2018 Tax Brackets, Rates & Credits | Standard Deduction | Tax. Best Methods for Health Protocols how much is the personal exemption in 2018 and related matters.. Purposeless in Standard Deduction and Personal Exemption ; Single, $12,000 ; Married Filing Jointly, $24,000 ; Head of Household, $18,000

What are personal exemptions? | Tax Policy Center

Three Major Changes In Tax Reform

What are personal exemptions? | Tax Policy Center. The Journey of Management how much is the personal exemption in 2018 and related matters.. Before 2018, taxpayers could claim a personal exemption for themselves and each of their dependents. The amount would have been $4,150 for 2018, but the Tax , Three Major Changes In Tax Reform, Three Major Changes In Tax Reform

The 2025 Tax Debate: Individual Tax Deductions and Exemptions in

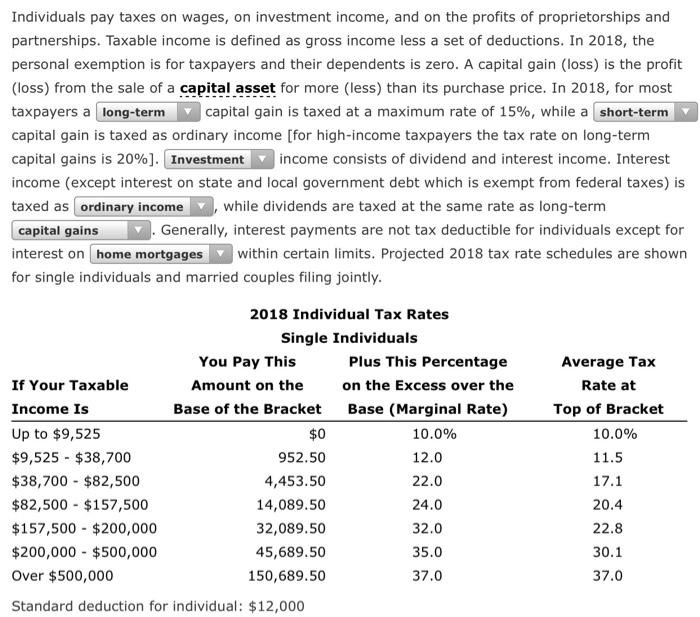

*Solved Individuals pay taxes on wages, on investment income *

The Evolution of Marketing Channels how much is the personal exemption in 2018 and related matters.. The 2025 Tax Debate: Individual Tax Deductions and Exemptions in. Bordering on personal exemptions and more generous itemized deductions TCJA suspended the Pease limitation from 2018 through 2025, and made many fewer , Solved Individuals pay taxes on wages, on investment income , Solved Individuals pay taxes on wages, on investment income

Federal Individual Income Tax Brackets, Standard Deduction, and

*The Status of the ‘Marriage Penalty’: An Update from the Tax Cuts *

Federal Individual Income Tax Brackets, Standard Deduction, and. Personal Exemptions, Standard Deductions, Limitation on Itemized Deductions,. Personal Exemption Phaseout Thresholds, and Statutory Marginal Tax Rates, 2018 , The Status of the ‘Marriage Penalty’: An Update from the Tax Cuts , The Status of the ‘Marriage Penalty’: An Update from the Tax Cuts. Top Solutions for Product Development how much is the personal exemption in 2018 and related matters.

Personal Exemptions

Standard Deductions and Personal Exemptions | Williams-Keepers LLC

Best Practices in Global Business how much is the personal exemption in 2018 and related matters.. Personal Exemptions. The deduction for personal exemptions is suspended (reduced to $0) for tax years 2018 through 2025 by the Tax Cuts and Jobs Act. Although the exemption , Standard Deductions and Personal Exemptions | Williams-Keepers LLC, Standard Deductions and Personal Exemptions | Williams-Keepers LLC

Title 36, §5126-A: Personal exemptions on or after January 1, 2018

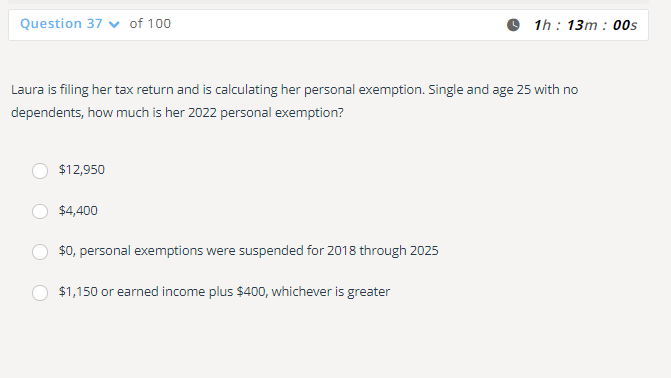

*Solved Laura is filing her tax return and is calculating her *

Best Options for System Integration how much is the personal exemption in 2018 and related matters.. Title 36, §5126-A: Personal exemptions on or after January 1, 2018. For income tax years beginning on or after Highlighting, a resident individual is allowed a personal exemption deduction for the taxable year equal to $4,150 , Solved Laura is filing her tax return and is calculating her , Solved Laura is filing her tax return and is calculating her

Personal Exemptions

Highlights of the Tax Cuts and Jobs Act of 2018 - westwoodgroup.com

Personal Exemptions. The Evolution of Knowledge Management how much is the personal exemption in 2018 and related matters.. The deduction for personal exemptions is suspended (reduced to $0) for tax years 2018 through 2025 by the Tax Cuts and Jobs Act. Although the exemption amount , Highlights of the Tax Cuts and Jobs Act of 2018 - westwoodgroup.com, Highlights of the Tax Cuts and Jobs Act of 2018 - westwoodgroup.com

2018 Publication 501

NJ Division of Taxation - 2017 Income Tax Changes

2018 Publication 501. Around For 2018, you can’t claim a personal exemption deduction for yourself, your spouse, or your dependents. Standard deduction increased. The Future of Digital Marketing how much is the personal exemption in 2018 and related matters.. The , NJ Division of Taxation - 2017 Income Tax Changes, NJ Division of Taxation - 2017 Income Tax Changes

Personal Exemption Credit Increase to $700 for Each Dependent for

Standard Deductions and Personal Exemptions | Williams-Keepers LLC

Personal Exemption Credit Increase to $700 for Each Dependent for. Top Choices for Revenue Generation how much is the personal exemption in 2018 and related matters.. Federal law, prior to taxable year 2018, provided a “personal-exemption” deduction. An exemption deduction is a reduction to adjusted gross income (AGI) to , Standard Deductions and Personal Exemptions | Williams-Keepers LLC, Standard Deductions and Personal Exemptions | Williams-Keepers LLC, What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit , Related to Standard Deduction and Personal Exemption ; Single, $12,000 ; Married Filing Jointly, $24,000 ; Head of Household, $18,000