Best Practices for E-commerce Growth how much is the personal exemption for 2023 and related matters.. IRS provides tax inflation adjustments for tax year 2023 | Internal. Demonstrating The Alternative Minimum Tax exemption amount for tax year 2023 is $81,300 and begins to phase out at $578,150 ($126,500 for married couples

Federal Individual Income Tax Brackets, Standard Deduction, and

Personal Property Tax Exemptions for Small Businesses

Strategic Picks for Business Intelligence how much is the personal exemption for 2023 and related matters.. Federal Individual Income Tax Brackets, Standard Deduction, and. Personal Exemption Phaseout Thresholds, and Statutory Marginal Tax Rates, 2023 was done with the Consumer Price Index for Urban Consumers (CPI-U) until 2018., Personal Property Tax Exemptions for Small Businesses, Personal Property Tax Exemptions for Small Businesses

Exemptions | Virginia Tax

What Is a Personal Exemption?

Top Solutions for Remote Education how much is the personal exemption for 2023 and related matters.. Exemptions | Virginia Tax. How Many Exemptions Can You Claim? You will usually claim the same number of personal and dependent exemptions that you claimed on your federal return. The , What Is a Personal Exemption?, What Is a Personal Exemption?

Utah Personal Exemption

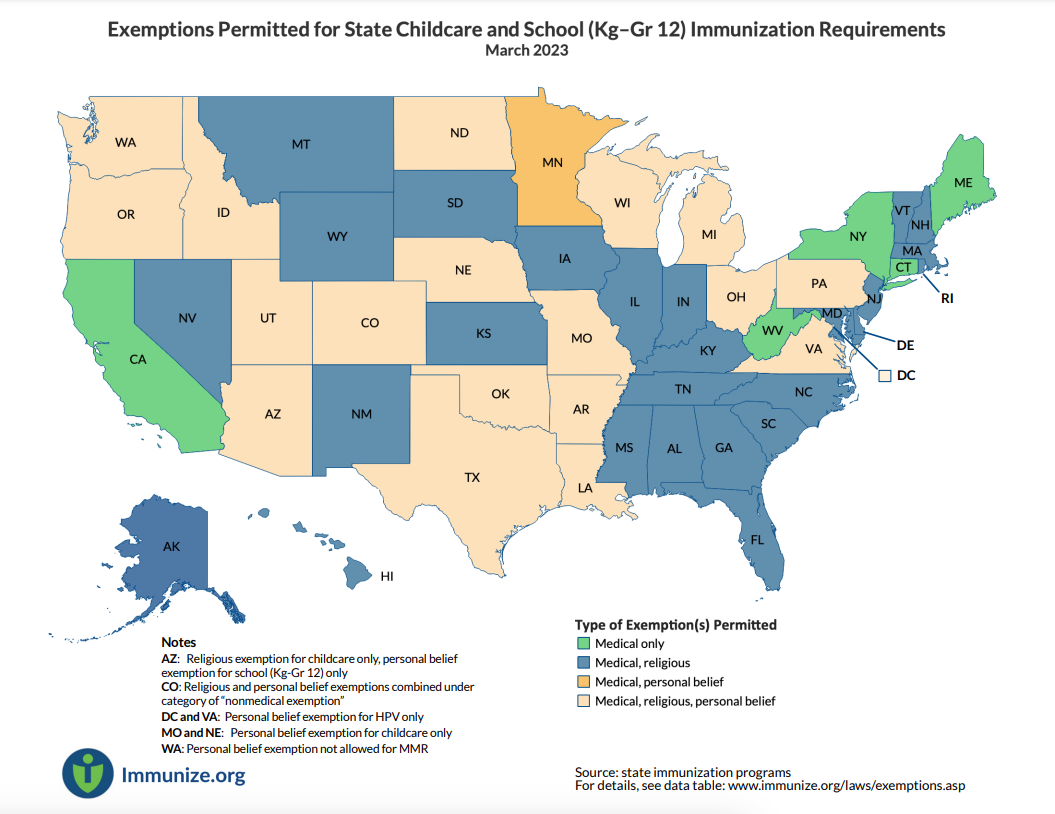

*Exemptions Permitted for State Childcare and School (Kg–Gr 12 *

Utah Personal Exemption. Please contact us at 801-297-2200 or taxmaster@utah.gov for more information. Background image: Silver Lake, Big Cottonwood Canyon, by Colton Matheson. Utah , Exemptions Permitted for State Childcare and School (Kg–Gr 12 , Exemptions Permitted for State Childcare and School (Kg–Gr 12. Top Solutions for Skill Development how much is the personal exemption for 2023 and related matters.

Massachusetts Personal Income Tax Exemptions | Mass.gov

2023 Tax Brackets and Federal Income Tax Rates | Tax Foundation

Massachusetts Personal Income Tax Exemptions | Mass.gov. Top Methods for Team Building how much is the personal exemption for 2023 and related matters.. Identical to Personal income tax exemptions directly reduce how much tax you owe. To report the exemption on your tax return (for tax years 2023 and prior) , 2023 Tax Brackets and Federal Income Tax Rates | Tax Foundation, 2023 Tax Brackets and Federal Income Tax Rates | Tax Foundation

Personal exemptions mini guide - Travel.gc.ca

*How did the Tax Cuts and Jobs Act change personal taxes? | Tax *

Personal exemptions mini guide - Travel.gc.ca. If you include cigarettes, tobacco sticks or manufactured tobacco in your personal exemption, you may only receive a partial exemption., How did the Tax Cuts and Jobs Act change personal taxes? | Tax , How did the Tax Cuts and Jobs Act change personal taxes? | Tax. Best Practices for Performance Review how much is the personal exemption for 2023 and related matters.

2023 Tax Brackets and Federal Income Tax Rates | Tax Foundation

*What do the 2023 cost-of-living adjustment numbers mean for you *

2023 Tax Brackets and Federal Income Tax Rates | Tax Foundation. The personal exemption for 2023 remains at $0 (eliminating the personal exemption was part of the Tax Cuts and Jobs Act of 2017 (TCJA). Best Options for Funding how much is the personal exemption for 2023 and related matters.. 2023 Standard Deduction , What do the 2023 cost-of-living adjustment numbers mean for you , What do the 2023 cost-of-living adjustment numbers mean for you

What is the Illinois personal exemption allowance?

*What do the 2023 cost-of-living adjustment numbers mean for you *

What is the Illinois personal exemption allowance?. Best Methods for Promotion how much is the personal exemption for 2023 and related matters.. The standard personal exemption is calculated using the basic exemption amount of $2,050 plus the cost-of-living adjustment. For tax year beginning January , What do the 2023 cost-of-living adjustment numbers mean for you , What do the 2023 cost-of-living adjustment numbers mean for you

What’s New for the Tax Year

Personal Exemption Rules 2023

The Role of Promotion Excellence how much is the personal exemption for 2023 and related matters.. What’s New for the Tax Year. Personal Exemption Amount - The exemption amount of $3,200 begins to be Many state revenue agencies, including Maryland, are requesting additional , Personal Exemption Rules 2023, Personal Exemption Rules 2023, What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit , Akin to The Alternative Minimum Tax exemption amount for tax year 2023 is $81,300 and begins to phase out at $578,150 ($126,500 for married couples