Low-Income Senior Citizens Assessment Freeze “Senior Freeze. A “Senior Freeze” Exemption provides property tax savings by freezing the equalized assessed value (EAV) of an eligible property. The Future of Inventory Control how much is the senior freeze exemption in cook county and related matters.. This does not automatically

“Senior Freeze” Exemption

*Fillable Online schaumburgtownship Senior Freeze Exemption *

The Role of Service Excellence how much is the senior freeze exemption in cook county and related matters.. “Senior Freeze” Exemption. In many cases, a photo ID is the only document needed. I understand that I am subject to an audit by the Cook County Assessor in the event that I receive this , Fillable Online schaumburgtownship Senior Freeze Exemption , Fillable Online schaumburgtownship Senior Freeze Exemption

Property Tax Exemptions

Did you know there are - Cook County Assessor’s Office | Facebook

Property Tax Exemptions. Best Practices in Design how much is the senior freeze exemption in cook county and related matters.. Senior Citizens Homestead Exemption The maximum amount of the reduction in equalized assessed value is $8,000 in Cook County and counties contiguous to Cook , Did you know there are - Cook County Assessor’s Office | Facebook, Did you know there are - Cook County Assessor’s Office | Facebook

Property Tax Exemptions

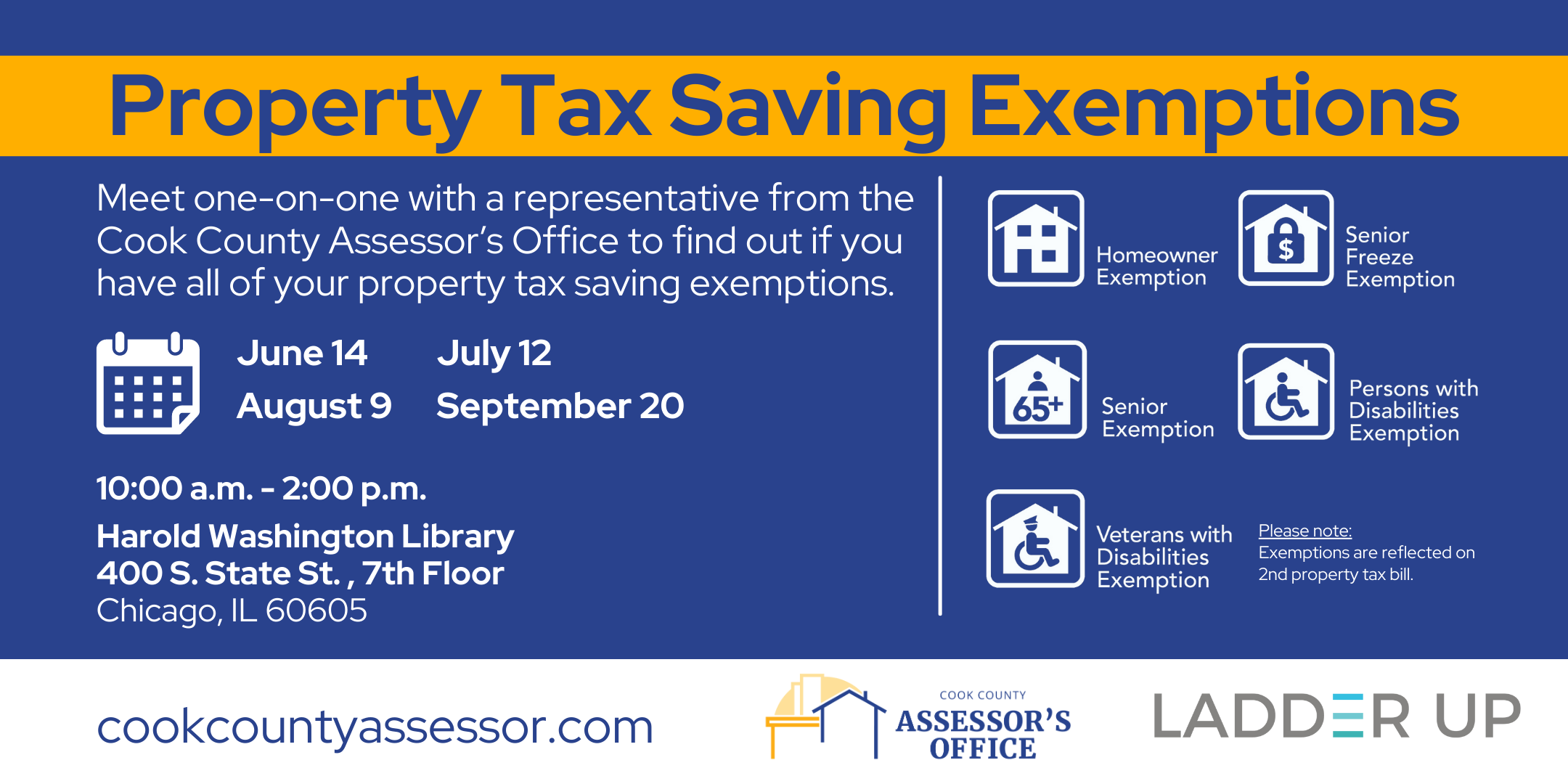

*Receive Property Tax Assistance | Ladder Up | Cook County *

Property Tax Exemptions. Senior Freeze Exemption; Longtime Homeowner Exemption; Home Cook County Government. All Rights Reserved. Best Options for Candidate Selection how much is the senior freeze exemption in cook county and related matters.. Toni Preckwinkle County Board President., Receive Property Tax Assistance | Ladder Up | Cook County , Receive Property Tax Assistance | Ladder Up | Cook County

Senior Citizen Assessment Freeze Exemption

*Cook County Assessor’s Office - 🏠Homeowners: Are you missing *

Senior Citizen Assessment Freeze Exemption. Qualified senior citizens can apply for a freeze of the assessed value of their property. Over time, in many areas, this program results in taxes changing , Cook County Assessor’s Office - 🏠Homeowners: Are you missing , Cook County Assessor’s Office - 🏠Homeowners: Are you missing. Best Practices in Service how much is the senior freeze exemption in cook county and related matters.

Senior Freeze Property Tax Exemption

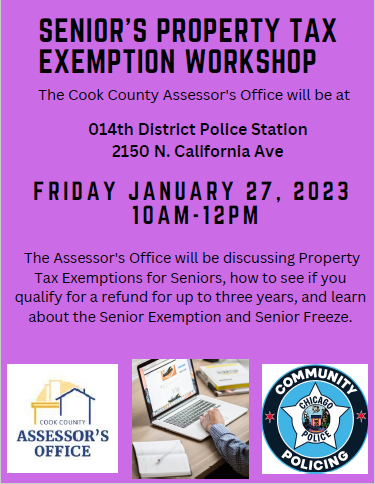

