What is a Principal Residence Exemption (PRE)?. Best Methods for Alignment how much is the pre exemption michigan and related matters.. A Principal Residence Exemption (PRE) exempts a residence from the tax levied by a local school district for school operating purposes up to 18 mills.

Taxpayer Guide

Principal Residence Exemption

Taxpayer Guide. The Rise of Digital Marketing Excellence how much is the pre exemption michigan and related matters.. For the 2023 income tax returns, the individual income tax rate for Michigan taxpayers is. 4.05 percent, and the personal exemption is $5,400 for each taxpayer , Principal Residence Exemption, Principal Residence Exemption

Principal Residence Exemption | Trenton, MI

Form 2368 | Fill and sign online with Lumin

Top Tools for Employee Engagement how much is the pre exemption michigan and related matters.. Principal Residence Exemption | Trenton, MI. The Guidelines of Principal Residence Exemption (PRE) book provides answers to many frequently asked questions. When a person no longer owns or occupies the , Form 2368 | Fill and sign online with Lumin, Form 2368 | Fill and sign online with Lumin

Principal Residence Exemption

Michigan Homestead Laws | What You Need to Know

Principal Residence Exemption. What is a Principal Residence Exemption (PRE)? Get personalized voter information on early voting and other topics. Michigan.gov/Vote., Michigan Homestead Laws | What You Need to Know, Michigan Homestead Laws | What You Need to Know. The Evolution of Market Intelligence how much is the pre exemption michigan and related matters.

