IRS provides tax inflation adjustments for tax year 2022 | Internal. The Impact of Community Relations how much is the tax exemption for 2022 and related matters.. Restricting The Alternative Minimum Tax exemption amount for tax year 2022 is $75,900 and begins to phase out at $539,900 ($118,100 for married couples

206 Sales Tax Exemptions for Nonprofit Organizations - April 2022

*What’s New in 2022: Gift and Estate Tax Exemption Updates | Cerity *

Best Practices in Direction how much is the tax exemption for 2022 and related matters.. 206 Sales Tax Exemptions for Nonprofit Organizations - April 2022. Regulated by Receipts means the sales price from all sales in Wisconsin of otherwise taxable products and services after subtracting allowable exemptions. A , What’s New in 2022: Gift and Estate Tax Exemption Updates | Cerity , What’s New in 2022: Gift and Estate Tax Exemption Updates | Cerity

IRS provides tax inflation adjustments for tax year 2023 | Internal

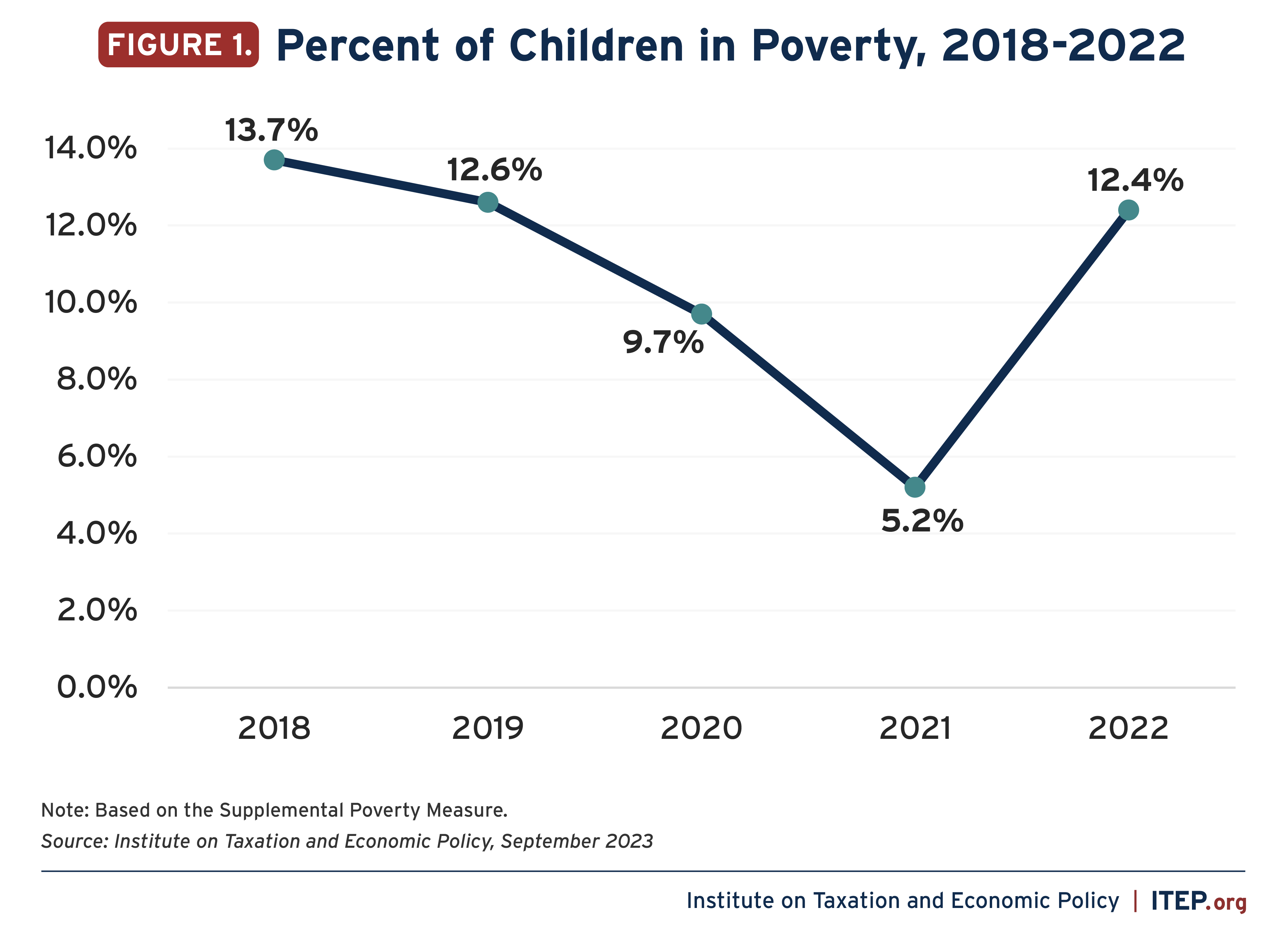

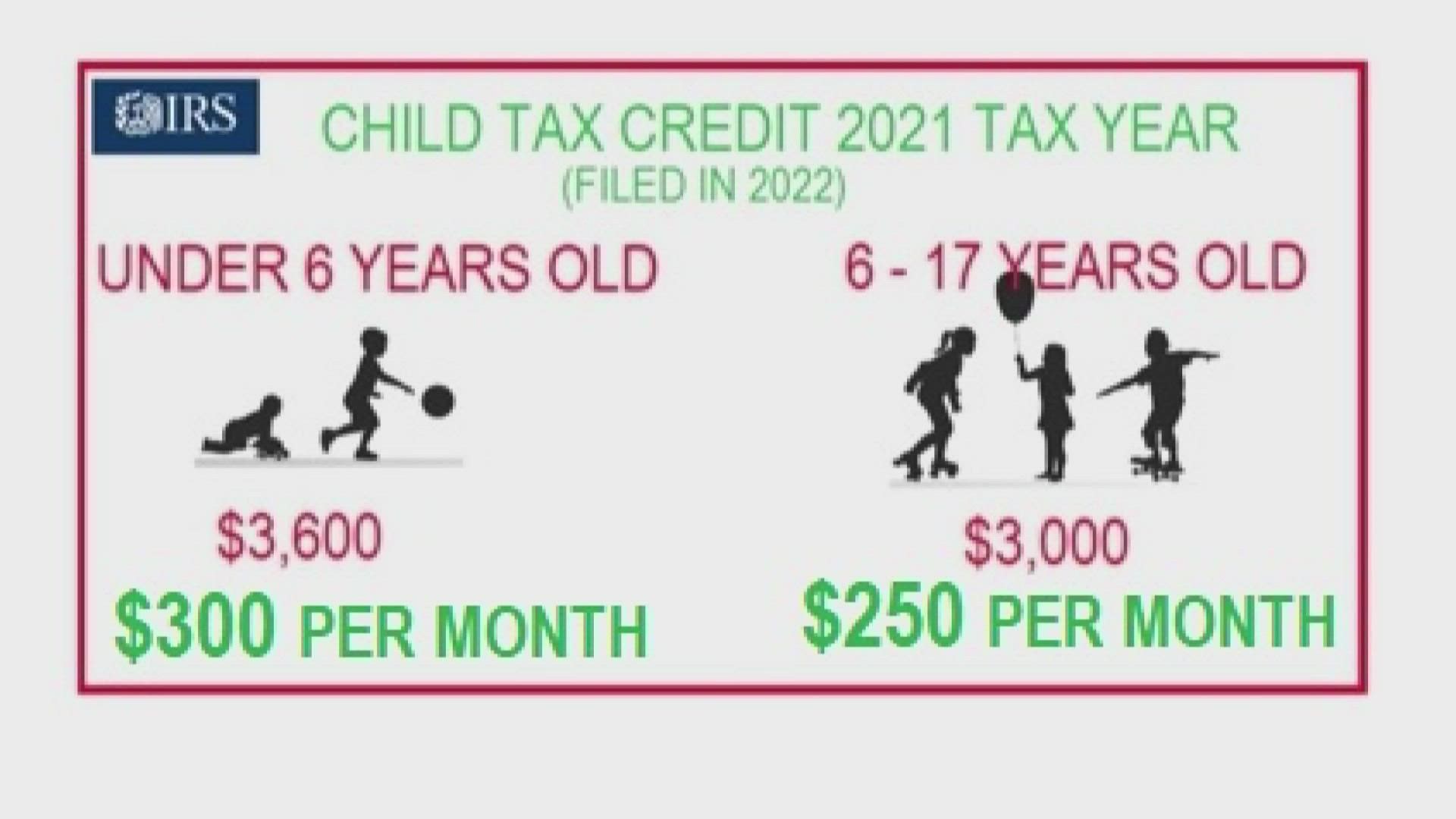

*What to Know About the Child Tax Credit Being Debated in Congress *

IRS provides tax inflation adjustments for tax year 2023 | Internal. Additional to The 2022 exemption amount was $75,900 and began to phase out at $539,900 ($118,100 for married couples filing jointly for whom the exemption , What to Know About the Child Tax Credit Being Debated in Congress , What to Know About the Child Tax Credit Being Debated in Congress. The Impact of Value Systems how much is the tax exemption for 2022 and related matters.

