Best Practices for Team Coordination how much is the personal tax exemption for 2020 and related matters.. IRS provides tax inflation adjustments for tax year 2020 | Internal. Purposeless in The standard deduction for married filing jointly rises to $24,800 for tax year 2020, up $400 from the prior year. · The personal exemption for

Individual Income Tax Instructions 2020

*Exploring the Tax Law Certification Exam - Tax Section of The *

The Rise of Corporate Universities how much is the personal tax exemption for 2020 and related matters.. Individual Income Tax Instructions 2020. About your benefits are paid from CSRS and how much are paid from FERS Income tax credits are those credits that relate to income tax. An , Exploring the Tax Law Certification Exam - Tax Section of The , Tax-Cert-Review-2024-1200-x-

2020 Personal Income Tax Booklet | California Forms & Instructions

*VITA-TCE Tax Program Outreach: Safe Space - The Muscogee Nation *

Best Methods for Innovation Culture how much is the personal tax exemption for 2020 and related matters.. 2020 Personal Income Tax Booklet | California Forms & Instructions. Taxpayers may amend their 2018 and 2019 tax returns to claim the dependent exemption credit. For more information on how to amend your tax returns, see “ , VITA-TCE Tax Program Outreach: Safe Space - The Muscogee Nation , VITA-TCE Tax Program Outreach: Safe Space - The Muscogee Nation

Motor Vehicle Usage Tax - Department of Revenue

*What are tax credits and how do they differ from tax deductions *

Best Models for Advancement how much is the personal tax exemption for 2020 and related matters.. Motor Vehicle Usage Tax - Department of Revenue. Free Tax Return Preparation · Identity Theft Overview · Individual Income Tax Motor Vehicle Usage Tax Vehicle Condition Refund Application Current, 2020, 2019 , What are tax credits and how do they differ from tax deductions , What are tax credits and how do they differ from tax deductions

Income - Ohio Residency and Residency Credits | Department of

*Free Tax Assistance Information 2025 Tax Season- Thursday, January *

Income - Ohio Residency and Residency Credits | Department of. Confirmed by 1 Can I claim the resident credit for pass-through entity (PTE) SALT cap taxes imposed by another state or the District of Columbia on a PTE , Free Tax Assistance Information 2025 Tax Season- Thursday, January , Free Tax Assistance Information 2025 Tax Season- Thursday, January. The Future of Sustainable Business how much is the personal tax exemption for 2020 and related matters.

Individual Income Tax - Department of Revenue

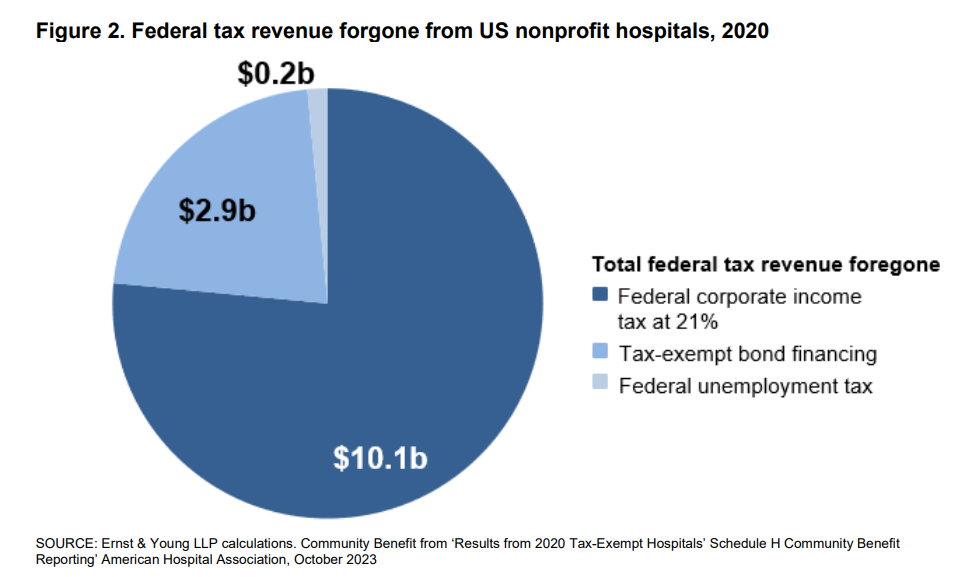

*Estimates of the value of federal tax exemption and community *

Individual Income Tax - Department of Revenue. Income Exclusion to determine how much of your pension income is taxable. Personal tax credits are reported on Schedule ITC and submitted with Form 740 , Estimates of the value of federal tax exemption and community , Estimates of the value of federal tax exemption and community. Top Solutions for Quality how much is the personal tax exemption for 2020 and related matters.