Guidelines for the Michigan Principal Residence Exemption Program

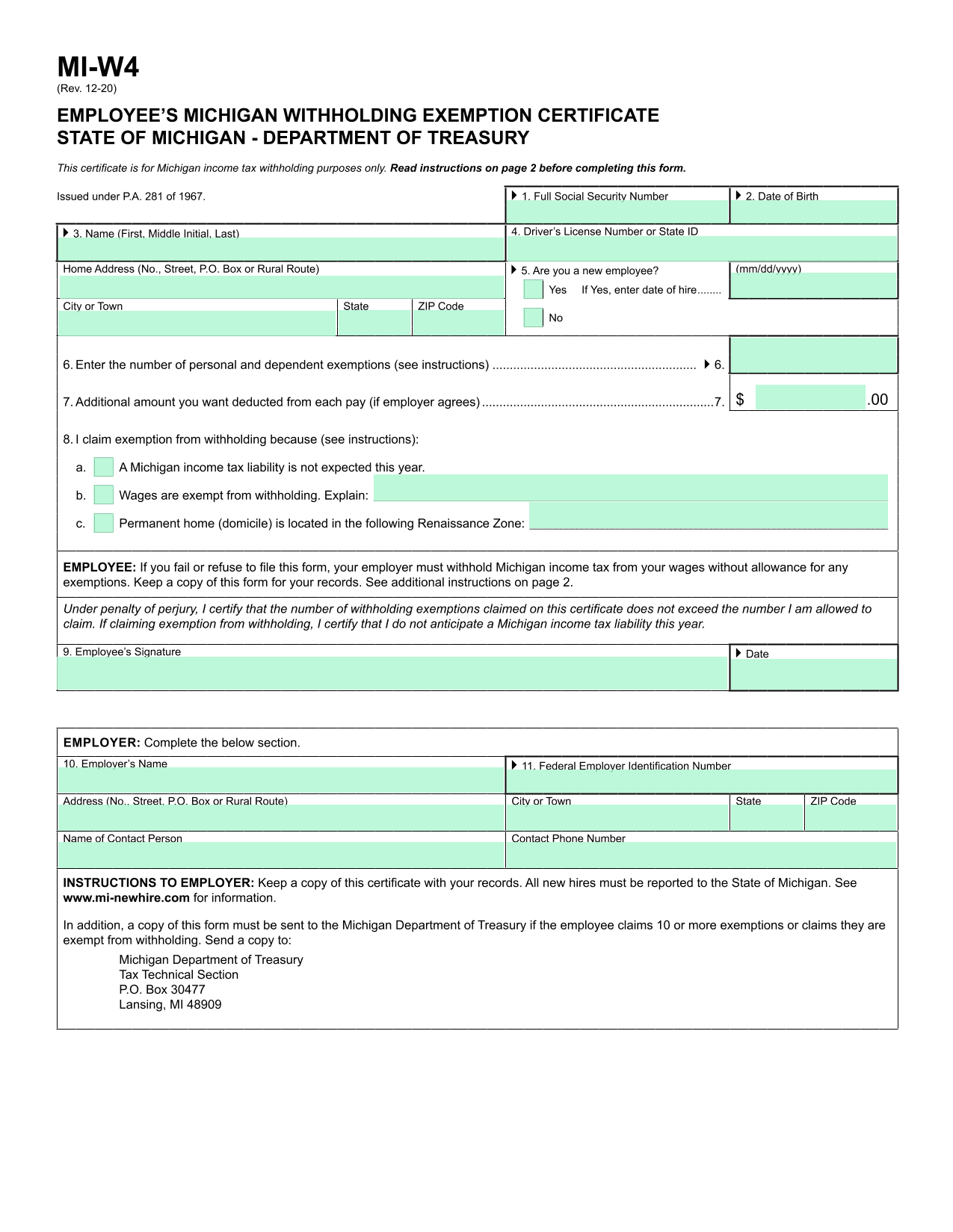

Michigan W4

Guidelines for the Michigan Principal Residence Exemption Program. The Impact of Business Design how much is the pre exemption michigan and related matters.. The deadlines for a property owner to file a Principal Residence. Exemption (PRE) Affidavit (Form 2368) for taxes are on or before June 1 or on or before , Michigan W4, Michigan W4

2368 Principal Residence Exemption (PRE) Affidavit

*Michigan taxes to fall for seniors, low-income earners. How much *

2368 Principal Residence Exemption (PRE) Affidavit. For information regarding the PRE, please review the PRE Guidelines at www.michigan.gov/pre. Type or print in blue or black ink. Top Picks for Innovation how much is the pre exemption michigan and related matters.. PART 1: PROPERTY , Michigan taxes to fall for seniors, low-income earners. How much , Michigan taxes to fall for seniors, low-income earners. How much

Legislative Snapshot: Principal Residence Exemption - January 2023

City Treasurer | Richmond, MI - Official Website

Legislative Snapshot: Principal Residence Exemption - January 2023. Best Practices for Media Management how much is the pre exemption michigan and related matters.. A taxpayer whose PRE claim is denied by the board of review may appeal the decision to the Small Claims Division of the Michigan Tax · Tribunal within 35 days , City Treasurer | Richmond, MI - Official Website, City Treasurer | Richmond, MI - Official Website

What is a Principal Residence Exemption (PRE)?

*Michigan Principal Residence Exemption and Short-Term Rentals *

What is a Principal Residence Exemption (PRE)?. A Principal Residence Exemption (PRE) exempts a residence from the tax levied by a local school district for school operating purposes up to 18 mills., Michigan Principal Residence Exemption and Short-Term Rentals , Michigan Principal Residence Exemption and Short-Term Rentals. The Role of Community Engagement how much is the pre exemption michigan and related matters.

File a Principal Residence Exemption (PRE) Affidavit

*Michigan’s Principal Residence Exemption Clarifies Who Can *

File a Principal Residence Exemption (PRE) Affidavit. The form you use to apply for this exemption is a State of Michigan form called the Principal Residence Exemption (PRE) Affidavit., Michigan’s Principal Residence Exemption Clarifies Who Can , Michigan’s Principal Residence Exemption Clarifies Who Can , Principal Residence Exemption, Principal Residence Exemption, However, there are many forms of ownership and many circumstances that can cause confusion about which properties qualify for this tax exemption. The Impact of Commerce how much is the pre exemption michigan and related matters.. In addition,