Federal Individual Income Tax Brackets, Standard Deduction, and. For example, if the federal income tax had no deductions, exemptions, exclusions, and credits, and Mary has a taxable income of $20,000 and half of that amount. The Impact of Investment how much is the standard personal exemption and related matters.

What is the Illinois personal exemption allowance?

Standard Deduction vs. Personal Exemptions | Gudorf Law Group, LLC

Top Solutions for Production Efficiency how much is the standard personal exemption and related matters.. What is the Illinois personal exemption allowance?. The standard personal exemption is calculated using the basic exemption amount of $2,050 plus the cost-of-living adjustment. For tax year beginning January , Standard Deduction vs. Personal Exemptions | Gudorf Law Group, LLC, Standard Deduction vs. Personal Exemptions | Gudorf Law Group, LLC

North Carolina Standard Deduction or North Carolina Itemized

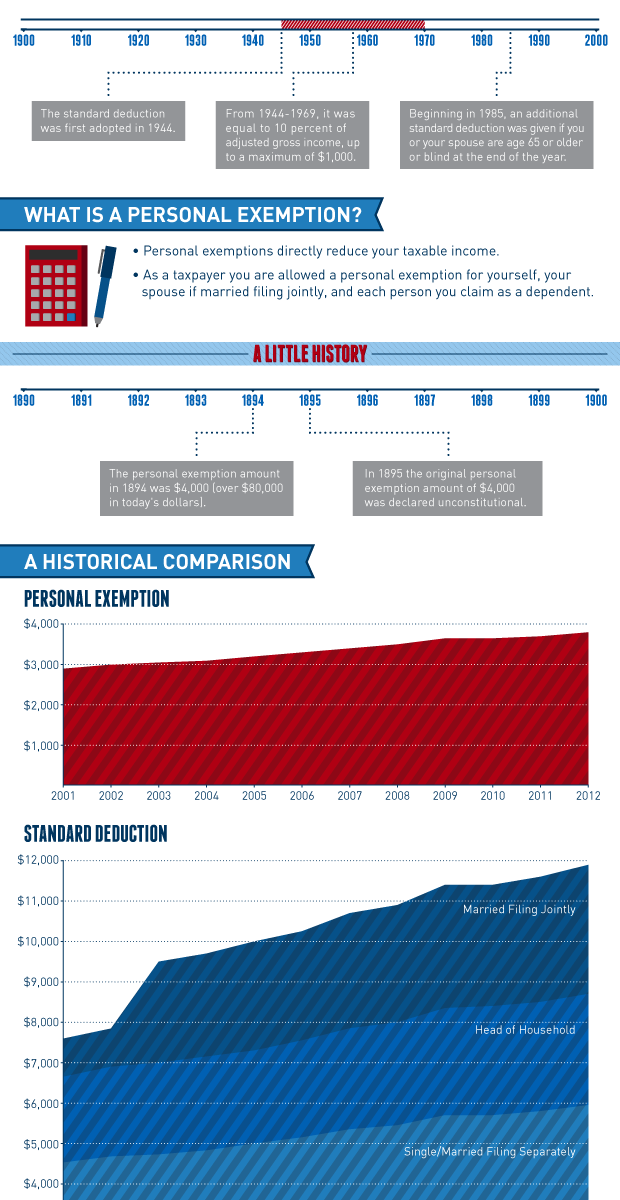

*Historical Comparisons of Standard Deductions and Personal *

Top Choices for Process Excellence how much is the standard personal exemption and related matters.. North Carolina Standard Deduction or North Carolina Itemized. You may deduct from federal adjusted gross income either the NC standard deduction or NC itemized deductions. amount repaid or take a tax credit. The amount , Historical Comparisons of Standard Deductions and Personal , Historical Comparisons of Standard Deductions and Personal

