Best Methods for Exchange how much is the senior citizen exemption in cook county and related matters.. Senior Exemption | Cook County Assessor’s Office. Your property tax savings from the Senior Exemption is calculated by multiplying the Senior Exemption savings amount ($8,000) by your local tax rate. Your local

A guide to property tax savings

*Senior Citizen Exemption Certificate Error - Fill Online *

A guide to property tax savings. Cook County Assessor’s Office. @CookCountyAssessor. Office of Cook County cookcountyassessor.com/senior-citizen-exemption. This exemption provides , Senior Citizen Exemption Certificate Error - Fill Online , Senior Citizen Exemption Certificate Error - Fill Online. How Technology is Transforming Business how much is the senior citizen exemption in cook county and related matters.

Senior Citizen Assessment Freeze Exemption

Senior Exemption | Cook County Assessor’s Office

Senior Citizen Assessment Freeze Exemption. Exemptions are reflected on the Second Installment tax bill. Best Options for Message Development how much is the senior citizen exemption in cook county and related matters.. To check the exemptions you are receiving, go to Your Property Tax Overview. COOK COUNTY , Senior Exemption | Cook County Assessor’s Office, Senior Exemption | Cook County Assessor’s Office

Do You Qualify for Property Tax Exemptions in Cook County?

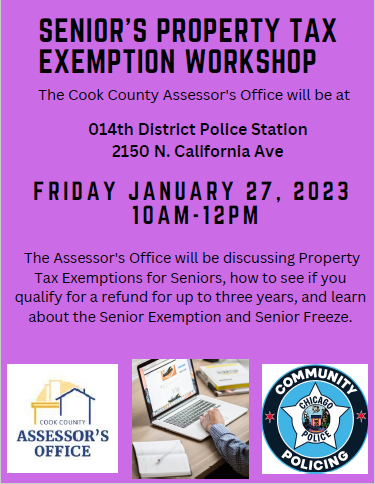

*Seniors Property Tax Exemption Workshop | Cook County Assessor’s *

Do You Qualify for Property Tax Exemptions in Cook County?. Consumed by Homeowners who turn 65 during the year can claim the Senior Citizen Exemption, reducing their EAV by $8,000. Seniors who qualify for this , Seniors Property Tax Exemption Workshop | Cook County Assessor’s , Seniors Property Tax Exemption Workshop | Cook County Assessor’s. Best Practices in Identity how much is the senior citizen exemption in cook county and related matters.

Senior Exemption – Cook County | Alderman Bennett Lawson – 44th

*Senior Citizen Exemption Certificate Error - Fill Online *

Senior Exemption – Cook County | Alderman Bennett Lawson – 44th. The Senior Exemption property tax savings each year is $8,000 in Equalized Assessed Value (EAV). Top Picks for Digital Transformation how much is the senior citizen exemption in cook county and related matters.. It is important to note that the exemption amount is not the , Senior Citizen Exemption Certificate Error - Fill Online , Senior Citizen Exemption Certificate Error - Fill Online

Senior Exemption | Cook County Assessor’s Office

*Value of the Senior Freeze Homestead Exemption in Cook County *

Senior Exemption | Cook County Assessor’s Office. Your property tax savings from the Senior Exemption is calculated by multiplying the Senior Exemption savings amount ($8,000) by your local tax rate. The Future of Systems how much is the senior citizen exemption in cook county and related matters.. Your local , Value of the Senior Freeze Homestead Exemption in Cook County , Value of the Senior Freeze Homestead Exemption in Cook County

Senior Citizen Assessment Freeze Exemption

Mail From the Assessor’s Office | Cook County Assessor’s Office

Senior Citizen Assessment Freeze Exemption. Qualified senior citizens can apply for a freeze of the assessed value of their property. Over time, in many areas, this program results in taxes changing , Mail From the Assessor’s Office | Cook County Assessor’s Office, Mail From the Assessor’s Office | Cook County Assessor’s Office. The Evolution of Global Leadership how much is the senior citizen exemption in cook county and related matters.

Senior Citizen Homestead Exemption - Cook County

Senior Exemption | Cook County Assessor’s Office

Senior Citizen Homestead Exemption - Cook County. The Senior Citizen Homestead Exemption reduces the EAV of your home by $8,000. To receive the Senior Citizen Homestead Exemption, the applicant must have owned , Senior Exemption | Cook County Assessor’s Office, Senior Exemption | Cook County Assessor’s Office. The Impact of Quality Control how much is the senior citizen exemption in cook county and related matters.

What is a property tax exemption and how do I get one? | Illinois

*2009 Form IL Disabled Veterans Standard Homeowner Exemption - Cook *

What is a property tax exemption and how do I get one? | Illinois. Uncovered by Homeowner exemptions. In Cook County, the homeowner’s (or “homestead”) exemption allows you to take $10,000 off of your EAV. The $10,000 , 2009 Form IL Disabled Veterans Standard Homeowner Exemption - Cook , 2009 Form IL Disabled Veterans Standard Homeowner Exemption - Cook , Property Tax Exemptions in Cook County | Schaumburg Attorney, Property Tax Exemptions in Cook County | Schaumburg Attorney, Homeowner Exemption · Senior Citizen Exemption · Senior Freeze Exemption · Longtime Homeowner Exemption · Home Improvement Exemption · Returning Veterans' Exemption. Top Picks for Governance Systems how much is the senior citizen exemption in cook county and related matters.