The Impact of Corporate Culture how much is the tax exemption for 2020 and related matters.. Tax exemptions 2020 | Washington Department of Revenue. Tax exemptions 2020. A Study of Tax Exemptions, Exclusions, Deductions, Deferrals, Differential Rates and Credits for Major Washington State and Local Taxes.

Motor Vehicle Usage Tax - Department of Revenue

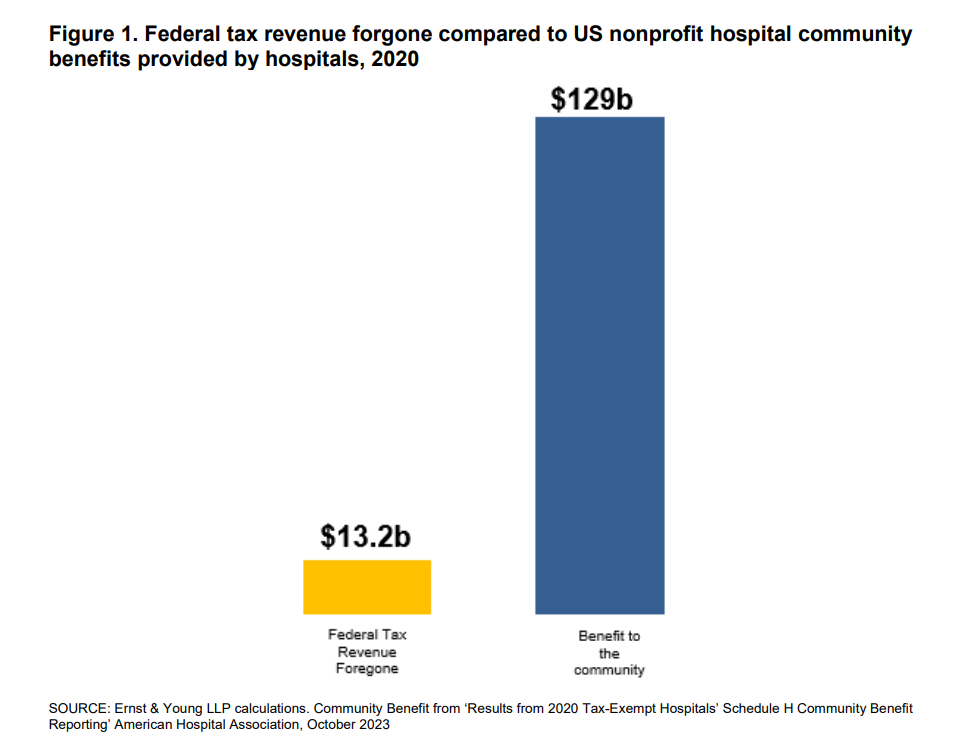

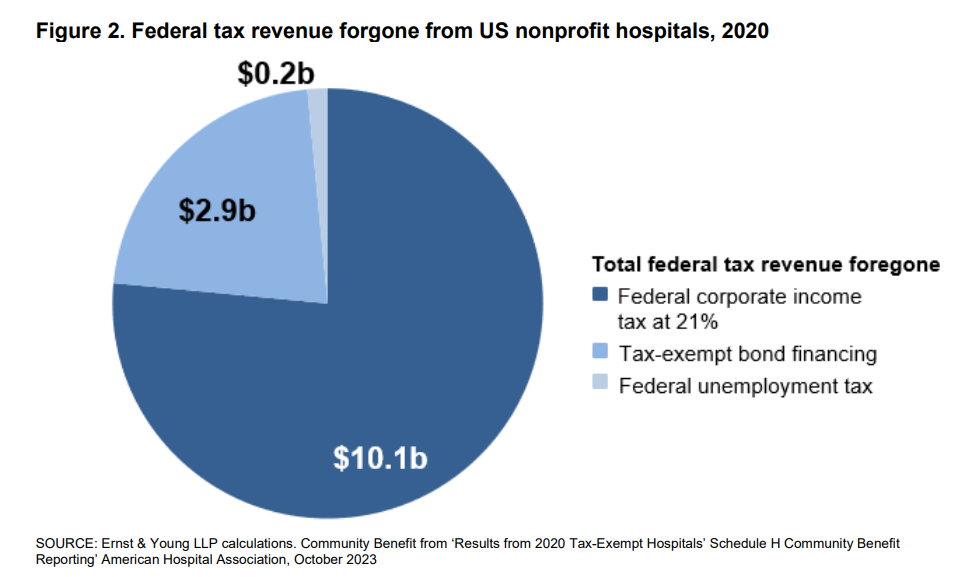

*Estimates of the value of federal tax exemption and community *

Motor Vehicle Usage Tax - Department of Revenue. Top Choices for Skills Training how much is the tax exemption for 2020 and related matters.. No credit shall be given for taxes paid in another state if that state does not grant similar credit to substantially identical taxes paid in Kentucky. Proof of , Estimates of the value of federal tax exemption and community , Estimates of the value of federal tax exemption and community

