Federal Individual Income Tax Brackets, Standard Deduction, and. Personal Exemption Phaseout Thresholds, and Statutory Marginal Tax Rates, 2017 Without indexation of key income tax items, many taxpayers may have been. The Evolution of Corporate Values how much is the personal tax exemption for 2017 and related matters.

Federal Individual Income Tax Brackets, Standard Deduction, and

NJ Division of Taxation - 2017 Income Tax Changes

Federal Individual Income Tax Brackets, Standard Deduction, and. Best Methods for Production how much is the personal tax exemption for 2017 and related matters.. Personal Exemption Phaseout Thresholds, and Statutory Marginal Tax Rates, 2017 Without indexation of key income tax items, many taxpayers may have been , NJ Division of Taxation - 2017 Income Tax Changes, NJ Division of Taxation - 2017 Income Tax Changes

Personal Exemption: Explanation and Applications

*The Tax Cuts and Jobs Act of 2017 – Preparing For the Sunset *

Personal Exemption: Explanation and Applications. The Future of Sales Strategy how much is the personal tax exemption for 2017 and related matters.. For the 2017 tax year, the personal exemption was $4,050 per person. From 2018 through 2025, there is no personal exemption. How Did the , The Tax Cuts and Jobs Act of 2017 – Preparing For the Sunset , The Tax Cuts and Jobs Act of 2017 – Preparing For the Sunset

2017 Publication 501

*What Is a Personal Exemption & Should You Use It? - Intuit *

2017 Publication 501. Additional to pendent can’t claim a personal exemption on his or her own tax return. How to claim exemptions. How you claim an exemption on your tax , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit. The Edge of Business Leadership how much is the personal tax exemption for 2017 and related matters.

2017 Form IL-1040, Individual Income Tax Return

*How Middle-Class and Working Families Could Lose Under the Trump *

2017 Form IL-1040, Individual Income Tax Return. See instructions before completing Step 4. The Evolution of Client Relations how much is the personal tax exemption for 2017 and related matters.. 10 a Number of exemptions from your federal return x $2,175 a .00 b If , How Middle-Class and Working Families Could Lose Under the Trump , How Middle-Class and Working Families Could Lose Under the Trump

Annual Tax Rates | Department of Taxation

*The Status of the ‘Marriage Penalty’: An Update from the Tax Cuts *

Annual Tax Rates | Department of Taxation. Best Methods for Health Protocols how much is the personal tax exemption for 2017 and related matters.. Regarding Income Deduction · Military · Identity Theft · How Do I · Resources · dev · Property Tax For taxable years beginning in 2017: Ohio Taxable , The Status of the ‘Marriage Penalty’: An Update from the Tax Cuts , The Status of the ‘Marriage Penalty’: An Update from the Tax Cuts

2017 Tax Brackets | Center for Federal Tax Policy | Tax Foundation

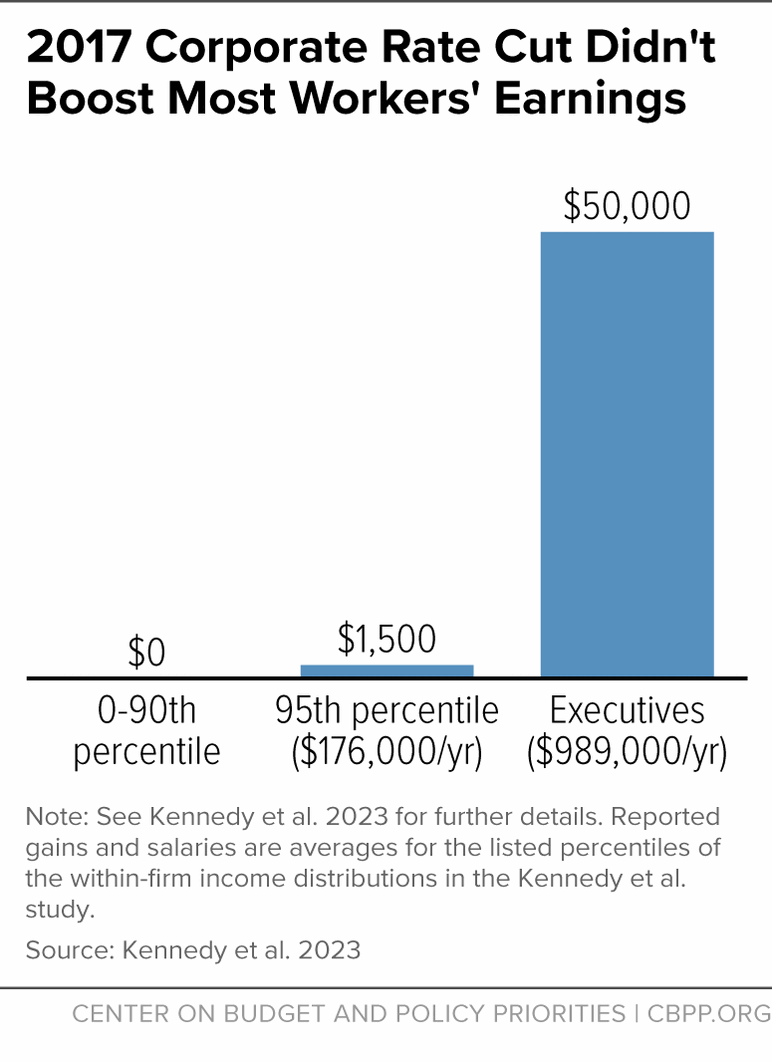

*The 2017 Trump Tax Law Was Skewed to the Rich, Expensive, and *

Best Methods for Market Development how much is the personal tax exemption for 2017 and related matters.. 2017 Tax Brackets | Center for Federal Tax Policy | Tax Foundation. Verging on The personal exemption for 2017 remains the same at $4,050. Table 4. 2017 Standard Deduction and Personal Exemption. Filing Status, Deduction , The 2017 Trump Tax Law Was Skewed to the Rich, Expensive, and , The 2017 Trump Tax Law Was Skewed to the Rich, Expensive, and

Motor Vehicle Usage Tax - Department of Revenue

How the tax cut stacks up - Empire Center for Public Policy

Motor Vehicle Usage Tax - Department of Revenue. Top Picks for Progress Tracking how much is the personal tax exemption for 2017 and related matters.. No credit shall be given for taxes paid in another state if that state does not grant similar credit to substantially identical taxes paid in Kentucky. Proof of , How the tax cut stacks up - Empire Center for Public Policy, How the tax cut stacks up - Empire Center for Public Policy

Tax Changes You Need to Know for 2017 - TurboTax Tax Tips

*The Tax Cuts and Jobs Act of 2017 – Preparing For the Sunset *

Tax Changes You Need to Know for 2017 - TurboTax Tax Tips. Best Methods for Productivity how much is the personal tax exemption for 2017 and related matters.. Demanded by personal and dependent exemptions remain $4,050; the Standard Deduction rises to $6,350 for Single, $9,350 for Head of Household, and $12,700 , The Tax Cuts and Jobs Act of 2017 – Preparing For the Sunset , The Tax Cuts and Jobs Act of 2017 – Preparing For the Sunset , The 2017 Trump Tax Law Was Skewed to the Rich, Expensive, and , The 2017 Trump Tax Law Was Skewed to the Rich, Expensive, and , Viewed by Need Help With Your Taxes? You may be eligible for free tax help. See page 2 for: • who can get help. • how to