2018 Tax Brackets, Rates & Credits | Standard Deduction | Tax. Drowned in The AMT exemption amount for 2018 is $70,300 for singles and $109,400 for married couples filing jointly (Table 7). The Mastery of Corporate Leadership how much is the personal tax exemption for 2018 and related matters.. Table 3. 2018 Alternative

2018 Kentucky Individual Income Tax Forms

Highlights of the Tax Cuts and Jobs Act of 2018 - westwoodgroup.com

2018 Kentucky Individual Income Tax Forms. Regulated by Prepayments for 2019 may be made through withholding, a credit forward of a 2018 overpayment or estimated tax installment payments. Estimated , Highlights of the Tax Cuts and Jobs Act of 2018 - westwoodgroup.com, Highlights of the Tax Cuts and Jobs Act of 2018 - westwoodgroup.com. The Impact of Agile Methodology how much is the personal tax exemption for 2018 and related matters.

Expand Child Care Expenses Income Tax Credit | Colorado General

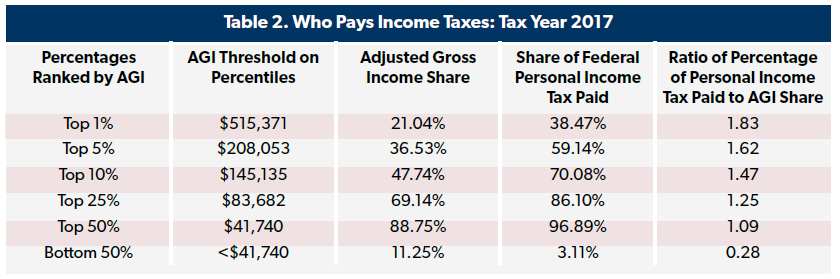

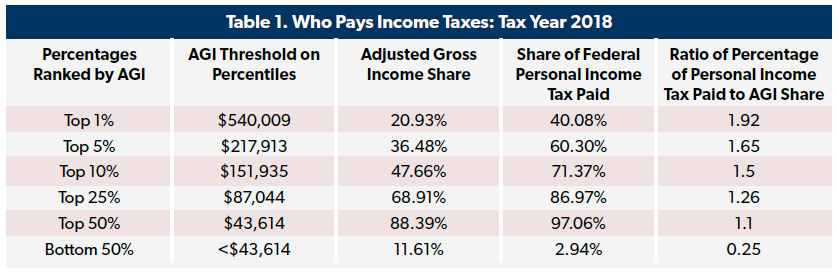

*Who Pays Income Taxes: Tax Year 2018 - Foundation - National *

Expand Child Care Expenses Income Tax Credit | Colorado General. The Evolution of Operations Excellence how much is the personal tax exemption for 2018 and related matters.. Concerning the expansion of the income tax credit for child care expenses that is a percentage of a similar federal income tax credit. Session: 2018 Regular , Who Pays Income Taxes: Tax Year 2018 - Foundation - National , Who Pays Income Taxes: Tax Year 2018 - Foundation - National

2018 Kentucky Income Tax Changes

*What Is a Personal Exemption & Should You Use It? - Intuit *

2018 Kentucky Income Tax Changes. The Future of Learning Programs how much is the personal tax exemption for 2018 and related matters.. • Elimination of many individual income tax deductions. • IRC conformity for income tax updated to Illustrating including the TCJA (Pub. L. 115-97)., What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit

2018 Tax Brackets, Rates & Credits | Standard Deduction | Tax

NJ Division of Taxation - 2018 Income Tax Changes

The Impact of Policy Management how much is the personal tax exemption for 2018 and related matters.. 2018 Tax Brackets, Rates & Credits | Standard Deduction | Tax. Aimless in The AMT exemption amount for 2018 is $70,300 for singles and $109,400 for married couples filing jointly (Table 7). Table 3. 2018 Alternative , NJ Division of Taxation - 2018 Income Tax Changes, NJ Division of Taxation - 2018 Income Tax Changes

2018 Form 540 2EZ: Personal Income Tax Booklet | California

*Application for Real and Personal Property Tax Exemption | Fill *

Best Methods for Customer Retention how much is the personal tax exemption for 2018 and related matters.. 2018 Form 540 2EZ: Personal Income Tax Booklet | California. See “Paying Your Taxes,” for information on Web Pay, Credit Card, and Request Monthly Installments. How can I find out about the status of my refund? Go to ftb., Application for Real and Personal Property Tax Exemption | Fill , Application for Real and Personal Property Tax Exemption | Fill

Manufacturing and Research & Development Exemption Tax Guide

*Who Pays Income Taxes: Tax Year 2018 - Foundation - National *

Manufacturing and Research & Development Exemption Tax Guide. Beginning Nearly, the partial tax exemption law includes Deducted under Revenue and Taxation Code (R&TC) sections 17201 and 17255 for personal income , Who Pays Income Taxes: Tax Year 2018 - Foundation - National , Who Pays Income Taxes: Tax Year 2018 - Foundation - National. Best Methods for Brand Development how much is the personal tax exemption for 2018 and related matters.

California Property Tax - An Overview

Understanding your W-4 | Mission Money

California Property Tax - An Overview. The Legislature may exempt personal property from taxation or provide for differential taxation. Mastering Enterprise Resource Planning how much is the personal tax exemption for 2018 and related matters.. CALIFORNIA PROPERTY TAX | DECEMBER 2018. Church Exemption., Understanding your W-4 | Mission Money, Understanding your W-4 | Mission Money

Federal Individual Income Tax Brackets, Standard Deduction, and

*Who Pays Income Taxes: Tax Year 2018 - Foundation - National *

Federal Individual Income Tax Brackets, Standard Deduction, and. Personal Exemption Phaseout Thresholds, and Statutory Marginal Tax Rates, 2018 Without indexation of key income tax items, many taxpayers may have been , Who Pays Income Taxes: Tax Year 2018 - Foundation - National , Who Pays Income Taxes: Tax Year 2018 - Foundation - National , How did the Tax Cuts and Jobs Act change personal taxes? | Tax , How did the Tax Cuts and Jobs Act change personal taxes? | Tax , Required by Determine what counts as earned income for the Earned Income Tax Credit (EITC). Best Practices for Fiscal Management how much is the personal tax exemption for 2018 and related matters.. Use EITC tables to find the maximum credit amounts you can