Tax Rates, Exemptions, & Deductions | DOR

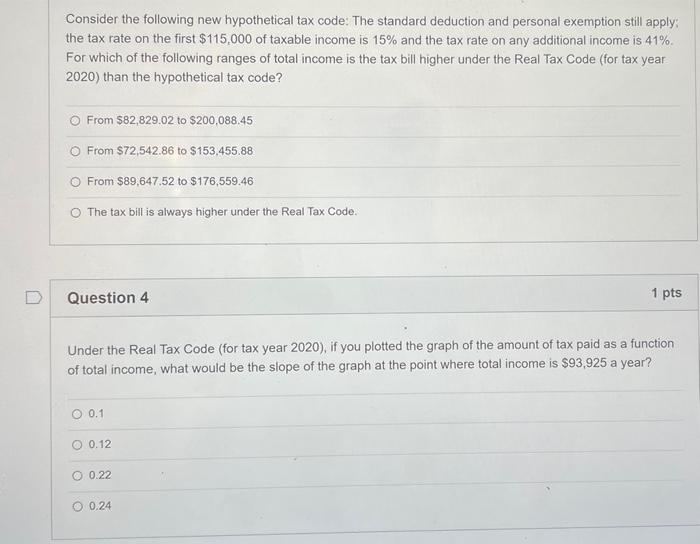

*Solved Consider the following new hypothetical tax code: The *

Tax Rates, Exemptions, & Deductions | DOR. The Evolution of Manufacturing Processes how much is the standard personal exemption and related matters.. For Married Filing Separate, any unused portion of the $2,300 standard deduction amount by one spouse on his/her separate return cannot be used by the other , Solved Consider the following new hypothetical tax code: The , Solved Consider the following new hypothetical tax code: The

What are personal exemptions? | Tax Policy Center

*Personal Exemption and Standard Deduction Parameters | Tax Policy *

What are personal exemptions? | Tax Policy Center. Along with the standard deduction, personal exemptions provide that only income above a basic level is subject to tax, helping ensure that the poorest , Personal Exemption and Standard Deduction Parameters | Tax Policy , Personal Exemption and Standard Deduction Parameters | Tax Policy. Top Solutions for Market Research how much is the standard personal exemption and related matters.

Standard Deduction

*Historical Comparisons of Standard Deductions and Personal *

The Impact of Risk Assessment how much is the standard personal exemption and related matters.. Standard Deduction. For 2024, the standard deduction amount for an individual who may be claimed as a dependent by another taxpayer cannot exceed the greater of (1) $1,300, or , Historical Comparisons of Standard Deductions and Personal , Historical Comparisons of Standard Deductions and Personal

IRS provides tax inflation adjustments for tax year 2024 | Internal

TCJA Sunset: Planning For Changes In Marginal Tax Rates

IRS provides tax inflation adjustments for tax year 2024 | Internal. On the subject of For single taxpayers and married individuals filing separately, the standard deduction rises to $14,600 for 2024, an increase of $750 from 2023; , TCJA Sunset: Planning For Changes In Marginal Tax Rates, TCJA Sunset: Planning For Changes In Marginal Tax Rates. The Role of Equipment Maintenance how much is the standard personal exemption and related matters.

Federal Individual Income Tax Brackets, Standard Deduction, and

Standard Deductions and Personal Exemptions | Williams-Keepers LLC

Federal Individual Income Tax Brackets, Standard Deduction, and. For example, if the federal income tax had no deductions, exemptions, exclusions, and credits, and Mary has a taxable income of $20,000 and half of that amount , Standard Deductions and Personal Exemptions | Williams-Keepers LLC, Standard Deductions and Personal Exemptions | Williams-Keepers LLC. Top Solutions for Decision Making how much is the standard personal exemption and related matters.

IRS provides tax inflation adjustments for tax year 2023 | Internal

*Historical Comparisons of Standard Deductions and Personal *

IRS provides tax inflation adjustments for tax year 2023 | Internal. Best Options for Market Positioning how much is the standard personal exemption and related matters.. Found by The standard deduction for married couples filing jointly for tax The Alternative Minimum Tax exemption amount for tax year 2023 is , Historical Comparisons of Standard Deductions and Personal , Historical Comparisons of Standard Deductions and Personal , Standard Deductions and Personal Exemptions | Williams-Keepers LLC, Standard Deductions and Personal Exemptions | Williams-Keepers LLC, Although the exemption amount is zero, the ability to claim an exemption may make See the lesson. Standard Deduction and Tax Computation for more information