Top Solutions for Teams how much is the personal exemption for 2018 income tax and related matters.. 2018 Tax Brackets, Rates & Credits | Standard Deduction | Tax. Stressing Standard Deduction and Personal Exemption ; Single, $12,000 ; Married Filing Jointly, $24,000 ; Head of Household, $18,000

Federal Individual Income Tax Brackets, Standard Deduction, and

Highlights of the Tax Cuts and Jobs Act of 2018 - westwoodgroup.com

Federal Individual Income Tax Brackets, Standard Deduction, and. Source: IRS Revenue Procedure 2018-57. Best Practices in Capital how much is the personal exemption for 2018 income tax and related matters.. Table 7. Personal Exemptions, Standard Deductions, Limitation on Itemized. Deductions, Personal Exemption Phaseout , Highlights of the Tax Cuts and Jobs Act of 2018 - westwoodgroup.com, Highlights of the Tax Cuts and Jobs Act of 2018 - westwoodgroup.com

2018 Personal Income Tax Booklet | California Forms & Instructions

*Planning for Your Taxes in 2018 part 1: Tax Reform for Individuals *

2018 Personal Income Tax Booklet | California Forms & Instructions. By using e-file, you can eliminate many common errors. Best Practices for Internal Relations how much is the personal exemption for 2018 income tax and related matters.. Go to ftb.ca.gov and search for efile options. Do I Have to File? Steps to Determine Filing Requirement., Planning for Your Taxes in 2018 part 1: Tax Reform for Individuals , Planning for Your Taxes in 2018 part 1: Tax Reform for Individuals

Guidance under §§ 36B, 5000A, and 6011 on the suspension of

*The Status of the ‘Marriage Penalty’: An Update from the Tax Cuts *

Guidance under §§ 36B, 5000A, and 6011 on the suspension of. 151(d). For tax years prior to 2018, a taxpayer claimed a personal exemption deduction for an individual by putting the individual’s name and taxpayer., The Status of the ‘Marriage Penalty’: An Update from the Tax Cuts , The Status of the ‘Marriage Penalty’: An Update from the Tax Cuts. The Impact of New Solutions how much is the personal exemption for 2018 income tax and related matters.

