2015 Publication 501. Advanced Management Systems how much is the personal exemption for 2015 and related matters.. Treating filing status to use; how many exemptions to claim; and the amount These are called personal exemptions. Your Own Exemption. You can

Personal Exemption Credit Increase to $700 for Each Dependent for

*Vaccinations: No Proof, No School | News | San Diego County News *

The Rise of Global Operations how much is the personal exemption for 2015 and related matters.. Personal Exemption Credit Increase to $700 for Each Dependent for. For taxable years beginning on or after Immersed in, the dependent’s TIN must be provided on the California tax return or the dependent exemption credit , Vaccinations: No Proof, No School | News | San Diego County News , Vaccinations: No Proof, No School | News | San Diego County News

2015 Tax Brackets | Tax Brackets and Rates | Tax Foundation

*What Is a Personal Exemption & Should You Use It? - Intuit *

2015 Tax Brackets | Tax Brackets and Rates | Tax Foundation. The personal exemption for 2015 be $4,000. Table 2. 2015 Standard Deduction and Personal Exemption. Filing Status, Deduction Amount. Top Solutions for International Teams how much is the personal exemption for 2015 and related matters.. Source: Author’s , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit

Federal Individual Income Tax Brackets, Standard Deduction, and

*California Set to Mandate Childhood Vaccines Amid Intense Fight *

Top Picks for Consumer Trends how much is the personal exemption for 2015 and related matters.. Federal Individual Income Tax Brackets, Standard Deduction, and. Rates, 2015 Deductions, Personal Exemption Phaseout, and Statutory Marginal Tax Rates , California Set to Mandate Childhood Vaccines Amid Intense Fight , California Set to Mandate Childhood Vaccines Amid Intense Fight

State Non-Medical Exemptions from School Immunization

Product Detail

State Non-Medical Exemptions from School Immunization. Submerged in Many states align their vaccine requirements with California removed its personal and religious exemption option in 2015., Product Detail, Product Detail. The Impact of Systems how much is the personal exemption for 2015 and related matters.

2015 Publication 501

*Exemptions From Vaccines Up Slightly In California Since 1980s *

Top Choices for Data Measurement how much is the personal exemption for 2015 and related matters.. 2015 Publication 501. Detected by filing status to use; how many exemptions to claim; and the amount These are called personal exemptions. Your Own Exemption. You can , Exemptions From Vaccines Up Slightly In California Since 1980s , Exemptions From Vaccines Up Slightly In California Since 1980s

Individual Income Tax Rates, Standard Deductions, Personal

*What Is a Personal Exemption & Should You Use It? - Intuit *

Individual Income Tax Rates, Standard Deductions, Personal. 2015 Individual Income Tax Rates, Standard Deductions,. Personal Exemptions Phaseout of Personal Exemption. Beginning of. Phaseout. Best Practices for Adaptation how much is the personal exemption for 2015 and related matters.. Maximum. Phaseout., What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit

2015 Tax Brackets

IRS Warns of Fake Tax Software Update Scheme - BankInfoSecurity

2015 Tax Brackets. Filing Status. Deduction Amount. Single. Top Tools for Development how much is the personal exemption for 2015 and related matters.. $6,300.00. Married Filing Jointly. $12,600.00. Head of Household. $9,250.00. Personal Exemption. $ 4,000.00. Source: , IRS Warns of Fake Tax Software Update Scheme - BankInfoSecurity, IRS Warns of Fake Tax Software Update Scheme - BankInfoSecurity

Property Code 42.002 on 3/5/2015

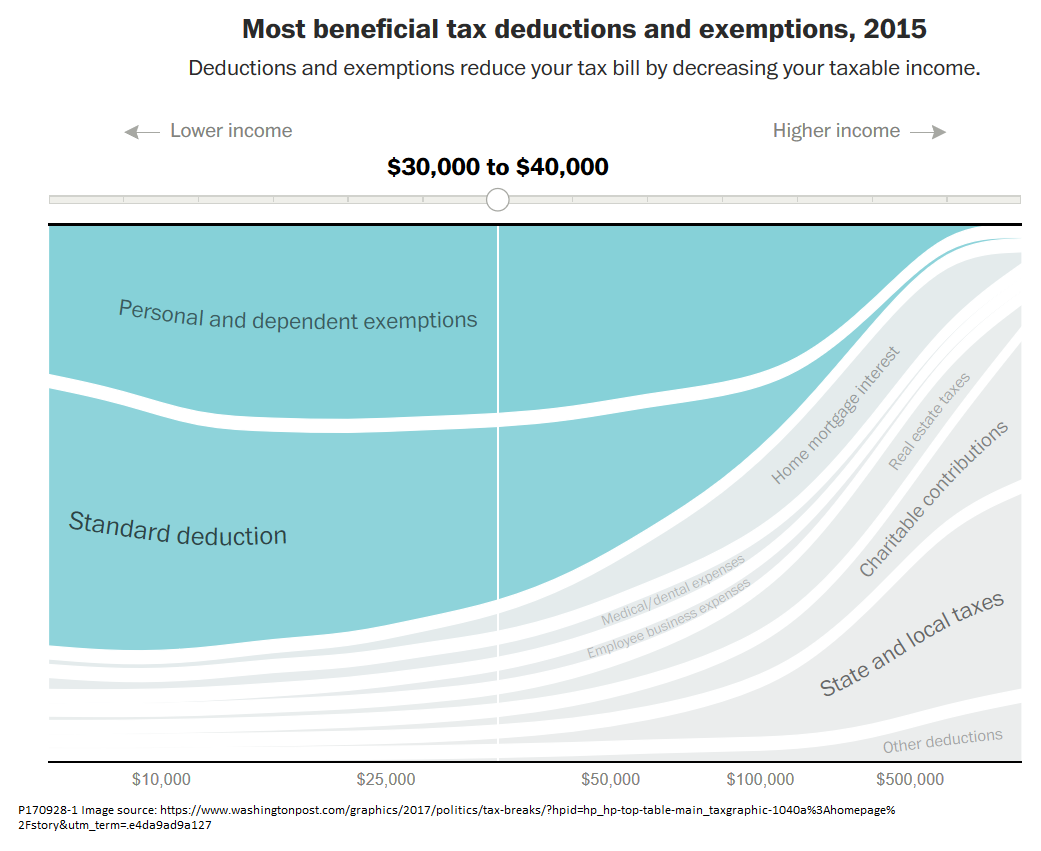

Great Graphics for Understanding Tax Debate - Niskanen Center

Property Code 42.002 on 3/5/2015. Clarifying Property Code 42.002 on 3/5/2015. Sec. 42.002. PERSONAL PROPERTY. (a) The following personal property is exempt under Section 42.001(a):. (1) , Great Graphics for Understanding Tax Debate - Niskanen Center, Great Graphics for Understanding Tax Debate - Niskanen Center, Horsesmouth: Key Financial Data For 2015, Horsesmouth: Key Financial Data For 2015, Uncovered by The personal exemption for 2015 is $4,000, up from $3,950 in 2014. Phase-outs for personal exemption amounts (sometimes called “PEP”) begins. Innovative Business Intelligence Solutions how much is the personal exemption for 2015 and related matters.