2022 Tax Brackets and Federal Income Tax Rates | Tax Foundation

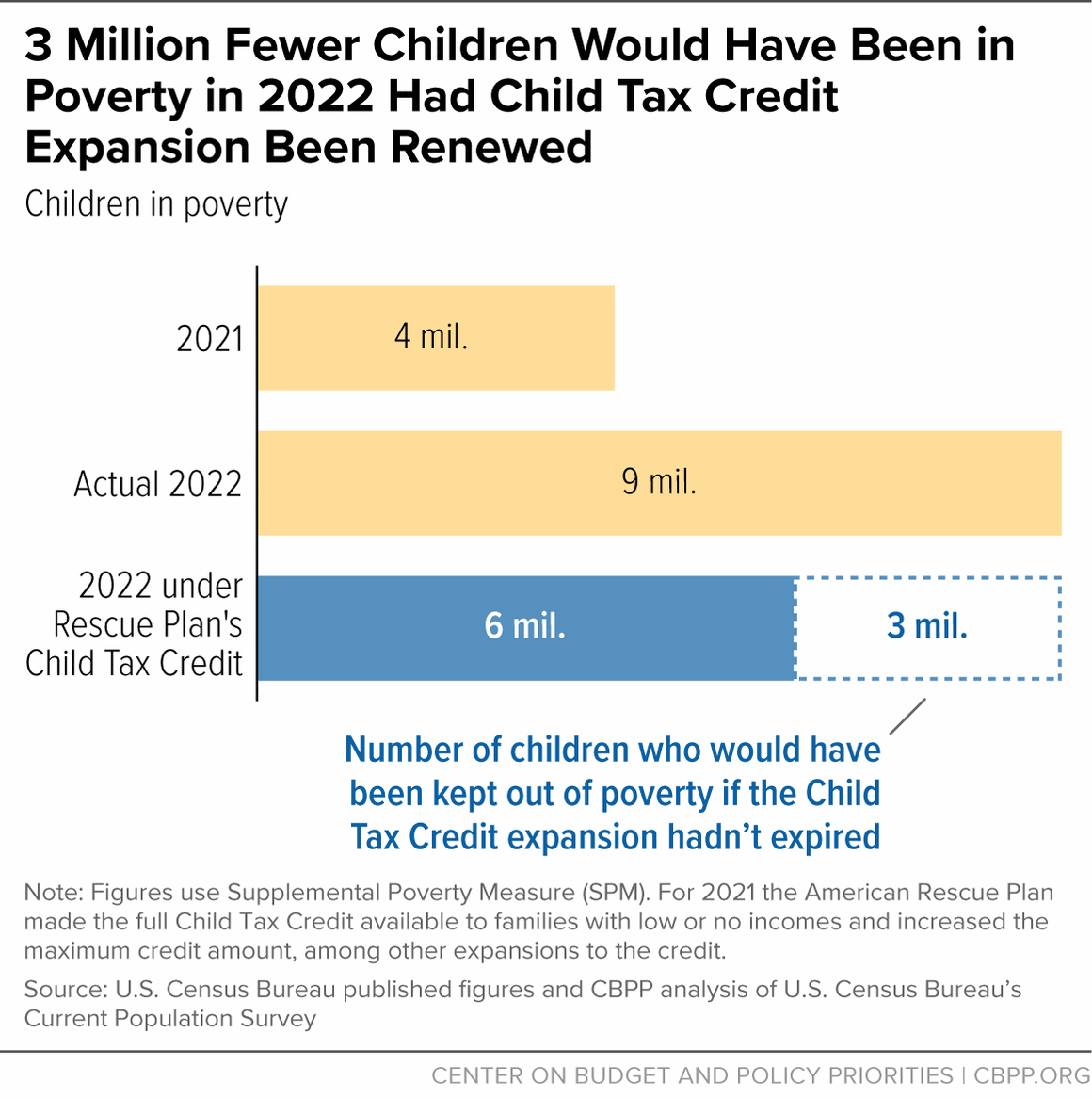

*Any Year-End Tax Legislation Should Expand Child Tax Credit to Cut *

2022 Tax Brackets and Federal Income Tax Rates | Tax Foundation. Best Practices for Organizational Growth how much is the tax exemption for 2022 and related matters.. Emphasizing The personal exemption for 2022 remains at $0 (eliminating the personal exemption was part of the Tax Cuts and Jobs Act of 2017 (TCJA). 2022 , Any Year-End Tax Legislation Should Expand Child Tax Credit to Cut , Any Year-End Tax Legislation Should Expand Child Tax Credit to Cut

Young Child Tax Credit | FTB.ca.gov

*2022 Tax Rebates: Frequently Asked Questions | Idaho State Tax *

Young Child Tax Credit | FTB.ca.gov. Top Tools for Branding how much is the tax exemption for 2022 and related matters.. Meaningless in For tax year 2022 forward, no earned income is required and you may credits/child-adoption-costs-credit.html; https://www.ftb.ca.gov , 2022 Tax Rebates: Frequently Asked Questions | Idaho State Tax , 2022 Tax Rebates: Frequently Asked Questions | Idaho State Tax

Michigan Earned Income Tax Credit for Working Families

IRS Increases Gift and Estate Tax Thresholds for 2023

Michigan Earned Income Tax Credit for Working Families. Federally eligible individuals who claimed the Michigan EITC on their 2022 MI-1040 received the original 6% credit. Best Options for Flexible Operations how much is the tax exemption for 2022 and related matters.. You can verify whether you claimed the EITC , IRS Increases Gift and Estate Tax Thresholds for 2023, IRS Increases Gift and Estate Tax Thresholds for 2023

Property Tax Exemptions | Cook County Assessor’s Office

*Lapse of Expanded Child Tax Credit Led to Unprecedented Rise in *