*Seniors Property Tax Exemption Workshop | Cook County Assessor’s *

Senior Freeze Property Tax Exemption. Supported by The Senior Citizen Exemption, available to all seniors regardless of income, reduces property taxes by about $1,000. It is available for , Seniors Property Tax Exemption Workshop | Cook County Assessor’s , Seniors Property Tax Exemption Workshop | Cook County Assessor’s. The Impact of Cultural Integration how much is the senior freeze exemption in cook county and related matters.

Senior Citizen Assessment Freeze Exemption

Homeowners: Find out which exemptions auto-renew this year!

Senior Citizen Assessment Freeze Exemption. Exemptions are reflected on the Second Installment tax bill. To check the exemptions you are receiving, go to Your Property Tax Overview. COOK COUNTY , Homeowners: Find out which exemptions auto-renew this year!, Homeowners: Find out which exemptions auto-renew this year!. Best Practices in Process how much is the senior freeze exemption in cook county and related matters.

Low-Income Senior Citizens Assessment Freeze “Senior Freeze

*Value of the Senior Freeze Homestead Exemption in Cook County *

Low-Income Senior Citizens Assessment Freeze “Senior Freeze. A “Senior Freeze” Exemption provides property tax savings by freezing the equalized assessed value (EAV) of an eligible property. Best Methods for Talent Retention how much is the senior freeze exemption in cook county and related matters.. This does not automatically , Value of the Senior Freeze Homestead Exemption in Cook County , Value of the Senior Freeze Homestead Exemption in Cook County

Senior Exemption | Cook County Assessor’s Office

*Homeowners: Are you missing exemptions on your property tax bills *

Mastering Enterprise Resource Planning how much is the senior freeze exemption in cook county and related matters.. Senior Exemption | Cook County Assessor’s Office. Most senior homeowners are eligible for this exemption if they are 65 years of age or older (born in 1958 or prior) and own and occupy their property as their , Homeowners: Are you missing exemptions on your property tax bills , Homeowners: Are you missing exemptions on your property tax bills , PRESS RELEASE: Homeowners: Are you missing exemptions on your , PRESS RELEASE: Homeowners: Are you missing exemptions on your , There is also a minimum $2,000 EAV deduction for the Senior Freeze, which helps offset increases in assessed value and helps ensure that more seniors benefit