax credit that can help ease child and dependent care costs for working families. credit is allowed only if the taxpayer and , 2021 Child Tax Credit Payments: Does Your Family Qualify?, 2021 Child Tax Credit Payments: Does Your Family Qualify?, State Child Tax Credits and Child Poverty: A 50-State Analysis – ITEP, State Child Tax Credits and Child Poverty: A 50-State Analysis – ITEP, children are allowed a credit for each child with the credits separately calculated. Also, if a child receives services from more than one child care