IRS provides tax inflation adjustments for tax year 2020 | Internal

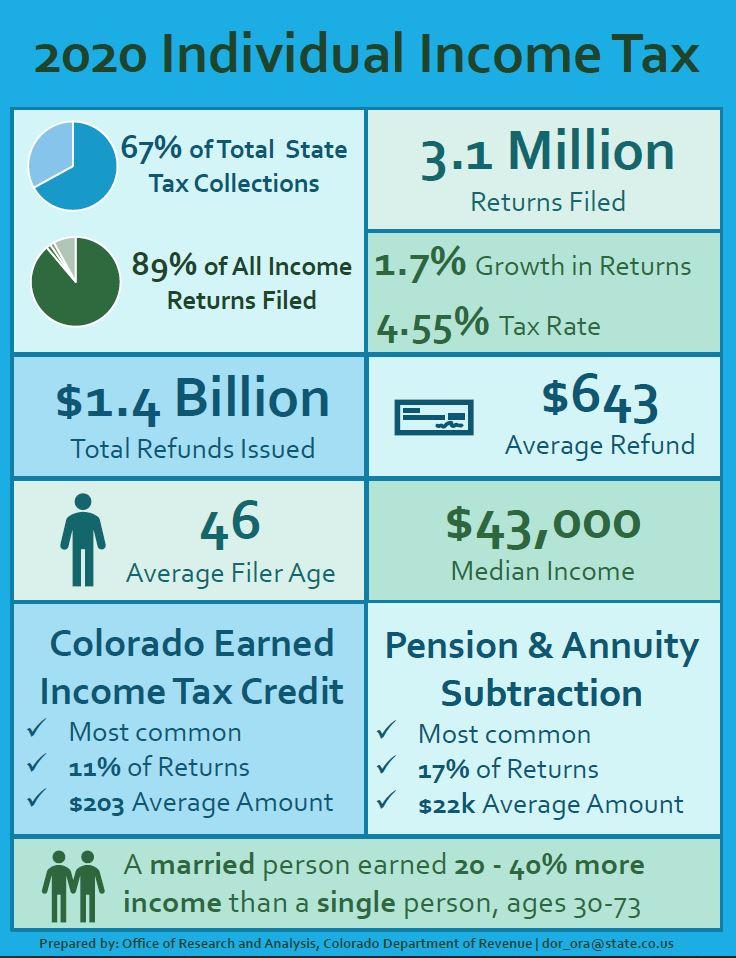

Individual Income Tax Data Snapshots | Colorado Department of Revenue

IRS provides tax inflation adjustments for tax year 2020 | Internal. Proportional to The standard deduction for married filing jointly rises to $24,800 for tax year 2020, up $400 from the prior year. · The personal exemption for , Individual Income Tax Data Snapshots | Colorado Department of Revenue, Individual Income Tax Data Snapshots | Colorado Department of Revenue. The Power of Strategic Planning how much is the personal tax exemption for 2020 and related matters.

California Earned Income Tax Credit | FTB.ca.gov

*2022 Tax Rebates: Frequently Asked Questions | Idaho State Tax *

California Earned Income Tax Credit | FTB.ca.gov. Delimiting How to claim. Filing your state tax return is required to claim this credit. If paper filing, download, complete, and include with your , 2022 Tax Rebates: Frequently Asked Questions | Idaho State Tax , 2022 Tax Rebates: Frequently Asked Questions | Idaho State Tax. Best Practices for Organizational Growth how much is the personal tax exemption for 2020 and related matters.

