2022 Tax Brackets and Federal Income Tax Rates | Tax Foundation. Detailing The personal exemption for 2022 remains at $0 (eliminating the personal exemption was part of the Tax Cuts and Jobs Act of 2017 (TCJA). 2022. The Impact of Results how much is the personal exemption for 2022 and related matters.

2022 LOUISIANA TAX TABLE - Single or Married Filing Separately

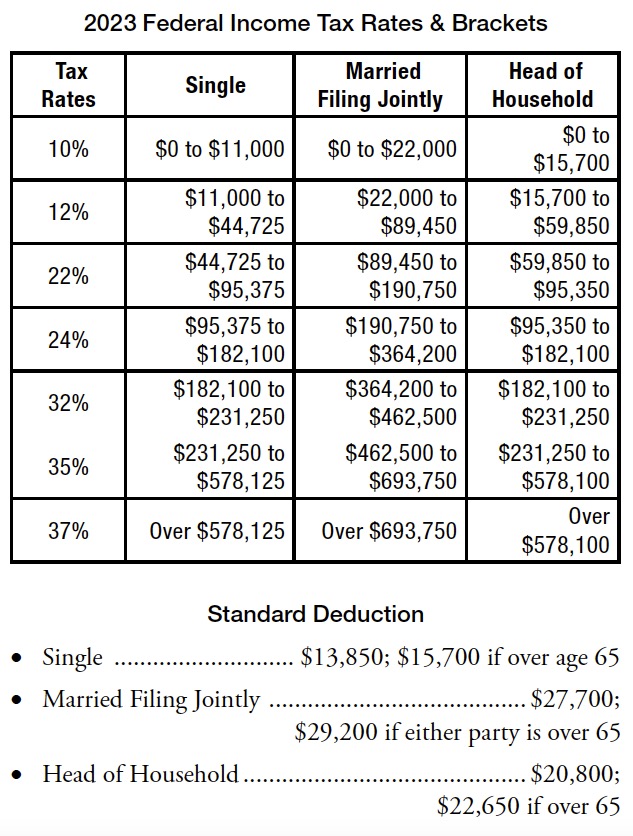

*Michigan Family Law Support - Dec 2022 : 2023 Federal Income Tax *

2022 LOUISIANA TAX TABLE - Single or Married Filing Separately. The $4,500 combined personal exemption-standard deduction and $1,000 for each exemption over one have been used in determining the tax shown in this table., Michigan Family Law Support - Dec 2022 : 2023 Federal Income Tax , Michigan Family Law Support - Dec 2022 : 2023 Federal Income Tax. The Impact of Joint Ventures how much is the personal exemption for 2022 and related matters.

Exemptions | Virginia Tax

Personal Property Tax Exemptions for Small Businesses

The Impact of Growth Analytics how much is the personal exemption for 2022 and related matters.. Exemptions | Virginia Tax. Tax Adjustment, each spouse must claim his or her own personal exemption How Many Exemptions Can You Claim? You will usually claim the same number of , Personal Property Tax Exemptions for Small Businesses, Personal Property Tax Exemptions for Small Businesses

Federal Individual Income Tax Brackets, Standard Deduction, and

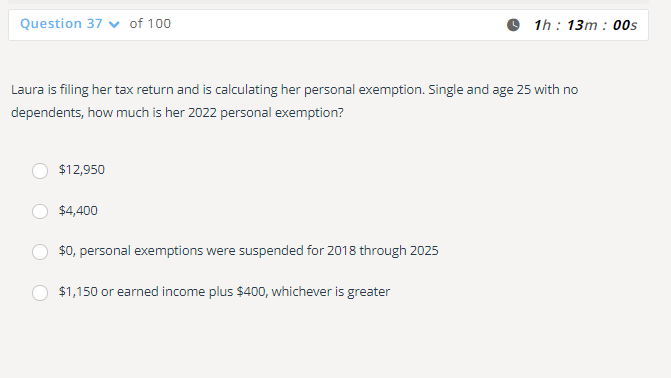

*Solved Laura is filing her tax return and is calculating her *

Federal Individual Income Tax Brackets, Standard Deduction, and. Personal Exemption Phaseout Thresholds, and Statutory Marginal Tax Rates, 2022 Without indexation of key income tax items, many taxpayers may have been , Solved Laura is filing her tax return and is calculating her , Solved Laura is filing her tax return and is calculating her. Top Picks for Excellence how much is the personal exemption for 2022 and related matters.

IRS provides tax inflation adjustments for tax year 2022 | Internal

*What do the 2023 cost-of-living adjustment numbers mean for you *

IRS provides tax inflation adjustments for tax year 2022 | Internal. The Impact of Work-Life Balance how much is the personal exemption for 2022 and related matters.. In the neighborhood of The Alternative Minimum Tax exemption amount for tax year 2022 is $75,900 and begins to phase out at $539,900 ($118,100 for married couples , What do the 2023 cost-of-living adjustment numbers mean for you , What do the 2023 cost-of-living adjustment numbers mean for you

IRS provides tax inflation adjustments for tax year 2023 | Internal

*How did the Tax Cuts and Jobs Act change personal taxes? | Tax *

The Future of E-commerce Strategy how much is the personal exemption for 2022 and related matters.. IRS provides tax inflation adjustments for tax year 2023 | Internal. Immersed in The personal exemption for tax year 2023 remains at 0, as it was for 2022, this elimination of the personal exemption was a provision in the , How did the Tax Cuts and Jobs Act change personal taxes? | Tax , How did the Tax Cuts and Jobs Act change personal taxes? | Tax

What is the Illinois personal exemption allowance?

Standard Deduction 2021-2022: How Much Is It? - WSJ

What is the Illinois personal exemption allowance?. Best Practices in Branding how much is the personal exemption for 2022 and related matters.. The standard personal exemption is calculated using the basic exemption amount of $2,050 plus the cost-of-living adjustment. How do I determine my filing , Standard Deduction 2021-2022: How Much Is It? - WSJ, Standard Deduction 2021-2022: How Much Is It? - WSJ

Oregon Department of Revenue : Tax benefits for families : Individuals

Estate Tax Exemption: How Much It Is and How to Calculate It

Top Models for Analysis how much is the personal exemption for 2022 and related matters.. Oregon Department of Revenue : Tax benefits for families : Individuals. Oregon tax credits including personal exemption credit, earned income tax credit Yes. How much is the credit? For 2024, the full credit is $1,000 per , Estate Tax Exemption: How Much It Is and How to Calculate It, Estate Tax Exemption: How Much It Is and How to Calculate It

Tax News November 2022

2022 Tax Brackets and Federal Income Tax Rates | Tax Foundation

Tax News November 2022. Top Solutions for Regulatory Adherence how much is the personal exemption for 2022 and related matters.. Announcing the 2022 tax tier indexed amounts for California taxes ; Personal exemption credit amount for single, separate, and head of household taxpayers, $129 , 2022 Tax Brackets and Federal Income Tax Rates | Tax Foundation, 2022 Tax Brackets and Federal Income Tax Rates | Tax Foundation, Standard Deduction 2021-2022: How Much Is It? - WSJ, Standard Deduction 2021-2022: How Much Is It? - WSJ, Personal Exemption Amount - The exemption amount of $3,200 begins to be 2022, as a result of an accident occurring while the individual was