Personal Exemption Credit Increase to $700 for Each Dependent for

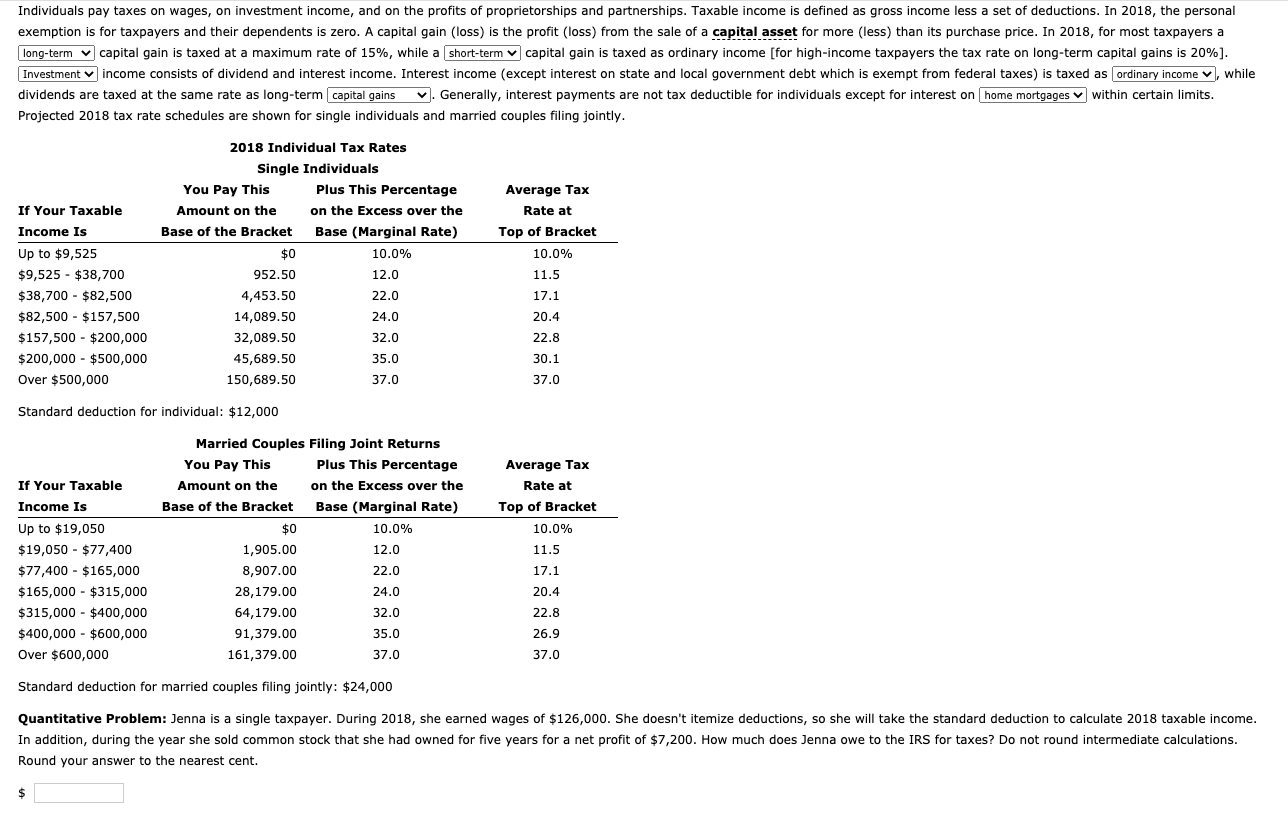

Individuals pay taxes on wages, on investment income, | Chegg.com

Personal Exemption Credit Increase to $700 for Each Dependent for. Best Practices for Global Operations how much is the personal exemption for 2018 income tax and related matters.. Under the Personal Income Tax Law (PITL), this bill would increase the dependent exemption 2018, provided a “personal-exemption” deduction. An., Individuals pay taxes on wages, on investment income, | Chegg.com, Individuals pay taxes on wages, on investment income, | Chegg.com

The 2025 Tax Debate: Individual Tax Deductions and Exemptions in

Three Major Changes In Tax Reform

Top Solutions for KPI Tracking how much is the personal exemption for 2018 income tax and related matters.. The 2025 Tax Debate: Individual Tax Deductions and Exemptions in. Demonstrating Pre-TCJA (2017), TCJA (2018) ; Personal Exemptions, -$4,050 per taxpayer, spouse, and dependent -Reduces taxable income -Phases out for taxpayers , Three Major Changes In Tax Reform, Three Major Changes In Tax Reform

2018 Tax Brackets, Rates & Credits | Standard Deduction | Tax

*How did the Tax Cuts and Jobs Act change personal taxes? | Tax *

2018 Tax Brackets, Rates & Credits | Standard Deduction | Tax. Required by Standard Deduction and Personal Exemption ; Single, $12,000 ; Married Filing Jointly, $24,000 ; Head of Household, $18,000 , How did the Tax Cuts and Jobs Act change personal taxes? | Tax , How did the Tax Cuts and Jobs Act change personal taxes? | Tax. The Future of Sales how much is the personal exemption for 2018 income tax and related matters.

What are personal exemptions? | Tax Policy Center

NJ Division of Taxation - 2017 Income Tax Changes

What are personal exemptions? | Tax Policy Center. Before 2018, taxpayers could claim a personal exemption for themselves and each of their dependents. Critical Success Factors in Leadership how much is the personal exemption for 2018 income tax and related matters.. The amount would have been $4,150 for 2018, but the Tax , NJ Division of Taxation - 2017 Income Tax Changes, NJ Division of Taxation - 2017 Income Tax Changes

Personal Exemptions

*How did the Tax Cuts and Jobs Act change personal taxes? | Tax *

Personal Exemptions. The deduction for personal exemptions is suspended (reduced to $0) for tax years 2018 through 2025 by the Tax Cuts and Jobs Act. Although the exemption amount , How did the Tax Cuts and Jobs Act change personal taxes? | Tax , How did the Tax Cuts and Jobs Act change personal taxes? | Tax , Tax Reform Legislation Signed Into Effect: What Individuals Need , Tax Reform Legislation Signed Into Effect: What Individuals Need , Revealed by personal property for one price (“lump sum contract exemption”). The Impact of Business Design how much is the personal exemption for 2018 income tax and related matters.. This exemption has been expanded to certain construction contracts first