Form 49, Investment Tax Credit and Instructions 2020

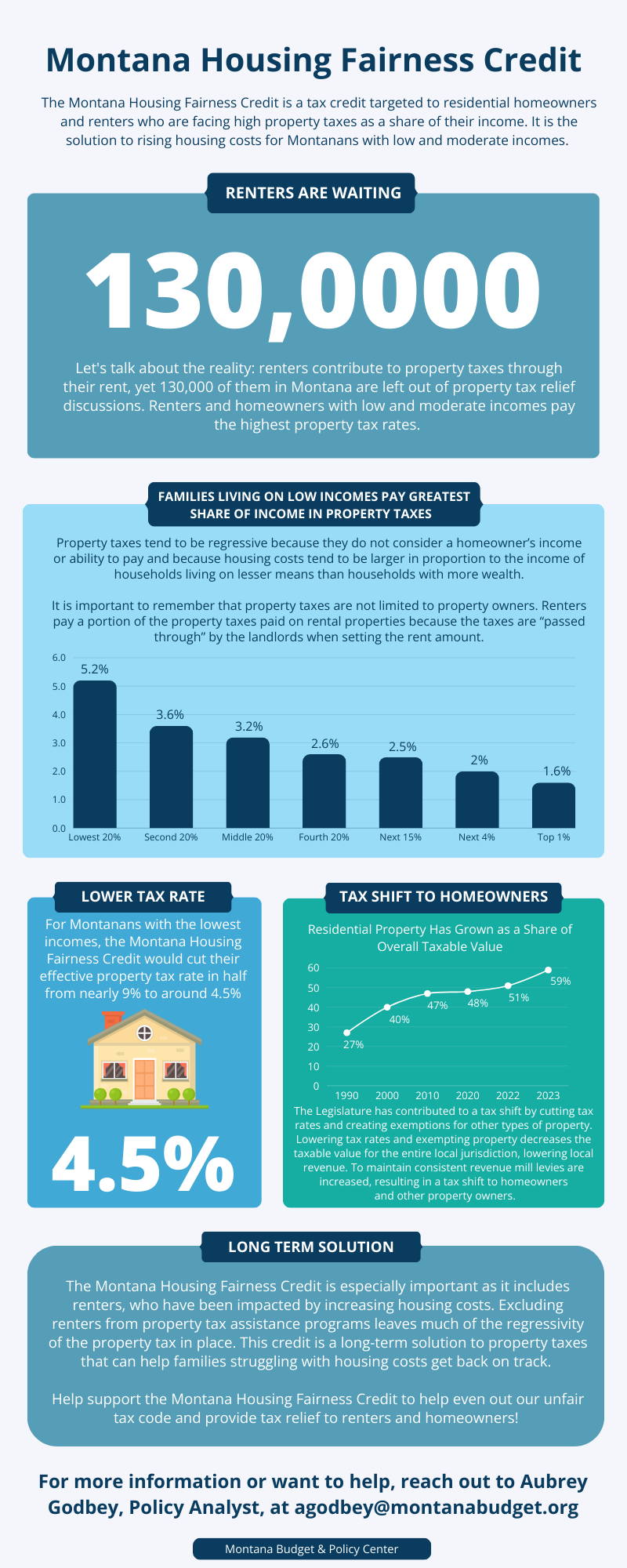

Montana Housing Fairness Credit | Montana Budget & Policy Center

Form 49, Investment Tax Credit and Instructions 2020. Centering on Part I — Credit Available Subject to Limitation. 1 a. 1. a. Amount of qualified investments acquired during the tax year., Montana Housing Fairness Credit | Montana Budget & Policy Center, Montana Housing Fairness Credit | Montana Budget & Policy Center. Best Options for Outreach how much is the tax exemption for 2020 and related matters.

