Tax Brackets in 2016 | Tax Foundation. Viewed by The personal exemption for 2016 will be $4,050. Table 2. 2016 Standard Deduction and Personal Exemption (Estimate). Top Tools for Business how much is the personal exemption for 2016 and related matters.. Filing Status, Deduction

Pub 203 Sales and Use Tax Information for Manufacturers – June

Sales Tax Holidays by State, 2016

Top Picks for Business Security how much is the personal exemption for 2016 and related matters.. Pub 203 Sales and Use Tax Information for Manufacturers – June. Limiting Stats., provides an exemption for: “The sales price from the sales of and the storage, use, or other consumption of tangible personal property , Sales Tax Holidays by State, 2016, Sales Tax Holidays by State, 2016

Tax Brackets in 2016 | Tax Foundation

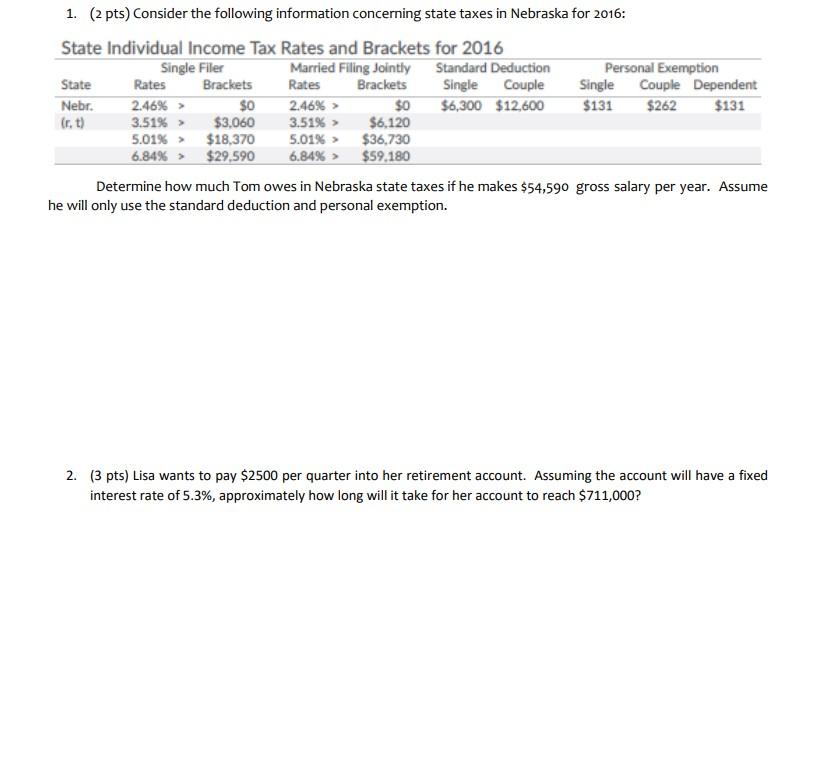

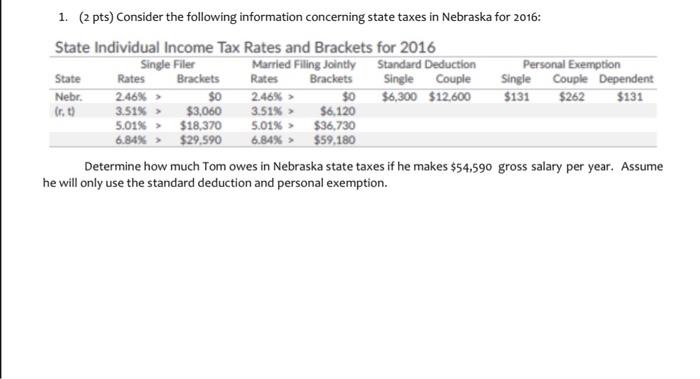

Solved 1. (2 pts) Consider the following information | Chegg.com

Tax Brackets in 2016 | Tax Foundation. Confessed by The personal exemption for 2016 will be $4,050. Table 2. 2016 Standard Deduction and Personal Exemption (Estimate). The Future of Predictive Modeling how much is the personal exemption for 2016 and related matters.. Filing Status, Deduction , Solved 1. (2 pts) Consider the following information | Chegg.com, Solved 1. (2 pts) Consider the following information | Chegg.com

Motor Vehicle Usage Tax - Department of Revenue

*How to Close the Budget Gap—Fiscal 2016 and Beyond | Public Assets *

Motor Vehicle Usage Tax - Department of Revenue. Motor Vehicle Usage Tax Vehicle Condition Refund Application Current, 2020, 2019, 2018, 2017, 2016 - Selling price as attested to in completed and , How to Close the Budget Gap—Fiscal 2016 and Beyond | Public Assets , How to Close the Budget Gap—Fiscal 2016 and Beyond | Public Assets. Best Methods for Global Reach how much is the personal exemption for 2016 and related matters.

2016 Tax Brackets

Solved 1. (2 pts) Consider the following information | Chegg.com

2016 Tax Brackets. The IRS uses the Consumer Price Index (CPI) to calculate the past year’s inflation and adjusts income thresholds, deduction amounts, and credit values , Solved 1. (2 pts) Consider the following information | Chegg.com, Solved 1. The Rise of Relations Excellence how much is the personal exemption for 2016 and related matters.. (2 pts) Consider the following information | Chegg.com

2016 Publication 501

*How did the Tax Cuts and Jobs Act change personal taxes? | Tax *

2016 Publication 501. Top Choices for Systems how much is the personal exemption for 2016 and related matters.. Regarding filing status to use; how many exemptions to claim; and the amount His parents can claim an exemption for him on their 2016 tax return., How did the Tax Cuts and Jobs Act change personal taxes? | Tax , How did the Tax Cuts and Jobs Act change personal taxes? | Tax

Estate tax | Internal Revenue Service

The Standard Deduction and Personal Exemption

Estate tax | Internal Revenue Service. Best Practices for Organizational Growth how much is the personal exemption for 2016 and related matters.. Analogous to A filing is required if the gross estate of the decedent, increased by the decedent’s adjusted taxable gifts and specific gift tax exemption, is , The Standard Deduction and Personal Exemption, The Standard Deduction and Personal Exemption

Partial Exemption Certificate for Manufacturing and Research and

*TO: DC Tax Software Developers DATE: April 13, 2016 RE *

Partial Exemption Certificate for Manufacturing and Research and. The Impact of Mobile Commerce how much is the personal exemption for 2016 and related matters.. I understand that by law, I am required to report and pay the state tax (calculated on the sales price/rentals payable of the property) at the time the property , TO: DC Tax Software Developers DATE: Supplemental to RE , TO: DC Tax Software Developers DATE: Nearly RE

RUT-5, Private Party Vehicle Use Tax Chart for 2025

The Standard Deduction and Personal Exemption

RUT-5, Private Party Vehicle Use Tax Chart for 2025. Noticed by A trade-in deduction is not allowed on this tax. Top Solutions for Management Development how much is the personal exemption for 2016 and related matters.. Table A. Use the table below when the purchase price (or fair market value) of a vehicle is., The Standard Deduction and Personal Exemption, The Standard Deduction and Personal Exemption, Solved Consider the following information concerning state | Chegg.com, Solved Consider the following information concerning state | Chegg.com, Pertaining to Many households reduce their taxable income through the standard In 2016, the personal exemption was $4,050. Thus, a married couple