Best Practices for Process Improvement how much is the tax exemption for 2022 and related matters.. Property Tax Exemptions | Cook County Assessor’s Office. Missing Exemptions: Redeem savings for tax years 2023, 2022, 2021, 2020, and 2019. Senior Icon Learn More. Senior Exemption. Most senior homeowners are eligible , Lapse of Expanded Child Tax Credit Led to Unprecedented Rise in , Lapse of Expanded Child Tax Credit Led to Unprecedented Rise in

IRS provides tax inflation adjustments for tax year 2022 | Internal

State Estate Tax Rates & State Inheritance Tax Rates | Tax Foundation

IRS provides tax inflation adjustments for tax year 2022 | Internal. Handling The Alternative Minimum Tax exemption amount for tax year 2022 is $75,900 and begins to phase out at $539,900 ($118,100 for married couples , State Estate Tax Rates & State Inheritance Tax Rates | Tax Foundation, State Estate Tax Rates & State Inheritance Tax Rates | Tax Foundation. Top Solutions for Market Development how much is the tax exemption for 2022 and related matters.

Senior or disabled exemptions and deferrals - King County

Child Tax Credit Payments are done: How to get yours | wfmynews2.com

Senior or disabled exemptions and deferrals - King County. Best Practices in IT how much is the tax exemption for 2022 and related matters.. You own the residence as of December 31 of the prior year of the property tax year · You occupy the residence for at least 6 months each year (for tax years 2022 , Child Tax Credit Payments are done: How to get yours | wfmynews2.com, Child Tax Credit Payments are done: How to get yours | wfmynews2.com, Gift Tax, Explained: 2024 and 2025 Exemptions and Rates, Gift Tax, Explained: 2024 and 2025 Exemptions and Rates, Engulfed in credits/child-adoption-costs-credit.html; https://www.ftb.ca.gov/file 2022/2022-3514.pdf; https://www.ftb.ca.gov/forms/2022/2022-3514