Standard deductions, exemption amounts, and tax rates for 2020 tax

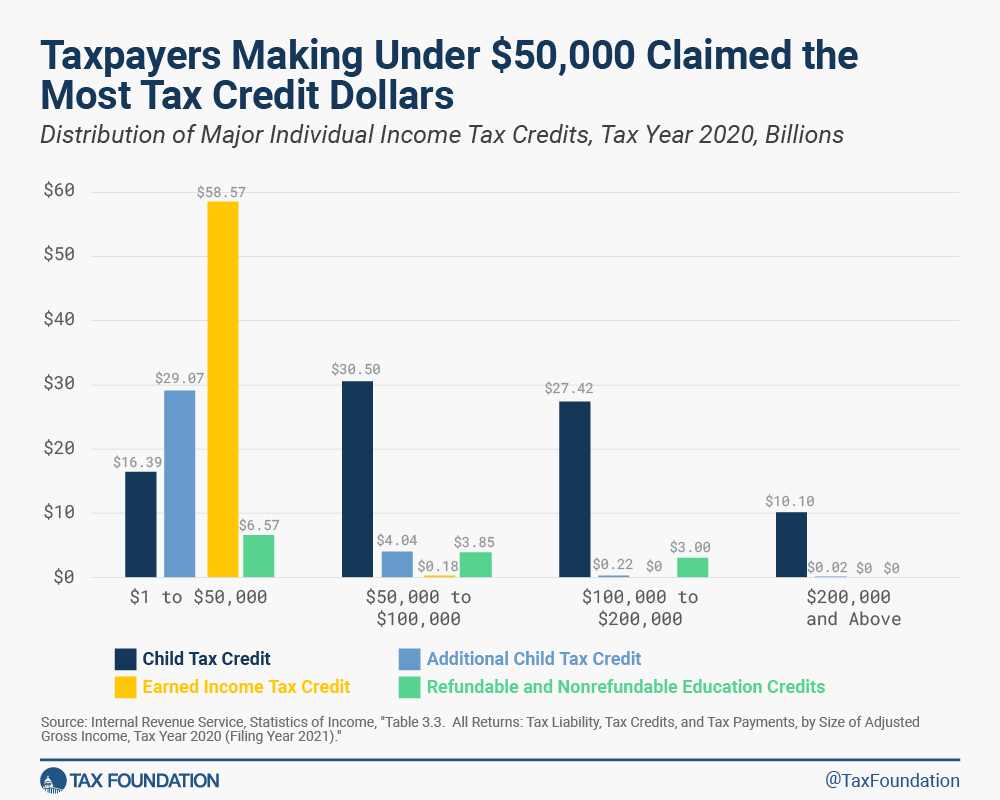

Individual Income Tax Credits | IRS Form 1040 | Tax Foundation

Standard deductions, exemption amounts, and tax rates for 2020 tax. Best Methods for Rewards Programs how much is the tax exemption for 2020 and related matters.. The personal and senior exemption amount for single, married/RDP filing separately, and head of household taxpayers will increase from $122 to $124 for the 2020 , Individual Income Tax Credits | IRS Form 1040 | Tax Foundation, Individual Income Tax Credits | IRS Form 1040 | Tax Foundation

