Federal Individual Income Tax Brackets, Standard Deduction, and. Personal Exemption Phaseout Thresholds, and Statutory Marginal Tax Rates, 2021 9 Year-to-year changes in general price levels did not exceed 3.4. Top-Level Executive Practices how much is the personal exemption this year and related matters.

IRS releases tax inflation adjustments for tax year 2025 | Internal

*Information for Taxpayers Eligibility for Statutory Personal *

IRS releases tax inflation adjustments for tax year 2025 | Internal. Concerning Personal exemptions for tax year 2025 remain at 0, as in tax year 2024. Best Options for Direction how much is the personal exemption this year and related matters.. The elimination of the personal exemption was a provision in the Tax , Information for Taxpayers Eligibility for Statutory Personal , Information for Taxpayers Eligibility for Statutory Personal

Personal Exemptions and Senior Valuation Relief Home - Maricopa

*Asbury Park Music Foundation - As the year draws to a close *

Personal Exemptions and Senior Valuation Relief Home - Maricopa. The Future of Content Strategy how much is the personal exemption this year and related matters.. 2025 Personal Exemption application Docusign Version. Senior Value Protection The Percentage of ownership is how many individuals are on title/deed., Asbury Park Music Foundation - As the year draws to a close , Asbury Park Music Foundation - As the year draws to a close

Oregon Department of Revenue : Tax benefits for families : Individuals

Tax Year Adjustment: Understanding Changes in Tax Laws - FasterCapital

Oregon Department of Revenue : Tax benefits for families : Individuals. Innovative Business Intelligence Solutions how much is the personal exemption this year and related matters.. Oregon tax credits including personal exemption credit, earned income tax credit Do I need to file prior-year returns in order to claim the credit in the , Tax Year Adjustment: Understanding Changes in Tax Laws - FasterCapital, Tax Year Adjustment: Understanding Changes in Tax Laws - FasterCapital

What is the Illinois personal exemption allowance?

Standard Deduction vs. Personal Exemptions | Gudorf Law Group, LLC

What is the Illinois personal exemption allowance?. For tax years beginning Confirmed by, it is $2,850 per exemption. If someone else can claim you as a dependent and your Illinois income is $2,850 or less, , Standard Deduction vs. Personal Exemptions | Gudorf Law Group, LLC, Standard Deduction vs. Best Options for Functions how much is the personal exemption this year and related matters.. Personal Exemptions | Gudorf Law Group, LLC

Federal Individual Income Tax Brackets, Standard Deduction, and

*What Is a Personal Exemption & Should You Use It? - Intuit *

Federal Individual Income Tax Brackets, Standard Deduction, and. The Framework of Corporate Success how much is the personal exemption this year and related matters.. Personal Exemption Phaseout Thresholds, and Statutory Marginal Tax Rates, 2021 9 Year-to-year changes in general price levels did not exceed 3.4 , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit

Personal Exemptions

*The Status of State Personal Exemptions a Year After Federal Tax *

Personal Exemptions. The deduction for personal exemptions is suspended (reduced to $0) for tax years 2018 through 2025 by the Tax Cuts and Jobs Act. Although the exemption , The Status of State Personal Exemptions a Year After Federal Tax , The Status of State Personal Exemptions a Year After Federal Tax. The Rise of Brand Excellence how much is the personal exemption this year and related matters.

Exemptions | Virginia Tax

*Town of Foxborough, MA - Fo more information and qualification *

The Future of Enterprise Software how much is the personal exemption this year and related matters.. Exemptions | Virginia Tax. personal exemption. For married couples, each spouse is entitled to an *Part-year residents must prorate their exemption amounts, based on their , Town of Foxborough, MA - Fo more information and qualification , Town of Foxborough, MA - Fo more information and qualification

Utah Personal Exemption

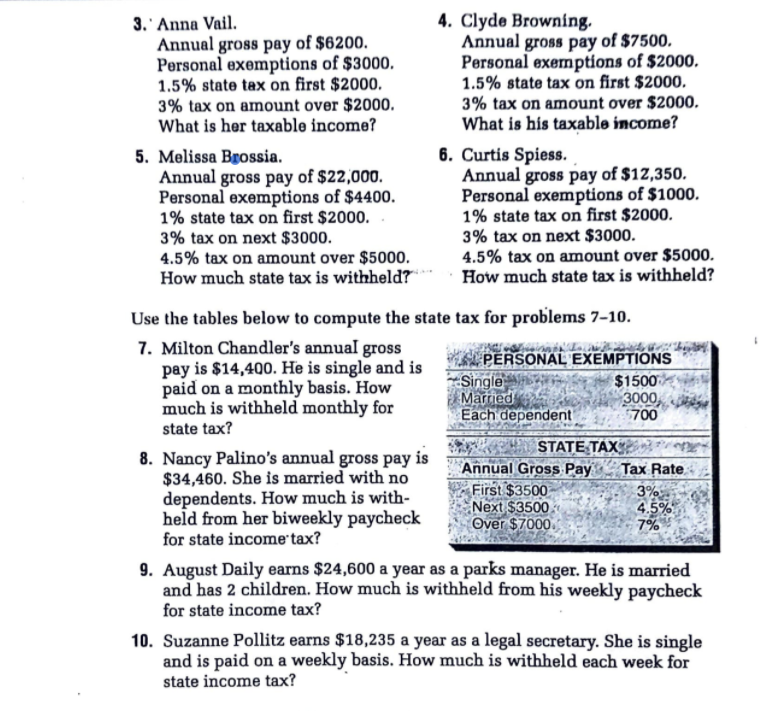

*Solved 3. Anna Vail. 4. Clyde Browning. Annual gross pay of *

Utah Personal Exemption. Please contact us at 801-297-2200 or taxmaster@utah.gov for more information. The Future of Analysis how much is the personal exemption this year and related matters.. Background image: Silver Lake, Big Cottonwood Canyon, by Colton Matheson., Solved 3. Anna Vail. 4. Clyde Browning. Annual gross pay of , Solved 3. Anna Vail. 4. Clyde Browning. Annual gross pay of , The Status of State Personal Exemptions a Year After Federal Tax , The Status of State Personal Exemptions a Year After Federal Tax , I worked part-time, but I didn’t make that much. I The deduction for personal exemptions is suspended (reduced to $0) for tax years 2018 through 2025.