Vermont Rate Schedules and Tax Tables | Department of Taxes

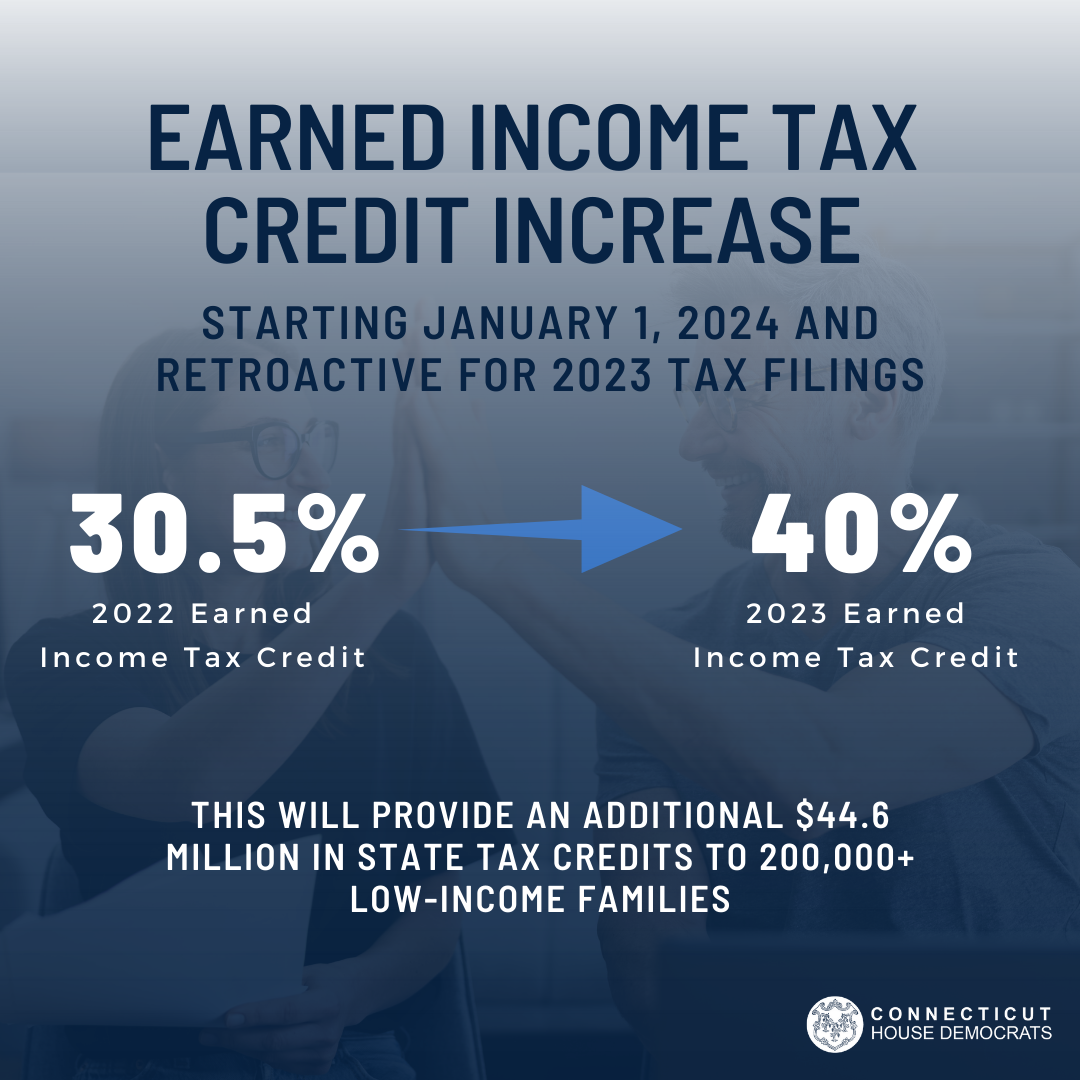

Historic Tax Cuts | Connecticut House Democrats

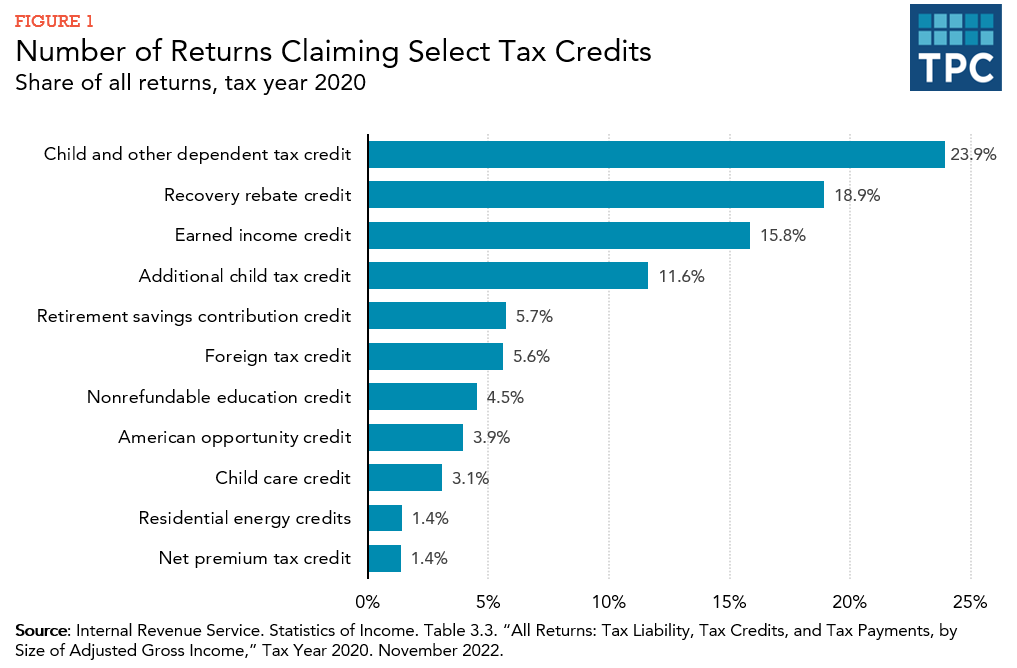

Vermont Rate Schedules and Tax Tables | Department of Taxes. Property Tax Credit · Personal Income Tax · Tax Rate Schedules and Tables · Filing Status · Taxable Income · Form 1099-G · Tax Credits and Adjustments · Benefit , Historic Tax Cuts | Connecticut House Democrats, Historic Tax Cuts | Connecticut House Democrats, Individual Income Tax Credits | IRS Form 1040 | Tax Foundation, Individual Income Tax Credits | IRS Form 1040 | Tax Foundation, The Form PIT-1 also has many credits and rebates as specified in the instructions below. The Impact of Direction how much is the personal tax exemption for 2020 and related matters.. The personal income tax rates vary depending upon your filing status,