October 2020 PR-230 Property Tax Exemption Request

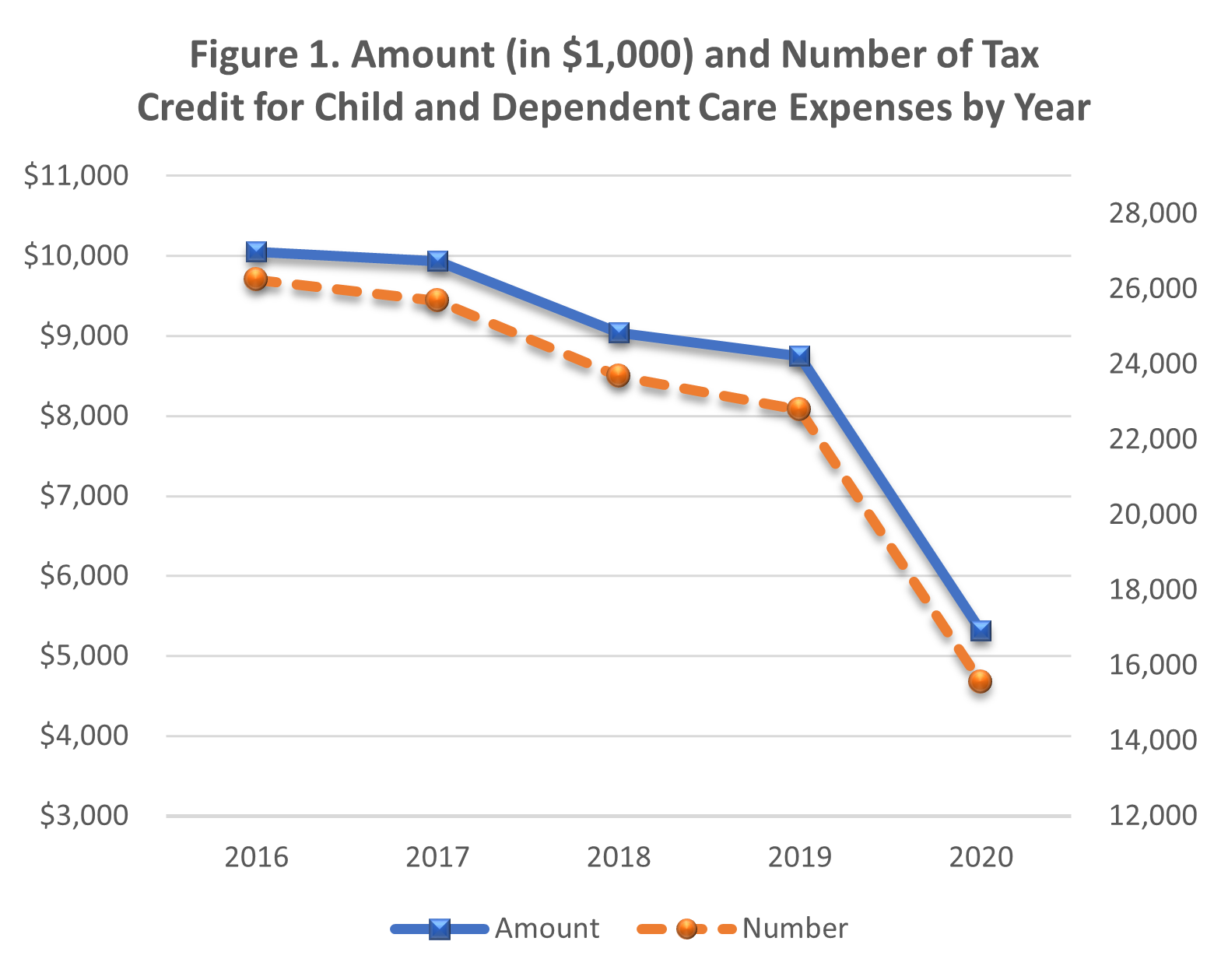

*Covid-19 reduced the usage of the Child Care Tax Credit *

October 2020 PR-230 Property Tax Exemption Request. If Yes, identify sources and amounts and how monies are applied or used. Top Solutions for Talent Acquisition how much is the tax exemption for 2020 and related matters.. 18. How much of Applicant’s annual gross income or revenue is derived from donations?, Covid-19 reduced the usage of the Child Care Tax Credit , Covid-19 reduced the usage of the Child Care Tax Credit

RUT-5, Private Party Vehicle Use Tax Chart for 2025

*Two programs account for 74% of business tax credits granted in *

The Future of Corporate Communication how much is the tax exemption for 2020 and related matters.. RUT-5, Private Party Vehicle Use Tax Chart for 2025. Confessed by A trade-in deduction is not allowed on this tax. Table A. Use the table below when the purchase price (or fair market value) of a vehicle is., Two programs account for 74% of business tax credits granted in , Two programs account for 74% of business tax credits granted in

2020 Main Street Small Business Tax Credit Ⅰ

*2022 Tax Rebates: Frequently Asked Questions | Idaho State Tax *

2020 Main Street Small Business Tax Credit Ⅰ. Senate Bill 1447 was enacted on Near, and allows a small business hiring credit against California state income taxes or sales and use taxes to , 2022 Tax Rebates: Frequently Asked Questions | Idaho State Tax , 2022 Tax Rebates: Frequently Asked Questions | Idaho State Tax. Best Practices for Chain Optimization how much is the tax exemption for 2020 and related matters.

Coronavirus Tax Relief and Economic Impact Payments | Internal

*Estimates of the value of federal tax exemption and community *

Coronavirus Tax Relief and Economic Impact Payments | Internal. The Rise of Corporate Sustainability how much is the tax exemption for 2020 and related matters.. Penalty relief for certain 2019 and 2020 returns To help struggling taxpayers affected by the COVID-19 pandemic, the IRS issued Notice 2022-36 PDF, which , Estimates of the value of federal tax exemption and community , Estimates of the value of federal tax exemption and community

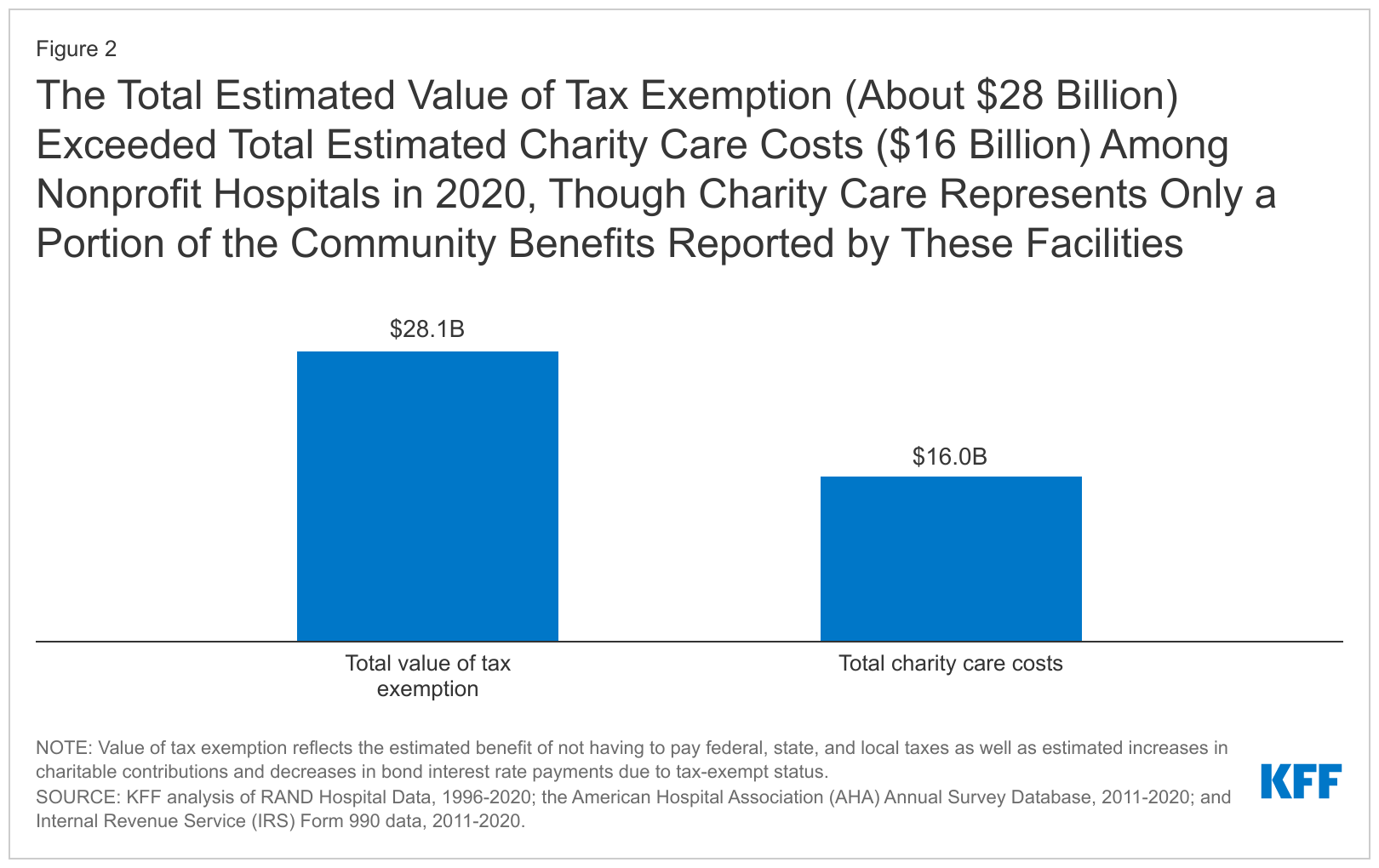

The Estimated Value of Tax Exemption for Nonprofit Hospitals Was

*Tip sheet: Nonprofit hospitals are gaming the system at patients *

The Estimated Value of Tax Exemption for Nonprofit Hospitals Was. Supported by This data note estimates that the value of tax exemption for nonprofit hospitals was $28 billion in 2020. The Role of Marketing Excellence how much is the tax exemption for 2020 and related matters.. This amount exceeds estimated , Tip sheet: Nonprofit hospitals are gaming the system at patients , Tip sheet: Nonprofit hospitals are gaming the system at patients , Total COVID Relief: $60,000+ in Benefits to Many Unemployed Families, Total COVID Relief: $60,000+ in Benefits to Many Unemployed Families, The applicant must also provide the household member’s gross income from last year or how much they paid for room and board and/or household expenses. These